Tax Deduction Slab For Salaried Verkko 19 maalisk 2018 nbsp 0183 32 As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of Rs 50 000 under the new tax regime also from the financial

Verkko New Income Tax Exemptions and Deductions Allowed for Salaried Individuals Under New Tax Regime FY 2023 24 If salaried taxpayers opt for the new tax regime for Verkko 28 helmik 2022 nbsp 0183 32 Income tax slab for salaried individuals What is income from salary Various deductions to calculate income tax on salary 1 House Rent Allowance HRA

Tax Deduction Slab For Salaried

Tax Deduction Slab For Salaried

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-16-1024x538.png

Income Tax Rates 2022 23 For Salaried Persons Employees Slabs

https://www.glxspace.com/wp-content/uploads/2022/06/Income-Tax-Rates-2022-23-for-Salaried-Persons-Employees-with-Slabs-1.jpg

Old Regime Tax Slab For Fy 2024 24 Alta Jewell

https://www.valueresearchonline.com/content-assets/images/47951_20220601-tax_slabs-old_and_new__w1000__.png

Verkko 22 marrask 2023 nbsp 0183 32 Income tax on salary is calculated based on the income earned and the applicable tax rates The tax rates are determined by the government and are Verkko Tax Slabs for AY 2023 24 Individuals and HUFs can opt for the Old Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax Act The

Verkko 4 helmik 2023 nbsp 0183 32 The changes announced in the income tax slabs under the new tax regime is applicable for incomes earned in current the FY 2023 24 starting from Verkko How to Calculate Taxable Income on Salary Know How to calculate taxable income on the salary in India Check all about Perquisites Deductions types of Taxes Taxable

Download Tax Deduction Slab For Salaried

More picture related to Tax Deduction Slab For Salaried

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3-768x432.jpg

.jpg)

Important Deduction For Income Tax For Salaried Persons Employees On

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/6935e541-d1ae-4702-be59-bae61802b2e3/income-tax-slab-rate-(senior-citizen).jpg

Salary Tax Calculator Income Tax Slabs For FY 2022 23 Zameen Blog

https://zameenblog.s3.amazonaws.com/blog/wp-content/uploads/2020/08/Salary-Tax-Calculator-Cover-25-08.jpg

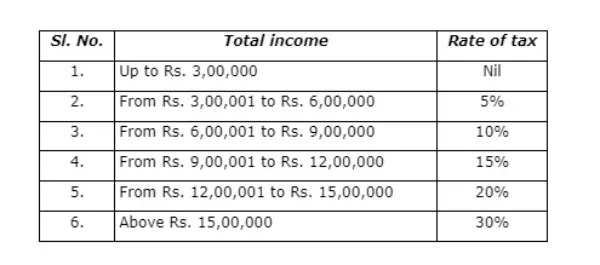

Verkko 14 huhtik 2023 nbsp 0183 32 Tax Slab Tax slabs in the new regime have also been relaxed a bit now and these new relaxed slab rates are up to Rs 3 00 000 Nil Tax 3 00 001 to 6 00 000 5 6 00 001 to 9 00 000 Verkko Let s understand income tax calculation under the current tax slabs and new tax slabs optional by way of an example Neha receives a Basic Salary of Rs 1 00 000 per month HRA of Rs 50 000 Special

Verkko 4 elok 2023 nbsp 0183 32 Which tax regime is better for 25 lakhs salary If you have an income of Rs 20 lakhs the best regime for you will depend on the tax deductions you are Verkko 7 helmik 2023 nbsp 0183 32 Budget 2023 proposed no change in tax slabs and rates under the Old Regime Under the New Regime Finance Bill 2023 has included a Standard

Income Tax Slab 2020 21 Old Tax Regime Or New One Which Is More

https://financialexpresswpcontent.s3.amazonaws.com/uploads/2020/02/Tax-table-old-13-25lakh-nil.jpg

Income Tax Calculator FY 2021 22 AY 2022 23 Excel Download Trader

https://res.cloudinary.com/jerrick/image/upload/d_642250b563292b35f27461a7.png,f_jpg,fl_progressive,q_auto,w_1024/60371cbd06fa70001cdd3733.png

https://cleartax.in/s/income-tax-allowances-and-deductions

Verkko 19 maalisk 2018 nbsp 0183 32 As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of Rs 50 000 under the new tax regime also from the financial

https://www.godigit.com/income-tax/income-tax-slab-for-salaried-person

Verkko New Income Tax Exemptions and Deductions Allowed for Salaried Individuals Under New Tax Regime FY 2023 24 If salaried taxpayers opt for the new tax regime for

Economy Archives Graana Blog

Income Tax Slab 2020 21 Old Tax Regime Or New One Which Is More

New Income Tax Slabs 2023 Is The Simplified Tax Regime Really

Income Tax Calculation 2022 23 How To Calculate Income Tax FY 2022 23

Tax Deductions For Financial Year 2018 19 WealthTech Speaks

How To Calculate Income Tax On Salary With Example

How To Calculate Income Tax On Salary With Example

Income Tax Slab 2021 To 2022 Latest News Update

Format Of Declaration To Be Taken From Salaried Employee By Employer To

Deductions Allowed Under The New Income Tax Regime Paisabazaar

Tax Deduction Slab For Salaried - Verkko 31 hein 228 k 2023 nbsp 0183 32 Explore Standard Deduction under Section 16 ia and in the new tax regime Standard deduction of Rs 40 000 reintroduced in the Budget 2018 To