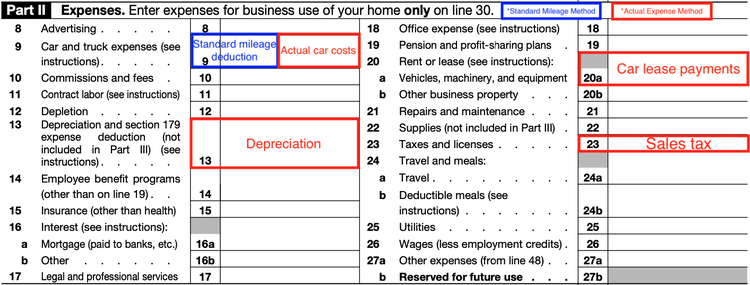

Tax Deduction On Car Loan Car loan interest is deductible in certain situations where you use your vehicle for business purposes Owning a car that you use some or all of the time for your business can provide tax

The loan amount will be deducted from your tax refund reducing the refund amount paid directly to you Tax returns may be e filed without applying for this loan Fees for other optional products or product features may apply Car loan interest is deductible in certain situations where you use your vehicle for business purposes Owning a car that you use some or all of the time for your business can provide tax

Tax Deduction On Car Loan

Tax Deduction On Car Loan

https://static.fmgsuite.com/media/InlineContent/originalSize/984f6148-60aa-49b7-971c-fb3554606b40.jpg

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

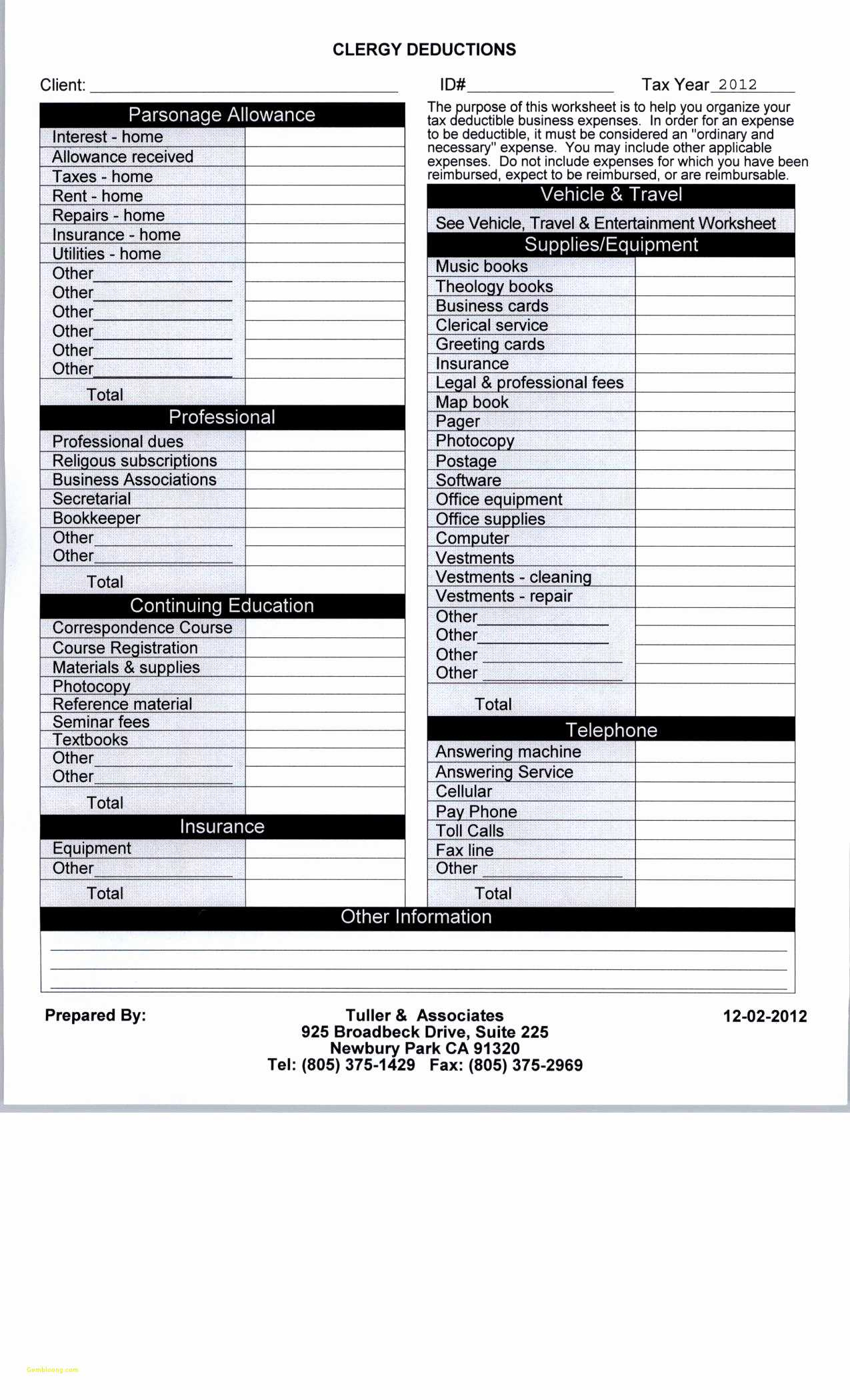

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

In all Americans have 1 63 trillion in auto loan debt across over 100 million loans according to the New York Fed However depending on how the deduction is structured it could be irrelevant Topic no 505 Interest expense Interest is an amount you pay for the use of borrowed money Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to

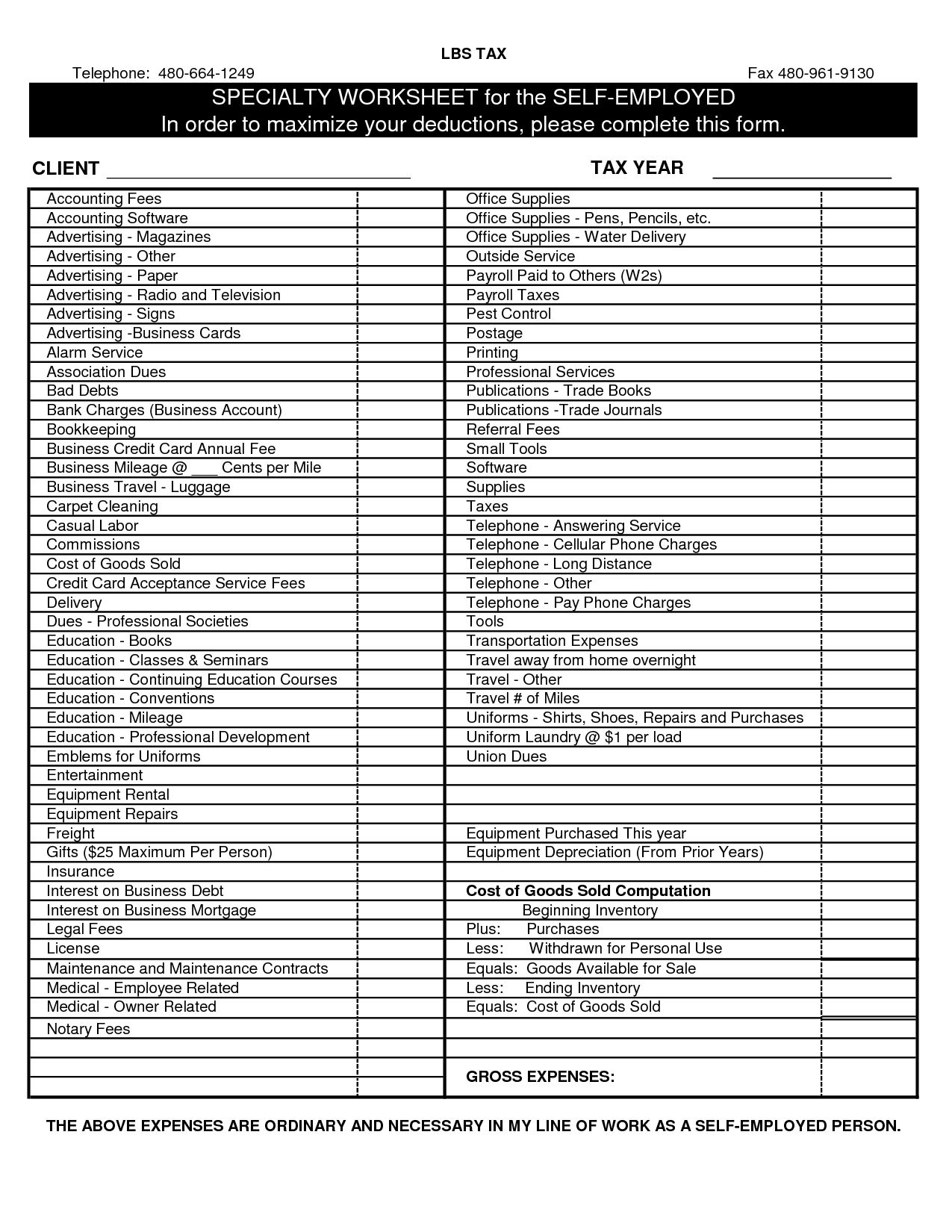

Car loan interest is only tax deductible if you re a business owner or self employed Unfortunately employees can t claim this deduction even if they use their car for work purposes Let s break down how the car loan interest tax deduction works and who qualifies As a business owner you can claim a tax deduction for expenses for motor vehicles used in running your business Last updated 16 July 2024 Print or Download On this page Types of vehicles Expenses you can claim Separate private from business use Car limit Watch

Download Tax Deduction On Car Loan

More picture related to Tax Deduction On Car Loan

Tax Deduction Letter PDF Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-c1c1da39f77a424f295c2df1cb0f2b87.png

EXCEL Of Tax Deduction Form xlsx WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20191025/a893d00e6a764d2f9dbbb7838baa295d.jpg

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

https://i.etsystatic.com/24598192/r/il/e3c7c0/3985544266/il_570xN.3985544266_82sm.jpg

If you are self employed and use your car in your business you can deduct the business part of state and local personal property taxes on motor vehicles on Schedule C Form 1040 or Schedule F Form 1040 Republican presidential candidate Donald Trump made the surprise announcement Thursday that he plans to make car loan interest tax deductible a move that if actually adopted could help millions of Americans who are carrying auto loan debt

You can t deduct your car loan principal payments on your taxes but if you re self employed and you re financing a car you use for work all or a portion of the auto loan interest may be tax deductible The amount you can deduct will depend on how many miles you drive for business vs personal use How does vehicle loan tax exemption work If you re a business owner or a self employed professional you can claim a car loan tax exemption by treating the interest payment as an expense Which means you can decrease your taxable income by the amount you have already paid as interest

Corporation Prepaid Insurance Tax Deduction Financial Report

https://i2.wp.com/www.patriotsoftware.com/wp-content/uploads/2019/12/business-tax-credit-vs-tax-deduction-visual.jpg

Car Donation Tax Deduction HumaneCARS

https://www.humanecars.org/wp-content/uploads/tax-deduction-note.jpg

https://www.bankrate.com/loans/auto-loans/car-loan...

Car loan interest is deductible in certain situations where you use your vehicle for business purposes Owning a car that you use some or all of the time for your business can provide tax

https://www.hrblock.com/tax-center/filing/...

The loan amount will be deducted from your tax refund reducing the refund amount paid directly to you Tax returns may be e filed without applying for this loan Fees for other optional products or product features may apply

Salary Deduction Letter To Employee For Loan Dollar Keg

Corporation Prepaid Insurance Tax Deduction Financial Report

How To Save Tax Without Investing In India 2023 Coin Wall

From Pan To Crypto New Income Tax Reforms That Take Effect On July 1

Self Employed Tax Deduction Worksheet

How To Make Your Car A Tax Deduction YouTube

How To Make Your Car A Tax Deduction YouTube

Realtor Tax Deduction Worksheet

Get An Immediate Crypto Tax Deduction By Using Donor Advised Funds

How To Take A Tax Deduction For The Business Use Of Your Car

Tax Deduction On Car Loan - Car loan interest is only tax deductible if you re a business owner or self employed Unfortunately employees can t claim this deduction even if they use their car for work purposes Let s break down how the car loan interest tax deduction works and who qualifies