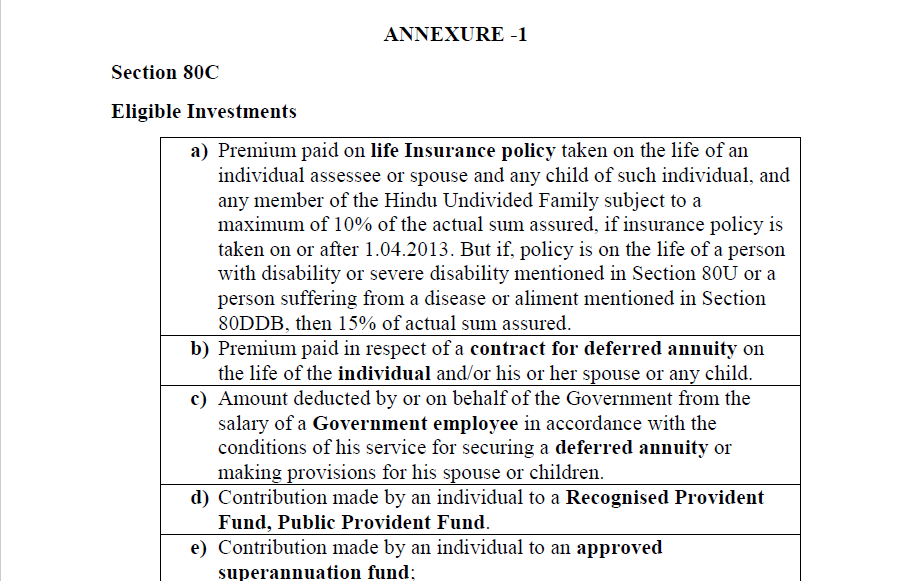

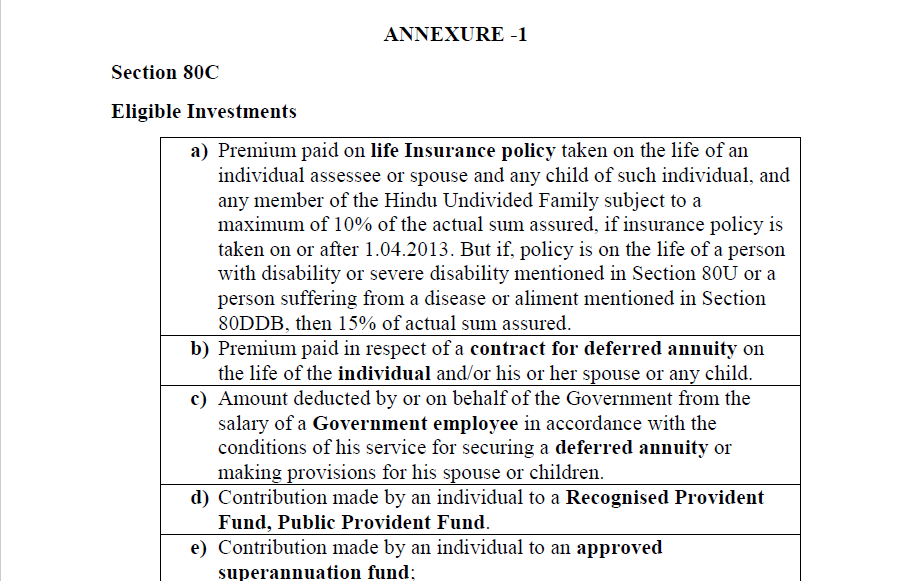

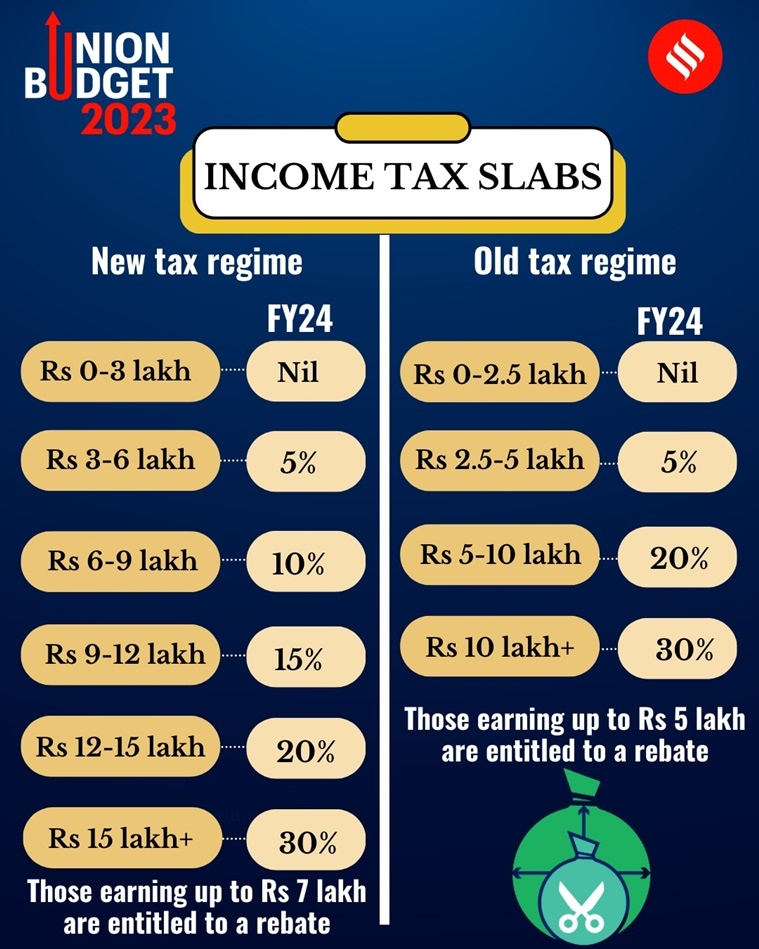

Tax Deduction Slabs As per the latest income tax regulations for the year 2024 2025 the following slabs and income tax rates will be applicable for salaried persons Where the taxable salary income does not exceed Rs 600 000 the rate of income tax is

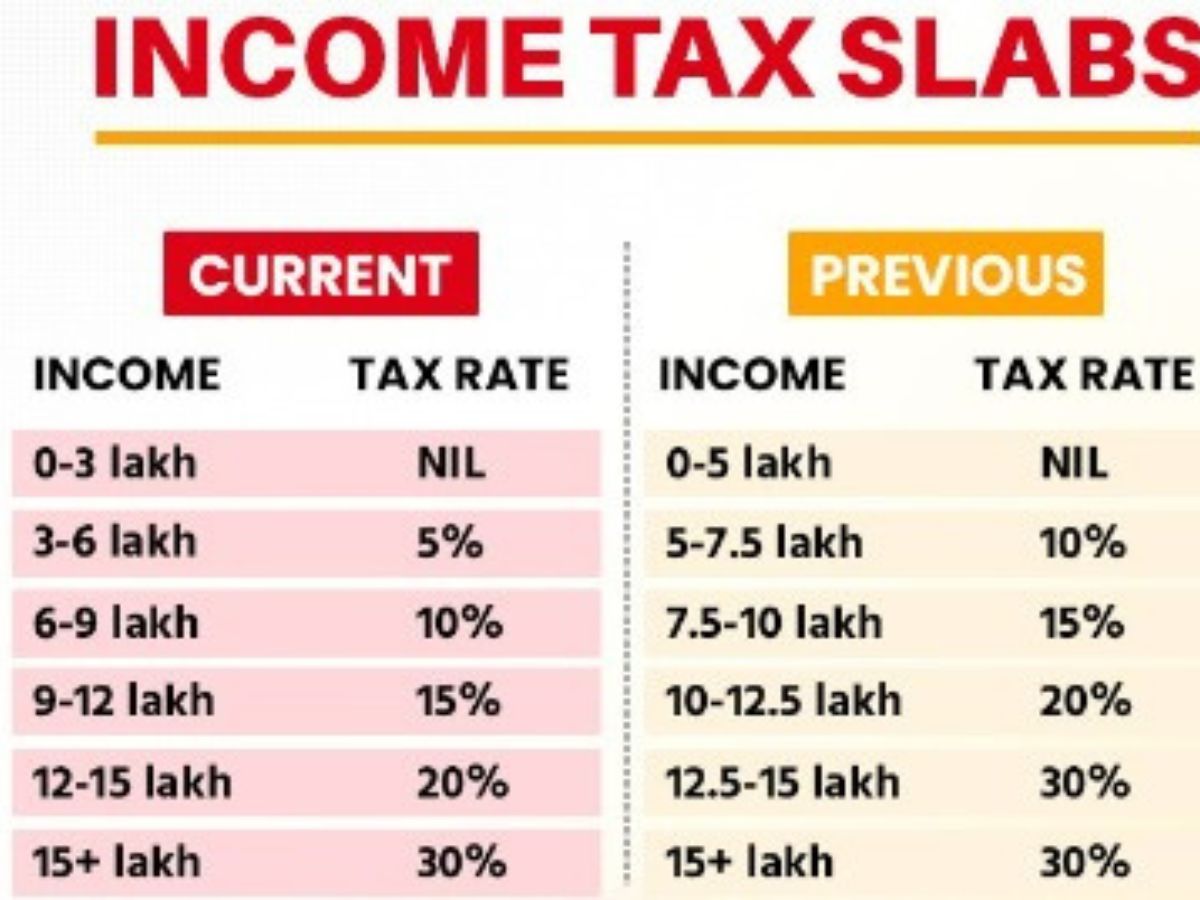

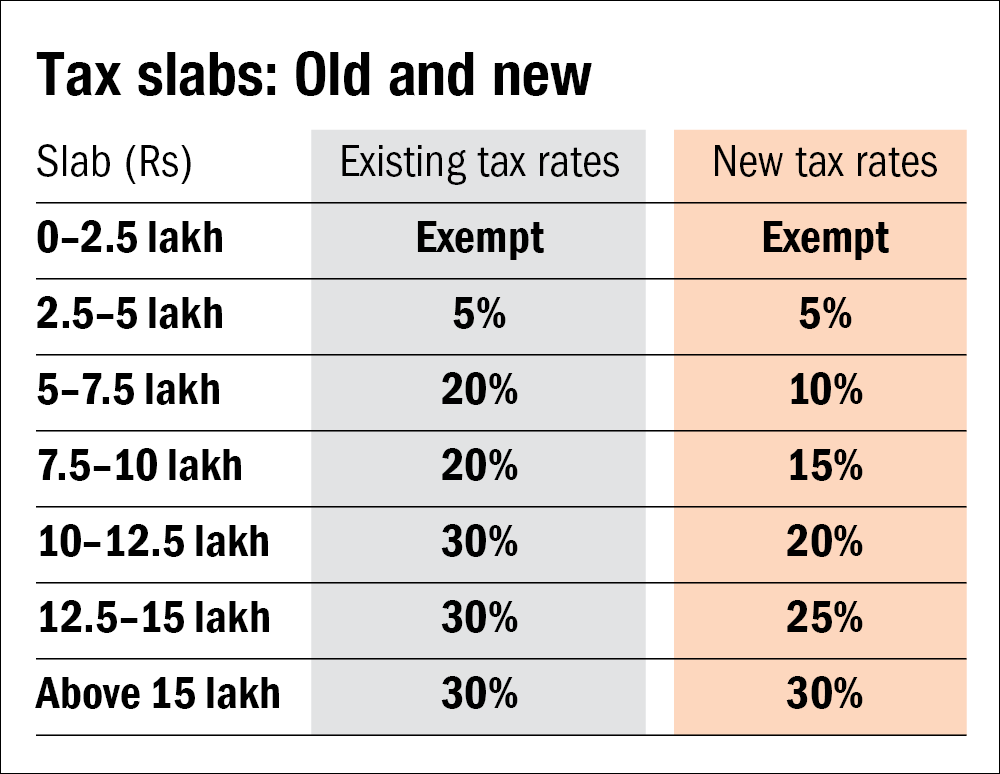

The tax rate is determined by the amount of earned income you receive during the year Earned income includes pay from employment as well as pensions and benefits Your The Budget 2024 introduced significant changes to the tax slabs under the New Tax Regime which will be applicable for FY 2024 25 AY 2025 26 Taxpayers can now

Tax Deduction Slabs

Tax Deduction Slabs

https://feeds.abplive.com/onecms/images/uploaded-images/2023/02/01/a7b773f5d25d441b1f70bb4e5af7e14f1675251759563314_original.jpg

How To Get Your Biggest Tax Deduction The Motley Fool

https://g.foolcdn.com/editorial/images/437194/tax-deduction_gettyimages-515708887.jpg

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-12.jpg

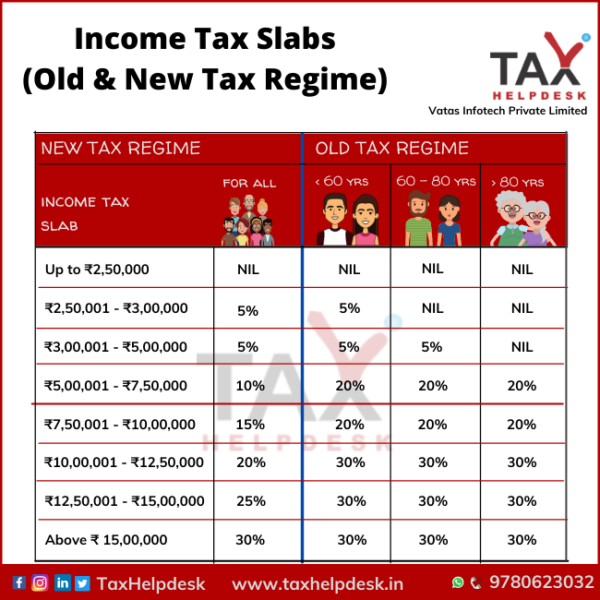

Explore the updated income tax slabs for FY 2024 25 comparing the new and old regimes including deductions rebates and surcharge details Tax Slabs for AY 2025 26 The Finance Act 2024 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the assessee

Income tax on salary is calculated based on the income earned and the applicable tax rates The tax rates are determined by the government and are based on income slabs The Budget 2024 introduced significant changes to the tax slabs under the New Tax Regime which will be applicable for FY 2024 25 AY 2025 26 Taxpayers can now

Download Tax Deduction Slabs

More picture related to Tax Deduction Slabs

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

https://tax.net.pk/wp-content/uploads/2022/06/Income-Tax-Slabs-Proposed-Budget-2022-and-2023-Salary-Tax-Calculator.png

2018 Standard Deduction Chart

https://taxguru.in/wp-content/uploads/2019/01/INCOME-TAX-SLABS-FOR-FY-2018-19-AY-2019-20.jpg

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

https://cdn1.npcdn.net/image/164268488608eb2865a0692287fabecd75401ae768.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

Learn about the income tax slabs for FY 2024 25 AY 2025 26 under the old and new regimes Compare rates deductions and features to choose the best option Standard Deduction 50 000 50 000 Effective Tax Know about the income tax slab rates for the FY 2023 24 and 2024 25 Get the information about the old and new income tax slabs for individuals senior citizens and super senior citizens on

Income Tax Slabs Know the Comparison of Tax Rates under New Tax Regime for FY 2024 25 2025 26 Also Check the updated Tax Slabs for Individuals Income Tax Calculator is a useful tool to determine tax liability with respect to income tax slabs and deductions available Use online income tax calculator available at Groww to calculate

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax

https://i.ytimg.com/vi/Ib9IdrMgw84/maxresdefault.jpg

Understand About Deductions Under Old And New Tax Regime TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/07/Income-Tax-Slabs-Old-New-Tax-Regime-600x600.png

https://taxcalculator.pk › incom-tax-slabs

As per the latest income tax regulations for the year 2024 2025 the following slabs and income tax rates will be applicable for salaried persons Where the taxable salary income does not exceed Rs 600 000 the rate of income tax is

https://www.vero.fi › en › individuals › tax-cards-and...

The tax rate is determined by the amount of earned income you receive during the year Earned income includes pay from employment as well as pensions and benefits Your

Income Tax Rebate 10 7 Slab 2 5

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax

INCOME TAX CALCULATOR 2020 21 BY Jagadish Patel

Tax Deduction Stock Photo Photo By LendingMemo Under CC 2 Flickr

Choosing Between The Old And New Tax Slabs Value Research

Tax Slabs And Deductions

Tax Slabs And Deductions

What Are The New Income Slabs Under The New Tax Regime

How To Choose Between The New And Old Income Tax Regimes Chandan

Income Tax Clarification Opting For The New Income Tax Regime U s

Tax Deduction Slabs - In this article we have discussed Income Tax deduction available to Taxpayers from various sources of Income for A Y 2025 26 F Y 2024 25 and subsequent Years