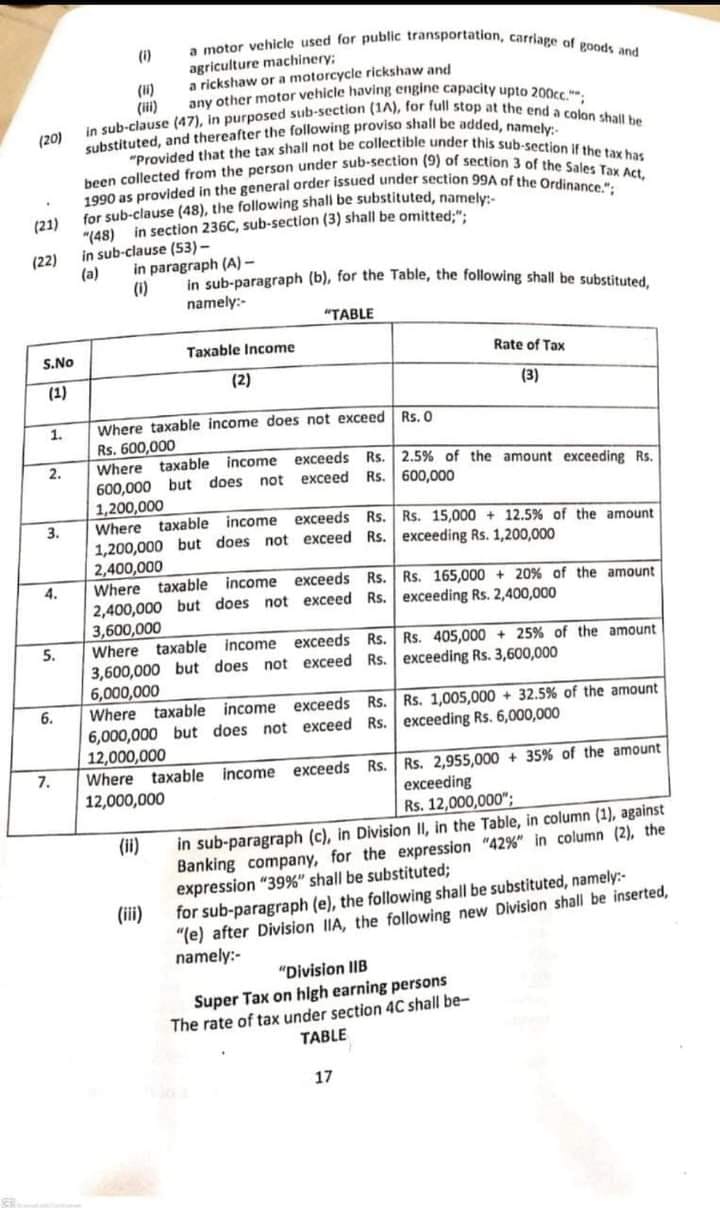

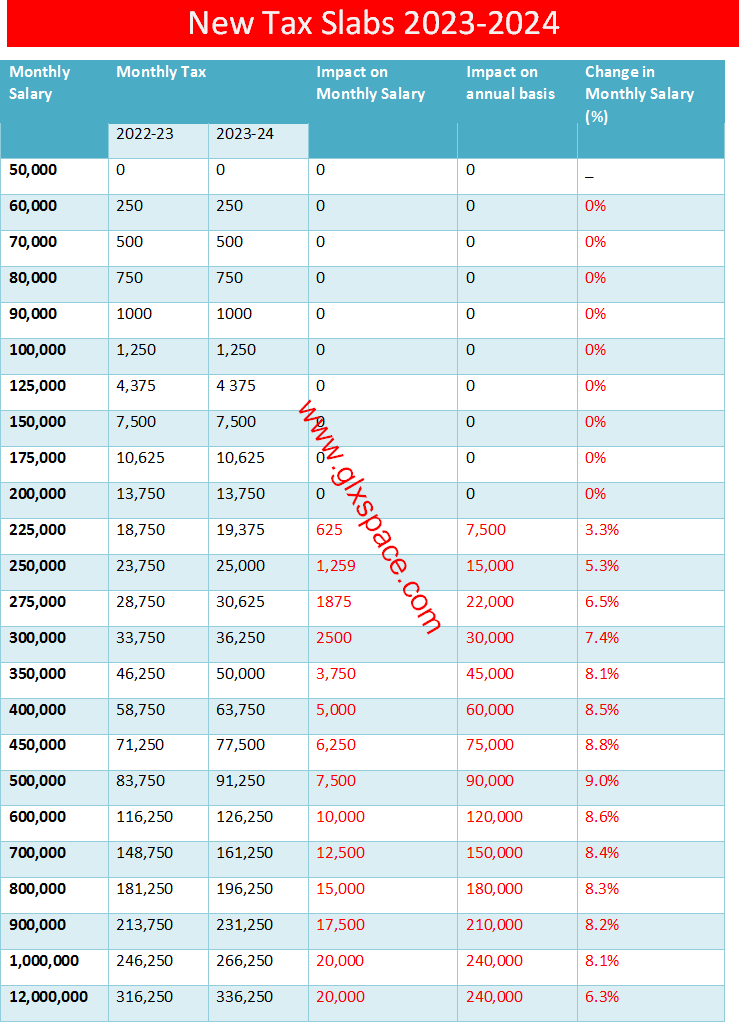

Tax Exemption For Salaried Employees 2023 24 Let us take a look at all the slab rates applicable for FY 2023 24 AY 2024 25 For Old Regime a tax rebate up to Rs 12 500 is applicable if the total income does

The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the assessee being an Individual HUF New Tax Regime 2024 Check out here all the frequently asked questions about the new income tax regime for FY 2023 24 slabs calculator and deductions for salaried

Tax Exemption For Salaried Employees 2023 24

Tax Exemption For Salaried Employees 2023 24

https://blogger.googleusercontent.com/img/a/AVvXsEgLDCnTZQuLnWBa8kiTwkdPhtVgzZiHH6BxGRp2eAYcysQ8S_DEuU7UQePjlrHlAZS4ajTVqfOZ3GbxKKR-63sbcNJATyghfwcQyN_7zwg2cdneuk46ffaLrRqHZe5vj5ZJJY-r8PDsrxyB6vOJoq-yCfY1agw1LwqrF1mAlhf71MR8MYMRP3uGWEVXRg=s16000

Budget 2023 Income Tax Slab Change Expectations Salaried Employees

https://static.tnn.in/thumb/msid-96597124,imgsize-100,updatedat-1672313818106,width-1280,height-720,resizemode-75/96597124.jpg

Income Tax Exemption List For Salaried Employees In AY 2021 22 Blog

https://www.tickertape.in/blog/wp-content/uploads/2022/02/12.png

Income tax for 2023 24 Salaried individuals pensioners must know Salaried individuals and pensioners do not have to pay any tax if their income is up to Rs 7 5 lakh under the new income tax regime in Updated on Apr 1st 2024 25 min read As the famous saying goes A penny saved is a penny earned Tax planning is one of the ways that will help you save on taxes and

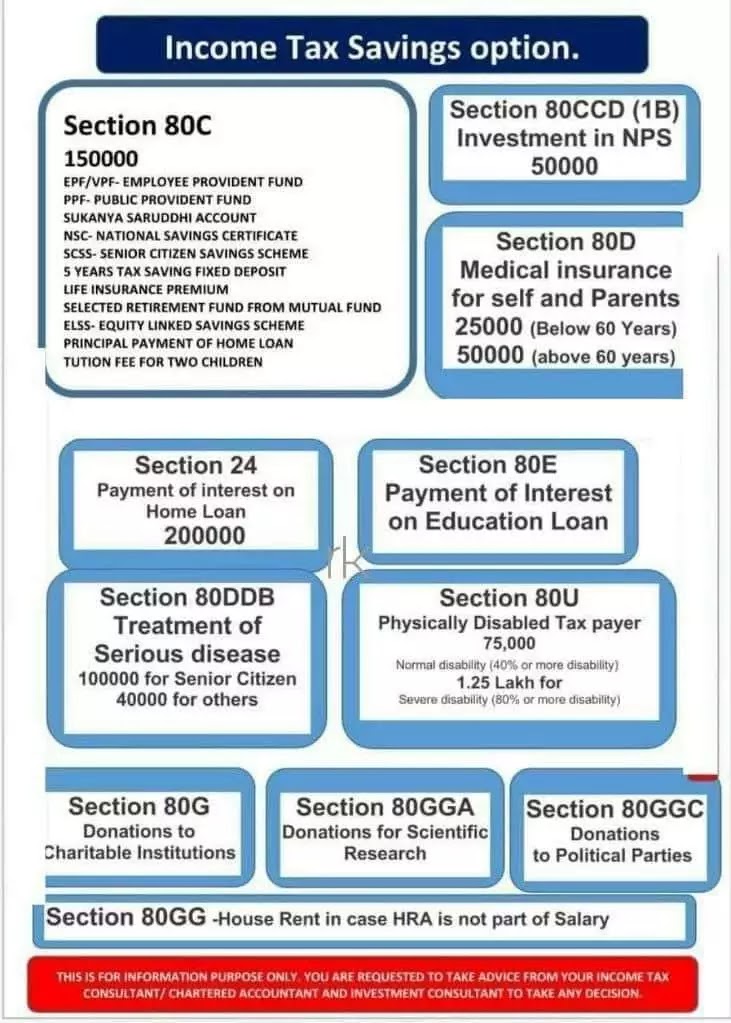

New Tax Regime Exemption List FY 2023 24 The following deductions under New Tax Regime are still available for tax payers The Standard Deduction of Rs 50 000 for Updated on Mar 13th 2024 11 min read The Government of India provides some exemptions in order to reduce your income tax burdens Section 10 of the Income tax

Download Tax Exemption For Salaried Employees 2023 24

More picture related to Tax Exemption For Salaried Employees 2023 24

Salaried Employees Alert Income Tax Exemption Limit Likely To Be

https://i0.wp.com/taxconcept.net/wp-content/uploads/2023/01/TDSOnSalary1.png?fit=1379%2C919&ssl=1

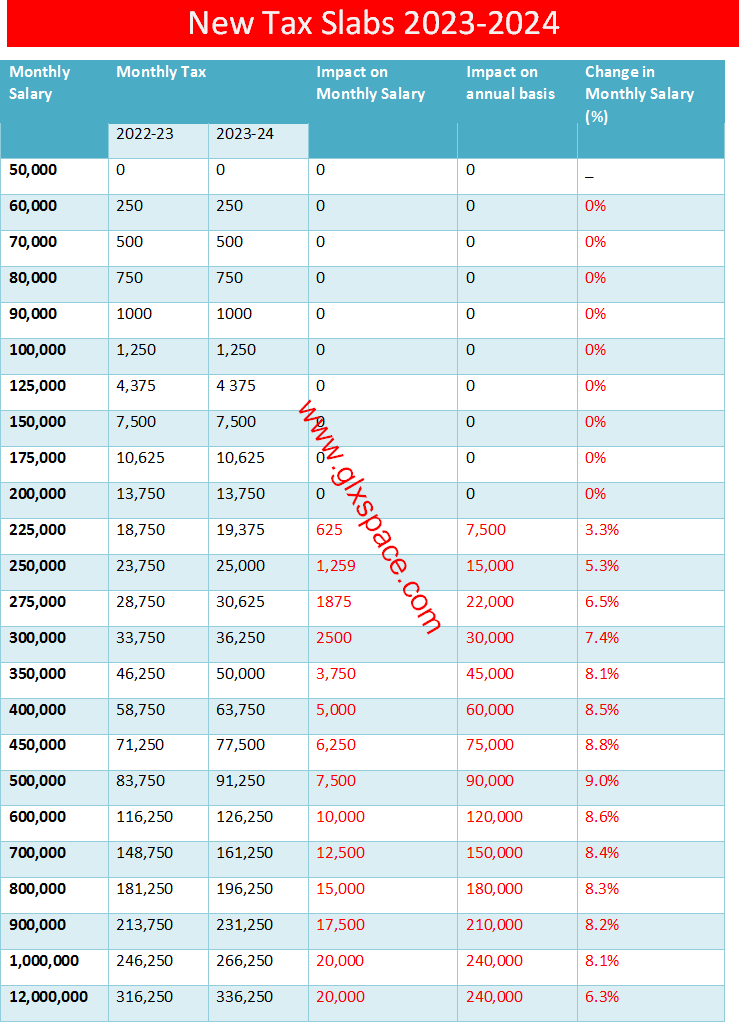

Income Tax Rates 2022 23 For Salaried Persons Employees Slabs

https://www.glxspace.com/wp-content/uploads/2022/06/Income-Tax-Rates-2022-23-for-Salaried-Persons-Employees-with-Slabs-1.jpg

The Exempt Vs The Non Exempt Employees The Fair Labor Standards Act

https://wholeangel.files.wordpress.com/2021/07/exempt-vs-non-exempt-flsa.jpg?w=1024

Income Tax Calculator Use our income tax calculator to calculate tax payable on your income for FY 2024 25 old tax regime vs new tax regime FY 2023 24 and FY 2022 23 in a few simple steps Check how much Home Income Tax Exemptions for Salaried Employees Instant Tax Receipt Top Tax Saving Plans 2024 You Invest 150 000 year Invest For 10 Years Age 30 Year Tax

Contents What is Income Tax Slab New Income Tax Slabs For FY 2023 24 AY 2024 25 New Tax Regime Slab Old Tax Regime Slab Old Tax Regime Vs New What is Income Tax Calculator The Income tax calculator is an easy to use online tool that helps you estimate your taxes based on your income after the Union Budget is

Revised Income Tax Slabs 2023 24 For Salaried Persons Govt Jobs

https://www.glxspace.com/wp-content/uploads/2023/07/TAXzz.png

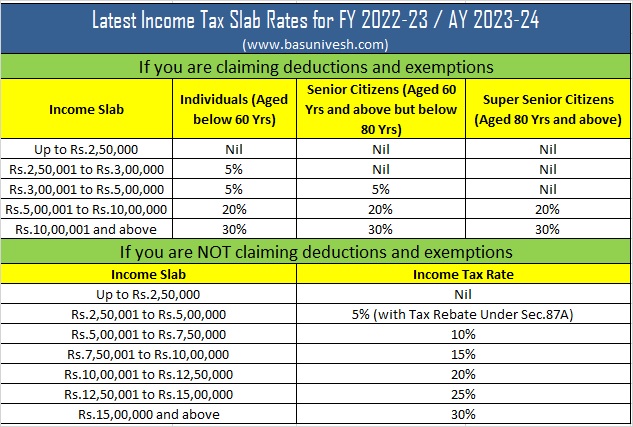

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

https://www.basunivesh.com/wp-content/uploads/2022/02/Latest-Income-Tax-Slab-Rates-for-FY-2022-23-AY-2023-24.jpg

https://cleartax.in/s/income-tax-slabs

Let us take a look at all the slab rates applicable for FY 2023 24 AY 2024 25 For Old Regime a tax rebate up to Rs 12 500 is applicable if the total income does

https://www.incometax.gov.in/iec/foportal/help/...

The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the assessee being an Individual HUF

FY 2023 24 Income Tax Calculation On Salaried Employee CTC

Revised Income Tax Slabs 2023 24 For Salaried Persons Govt Jobs

13161 Pdf Tax Saving Strategies A Study On Financial Planning For

New Employee Tax Declaration Form 2023 Employeeform Net Vrogue

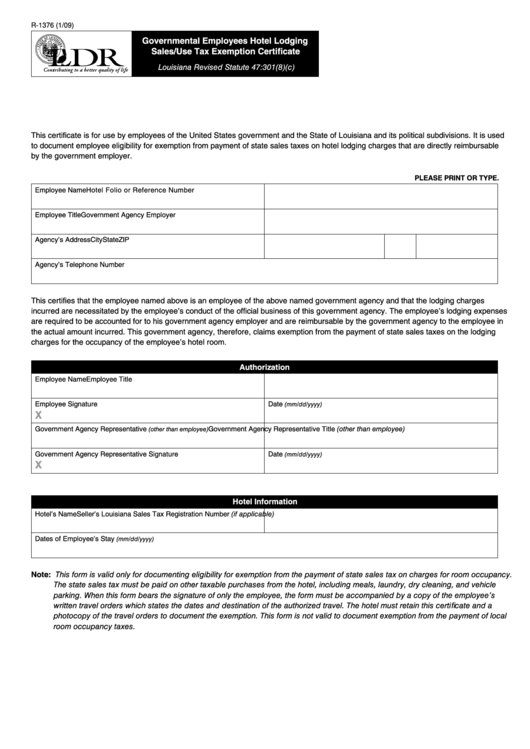

Federal Employee Lodging Tax Exempt Form ExemptForm

5 Tax Saving Tips For Salaried Employees How To Save Maximum Tax For

5 Tax Saving Tips For Salaried Employees How To Save Maximum Tax For

How To File Income Tax Returns For Salaried Employees By Raju Kumar On

State Lodging Tax Exempt Forms ExemptForm

Increased Limit For Tax Exemption On Leave Encashment For Non govt

Tax Exemption For Salaried Employees 2023 24 - Updated on Apr 29th 2024 57 min read The Budget 2023 caused a lot of confusion among taxpayers regarding the choice between the old and new tax regimes The