Tax Exemption On House Rent Allowance Verkko 5 toukok 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Section 80GG of Income Tax Act 1961 Stay in Rented Accommodation Not living in a self owned Rent paid

Verkko 24 marrask 2023 nbsp 0183 32 Actual Rent Paid 10 of Basic Salary INR 1 90 000 2 40 000 10 5 00 000 INR 1 90 000 will be exempt from the total House Rent Allowance received and the remaining INR 60 000 2 50 000 1 90 000 will be taxable Use the HRA calculator to find taxable and tax exempt House Rent Allowance Verkko 18 jouluk 2023 nbsp 0183 32 Is House Rent Allowance Fully Exempt from Taxation Are Self Employed Individuals eligible for HRA Exemption Which Income Tax Category is HRA under Does HRA Vary in metropolitan cities What are the Documents Required for HRA Exemption Can you claim HRA and Home Loan Tax Exemption Is Paying Rent to

Tax Exemption On House Rent Allowance

Tax Exemption On House Rent Allowance

https://1.bp.blogspot.com/-ZMH3HiCoIAk/XhnBu-Xz5QI/AAAAAAAAAEs/HgjoRgnDJPY2_HspsMmkJk7FPdVEoJBpwCLcBGAsYHQ/s1600/income-tax.jpg

How To Claim HRA Allowance House Rent Allowance Exemption

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

Ag Exemptions For Sales Tax And Excise Tax On Clear And Red Diesel

https://www.gregspetro.com/wp-content/uploads/2019/08/Tax-Exemptions-Just-Ahead-01.jpg

Verkko Enter the dearness allowance amount Enter how much HRA allowance you have received from your employer Select the location of your residence whether it is in the metro city or non metro city Enter the total rent paid amount After entering all the information the calculator will show you the taxable HRA amount and applicable tax Verkko 30 syysk 2023 nbsp 0183 32 House Rent Allowance HRA is a pivotal component of many employees salaries wielding the power to significantly impact their tax liabilities under Section 10 13A of the Income Tax Act While

Verkko 19 huhtik 2021 nbsp 0183 32 Basically the tax exemption that one can claim on their House Rent Allowance is the lowest amount of these three The rent paid by the employee minus 10 of their basic salary The total amount of House Rent Allowance offered by the employer 50 of the salary if the employee works in a Metro city or 40 if he or she Verkko PAN card of your landlord As the taxpayer you will have to submit your rent receipts to avail of tax exemption on HRA The PAN Card details of the landlord landlady are required to be provided as well in the cases where the annual rent of the housing unit exceeds the mark of Rs 1 lakh

Download Tax Exemption On House Rent Allowance

More picture related to Tax Exemption On House Rent Allowance

HOUSE RENT ALLOWANCES EXEMPTION RULES CALCULATION OF HOUSE RENT

https://i.ytimg.com/vi/gedlw3gWwuE/maxresdefault.jpg

Meaning Of House Rent Allowance And How Does It Cater To Tax Exemption

https://www.houssed.com/wp-content/uploads/2022/08/meaning-of-house-rent-allowance-and-how-does-it-cater-to-tax-exemption_articleimage.jpg

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

Verkko 7 maalisk 2023 nbsp 0183 32 Self employed and salaried individuals can claim HRA exemptions even if they do not get House Rent Allowance u S 80GG of the Income Tax Act As per this section people can claim the least among the following instead of house rent 25 of gross total income The rent paid 10 of the gross total income Verkko 12 kes 228 k 2023 nbsp 0183 32 HRA exemptions for a self employed individual House Rent Allowance HRA exemptions from taxes are also available to individuals who are self employed and who pay their own rent They are eligible to receive these advantages if they use Section 80 GG

Verkko 26 hein 228 k 2023 nbsp 0183 32 Rent Paid Minus 10 of Basic Salary The exemption is allowed on the amount that exceeds 10 of the basic salary The basic salary includes basic pay and dearness allowance if applicable 3 50 of Basic Salary 40 in non metro cities This is the maximum HRA exemption allowed under the Income Tax Act Verkko 22 syysk 2022 nbsp 0183 32 HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting a house You can claim a deduction for HRA under Section 10 13A of the Income Tax Act but remember it can be fully or partially taxable

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

https://emailer.tax2win.in/assets/guides/hra/available_tax_exemptions.png

House Rent Allowance Hra Tax Exemption Hra Calculation Rules Free

https://wp.sqrrl.in/wp-content/uploads/2019/08/FOR-ANAND-3-1024x796.png

https://taxguru.in/income-tax/house-rent-allowance-hra-exemption-rule…

Verkko 5 toukok 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Section 80GG of Income Tax Act 1961 Stay in Rented Accommodation Not living in a self owned Rent paid

https://learn.quicko.com/house-rent-allowance-hra

Verkko 24 marrask 2023 nbsp 0183 32 Actual Rent Paid 10 of Basic Salary INR 1 90 000 2 40 000 10 5 00 000 INR 1 90 000 will be exempt from the total House Rent Allowance received and the remaining INR 60 000 2 50 000 1 90 000 will be taxable Use the HRA calculator to find taxable and tax exempt House Rent Allowance

House Rent Allowance HRA Calculation Exemption Rules Allowance

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

HRA Exemption House Rent Exemption U S 10 13A

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

House Rent Allowance A Tax Planning Tool For Salaried Chandan

House Rent Allowance In Hindi Exemption B Taxation YouTube

House Rent Allowance In Hindi Exemption B Taxation YouTube

Tax Bd 2015 VAT Exemption On House Rent For IT ITES Company

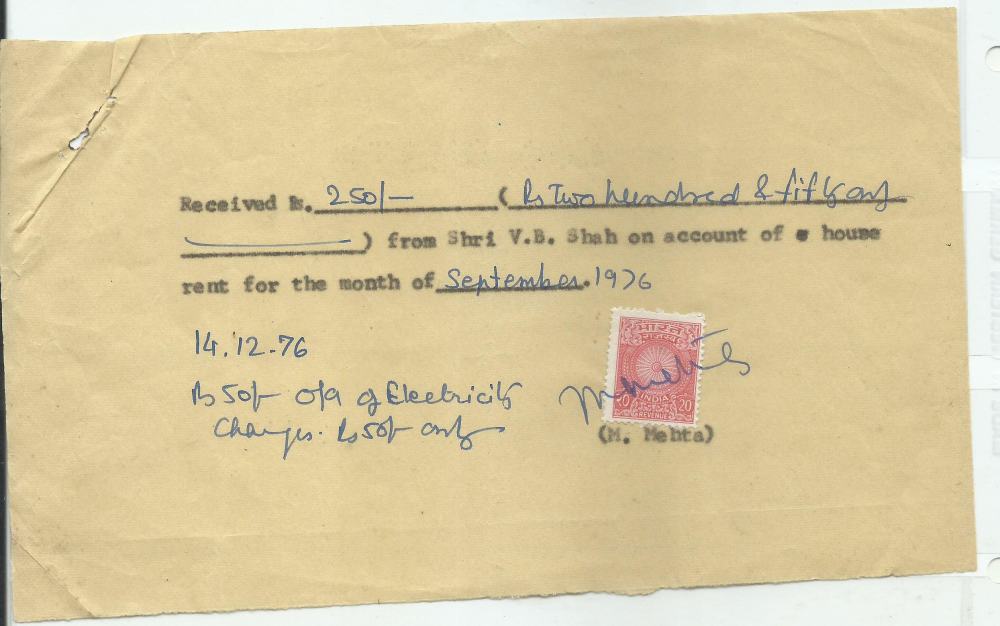

Rent Receipts With Revenue Stamps Its Role In Claiming HRA Tax Benefits

The Best How To Calculate House Rent Allowance In Excel References

Tax Exemption On House Rent Allowance - Verkko Salaried individuals who live in a rented house can claim this exemption and bring down their taxes HRA can be fully or partially exempt from tax Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable