Tax Deduction Working From Home 2021 You can claim tax relief if you have to work from home for example because your job requires you to live far away from your office your employer does not have an office Who cannot claim tax

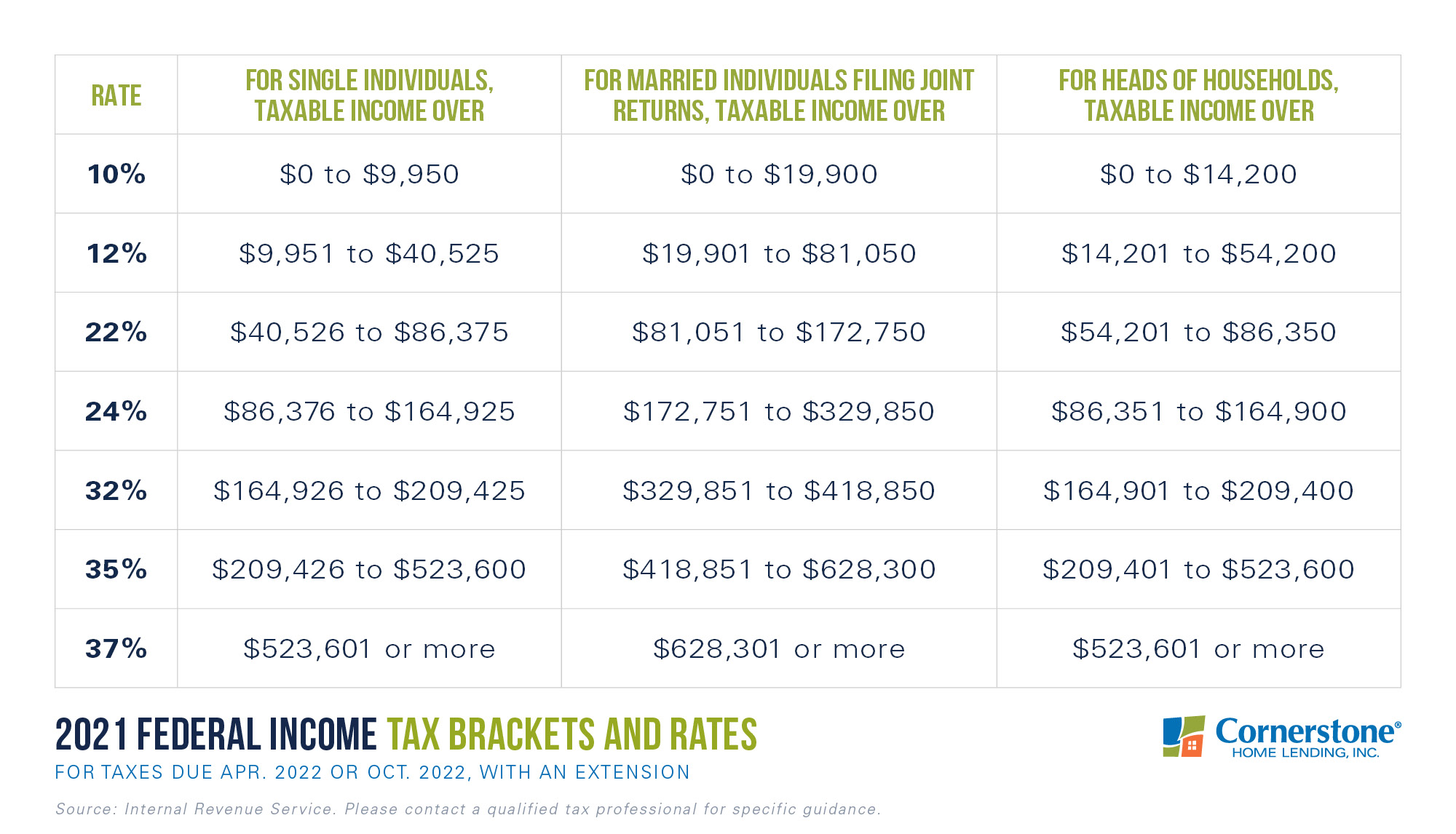

13 May 2021 HM Revenue and Customs HMRC is accepting tax relief claims for working from home due to coronavirus during 2021 to 2022 More than 550 000 employed workers have already claimed Key Takeaways Employees who work from home can no longer claim tax deductions for their unreimbursed employee expenses or home office costs on their federal tax return Prior to the 2018 tax reform employees could claim these expenses as an itemized deduction

Tax Deduction Working From Home 2021

Tax Deduction Working From Home 2021

https://standard-deduction.com/wp-content/uploads/2020/10/standard-deduction-2021-federal-standard-deduction-4.jpg

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

https://www.houseloanblog.net/wp-content/uploads/2021/12/220003_SM_BLOG_Homeowner-Tax-Breaks-2022-CHART.jpg

Rental Property Tax Deductions A Comprehensive Guide Credible Cash

https://i.pinimg.com/originals/8e/f4/2c/8ef42c9ab3dffc9b087a7a496909a1de.png

To claim the home office deduction in 2021 taxpayers must exclusively and regularly use part of their home or a separate structure on their property as their primary place of business What is the home office deduction Small business owners and freelancers who regularly and exclusively use part of their home for work and business related activities may be able to write off

If you worked remotely in 2021 you may be wondering if you can claim a home office deduction on your upcoming tax return Here s what you need to know Qualifying for a home office Tax Tip 2022 10 January 19 2022 The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes To claim the home office deduction on their 2021 tax return taxpayers generally must exclusively and regularly use part of their home or a separate structure on their property as their primary place

Download Tax Deduction Working From Home 2021

More picture related to Tax Deduction Working From Home 2021

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

Special Tax Deduction Flexible Working Arrangement Mar 01 2022

https://cdn1.npcdn.net/image/16461036862a2b9367f2ff16eb9b748ff28b5b7ef8.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

10 Business Tax Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/08/tax-itemized-deduction-worksheet_472223.png

Getty At the start of the pandemic the number of people working from home increased significantly but not all of them will qualify for the home office deduction If you are self employed or Updated on December 18 2023 Written by Mark Henricks Edited by Jeff White CEPF The 2017 tax reform law ended the ability for most taxpayers to deduct expenses for working from home just in time for millions more people to begin working from in response to the Covid pandemic

Home Office Tax Deduction Work from Home Write Offs for 2023 Can you claim the home office tax deduction this year Although you can t take federal tax deductions for work from home expenses if you are an employee some states have enacted their own laws requiring employers to reimburse employees for necessary business expenses or allowing them to deduct unreimbursed employee expenses on their state tax returns

Itemized Deductions Still Exist For 2018 Tax Return BMP CPA

https://www.bmp-cpa.com/wp-content/uploads/2019/01/tax-deductions.jpg

10 Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2012/03/2015-itemized-tax-deduction-worksheet-printable_426931.png

https://www.gov.uk/tax-relief-for-employees/working-at-home

You can claim tax relief if you have to work from home for example because your job requires you to live far away from your office your employer does not have an office Who cannot claim tax

https://www.gov.uk/government/news/working-from...

13 May 2021 HM Revenue and Customs HMRC is accepting tax relief claims for working from home due to coronavirus during 2021 to 2022 More than 550 000 employed workers have already claimed

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

Itemized Deductions Still Exist For 2018 Tax Return BMP CPA

Qualified Business Income Deduction And The Self Employed The CPA Journal

Tax Deduction Thailand 2022 Pay Less With Health Insurance

Can You Claim The Home Office Tax Deduction If Ve Been Working Remotely

Australian Tax Office Introduces Fixed rate Work From Home Deduction

Australian Tax Office Introduces Fixed rate Work From Home Deduction

Standard Deduction 2020 Self Employed Standard Deduction 2021

Employee Income Tax Deduction Form 2023 Employeeform

Tax Deductions Excel Spreadsheets Budgeting Tracking Finance Spending

Tax Deduction Working From Home 2021 - Filing a 2020 2021 or 2022 tax year return Steps Confirm you are eligible You must meet the eligibility criteria Detailed method to claim your home office expenses Fill in the applicable form Tip Use the calculator to determine the employment use amount to enter on Form T777 or Form T777S