Tax Exemption For Dependents 2022 In the 2017 tax year the exemption typically resulted in a 4 050 reduction of taxable income for each one you qualified for For a

The maximum percentage is 35 As your AGI climbs the credit is eventually reduced to 0 If your AGI is 438 000 or higher you won t get the credit The child and Enter the dependent s gross income If line 6 is more than line 5 the dependent must file an income tax return If the dependent is married and his or her spouse itemizes deductions on a separate return the

Tax Exemption For Dependents 2022

Tax Exemption For Dependents 2022

https://i.pinimg.com/736x/8b/e9/4b/8be94b89266a2619acb350fca664f4b1.jpg

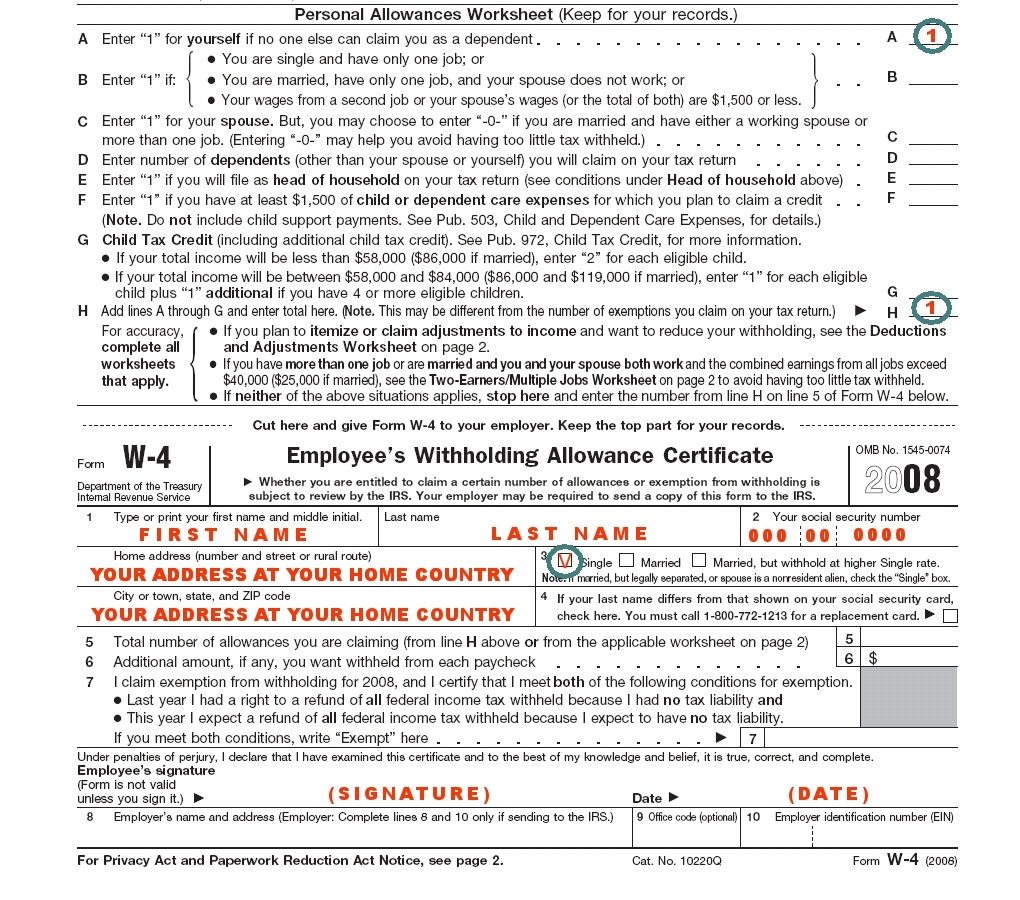

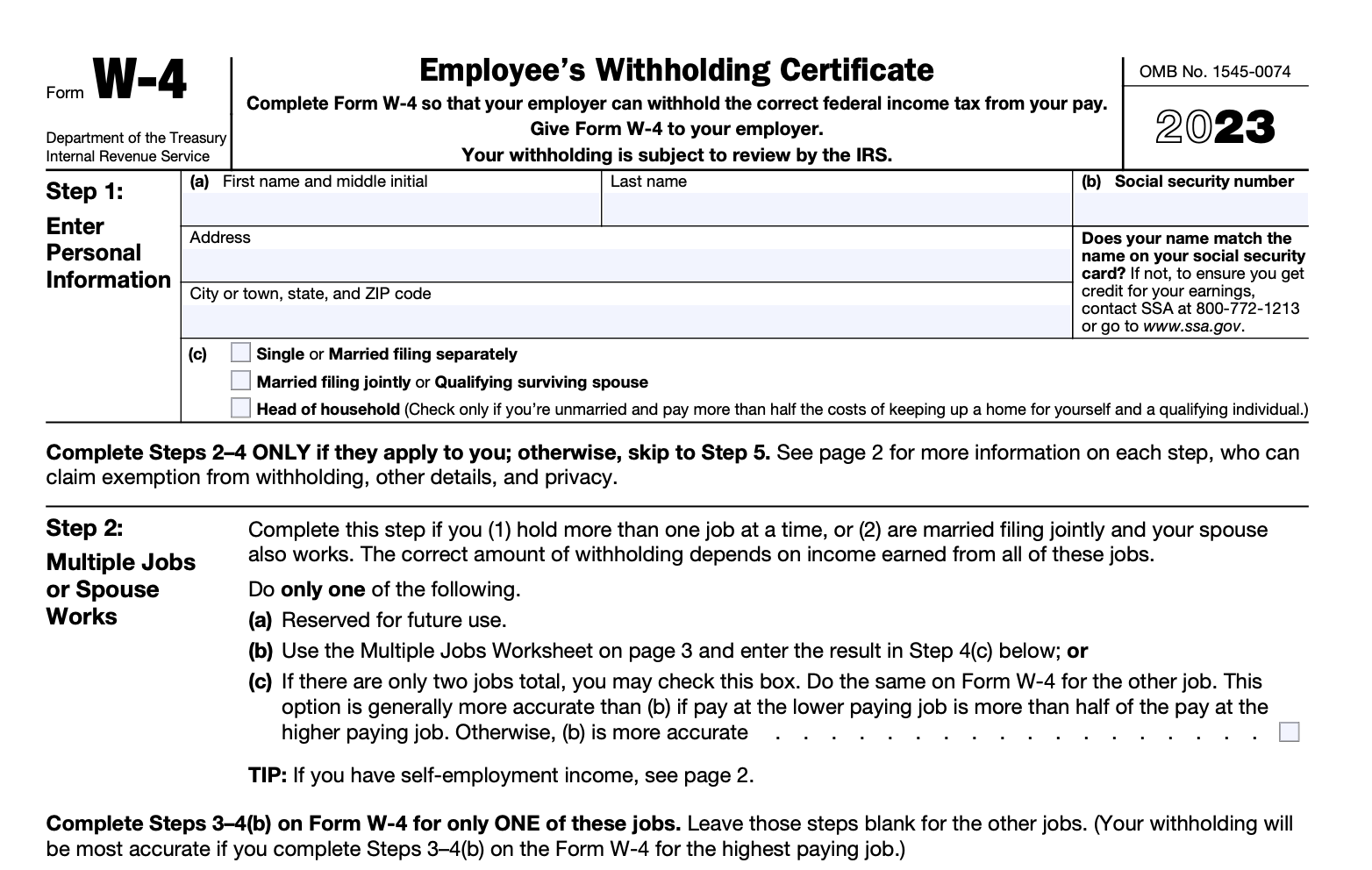

Blank W4 Form 2023 Printable Forms Free Online

https://smartasset.com/wp-content/uploads/sites/2/2018/06/Screen-Shot-2022-12-29-at-5.49.46-PM.png

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

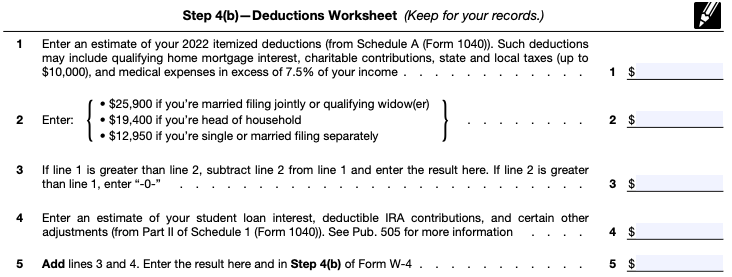

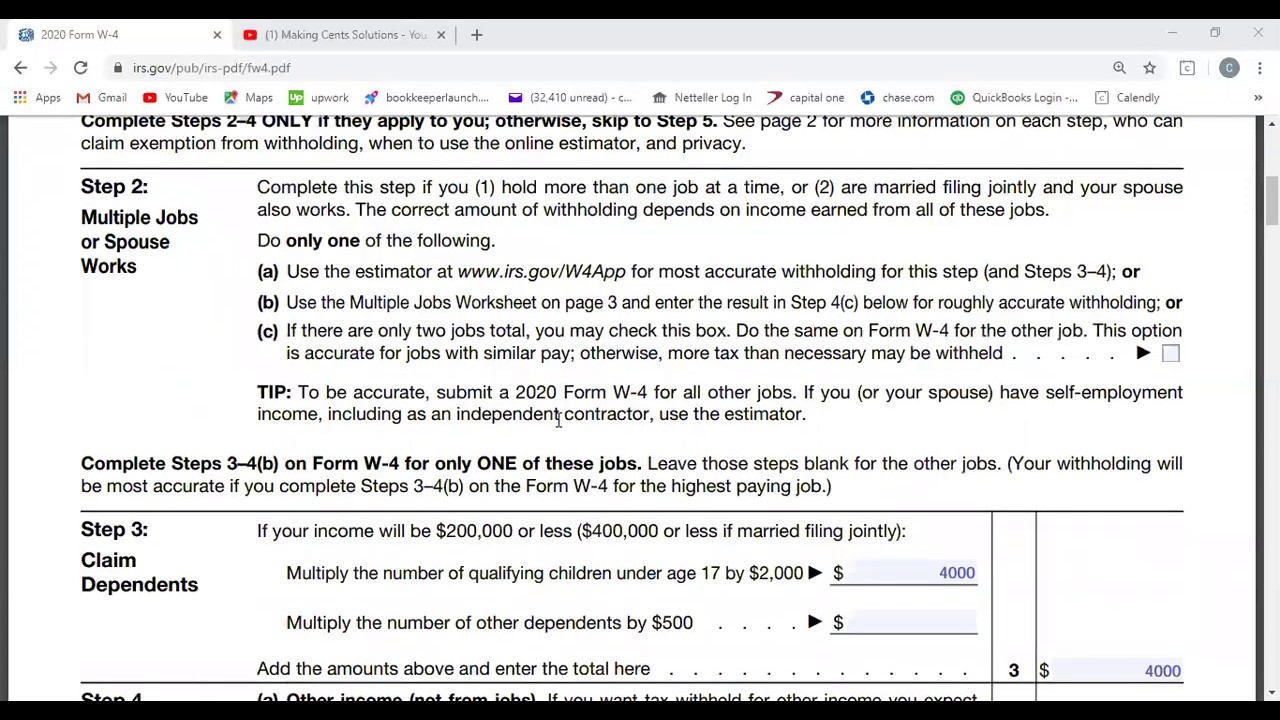

How To Reduce Withholding Tax Outsiderough11

https://www.investopedia.com/thmb/tpP5HsGjVr_OQsxGVST1E7d-TwQ=/1184x1390/filters:no_upscale():max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg

Tax Tip 2022 98 June 28 2022 Parents who are divorced separated never married or live apart and who share custody of a child with an ex spouse or ex partner need to Personal Exemptions and Dependents on the 2022 Federal Income Tax Return The Tax Cuts and Jobs Act TCJA reduced the exemption deduction to 0 for

The standard deduction amount for the 2022 tax year jumps to 12 950 for single taxpayers up 400 and 25 900 for a married couple filing jointly up 800 The IRS Announces New Tax Numbers for 2022 Each year the IRS updates the existing tax code numbers for items that are indexed for inflation This includes the

Download Tax Exemption For Dependents 2022

More picture related to Tax Exemption For Dependents 2022

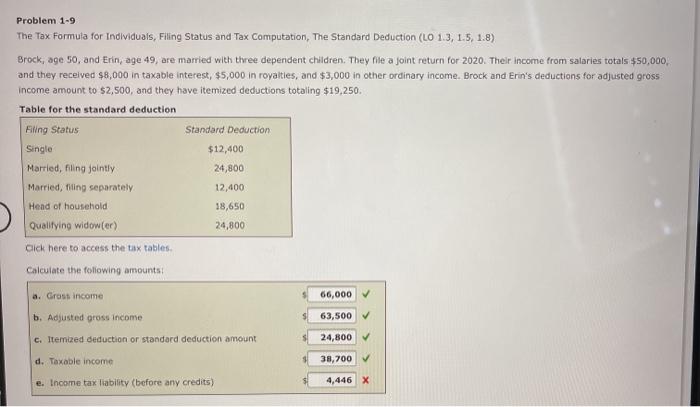

Solved Problem 1 9 The Tax Formula For Individuals Filing Chegg

https://media.cheggcdn.com/study/06d/06d17a33-f60a-4748-ae2a-bc7a3eb2441a/image

Figuring Out Your Form W4 How Many Allonces Should You Db excel

https://db-excel.com/wp-content/uploads/2019/09/figuring-out-your-form-w4-how-many-allonces-should-you-1.png

Federal W4 Form Printable

https://w4formsprintable.com/wp-content/uploads/2020/09/how-to-fill-out-w-4-for-a-single-person-mkrd-info.jpg

A tax dependent is a child spouse family member or even an unrelated friend who needs your financial support and lives with you Dependents can be claimed by a taxpayer as an exemption to reduce The maximum Earned Income Tax Credit for 2022 will be 6 935 vs 6 728 for tax year 2021 for taxpayers with three or more qualifying children Basic exclusion for

For the 2023 tax year the child and dependent care tax credit is 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying The IRS recently released the new inflation adjusted 2022 tax brackets and rates Explore updated credits deductions and exemptions including the standard

Standard Deduction For Dependents

https://www.unclefed.com/TaxHelpArchives/2001/Pub17/graphics/10311g29.gif

11 W4 Stickeinheit Eu3 Schritt F r Schritt TamikaAdalay

https://gusto.com/wp-content/uploads/2021/12/2022-Form-W-4-deductions-worksheet.png

https://turbotax.intuit.com/tax-tips/family/tax-e…

In the 2017 tax year the exemption typically resulted in a 4 050 reduction of taxable income for each one you qualified for For a

https://www.investopedia.com/.../102015/how-much-does-dependent-redu…

The maximum percentage is 35 As your AGI climbs the credit is eventually reduced to 0 If your AGI is 438 000 or higher you won t get the credit The child and

W4 Form 2 Dependents New Form

Standard Deduction For Dependents

How Do You Exempt From Federal Taxes Tax Walls

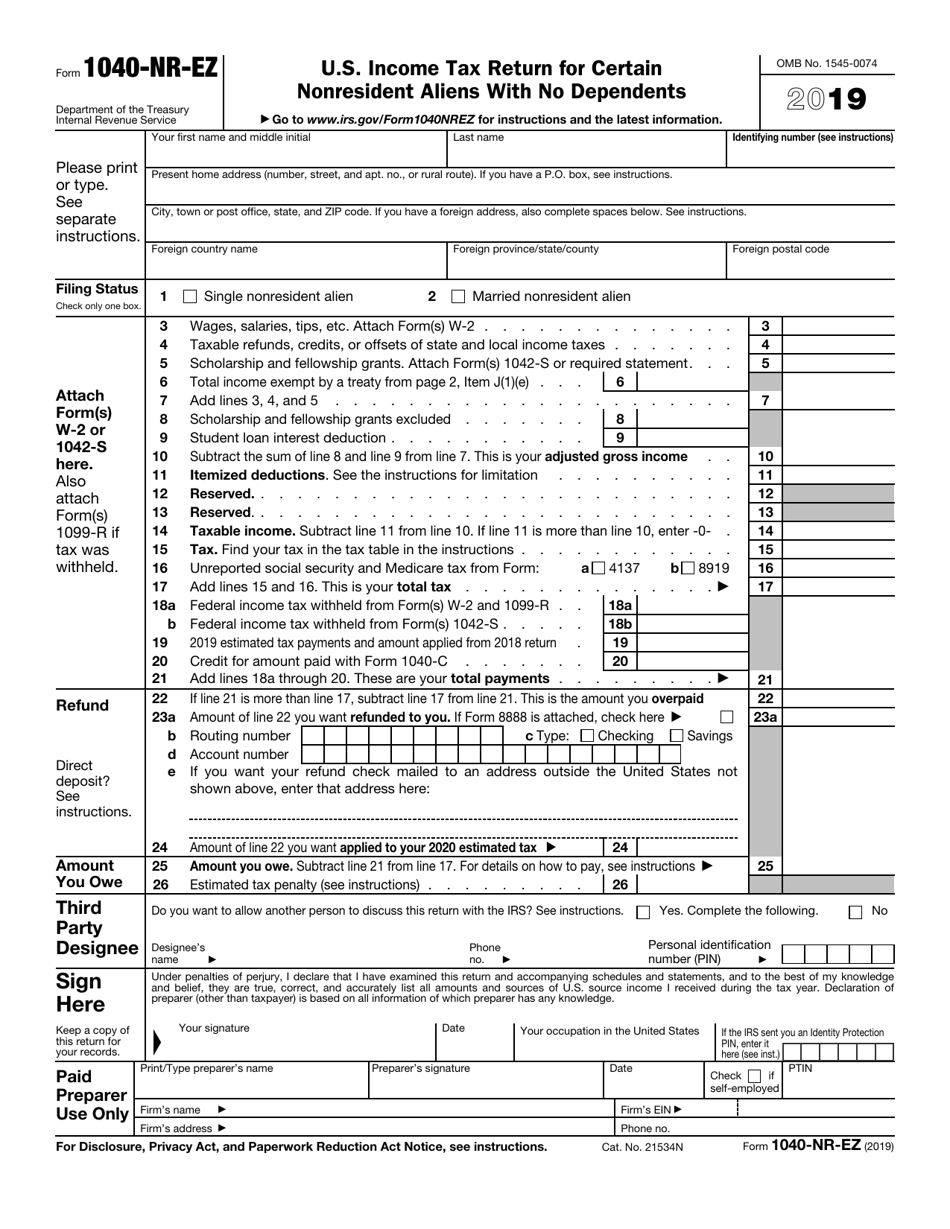

IRS Form 1040 NR EZ Download Fillable PDF Or Fill Online U S Income

Tax Exemption Form Fill Online Printable Fillable Blank PdfFiller

Tax Exemption Certificate PWF Pakistan

Tax Exemption Certificate PWF Pakistan

Mastering Your Taxes 2024 W 4 Form Explained 2024 AtOnce

Mastering Your Taxes 2024 W 4 Form Explained 2024 AtOnce

Irs Publication 17 Worksheet For Determining Support Breadandhearth

Tax Exemption For Dependents 2022 - The original dependent exemption amount worth 4 050 is no longer available However other tax benefits such as the child tax credit are still available to