Tax Deduction Under Section 87a Web 3 Feb 2023 nbsp 0183 32 If your net taxable income does not exceed Rs 7 lakh you are eligible for the tax rebate under Section 87A This rebate will be automatically taken into account

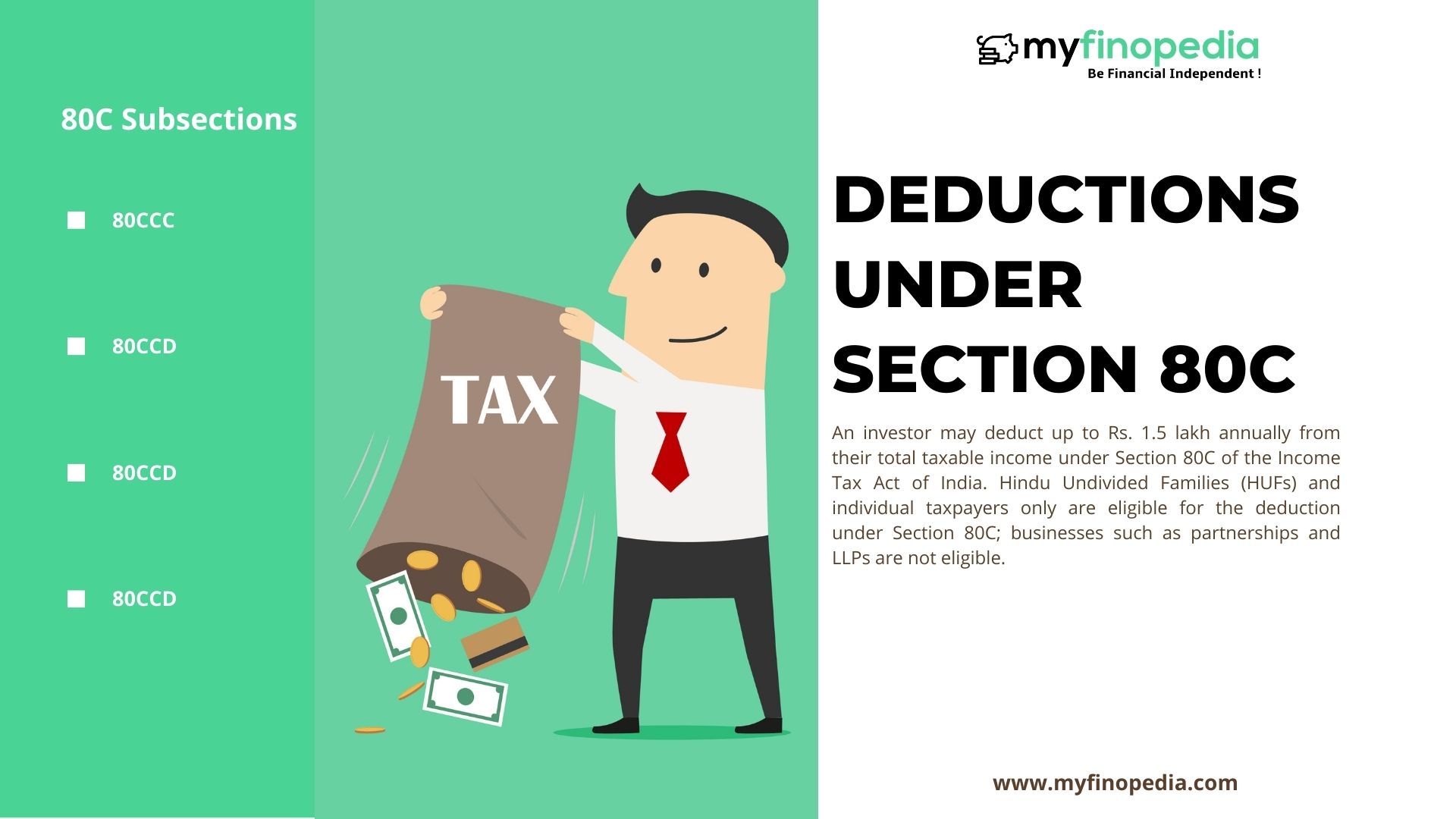

Web 3 Zeilen nbsp 0183 32 28 Dez 2023 nbsp 0183 32 Reduce the deductions under sections 80C to 80U Calculate your Tax Payable as per Income Web Any individual whose annual net income does not exceed Rs 5 Lakh qualifies to claim tax rebate under Section 87a of the Income Tax Act 1961 This implies an individual

Tax Deduction Under Section 87a

Tax Deduction Under Section 87a

https://www.legalraasta.com/blog/wp-content/uploads/2021/08/Income-tax-rebate-tax-deduction-and-exemption-scaled.jpg

What Is Section 87A Refund Under Section 87A Section 87A Deduction In

https://i.ytimg.com/vi/GxhuAMGX5sU/maxresdefault.jpg

Section 80C Deductions List Save Income Tax With Section 80C Options

https://i.ytimg.com/vi/6nlYwNEIo48/maxresdefault.jpg

Web 26 Apr 2022 nbsp 0183 32 Taxpayers can reduce their tax liability through the rebate under Section 87A of the Income Tax Act Individuals can claim the rebate if the total income after Web Rebate under section 87A can be claimed when your taxable income does not exceed the prespecified limit for the given financial year For example for FY 2021 22 AY 2022 23

Web If your annual income net of deductions and exemptions does not exceed INR 5 lakhs you can claim a tax rebate under 87A on your tax liability Through the available tax Web 25 Aug 2020 nbsp 0183 32 What is an income tax rebate As per the amendments to Section 87A if your annual taxable income is INR 5 00 000 or lower you can avail the tax rebate The

Download Tax Deduction Under Section 87a

More picture related to Tax Deduction Under Section 87a

Exemption Under Section 87A With Automatic Income Tax Form 16 Part A

https://blogger.googleusercontent.com/img/a/AVvXsEhZQi5Ln43Bt9k-pbvTrPSfypjB_GE_1j1Y9DeNCTK26XuHgerBTWwh58nQRJZgzuL143kSP6CctV6W3EwVilLcf3L52A5wtUVy8MS0GfbW4JPHrN0VLim6AVTMeYg2eS8WCLGRDcsn_c4mrZKezFEBY2LNHqM5kNZri1BcmUCS2JjDRxdKfZrspLxB=w1200-h630-p-k-no-nu

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

Income Tax Deduction Under Section 80C To 80U FY 2022 23

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

Web Individuals can enjoy a tax rebate under Section 87A when they earn a net taxable income within 5 00 000 in a given financial year Eligible candidates can claim a tax rebate of Web The government only wants to decrease taxes for persons who fall in a lower income bracket Therefore rebate under section 87A is introduced to lower the tax for

Web 21 Nov 2023 nbsp 0183 32 Section 87A provides a tax credit of Rs 12 500 to people with taxable incomes of up to Rs 5 lakhs for the 2019 2020 fiscal year This is a big rise over the Web 31 Juli 2020 nbsp 0183 32 SECTION 87A An assessee being an individual resident in India whose total income does not exceed 45 five hundred thousand rupees shall be entitled to a

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction-913x1024.jpg

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

https://life.futuregenerali.in/media/2zjhyg5j/section-80c-deductions.jpg

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 Feb 2023 nbsp 0183 32 If your net taxable income does not exceed Rs 7 lakh you are eligible for the tax rebate under Section 87A This rebate will be automatically taken into account

https://tax2win.in/guide/section-87a

Web 3 Zeilen nbsp 0183 32 28 Dez 2023 nbsp 0183 32 Reduce the deductions under sections 80C to 80U Calculate your Tax Payable as per Income

Deductions Under Section 80C Benefits Works Myfinopedia

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Section 87A Tax Rebate Under Section 87A Rebates Financial

Donation Exemption For Income Tax Malaysia Amy Dyer

What Are Pre tax Deductions Before Tax Deduction Guide

What Are Pre tax Deductions Before Tax Deduction Guide

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Section 87a Of Income Tax Act Income Tax Taxact Income

All About Deduction Under Section 80C Of The Income Tax Act Ebizfiling

Tax Deduction Under Section 87a - Web If your annual income net of deductions and exemptions does not exceed INR 5 lakhs you can claim a tax rebate under 87A on your tax liability Through the available tax