Tax Exemption On Transport Allowance The criteria for and amounts of allowances for travel expenses to be considered exempt from tax in the 2024 taxation shall be as prescribed in this decision below 2 Travel expenses are the

The criteria for and amounts of allowances for travel expenses to be considered exempt from tax in the 2025 taxation shall be as prescribed in this decision below Travel Transport Allowance of Rs 1 600 per month is tax free for a salaried employee Any amount received in excess of Rs 1600 is taxable Transport Allowance of Rs 3 200 per

Tax Exemption On Transport Allowance

Tax Exemption On Transport Allowance

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/497/332/497332566/large.png

If other persons for whose transport the employer is responsible travel in a vehicle owned or held by the employee the maximum allowance referred to in paragraph 1 is The Income Tax Act of 1961 provides a unique exemption known as the transport allowance exemption which allows salaried individuals to deduct a certain amount from their gross pay income to cover the expenses incurred

Transport allowance is exempt either through standard deduction or a fixed amount of monthly exemption On the other hand conveyance allowance is exempt on the basis of the actual amount spent by the employee EXEMPTION LIMIT PER YEAR 1 Petrol allowance travelling allowance or toll payment or any of its combination for official duties If the amount received exceeds RM6 000 a year the

Download Tax Exemption On Transport Allowance

More picture related to Tax Exemption On Transport Allowance

Travelling Allowance To The Officials Deployed For Election Duty

https://www.staffnews.in/wp-content/uploads/2022/09/travelling-allowance-to-the-officials-deployed-for-election-duty-claim-form.jpg

Filling Out An Application For A Tax Exemption On Transport Tax Land

https://as2.ftcdn.net/v2/jpg/02/83/52/31/1000_F_283523139_GrXpgg2KdqeWgIZds3MV6NV2hKpb2uC9.jpg

2017 PAFPI Certificate of TAX Exemption Certificate Of

https://www.certificateof.com/wp-content/uploads/2018/06/2017-PAFPI-Certificate-of-TAX-Exemption.jpg

Transport allowances Transport allowance granted to an employee to meet his expenditure for the purpose of commuting between the place of his residence and the place of his duty is fully taxable Exemption The maximum transport allowance that is exempt from tax is Rs 1 600 per month or Rs 19 200 per year This exemption is available to all salaried employees and is not dependent on the actual amount of expense incurred by

The tax exemption limit for transport allowance was Rs 1 600 per month Rs 19 200 annually based on previous regulations If the received amount is above this exemption limit the Under Rule 2BB and Section 10 14 the travel allowance is exempt The exemption amount is as follows Transportation reimbursement for travel between home and

How To Claim Rent Exemption Without An HRA Component In Your Salary

https://www.kanakkupillai.com/learn/wp-content/uploads/2023/10/How-to-Claim-Rent-Exemption-Without-an-HRA-Component-in-Your-Salary.jpg

In Tuva The Participants Of The Special Operation Are Exempt From The

https://sun9-51.userapi.com/impg/1wwRgHTlXHq-qcjEvG9puDj1DcrB6qi1PwSROw/fzubNYOrAc8.jpg?size=1080x1080&quality=95&sign=2cbc0fb4ab6d672f047f6c3c3ed0c51c&c_uniq_tag=dGBlY-KhsebL5FUGrh-1DiU5GvY1cxK39WNilpzyqgI&type=album

https://www.vero.fi › en › detailed-guidance › decisions

The criteria for and amounts of allowances for travel expenses to be considered exempt from tax in the 2024 taxation shall be as prescribed in this decision below 2 Travel expenses are the

https://www.vero.fi › en › detailed-guidance › decisions

The criteria for and amounts of allowances for travel expenses to be considered exempt from tax in the 2025 taxation shall be as prescribed in this decision below Travel

Unlock Your Tax Freedom Master The Art Of Non Taxable Income With Our

How To Claim Rent Exemption Without An HRA Component In Your Salary

Transport Allowance Exemption For Central Government Employees RDP

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

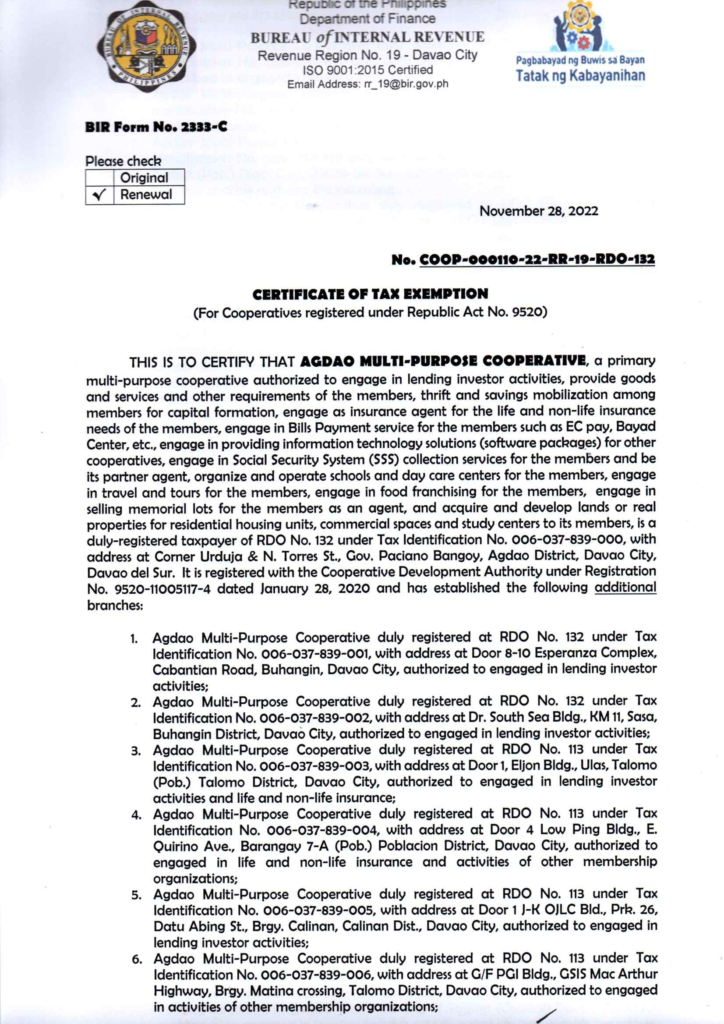

BIR Certificate Of Tax Exemption AMPC

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

Sample Letter Exemptions Doc Template PdfFiller

IRS Tax Exemption Letter Peninsulas EMS Council

TRANSPORT ALLOWANCE EXEMPTION LIMIT INCREASED BY CBDT SIMPLE TAX INDIA

Tax Exemption On Transport Allowance - Under this standard deduction employees can now claim a tax exemption of up to 50 000 in the old tax regime and 75 000 in the new tax regime without needing to submit