Tax Deduction Travel Allowance Travel expenses There are many different travel expenses that qualify for tax deductions on the condition that they relate to your work You can already now claim

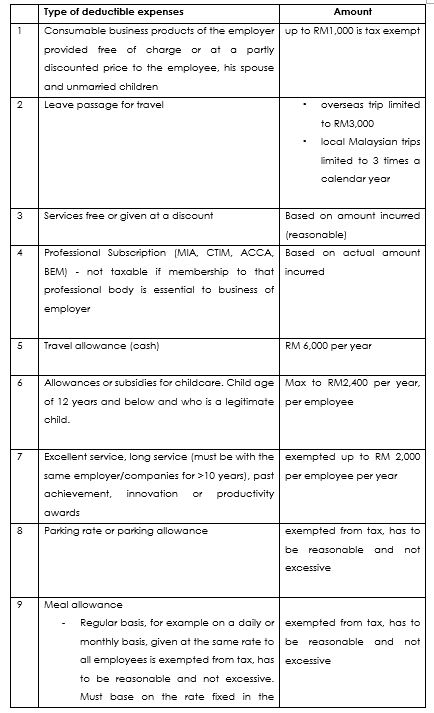

What to do if you receive a travel allowance to cover your travel expenses when travelling for work Receiving a travel allowance from your employer does not automatically 1 Petrol allowance travelling allowance or toll payment or any of its combination for official duties If the amount received exceeds RM6 000 a year the employee can make a further

Tax Deduction Travel Allowance

Tax Deduction Travel Allowance

https://images.squarespace-cdn.com/content/v1/5693d8a2a976af0bfc5ec849/0ea1d62b-994c-41ec-a485-b26b8b381f4e/businessdeductionguide.png

New Tax Laws Business Deduction Changes You Need To Know About

https://www.innovativecpagroup.com/wp-content/uploads/2019/11/Tax-Cut_image_for_LinkedIn_article.jpg

Tax Deduction Planner Graphic By Watercolortheme Creative Fabrica

https://www.creativefabrica.com/wp-content/uploads/2021/07/17/Tax-Deduction-Planner-Graphics-14848059-3.jpg

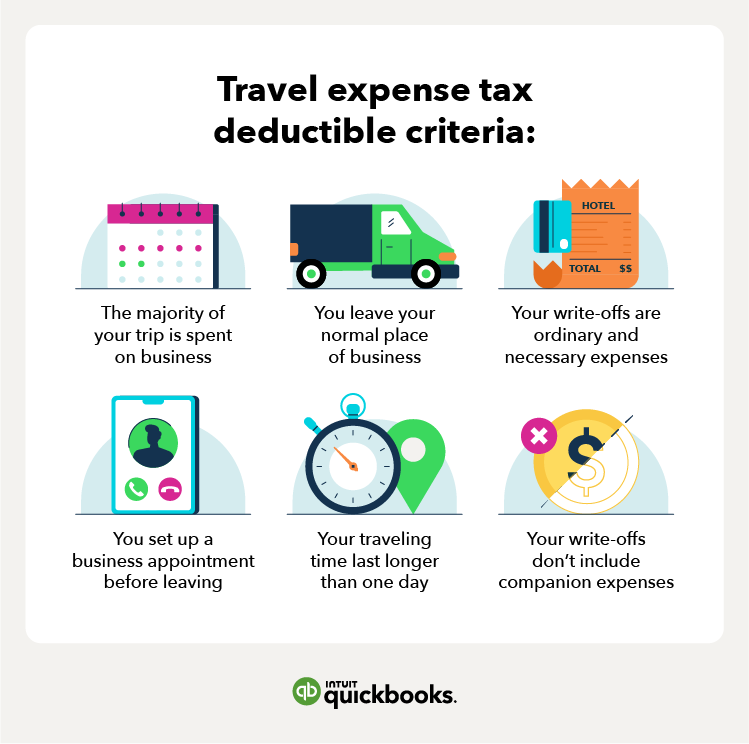

You can claim a tax deduction for the cost of transport on trips to perform your work duties for example if you travel from your regular place of work to meet with a client attend work related Travel Deduction Tax Calculator for 2025 Compare Actual Costs and Deemed Costs for the Maximum Tax Deduction

If your employees travel for your business the business must actually pay for the travel expense to be able to claim it as a deduction The business can pay for the expense by Leave Travel Allowance Find out LTA rules eligibility claiming process exemption limit section and stay updated with the latest developments Check out the example given for better understanding of LTA block

Download Tax Deduction Travel Allowance

More picture related to Tax Deduction Travel Allowance

Kurzstudie Tax Deduction Scheme Belgien EUKI

https://www.euki.de/wp-content/uploads/2019/09/20180827_BE_Tax-deductions_Study-pdf.webp

What Will My Tax Deduction Savings Look Like The Motley Fool

https://g.foolcdn.com/editorial/images/436120/tax-deduction_gettyimages-515708887.jpg

Travel Expense Tax Deduction Guide How To Maximize Write offs QuickBooks

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/tax-deduction-criteria.png

The Income Tax Department introduced a standard deduction in place of transport and medical allowance From the financial year 2019 2020 the standard deduction is Rs 50 000 which What is the deduction for commuting expenses when you use other than public transportation If you drive your own car the deduction for commuting expenses is 0 27 km

A reimbursive travel allowance which DOES NOT comply with both criteria mentioned above is a taxable reimbursive travel allowance and employees tax must be Business travel deductions are available when employees must travel away from their tax home or main place of work for business reasons A taxpayer is traveling away from

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

https://c1.staticflickr.com/9/8606/28374128013_523fe7f52b_b.jpg

What Are Pre tax Deductions Before Tax Deduction Guide

https://synder.com/blog/wp-content/uploads/sites/5/2023/03/what-are-pre-tax-deductions.png

https://www.vero.fi › en › individuals › deductions › travel-expenses

Travel expenses There are many different travel expenses that qualify for tax deductions on the condition that they relate to your work You can already now claim

https://www.ato.gov.au › individuals-and-families...

What to do if you receive a travel allowance to cover your travel expenses when travelling for work Receiving a travel allowance from your employer does not automatically

Maximising Tax Benefits Your Guide To Claiming A Rental Property

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

Car Allowance Taxable In Malaysia JorgefvSullivan

Tax Deduction On Payment To Release Bumi Lot Sep 01 2022 Johor

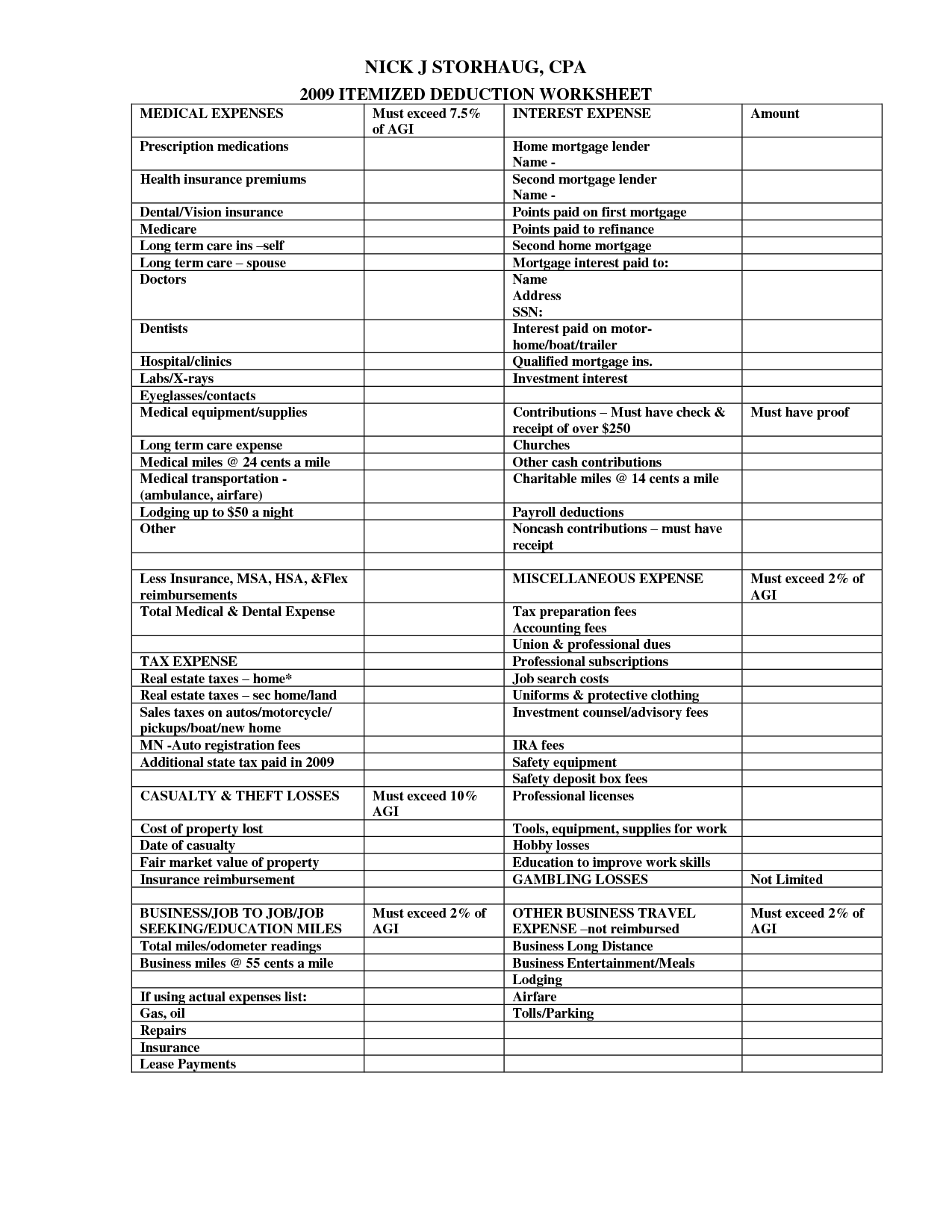

16 Insurance Comparison Worksheet Worksheeto

Tax Deduction At Rs 50 hour In Mumbai ID 19044943762

Tax Deduction At Rs 50 hour In Mumbai ID 19044943762

Tax Deduction Guide

Salary Payments That Need To Contribute To Payroll L Co

How Does A Tax Deduction Work If An Exchange Enters Bankruptcy The

Tax Deduction Travel Allowance - You can claim a tax deduction for the cost of transport on trips to perform your work duties for example if you travel from your regular place of work to meet with a client attend work related