Tax Deduction On Rent Paid Calculator Rental income You must report the rental income you receive and the expenses of renting The income you receive as you rent out your investment property is treated as capital income

Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a rented accommodation but still get house rent allowance Use Tax Calculator and get your taxes estimates in mins as per new budget Calculate Now HRA for Self Employed Individuals Individuals who are self employed cannot claim HRA but they can avail tax deductions

Tax Deduction On Rent Paid Calculator

Tax Deduction On Rent Paid Calculator

https://thefivefortyfive.com/wp-content/uploads/2023/07/Tax-Deduction-on-Rent-Paid.webp

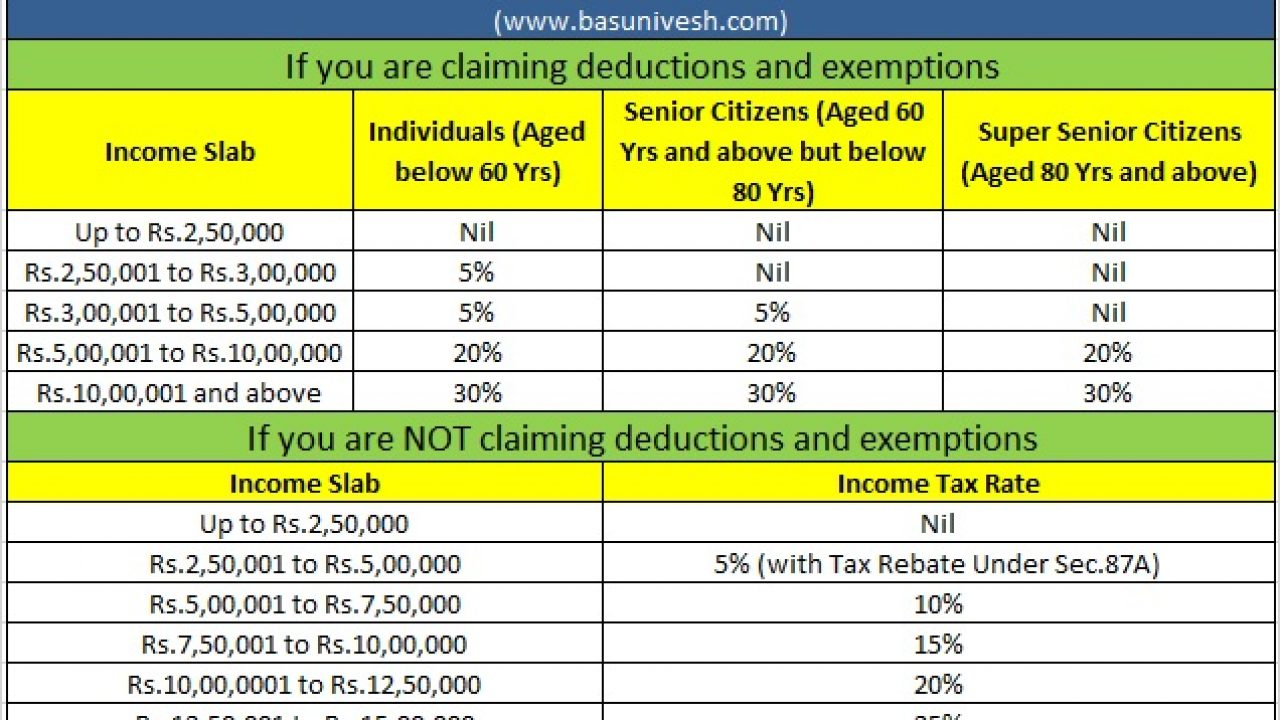

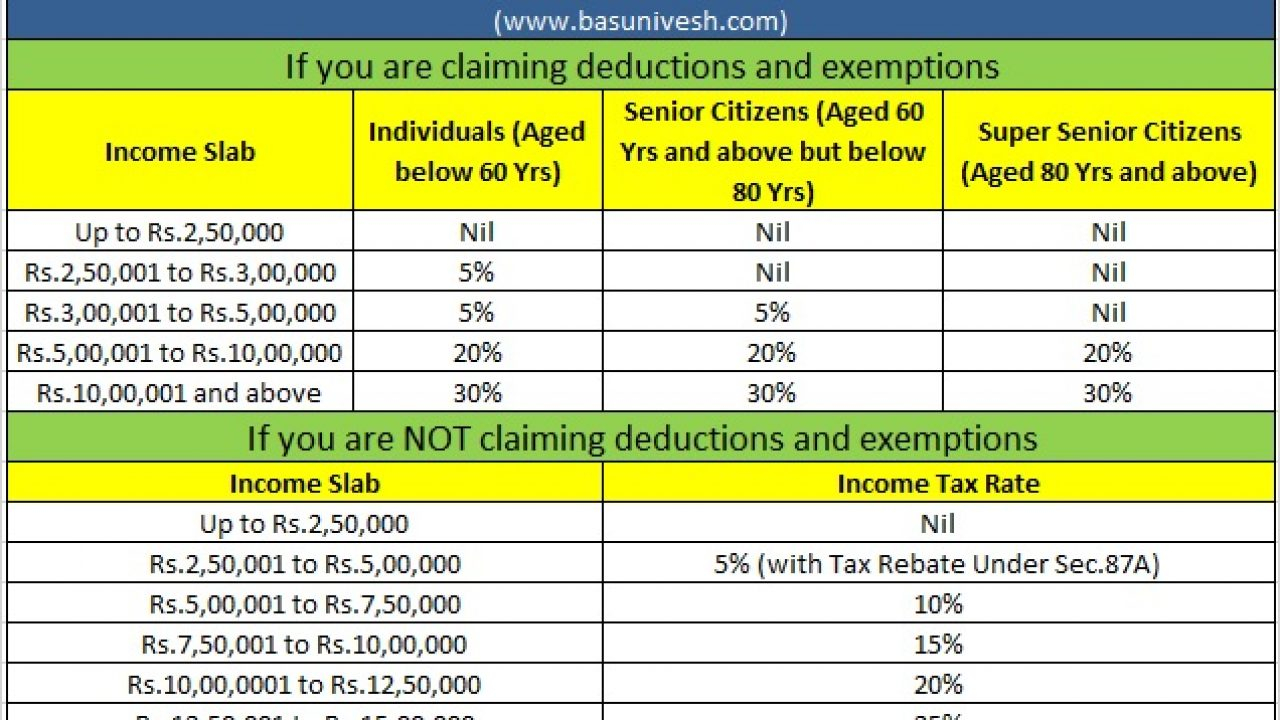

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-7.jpg

RCM On Rent Under GST Rcm On Rent Paid Under Gst Reverse Charge

https://i.ytimg.com/vi/Yo2ajdytSuA/maxresdefault.jpg

Enter how much HRA allowance you have received from your employer Select the location of your residence whether it is in the metro city or non metro city Enter the total rent paid As per the Income Tax Act of 1961 section 80GG allows you to claim a deduction on yearly rent Contents What is Section 80GG of Income Tax Act Who is eligible to claim deductions under Section 80GG How are

You can deduct expenses from your rental income when you work out your taxable rental profit as long as they are wholly and exclusively for the purposes of renting out If you don t receive HRA House Rent Allowance but pay rent you can still get a tax deduction on the rent paid under Section 80 GG of the Income Tax Act 1961 The maximum deduction permitted under Section 80

Download Tax Deduction On Rent Paid Calculator

More picture related to Tax Deduction On Rent Paid Calculator

Section 80GG Deduction On Rent Paid Kartik M Jain

https://www.cakartikmjain.com/wp-content/uploads/2020/07/80gg-on-rent-paid-600x285.jpg

I T Deduction On Rent Paid The Economic Times

https://img.etimg.com/thumb/msid-5330295,width-1070,height-580,overlay-etpanache/photo.jpg

Understanding Tax Deduction On Rent Paid To An NRI Essential

https://thefivefortyfive.com/wp-content/uploads/2023/07/Tax-Deduction-on-Rent-Paid-1.webp

Section 80GG permits a person to claim a deduction for rent paid for the house Get to know its meaning eligibility criteria calculation etc on Groww Rental income tax calculator Landlord earning rental income from a tenant in your home or a buy to let property Quickly calculate how much you can expect to pay in rental income tax Tax year 2024 25

HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting a House Rent Allowance HRA Calculator calculates HRA exemption refund for salaried individuals Consider Metros like Delhi Mumbai Hyderabad Chennai

Section 80GG Deduction On Rent Paid

https://taxguru.in/wp-content/uploads/2018/06/Section-80GG-rent-paid.jpg

Deduction On Electrical Vehicle For Interest Paid On Loan

https://www.taxhelpdesk.in/wp-content/uploads/2021/08/Deduction-under-Section-80EEB-Interest-paid-on-loan-taken-for-purchase-of-electric-vehicle.png

https://www.vero.fi/en/individuals/property/rental_income

Rental income You must report the rental income you receive and the expenses of renting The income you receive as you rent out your investment property is treated as capital income

https://cleartax.in/paytax/hracalculator

Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a rented accommodation but still get house rent allowance

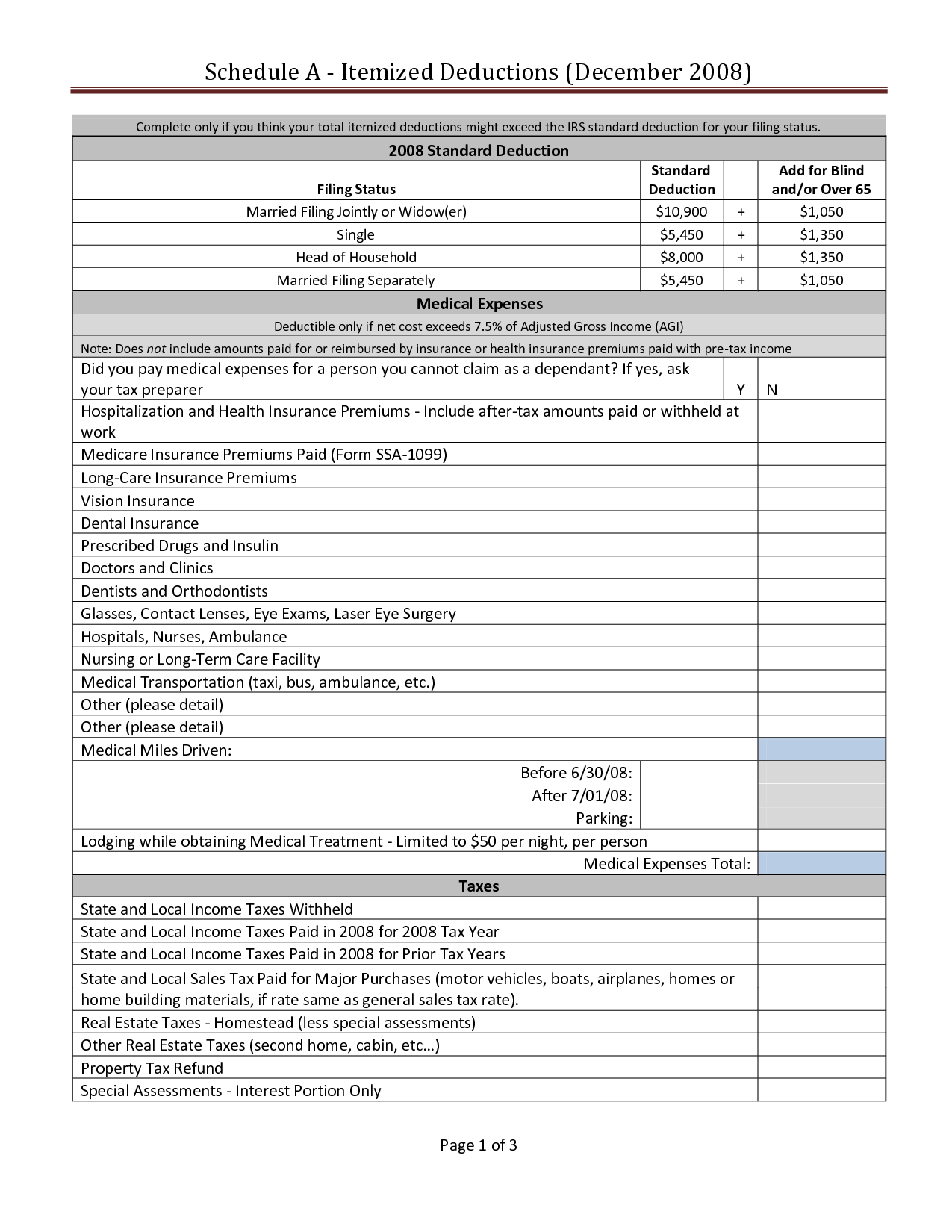

5 Itemized Tax Deduction Worksheet Worksheeto

Section 80GG Deduction On Rent Paid

5 Itemized Tax Deduction Worksheet Worksheeto

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

Tax Deduction In Respect Of Rent Paid I Section 80GG I Who Can Take

How To Claim Tax Deduction On Rent If You Are Sharing The Flat

How To Claim Tax Deduction On Rent If You Are Sharing The Flat

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

Commercial Rent Tax October 2022 Issue

Section 80GG Of Income Tax Act Tax Deduction On Rent Paid

Tax Deduction On Rent Paid Calculator - Enter how much HRA allowance you have received from your employer Select the location of your residence whether it is in the metro city or non metro city Enter the total rent paid