Tax Exemption For Salaried Employees In Budget 2023 As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of Rs 50 000 under the new tax regime also from the financial year 2023 24

Income Tax Slab Budget 2023 LIVE Updates Salaried pensioners to pay nil tax on income up to Rs 7 5 lakh in new tax regime Post Budget 2023 salaried individuals pensioners Encashment of earned leave up to 10 months of average salary at the time of retirement in case of an employee other than an employee of the Central Government or State Government is

Tax Exemption For Salaried Employees In Budget 2023

Tax Exemption For Salaried Employees In Budget 2023

https://static.tnn.in/thumb/msid-96597124,imgsize-100,updatedat-1672313818106,width-1280,height-720,resizemode-75/96597124.jpg

Tax Saving Guide 10 Smart Ways To Save Income Tax For Salaried Employees

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2021/07/20/986128-813334-saving-istock-041619.jpg

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

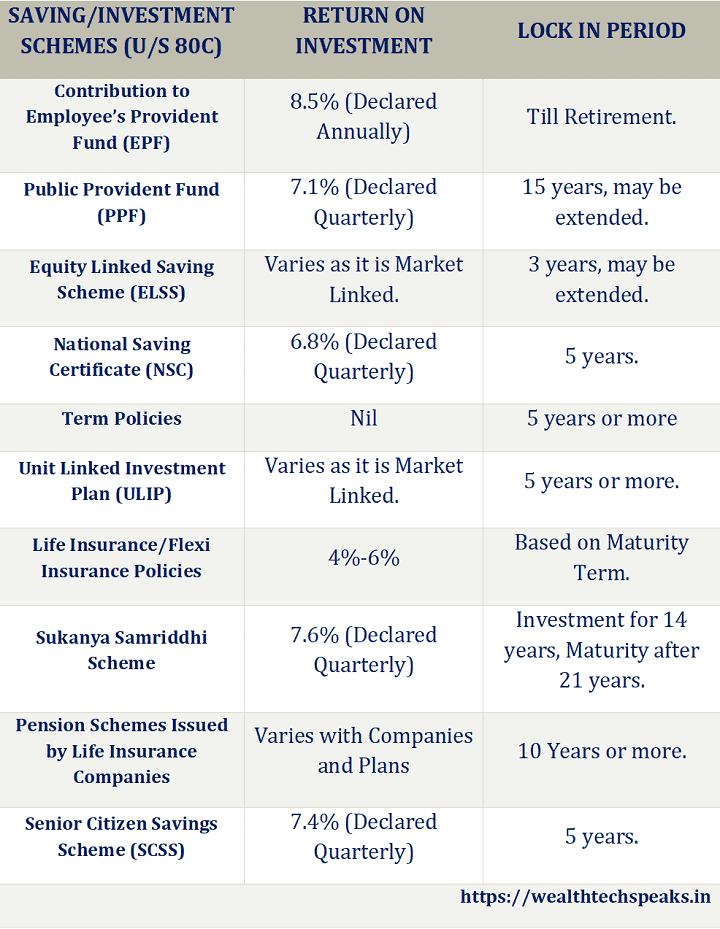

https://wealthtechspeaks.in/wp-content/uploads/2022/02/Income-Tax-Deductions.png

Income tax exemption limit is up to Rs 3 00 000 for Individuals HUF opting for the new regime Surcharge and cess will be applicable over and above the tax rates The standard deduction for salaried employees should be reinstated to at least Rs 1 00 000 to ease the tax burden of the employees and keeping in mind the

But the 2023 Budget could offer relief to individual taxpayers by raising tax exemption or rebate limit Currently salaried employees are one of the major tax contributors Extending benefits of the standard deduction to the new tax regime for salaried class and pensioners Increasing tax exemption limit to 25 lakh on leave encashment on retirement for non government

Download Tax Exemption For Salaried Employees In Budget 2023

More picture related to Tax Exemption For Salaried Employees In Budget 2023

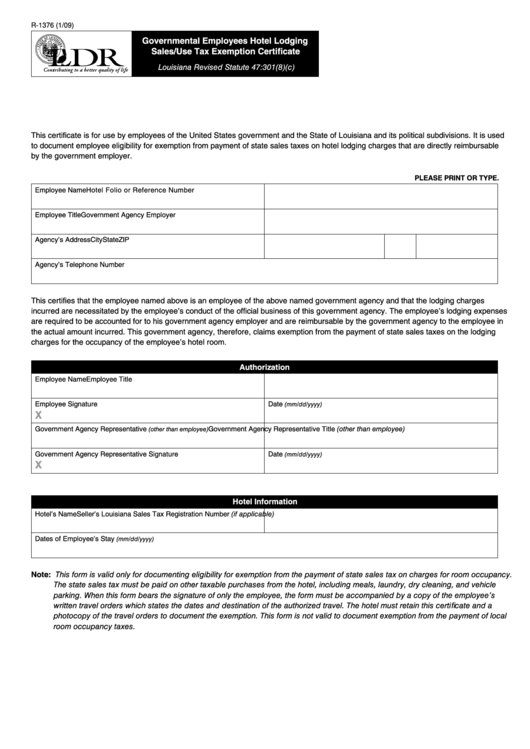

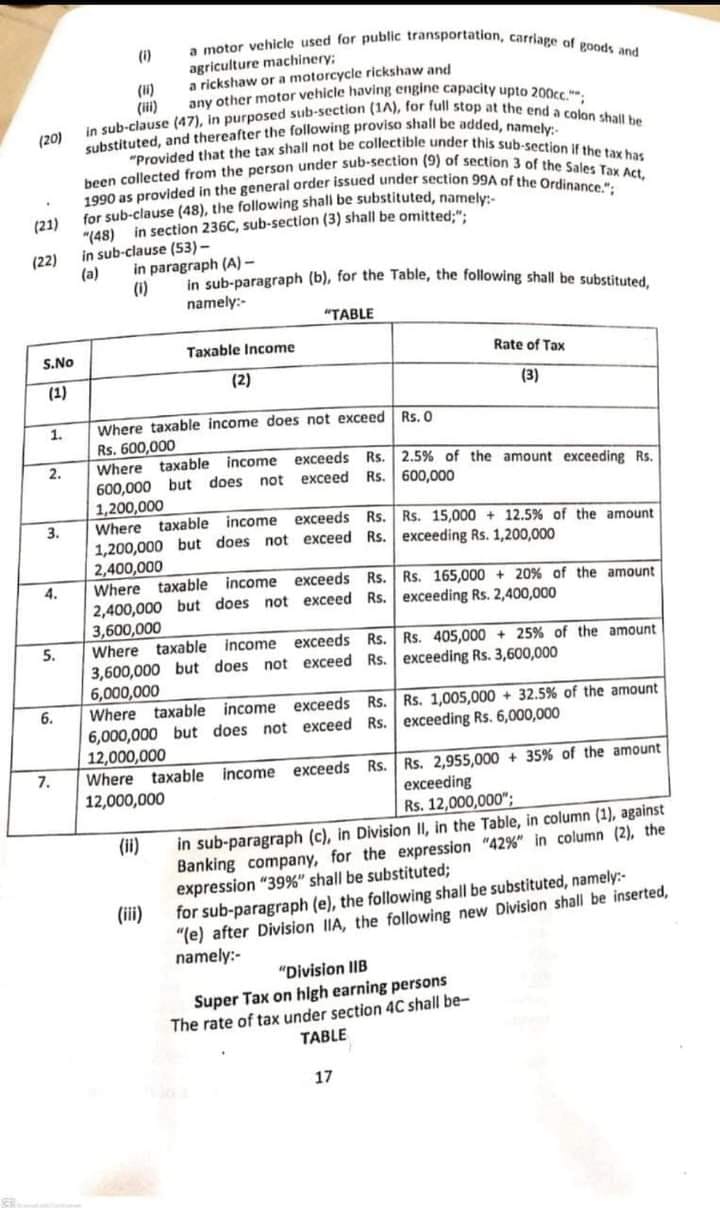

Govt Announced Seven Slabs For Salaried Class In Budget 2022 23

https://fsconline.info/wp-content/uploads/2022/06/Govt-Announced-Seven-Slabs-for-Salaried-Class-in-Budget-2022-23.jpeg

Federal Government Hotel Tax Exempt Form Virginia ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/fillable-form-r-1376-governmental-employees-hotel-lodging-sales-use-5.png

Income Tax Rates 2022 23 For Salaried Persons Employees Slabs

https://www.glxspace.com/wp-content/uploads/2022/06/Income-Tax-Rates-2022-23-for-Salaried-Persons-Employees-with-Slabs-1.jpg

Tax incentives for salaried class Salaried employees can expect that the Budget 2023 will incentivize them as no significant benefits were there for them in the Standard deduction for salaried and pension class taxpayers has been extended to the new tax regime Salaried non government employees who receive

The government could reduce the highest tax rate from 30 per cent to 25 per cent both under current and simplified regime to give more purchasing power and provide some relief to salaried employees Salaried individuals who live in a rented house can claim tax exemption on HRA The amount of exemption shall be lower of the following The total amount of HRA

Definition Of Exempt Vs Non Exempt Employees Information Online

https://i2.wp.com/www.surepayroll.com/globalassets/images/blog/2019/exempt-vs-non-exempt-employees_2.jpg

New Employee Tax Declaration Form 2023 Employeeform Net Vrogue

https://i0.wp.com/www.employeeform.net/wp-content/uploads/2022/06/free-11-sample-employee-declaration-forms-in-pdf-excel-word-5.jpg

https://cleartax.in/s/income-tax-allowances-and-deductions

As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of Rs 50 000 under the new tax regime also from the financial year 2023 24

https://economictimes.indiatimes.com/wealth/tax/...

Income Tax Slab Budget 2023 LIVE Updates Salaried pensioners to pay nil tax on income up to Rs 7 5 lakh in new tax regime Post Budget 2023 salaried individuals pensioners

Is Salary Exempt Or Non Exempt Urutudesign

Definition Of Exempt Vs Non Exempt Employees Information Online

All The Salaried Employees Out There Save More With These Simple Tax

13161 Pdf Tax Saving Strategies A Study On Financial Planning For

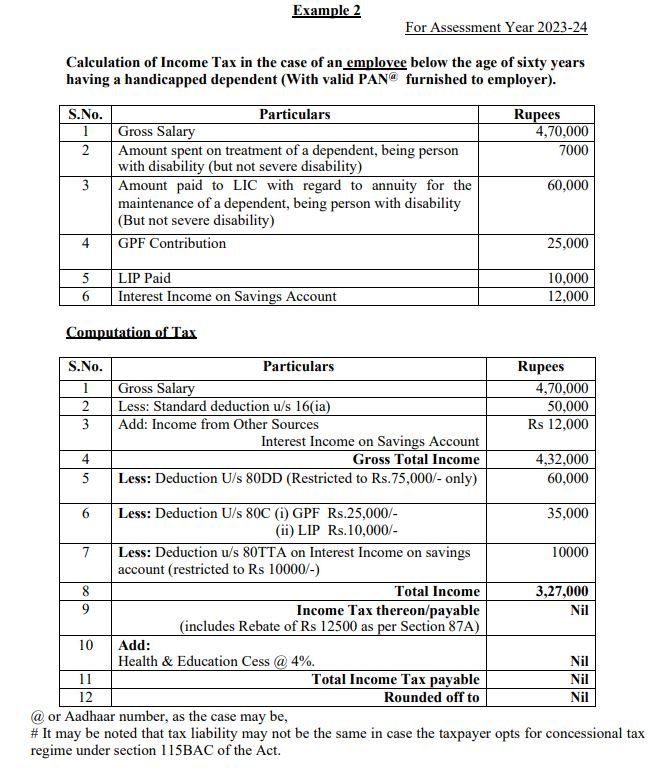

Income Tax Calculation Example 2 For Salary Employees 2023 24

Increased Limit For Tax Exemption On Leave Encashment For Non govt

Increased Limit For Tax Exemption On Leave Encashment For Non govt

Income Tax High Value Cash Transactions That Can Attract Income Tax Notice

Budget 2023 Expectations Income Tax Exemption Limit Likely To Be

What Is A Pension Plan And How Does It Work GOBankingRates

Tax Exemption For Salaried Employees In Budget 2023 - With just a few weeks left for Union Budget 2023 salaried employees are expecting some big tax relief announcements in view of the rising cost of living While