Tax Exemption For House Rent Allowance Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This

Tax Exemption on House Rent Allowance HRA When seeking tax exemption for House Rent Allowance HRA it s essential to consider specific scenarios that may involve special claims Here are some key considerations Learn about House Rent Allowance HRA exemptions and how they affect tax savings Understand the rules calculations and potential benefits for salaried employees

Tax Exemption For House Rent Allowance

Tax Exemption For House Rent Allowance

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

What Is House Rent Allowance HRA Exemption Rules For FY 2018 19

https://www.paisabazaar.com/wp-content/uploads/2018/12/01-1.jpg

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

Understanding the rules and guidelines for claiming House Rent Allowance Exemption can significantly reduce the tax burden for salaried individuals In this article we will walk you through the process of claiming Learn about House Rent Allowance in detail including what is HRA Tax Exemptions and benefits of availing HRA Know about HRA Calculation with examples on Groww

To qualify for tax benefit on HRA the individual should be a salaried employee should reside in a rented accommodation and pay rent Here are the key considerations and provisions with respect to HRA and the House rent allowance HRA tax benefit is available only to salaried individuals who are planning to opt for old tax regime Further this tax benefit can be claimed only if they have

Download Tax Exemption For House Rent Allowance

More picture related to Tax Exemption For House Rent Allowance

Meaning Of House Rent Allowance And How Does It Cater To Tax Exemption

https://www.houssed.com/wp-content/uploads/2022/08/meaning-of-house-rent-allowance-and-how-does-it-cater-to-tax-exemption_articleimage.jpg

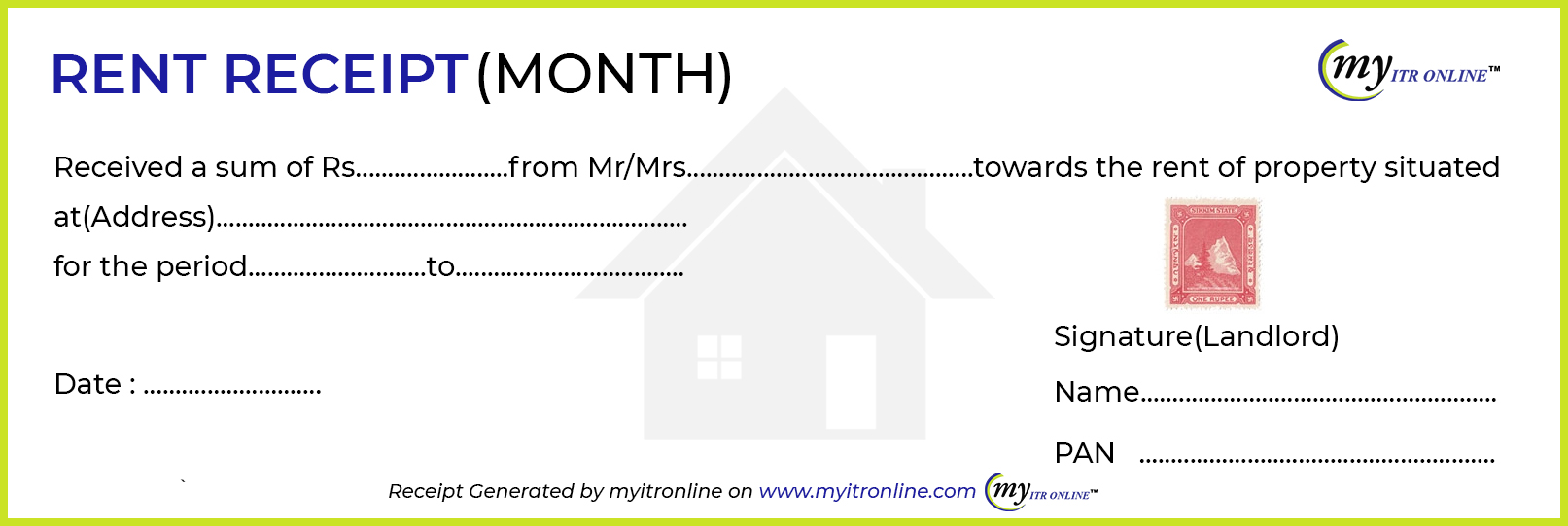

House Rent Receipt Format PDF Download

https://captainsclerk.com/18790bfb/https/34a049/geod.in/wp-content/uploads/2021/07/Receipt-of-House-Rent.jpg

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

https://emailer.tax2win.in/assets/guides/hra/available_tax_exemptions.png

According to the Income Tax Act the exemption limit for HRA is 50 of one s basic salary plus dearness allowance for employees living in metro cities Thus this is valid House Rent Allowance HRA in India Know HRA Meaning Full Form Exemptions Rules and Deductions Also know How to Calculate and Claim HRA

However if you reside in rented accommodation you can claim a partial or full tax exemption on HRA under Section 10 13A of the Income Tax Act This is commonly known as HRA is house rent allowance paid by employer to meet taxpayer rent expenses and this amount is tax free up to certain extent Updated per latest Union Budget 2024

House Rent Allowance Exemption How To Claim

https://d3l793awsc655b.cloudfront.net/blog/wp-content/uploads/2023/02/HRA-exemption.jpg

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/497/332/497332566/large.png

https://tax2win.in › guide › hra-house-rent-…

Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This

https://www.tankhapay.com › blog › house-rent-allowance

Tax Exemption on House Rent Allowance HRA When seeking tax exemption for House Rent Allowance HRA it s essential to consider specific scenarios that may involve special claims Here are some key considerations

House Rent Allowance

House Rent Allowance Exemption How To Claim

-compressed.jpg)

How To Claim House Rent Allowance Exemption In Income Tax

HRA House Rent Allowance Exemption Rules Tax Deductions

Free Rent Receipt Generator Online House Rent Receipt Generator With

House Rent Allowance HRA Calculation Exemption Rules Allowance

House Rent Allowance HRA Calculation Exemption Rules Allowance

House Rent Allowance A Tax Planning Tool For Salaried Chandan

Estate Tax Exemption Amount Goes Up In 2023

Most Common Tax Saving Allowance And Perquisite For Salaried Taxpayers

Tax Exemption For House Rent Allowance - HRA House Rent Allowance is a valuable tax benefit for salaried employees in rented accommodations By understanding HRA exemption rules deduction methods and