Tax Exemption In Spain The exemption system is applicable under certain conditions namely a participation in the foreign subsidiary of at least 5 and a minimum underlying nominal

Wealth tax in Spain If your wealth is over 700 000 you will be liable for a wealth tax of 0 2 2 5 on net assets Residents pay tax on worldwide Tax residents in Spain who perform work abroad may under certain conditions qualify for an exemption from income tax for income up to 60 100 euros Conditions In order to

Tax Exemption In Spain

Tax Exemption In Spain

https://file.mk.co.kr/mkde/N0/2015/12/201512030949331258065.jpg

Exemption In New Tax Regime List Of All The New Tax Regime

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/tax-exemption.jpg

Relevant Personal Income Tax Exemption In Spain

https://www.welex.es/wp-content/uploads/2018/04/capital-gain-tax-in-spain-xs.jpg

According to this article of the Spanish Personal Income Tax Law income from work actually performed abroad which complies with the following provisions is exempt from tax A If the employer is a company that is Individuals performing activities in Spain are subject to tax based on residence and source of income Residents are taxed on worldwide income Non residents are taxed on

Tax residents in Spain are entitled to certain allowances and deductions Basic personal allowances Similarly to the UK every resident has a basic personal In accordance with the provisions of Article 21 of the CIT Law dividends obtained by Spanish entities from foreign subsidiaries may be 95 exempt from taxation under the current participation exemption regime

Download Tax Exemption In Spain

More picture related to Tax Exemption In Spain

Autumn Statement 2022 HMRC Tax Rates And Allowances For 2023 24

https://images.contentstack.io/v3/assets/blt3de4d56151f717f2/blt8743826b67930bd8/63767939ac59ed1089b31054/table_1.png

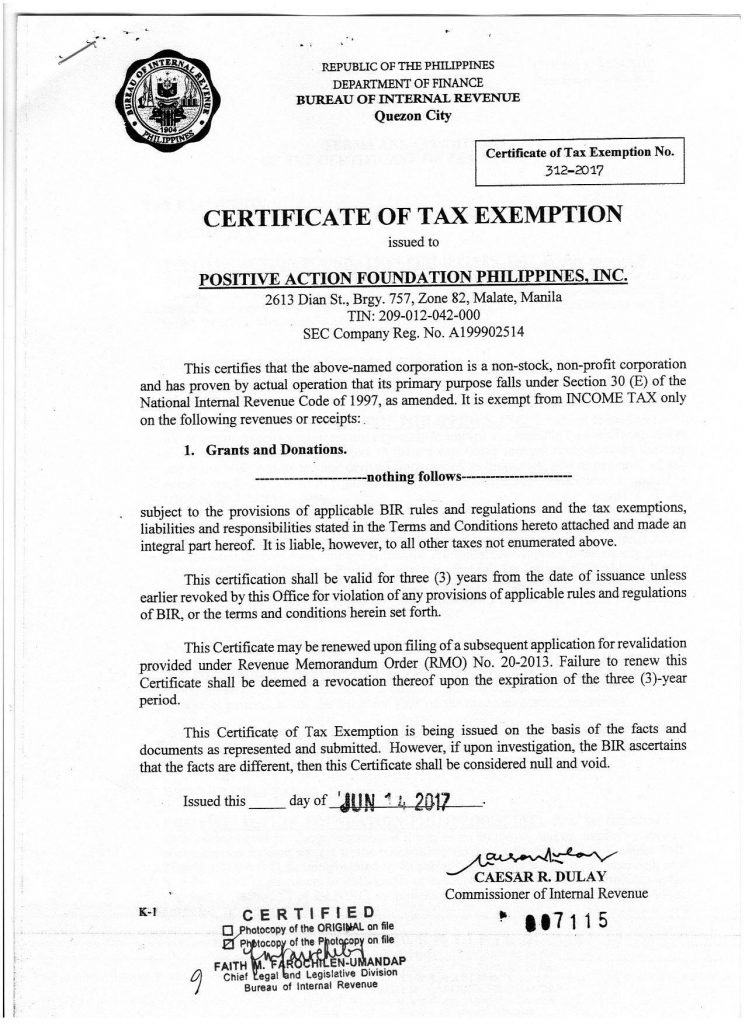

Revocation Of Federal Tax Exemption Grant Management Nonprofit Fund

https://mygrantmanagement.com/wp-content/uploads/2019/07/tax_exemption_1563850735.png

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

Taxation An aspect of fiscal policy Policies Economics Collection Noncompliance Types International Trade Research Religious By country Business portal Money portal v t e A reduced tax rate of 24 applies to income between 17 707 and 24 000 Income below 17 707 is exempt from taxation The Spanish government also levies a social security

For residents there is an additional 300 000 tax allowance for primary residence in Spain From 2021 the tax rate is scaled from 0 2 to 3 5 rising to 3 75 Withholding tax on services fees When a payment is made to a Spanish non resident with reference to services performed in Spain the payer must withhold a 24 tax rate of the

Tax Exemption Better Than Success

https://betterthansuccess.com/wp-content/uploads/2016/03/Sales-Tax-Exemptions-1.jpg

State Tax Exemption Map National Utility Solutions

https://nationalutilitysolutions.com/wp-content/uploads/2019/01/State-Tax-Exemption-Map.png

https://www.accountinginspain.com/exemption-versus...

The exemption system is applicable under certain conditions namely a participation in the foreign subsidiary of at least 5 and a minimum underlying nominal

https://expatra.com/guides/spain/taxes-in-spain

Wealth tax in Spain If your wealth is over 700 000 you will be liable for a wealth tax of 0 2 2 5 on net assets Residents pay tax on worldwide

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

Tax Exemption Better Than Success

What Qualifies For Tax Free Exemption In Texas For The 2017 Tax Holiday

Tax Exemption Certificate Sachet Riset

Tax Exemption Request M R Embroidery LLC

Tax Benefit

Tax Benefit

Writing Religious Exemption Letters

Budget 2023 Check The Difference Between Income Tax Exemption

The Estate Tax The Motley Fool

Tax Exemption In Spain - According to this article of the Spanish Personal Income Tax Law income from work actually performed abroad which complies with the following provisions is exempt from tax A If the employer is a company that is