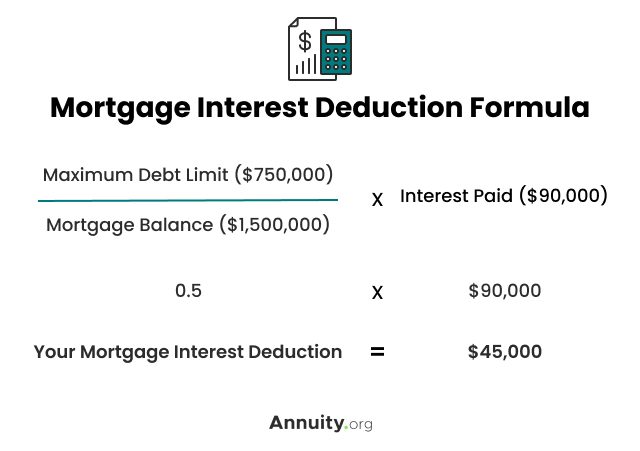

Tax Deduction Mortgage Interest 2022 Mortgage Interest This part explains what you can deduct as home mortgage interest It includes discussions on points and how to report deductible interest on your tax return Generally home mortgage interest is any in terest you pay on a loan secured by your home main home

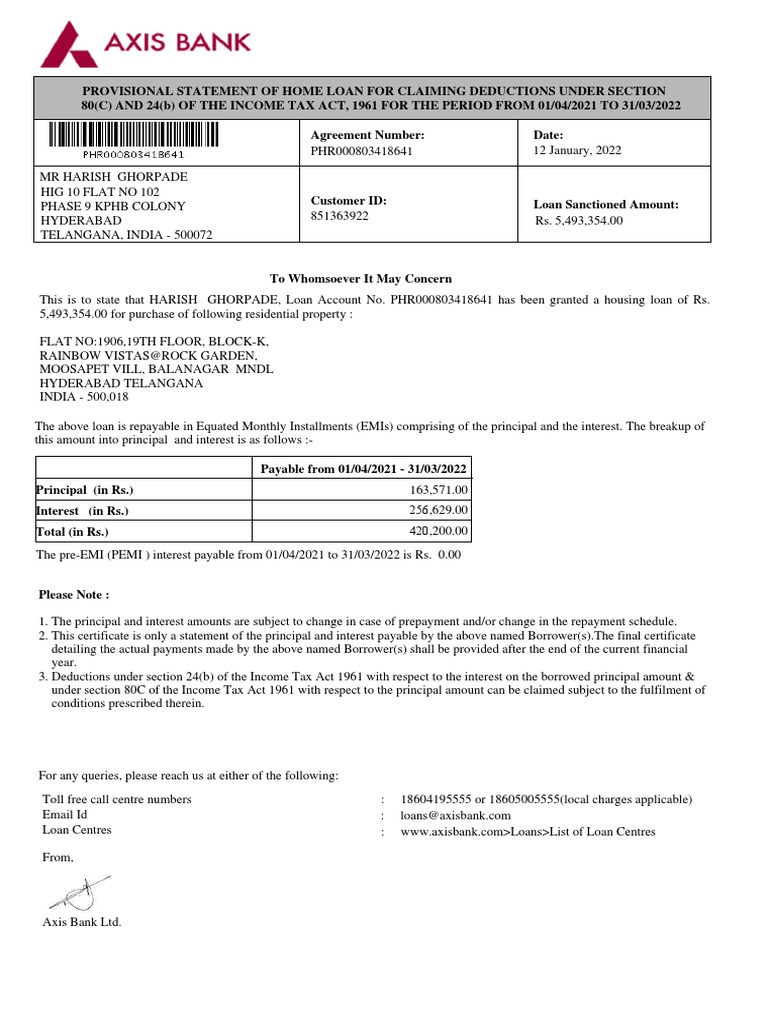

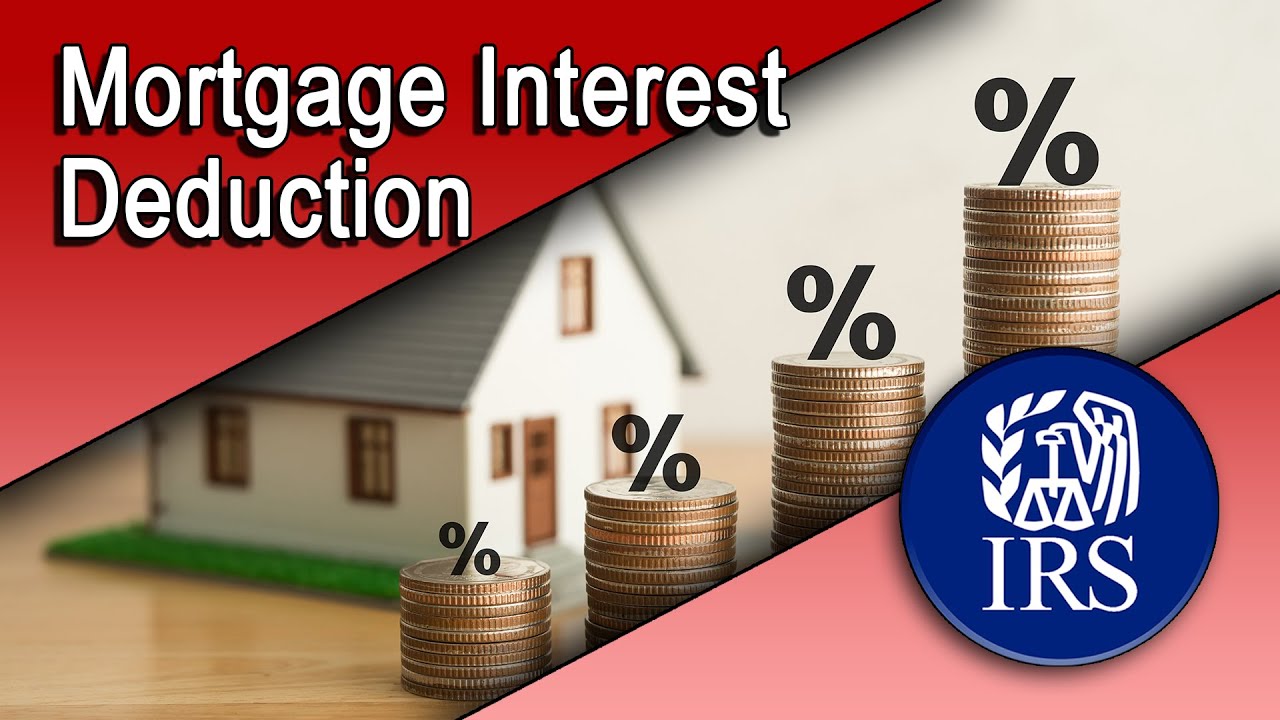

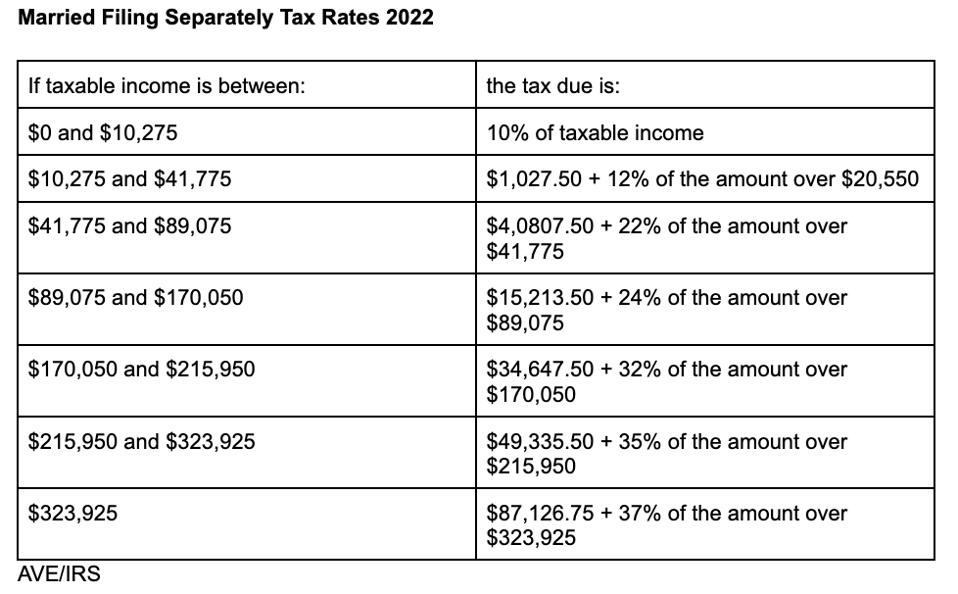

You can claim a tax deduction for the interest on the first 750 000 of your mortgage 375 000 if married filing separately HELOCs are no longer eligible for the deduction unless the proceeds are used to buy build or You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married filing separately the

Tax Deduction Mortgage Interest 2022

Tax Deduction Mortgage Interest 2022

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

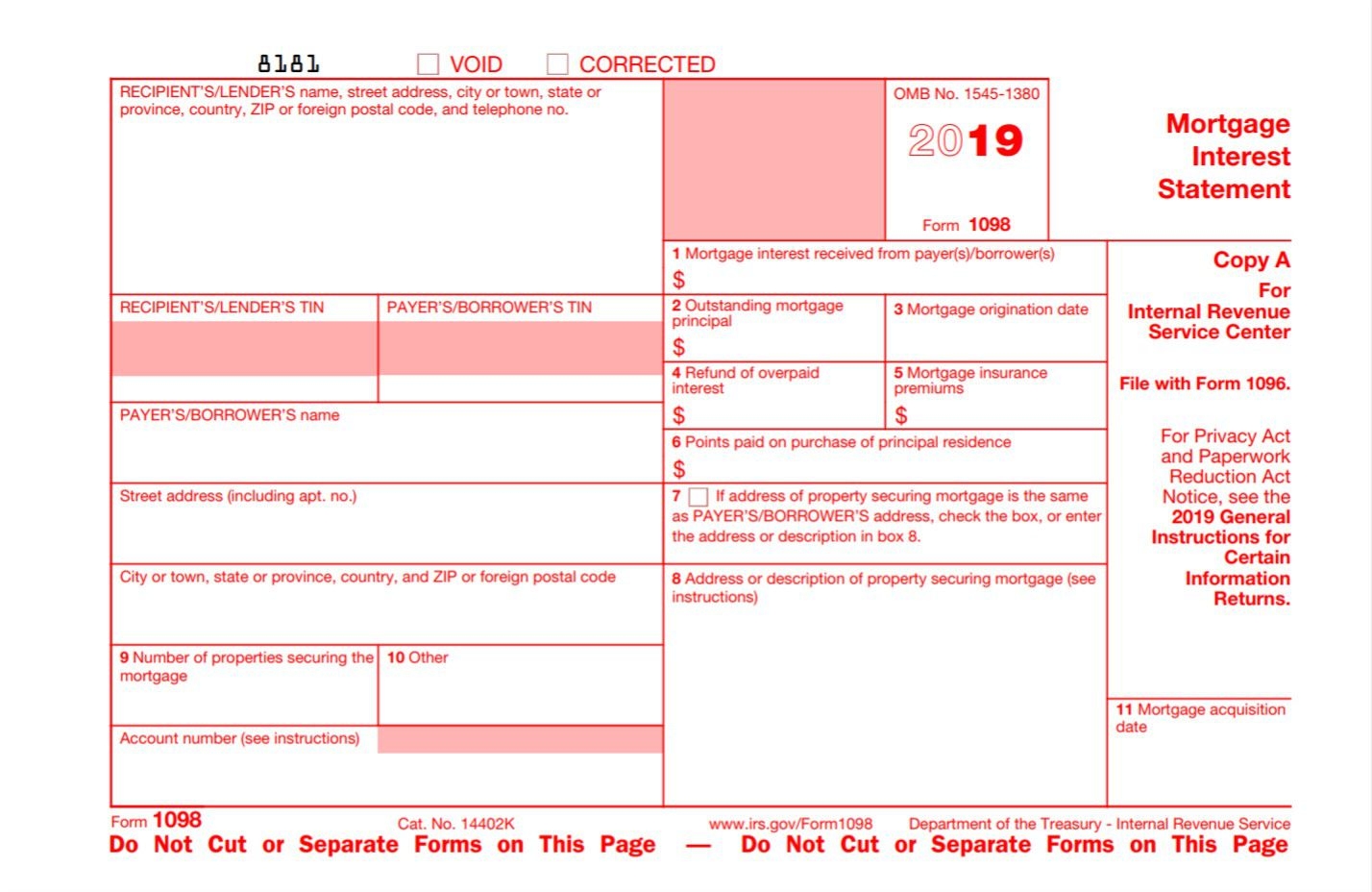

2022 1098 Mortgage Statement Forms Fillable Fillable Form 2023

https://fillableforms.net/wp-content/uploads/2022/07/2022-1098-mortgage-statement-forms-fillable.jpg

What Exactly Do I Need To Qualify For A Home Loan Blog Realty

https://www.realtyexecutives.com/blog/wp-content/uploads/2018/09/home-tax-deduction-mortgage-interest-picture-id903035430.jpg

For homeowners with a mortgage the mortgage interest deduction is one of several homeowner tax deductions provided by the Internal Revenue Service IRS Learn more about this valuable deduction and how You can deduct the interest from your mortgage payments when you file a tax return but only if the loan is secured by your home Also the loan proceeds must have been used to buy build or improve your main home and

Is mortgage interest tax deductible Yes The interest portion of your mortgage payment is tax deductible The deduction doesn t apply to the mortgage principal down payment or mortgage To reduce your taxable income you can deduct the interest you pay each tax year on your individual income tax return which is of value amidst rising mortgage rates Understanding the tax rules including the mortgage interest

Download Tax Deduction Mortgage Interest 2022

More picture related to Tax Deduction Mortgage Interest 2022

Mortgage Interest Deduction 2 The Official Blog Of TaxSlayer

https://www.taxslayer.com/blog/wp-content/uploads/2022/05/Mortgage-Interest-Deduction-2-1200x900.png

HOME LOAN INTEREST CERTIFICATE For FY 2021 22 PDF Loans Interest

https://imgv2-2-f.scribdassets.com/img/document/553973286/original/542bfb7a7c/1661356692?v=1

Mortgage Interest Deduction 2 The Official Blog Of TaxSlayer

https://www.taxslayer.com/blog/wp-content/uploads/2022/05/Mortgage-Interest-Deduction-2.png

The expansion of the standard deduction and a lower limit on deductible mortgage debt mean fewer filers take this popular write off Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up

You can find the amount of loan interest you paid in 2022 on your mortgage interest statement Form 1098 Your mortgage lender or loan servicer should mail the form or With the mortgage interest deduction MID you can write off a portion of the interest on your home loan lowering your taxable income and potentially moving you into a

Mortgage Interest Deduction Limit Worksheet

https://i2.wp.com/standard-deduction.com/wp-content/uploads/2020/10/how-to-reduce-your-tax-bill-with-itemized-deductions-bench-2-1024x883.png

Mortgage Interest Deduction YouTube

https://i.ytimg.com/vi/xyHdUVv36lg/maxresdefault.jpg

https://www.irs.gov/pub/irs-prior/p936--2022.pdf

Mortgage Interest This part explains what you can deduct as home mortgage interest It includes discussions on points and how to report deductible interest on your tax return Generally home mortgage interest is any in terest you pay on a loan secured by your home main home

https://www.thebalancemoney.com/hom…

You can claim a tax deduction for the interest on the first 750 000 of your mortgage 375 000 if married filing separately HELOCs are no longer eligible for the deduction unless the proceeds are used to buy build or

Is The Mortgage Interest Deduction In Play B Logics

Mortgage Interest Deduction Limit Worksheet

Property Tax Deduction Mortgage ProfitBooks

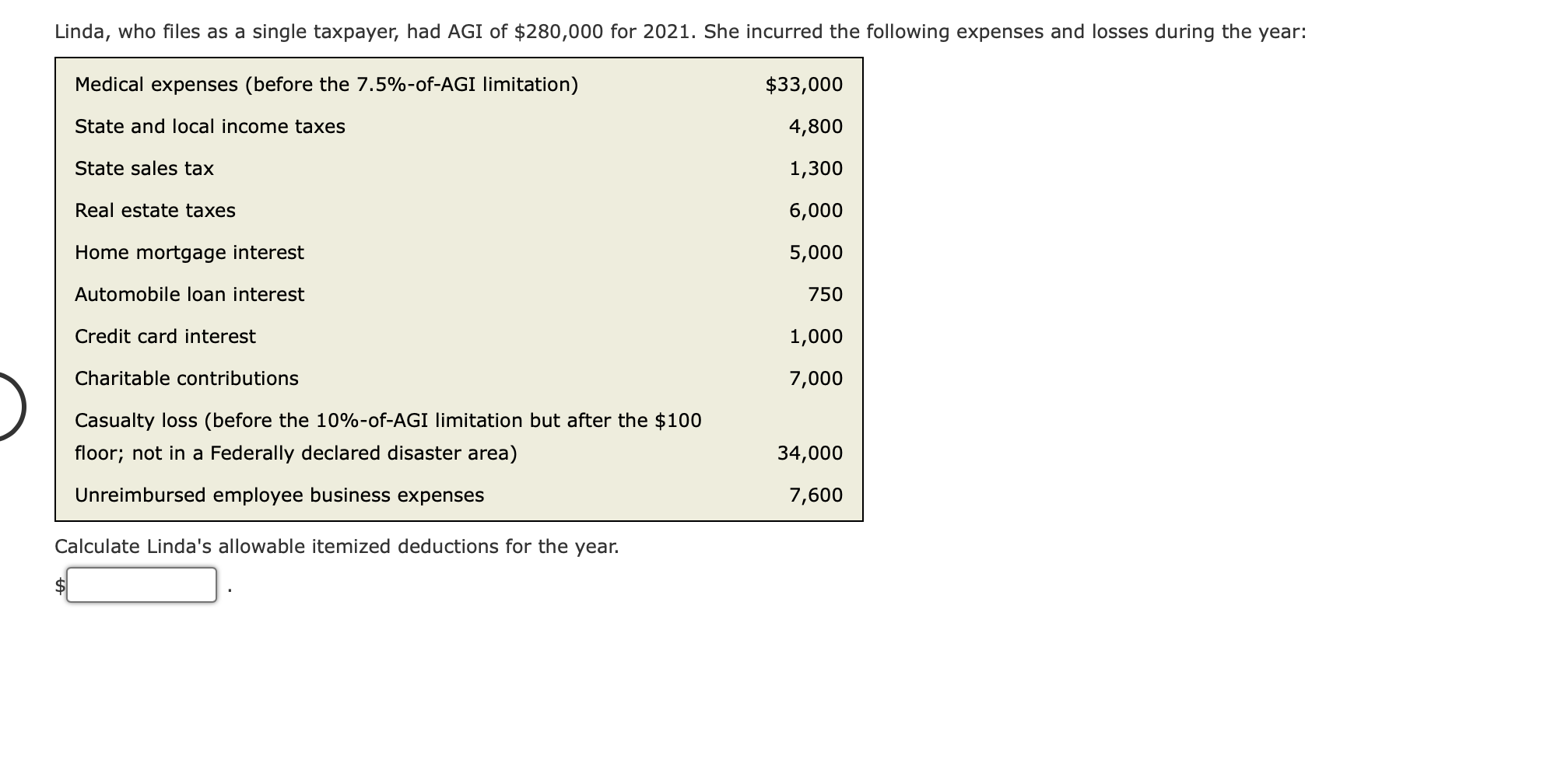

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

IRS Announces 2022 Tax Rates Standard Deduction

Can I Claim The Mortgage Interest Deduction Mortgage Interest Tax

Can I Claim The Mortgage Interest Deduction Mortgage Interest Tax

Irs Itemized Deductions Worksheet TUTORE ORG Master Of Documents

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction YouTube

Tax Deduction Mortgage Interest 2022 - For homeowners with a mortgage the mortgage interest deduction is one of several homeowner tax deductions provided by the Internal Revenue Service IRS Learn more about this valuable deduction and how