Tax Deduction Income Protection Only the premiums you pay to protect your income salary and wages are deductible This is known as income protection or continuing salary cover If you receive a payment to replace your salary and wages under an income protection policy you must include it in your tax return

Income protection insurance is tax deductible in most cases but there s a few quirks to be aware of If you have an income protection policy held outside of super it s generally tax deductible Income protection insurance provides up to 70 of your regular income in monthly payments if you become ill or injured and the premiums you pay are tax deductible This means you can protect future you against a number of risks to your income while also enjoying tax benefits along the way

Tax Deduction Income Protection

Tax Deduction Income Protection

https://carbongroup.com.au/wp-content/uploads/2022/11/tax-deductions-for-life-insurances.jpg

Happy Tax Tax Day Tax Season Tax Deductions Party Shirts Print On

https://i.pinimg.com/originals/c1/fe/77/c1fe77bfd3a19358901fe3dcd052a853.jpg

When Is Income Protection Tax Deductible

https://www.lifeinsurancedirect.com.au/wp-content/uploads/2022/06/Tax-image-01.png

What tax deductions can you claim for income protection insurance To answer this question it s best to look at income protection cover from two perspectives the premiums what you pay and the benefits what you receive An income protection insurance policy covers for the loss of salary or wages due to illness or accidents The amount of the payments you receive is a percentage of your earnings based on your employment income prior to a claim

If you receive income protection cover as a perk from your employer or if they are paying your policy premiums then tax will be due on any payout you receive Your employer can seek corporation tax relief on your premium payments and any payouts you receive will most likely be taxed via PAYE You may claim debt deductions incurred in earning assessable income for example foreign source income that has been included at item 20 on your tax return at this item if you have not claimed them elsewhere on your tax return

Download Tax Deduction Income Protection

More picture related to Tax Deduction Income Protection

Tax deduction checklist Etsy

https://i.etsystatic.com/37903484/r/il/61e14b/5462529921/il_1080xN.5462529921_cvyy.jpg

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

100 Tax Deduction On Your Donation In Malaysia Jul 26 2021 Johor

https://cdn1.npcdn.net/image/16272778521a6ef50158b79f67207a9ee7fe2b2eb3.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

For employees your income protection insurance premiums are not subject to fringe benefits tax FBT This is because it would otherwise be tax deductible if you were paying for it personally For employers the income protection premium should be tax deductible as an employer company Because income protection is designed to replace your income if you can t work due to illness or injury premiums for this type of cover are generally tax deductible with some exceptions Tax deductible premiums may result in significant savings for you

Clients can benefit from income tax savings by claiming a tax deduction for personal contributions or by contributing via a salary sacrifice arrangement using pre tax salary which may provide cost savings on premiums You can claim the cost of premiums you pay for insurance against the loss of your income If the policy provides benefits of an income and capital nature only that part of the premium that relates to the income benefit is deductible

Qualified Business Income Deduction And The Self Employed LaptrinhX

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t001.jpg

Abolition Of State Tax Deduction Keeps NJ Tax In Check

https://d.newsweek.com/en/full/718411/gettyimages-109917953.jpg

https://www.ato.gov.au/.../income-protection-insurance

Only the premiums you pay to protect your income salary and wages are deductible This is known as income protection or continuing salary cover If you receive a payment to replace your salary and wages under an income protection policy you must include it in your tax return

https://www.finder.com.au/income-protection/is...

Income protection insurance is tax deductible in most cases but there s a few quirks to be aware of If you have an income protection policy held outside of super it s generally tax deductible

What Will My Tax Deduction Savings Look Like The Motley Fool

Qualified Business Income Deduction And The Self Employed LaptrinhX

Deduction For Income Protection Insurance YouTube

Tax Prep Documents Checklist H R Block Top 11 Construction

What Are Pre tax Deductions Before Tax Deduction Guide

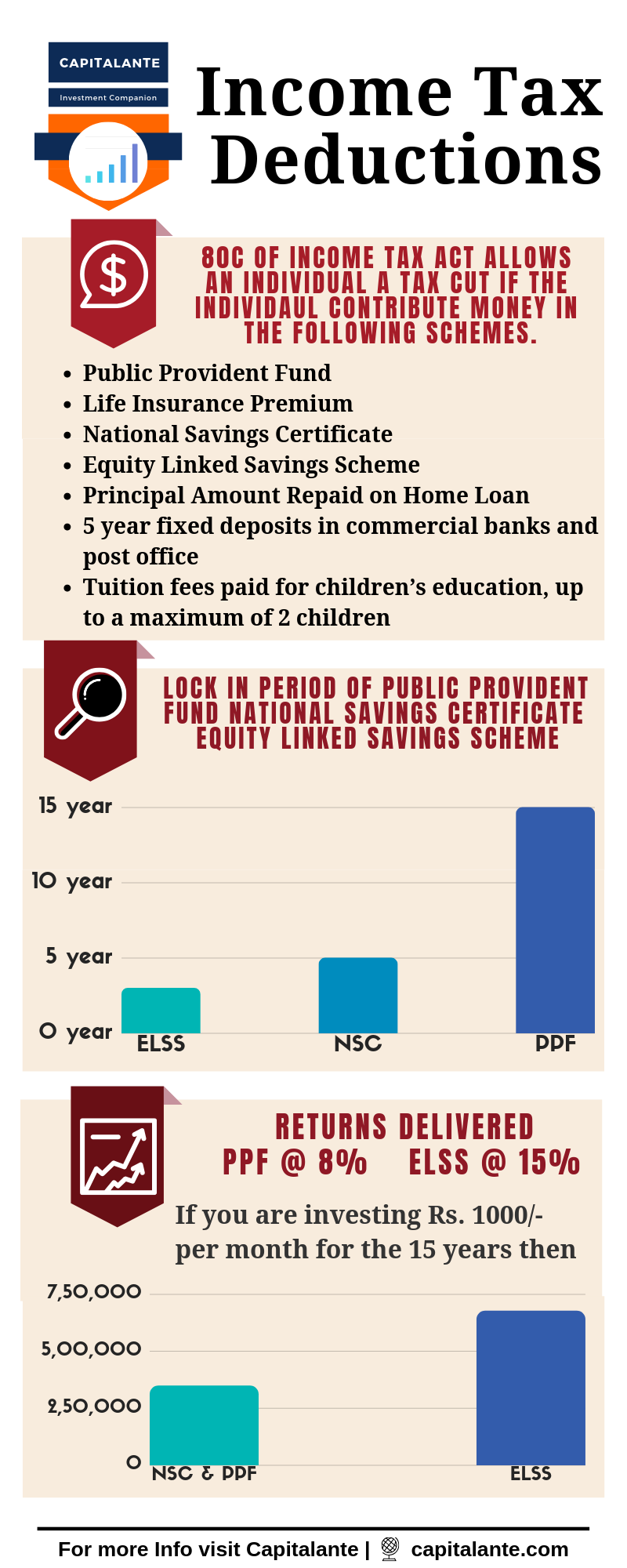

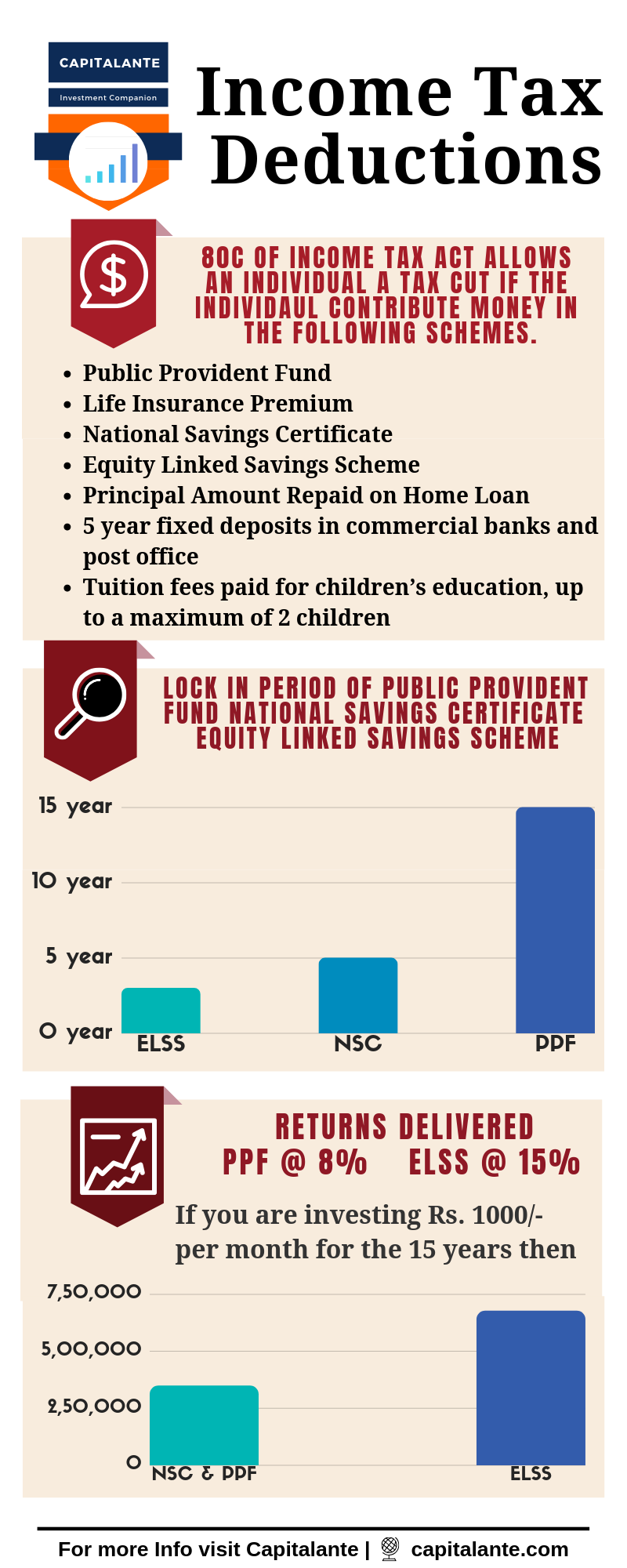

Income Tax Deductions In India Capitalante

Income Tax Deductions In India Capitalante

Tax Deduction On Cash Loss Mar 18 2021 Johor Bahru JB Malaysia

Tax Deduction On Payment To Release Bumi Lot Sep 01 2022 Johor

Maximising Tax Benefits Your Guide To Claiming A Rental Property

Tax Deduction Income Protection - Income protection insurance policies taken out with an insurance company a financial adviser or broker and not through your superannuation fund are generally tax deductible according to Australian Government s Moneysmart website