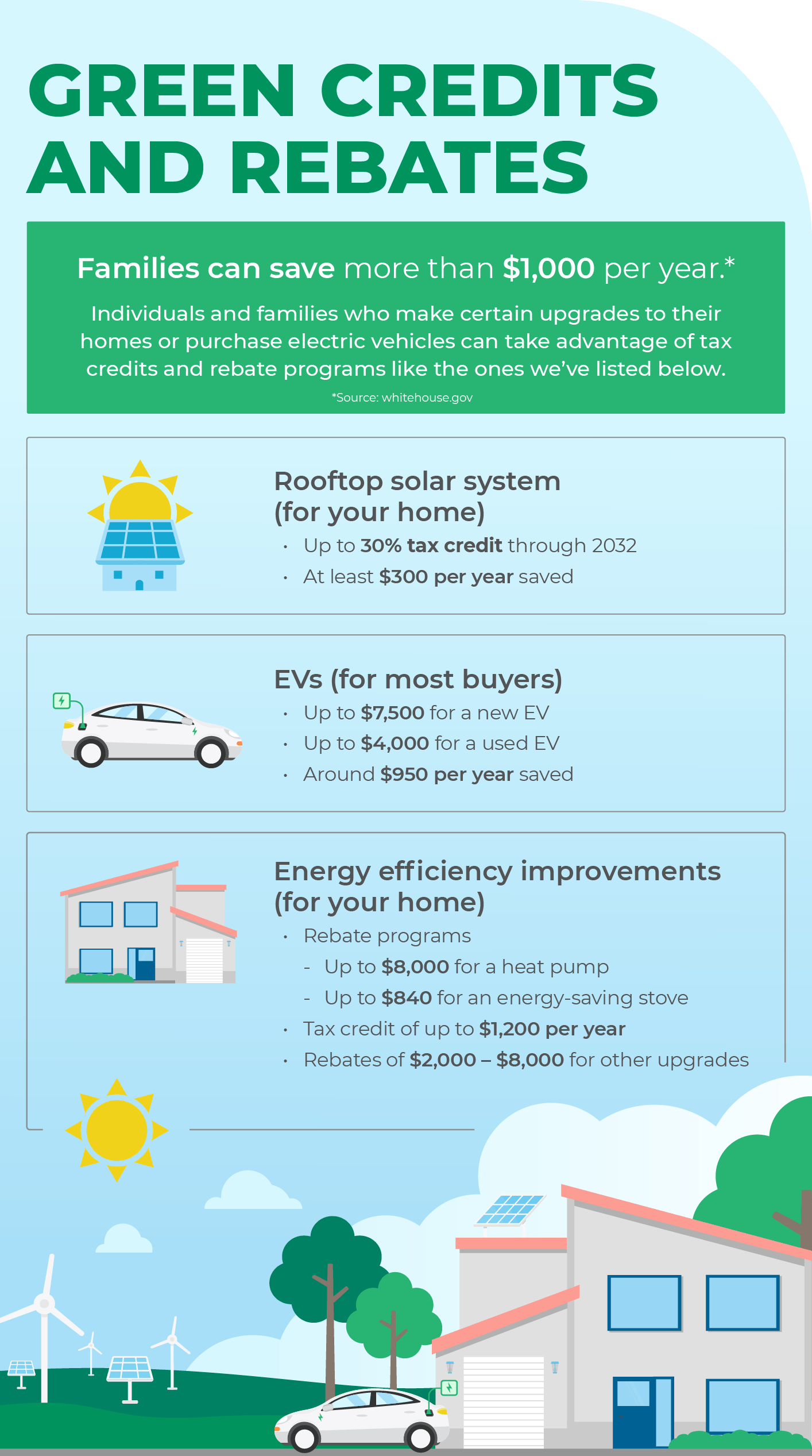

Tax Deductions For Clean Energy Several energy related tax credits are available for 2023 including two major energy tax credits for homeowners the Energy Efficient Home Improvement Credit and the Residential Clean

From purchasing clean vehicles to making your home more energy efficient the Inflation Reduction Act of 2022 may have a significant effect on your taxes Clean vehicle If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit of 30 of the costs for qualified

Tax Deductions For Clean Energy

Tax Deductions For Clean Energy

https://www.greenmountainenergy.com/Images/GME-Blog-SolarIncentives-Infographic-2x_tcm465-57648.png

Legal Aspects On The Deductions From Income From Business And

https://blog.ipleaders.in/wp-content/uploads/2020/11/Tax-Deduction-blog-1.jpg

5 Tax Deductions You Can Still Claim In 2020 The Motley Fool

https://g.foolcdn.com/editorial/images/558443/man-typing-on-calculator_gettyimages-904047990.jpg

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products

Announcement 2024 19 provides that amounts received from the Department of Energy DOE home energy rebate programs funded through the IRA will OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE OF CONTENTS What are energy tax credits

Download Tax Deductions For Clean Energy

More picture related to Tax Deductions For Clean Energy

7 Tax Deductions For Homeowners Vermont Mortgage Advisor

https://vermontmortgageadvisor.com/wp-content/uploads/2021/02/Tax-Deductions.png

7 Home Improvement Tax Deductions INFOGRAPHIC Tax Deductions

https://i.pinimg.com/originals/bb/c7/4e/bbc74ee927d067f43bbaf4252e12eb28.jpg

10 Tax Deductions For The Self Employed In Ireland TaxReturnPlus ie

https://blog.taxreturnplus.ie/wp-content/uploads/2017/11/shutterstock_335440124.jpg

The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe A significant portion of the Inflation Reduction Act s clean energy investment is delivered through tax incentives which will help catalyze historic levels of

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind When you purchase not lease new solar powered equipment that generates electricity or heats water or purchase solar power storage equipment you generally can

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

Inflation Reduction Act Expands Deductions For Energy efficient

https://www.jrcpa.com/wp-content/uploads/Inflation-Reduction-Act-expands-deductions-for-energy-efficient-construction.jpg

https://www.investopedia.com › terms › e…

Several energy related tax credits are available for 2023 including two major energy tax credits for homeowners the Energy Efficient Home Improvement Credit and the Residential Clean

https://www.irs.gov

From purchasing clean vehicles to making your home more energy efficient the Inflation Reduction Act of 2022 may have a significant effect on your taxes Clean vehicle

Tax Deductions For Businesses BUCHBINDER TUNICK CO

Tax Credits Save You More Than Deductions Here Are The Best Ones

Tax Deductions For Daycare Business Top 10 Deductions

Sweeping Up Tax Savings Tax Deductions For Self Employed Housekeepers

Tax Planning And Preparation The Complete Guide

Tax Deductions IEC

Tax Deductions IEC

Overlooked Tax Deductions For Healthcare Workers Nursing Jobs Nurse

Tax Credits And Deductions Available For Sustainable Energy And Green

Residential Energy Credit Application 2024 ElectricRate

Tax Deductions For Clean Energy - Announcement 2024 19 provides that amounts received from the Department of Energy DOE home energy rebate programs funded through the IRA will