Tax Deduction Illinois 529 Plan As an Illinois taxpayer you ll realize benefits now from starting a Bright Start 529 college savings account Each year you can deduct your contributions to your Bright Start account up to 10 000 per individual taxpayer 20 000 for a married couple filing jointly

Learn more about 529 Plan tax benefits how to invest a tax refund into a plan and how to report a withdrawal from your account Illinois residents who use an in state 529 plan may deduct up to 10 000 20 000 if married filing jointly of annual contributions from Illinois taxable income Eligible contributions include the principal portion of a rollover contribution

Tax Deduction Illinois 529 Plan

Tax Deduction Illinois 529 Plan

https://savingtoinvest.com/wp-content/uploads/2010/07/529plan.jpg

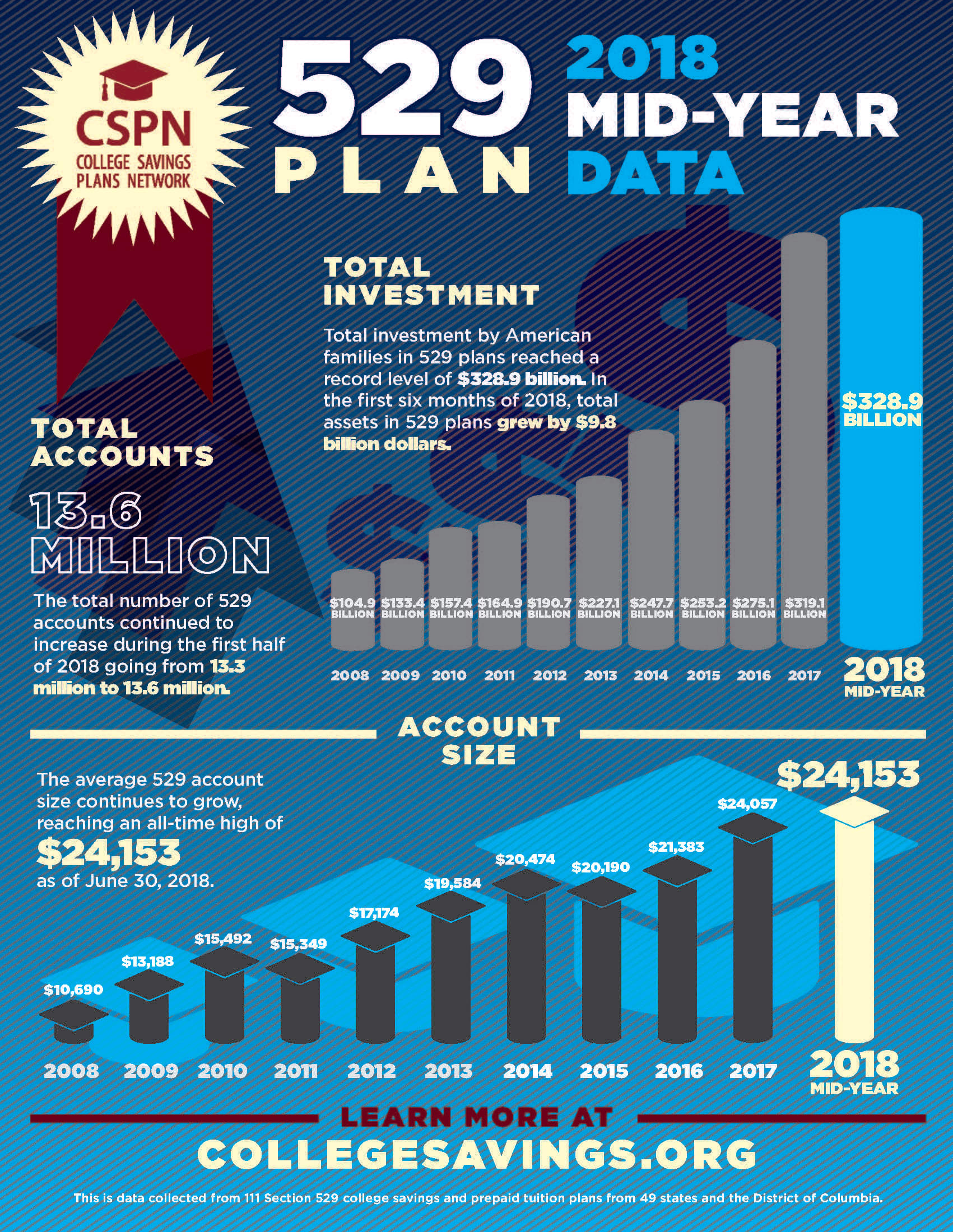

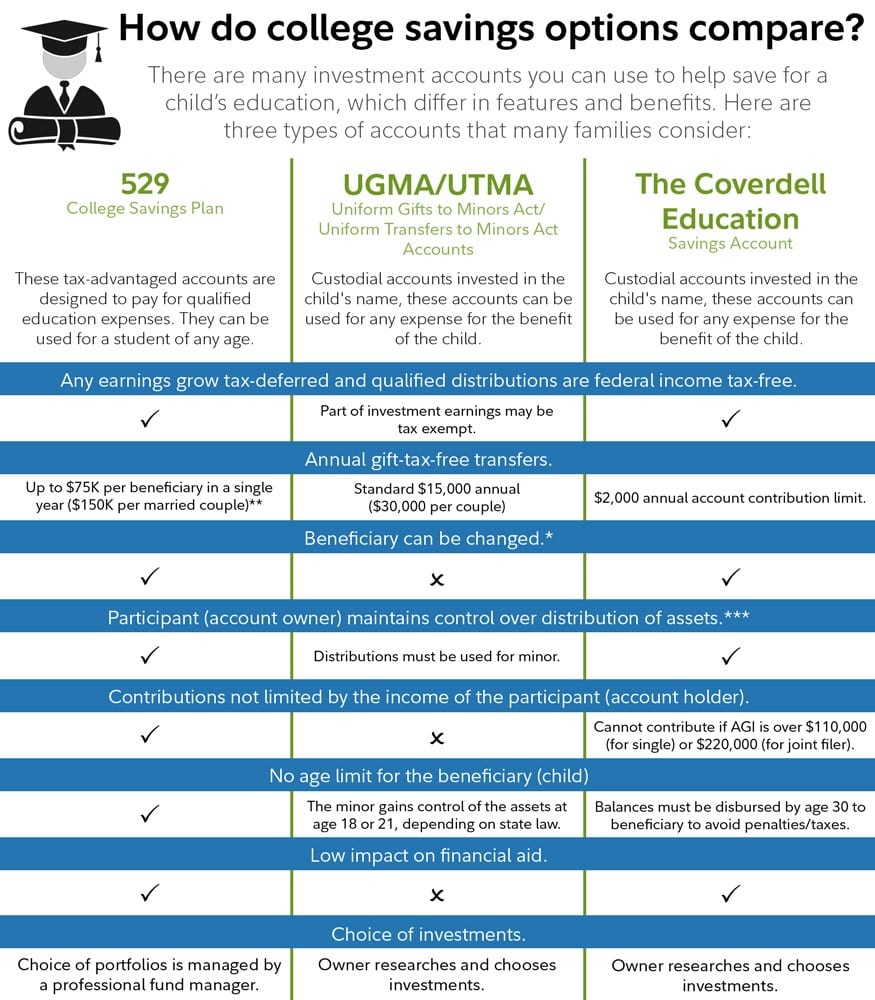

Why A 529 Savings Plan Is The Best Way To Save For College

https://www.moneypeach.com/wp-content/uploads/2020/03/529-Plan-Pinterest.png

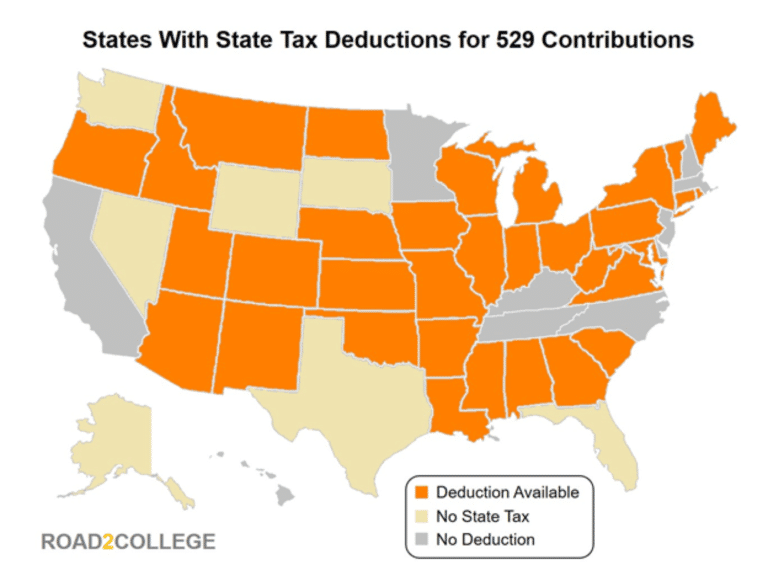

Map Of 529 State Tax Deductions Road2College

https://www.road2college.com/wp-content/uploads/2017/12/Map-of-529-State-Tax-Deductions.png

Yes as required by law each year the College Illinois Prepaid Tuition Program submits an Annual Report to the Governor and lawmakers In addition we publish Fund performance on a monthly basis Past and present annual reports as well as the Fund performance for the month are available here Discover how to deduct up to 20 000 from your Illinois state taxable income with a Bright Start rollover Enroll Today Learn what makes Bright Start an Illinois 529 college savings plan one of the nation s best and how you can save tax free for future expenses

Illinois offers a state tax deduction for contributions to a 529 plan of up to 10 000 for single filers and 20 000 for married filing jointly tax filers Bonus Contribution Illinois will automatically deposit 50 into a 529 college savings account for every child born or adopted in Illinois State Treasurer Michael Frerichs takes pride in helping Illinois families save for the future Through his Illinois 529 College Savings initiative families can take advantage of award winning 529 plans to help save for the rising costs of college

Download Tax Deduction Illinois 529 Plan

More picture related to Tax Deduction Illinois 529 Plan

Here s What To Do With Your 529 College Savings Plan Amid Stock Market

https://image.cnbcfm.com/api/v1/image/105467526-529.jpg?v=1537796635

If You Use Your 529 College Savings Plan For This You May Get A Tax

https://sc.cnbcfm.com/applications/cnbc.com/resources/files/2018/04/04/original-state-map-2017-12.png

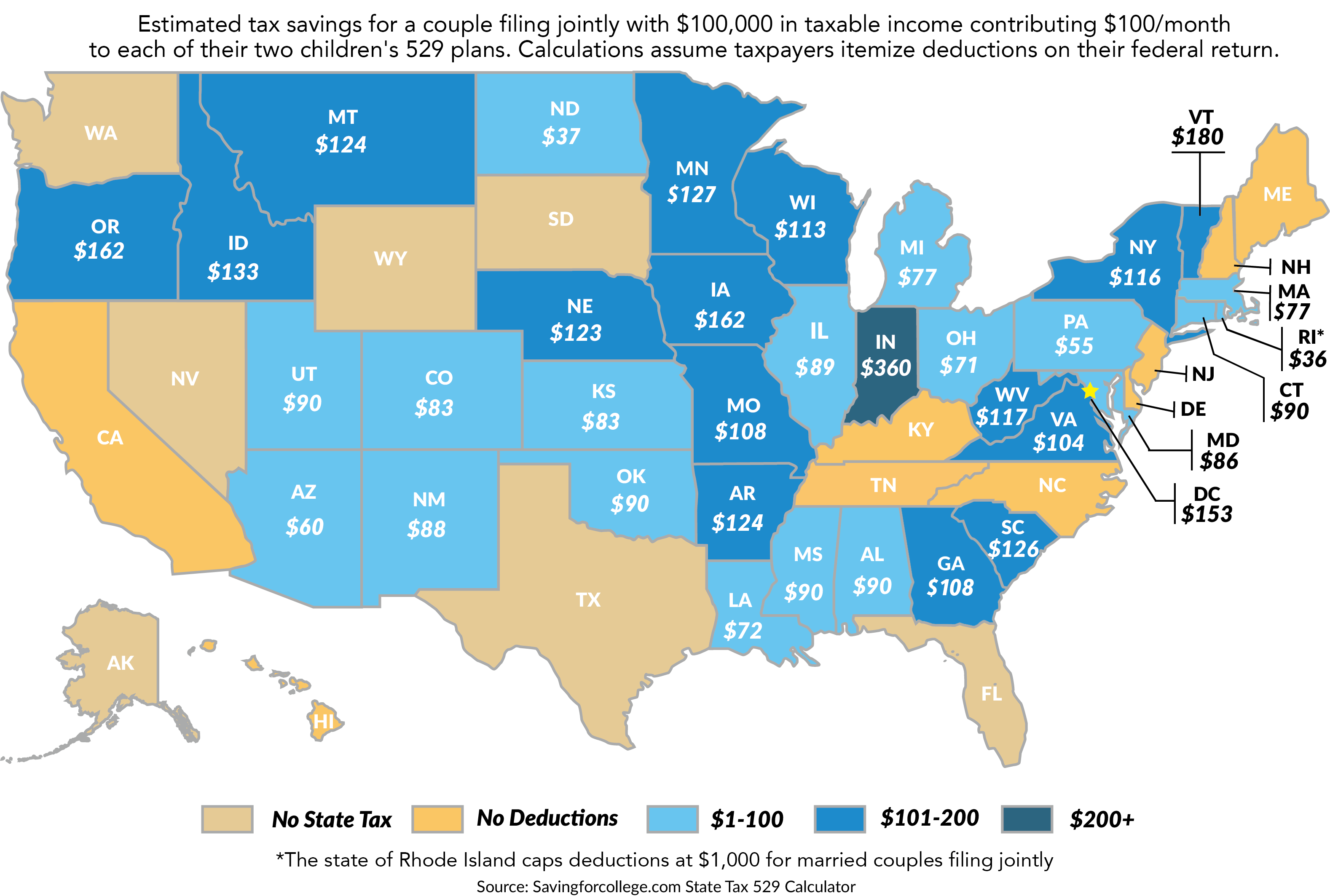

Comparing Your 529 In State Tax Deduction Vs Better Out of State Plans

http://www.mymoneyblog.com/wordpress/wp-content/uploads/2015/02/cs529tool.gif

The amount of any deduction previously taken for Illinois income tax purposes is added back to Illinois taxable income in the event an Account Owner takes a Nonqualified Withdrawal from an Account or if such assets are rolled over to a non Illinois 529 plan Families who invest in 529 plans may be eligible for tax deductions A 529 plan can be a great alternative to a private student loan This article will explain the tax deduction rules for 529 plans for current and future investors

To claim a tax deduction or credit for 529 plan contributions you must live and file taxes in a state that offers these benefits You must also be eligible to get a tax break based on your relationship with the account beneficiary You benefit from state tax advantages This includes 100 tax exempt earnings and an Illinois state income tax deduction up to 10 000 20 000 per couple in the year that you contribute

How Much Is Your State s 529 Plan Tax Deduction Really Worth

https://webresources-savingforcollege.s3.amazonaws.com/images/529-tax-deduction-worth.jpg

Comparing Your 529 In State Tax Deduction Vs Better Out of State Plans

http://www.mymoneyblog.com/wordpress/wp-content/uploads/2015/02/vg529tool.gif

https://brightstart.com/tax-benefits

As an Illinois taxpayer you ll realize benefits now from starting a Bright Start 529 college savings account Each year you can deduct your contributions to your Bright Start account up to 10 000 per individual taxpayer 20 000 for a married couple filing jointly

https://brightstart.com/tax-center

Learn more about 529 Plan tax benefits how to invest a tax refund into a plan and how to report a withdrawal from your account

Your State May Allow A Tax Deduction For A 529 Contribution

How Much Is Your State s 529 Plan Tax Deduction Really Worth

529 College Savings Plan Options For Illinois Good Financial Cents

Our View Brightens On This Illinois 529 Plan YouTube

Let s Break It Down 529 Plans

State Tax Deduction Or Credit For Contributions To A 529 Plan Meld

State Tax Deduction Or Credit For Contributions To A 529 Plan Meld

What Is The Right 529 Plan For College Savings Merriman

The ABCs Of A 529 Savings Account GWell

College Tuition Can Be Tax Deductible

Tax Deduction Illinois 529 Plan - Illinois account owners receive significant tax advantages for investing in Bright Directions including up to an annual 10 000 state income tax deduction 20 000 for a married couple filing jointly 2