Tax Exemption Retirement Plan Review exceptions to the 10 additional tax on early retirement plan distributions Most retirement plan distributions are subject to income tax and may be

Retirement plans may also help an organization attract and retain better qualified employees For more information including a helpful chart comparing the Get tax information for retirement plans required minimum distribution contribution limits plan types and reporting requirements for plan administrators Tax

Tax Exemption Retirement Plan

Tax Exemption Retirement Plan

https://www.washfinancial.com/wp-content/uploads/2018/06/Image.jpg

Free Retirement Plan Contribution Limits Campaign Advisorexpressions

https://advisorexpressions.com/wp-content/uploads/2022/01/AE-2022-FB-Posts_2022ContributionLimits2.jpg

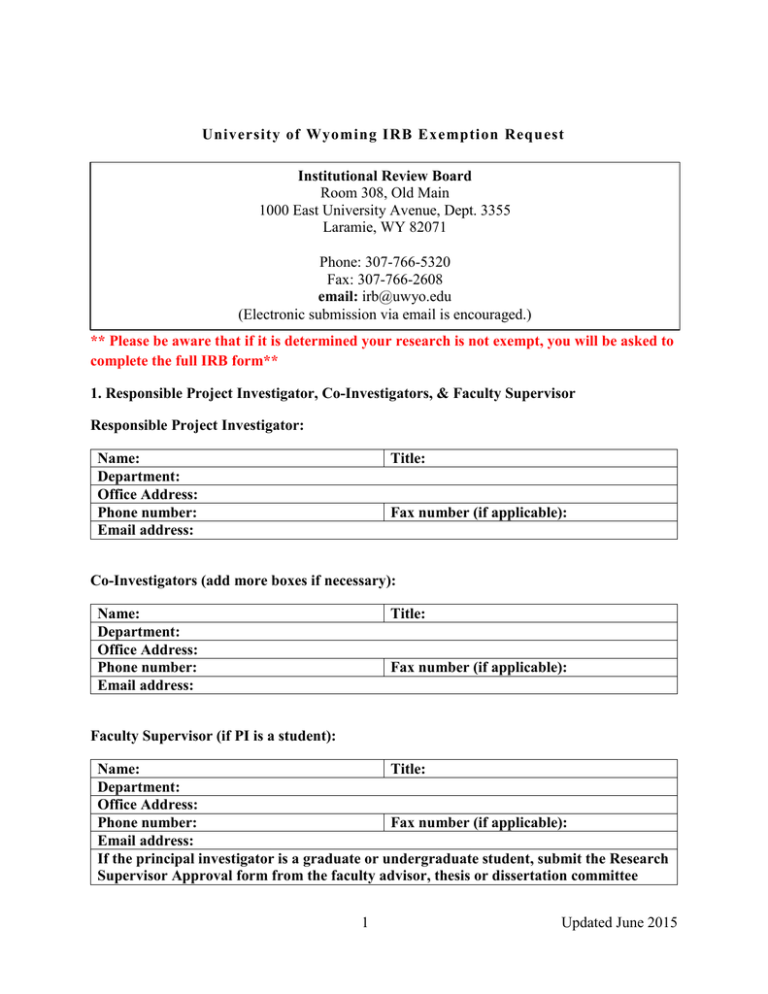

Exemption Request Form June 2015

https://s2.studylib.net/store/data/015426834_1-65bfca52b0937b0852d7580bb2be5837-768x994.png

A portion of taxable income may be taxed at one rate while another portion of the income may be taxed at another For example if you re married filing jointly in The tax rate may be zero 15 or 20 depending on your taxable income Losses That Offset Capital Gains You can use losses on the sale of securities and other property to offset capital gains

A new law effective last year makes the first 6 000 or distributions from retirement plans like IRAs and 401 k s tax exempt for retirees age 65 and older in Alabama Federal Estate and Gift Tax Exemption Exclusion Levels Retirement Account Planning The SECURE Act of 2022 SECURE 2 0 raised the age at which

Download Tax Exemption Retirement Plan

More picture related to Tax Exemption Retirement Plan

Income Tax ShareChat Photos And Videos

https://cdn.sharechat.com/2b0d0eef_1588734670621.jpeg

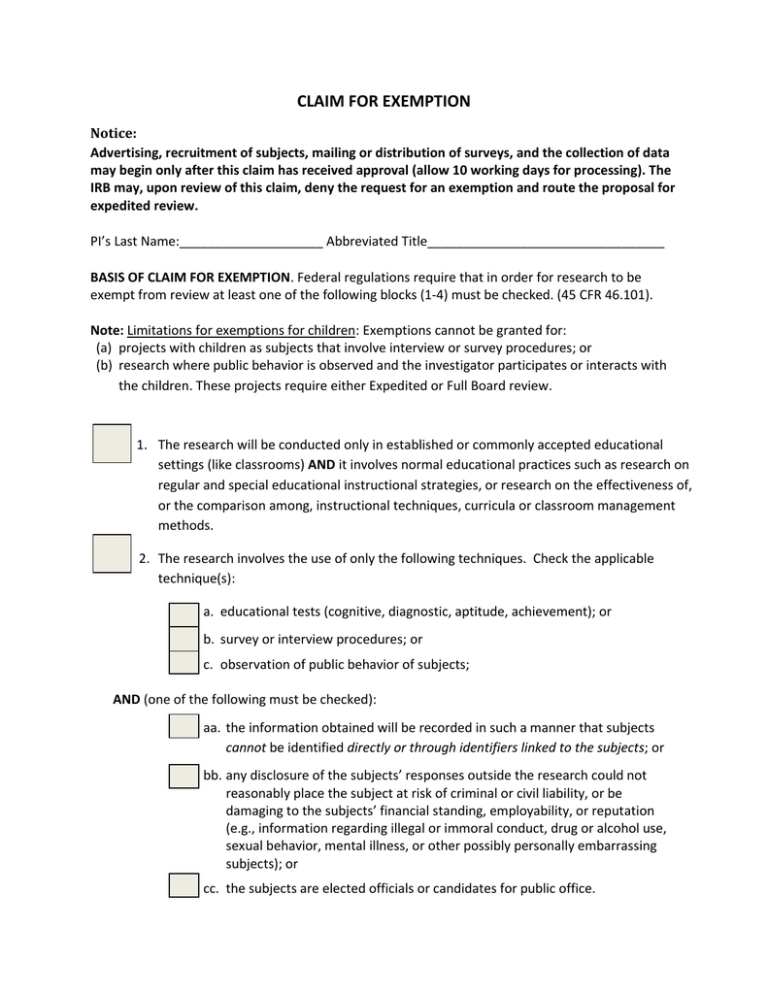

Claim For Exemption

https://s2.studylib.net/store/data/015290925_1-c28b6785682afa346c6300cf0893f532-768x994.png

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

Some retirees might benefit from taking the tax hit that comes from transferring tax deferred money in a traditional I R A or 401 k to a Roth I R A which Carly Grey Ogletree Deakins Stephanie Smithey and Carly Grey examine factors that may affect whether retirement plan sponsors continue their wait and see

The Consolidated Appropriations Act 2023 P L 117 328 enacted on Dec 29 included as its Division T the Secure 2 0 Act which contains several retirement and There are two major options for retirement savings tax deferred and tax exempt A tax deferred account lets you delay paying taxes until you retire Examples include

Where Could Your Retirement Income Come From Rob The IRA Guy

https://robtheiraguy.com/wp-content/uploads/2021/07/Where-Could-Your-Retirement-Income-Come-From.jpeg

Homestead Tax Exemption For Seniors Adams County Iowa

https://adamscounty.iowa.gov/images/news/homestead_tax_exemption_for_seniors_93413.png

https://www.irs.gov/retirement-plans/plan...

Review exceptions to the 10 additional tax on early retirement plan distributions Most retirement plan distributions are subject to income tax and may be

https://www.irs.gov/charities-non-profits/...

Retirement plans may also help an organization attract and retain better qualified employees For more information including a helpful chart comparing the

Blog Best Retirement Plan For Self Employed Gold Standard Tax

Where Could Your Retirement Income Come From Rob The IRA Guy

Product Detail

HRDF Exemption 2021 Aug 17 2021 Johor Bahru JB Malaysia Taman

Retirement Income Retirement Pension Retirement Advice Investing For

Optima Tax Relief Reviews Form 1023 Tax Exemption Revision

Optima Tax Relief Reviews Form 1023 Tax Exemption Revision

COVID 19 CARES Act Financial Planning Series 5 Retirement Plan

Certify Your Business Exemption From MarylandSaves MarylandSaves

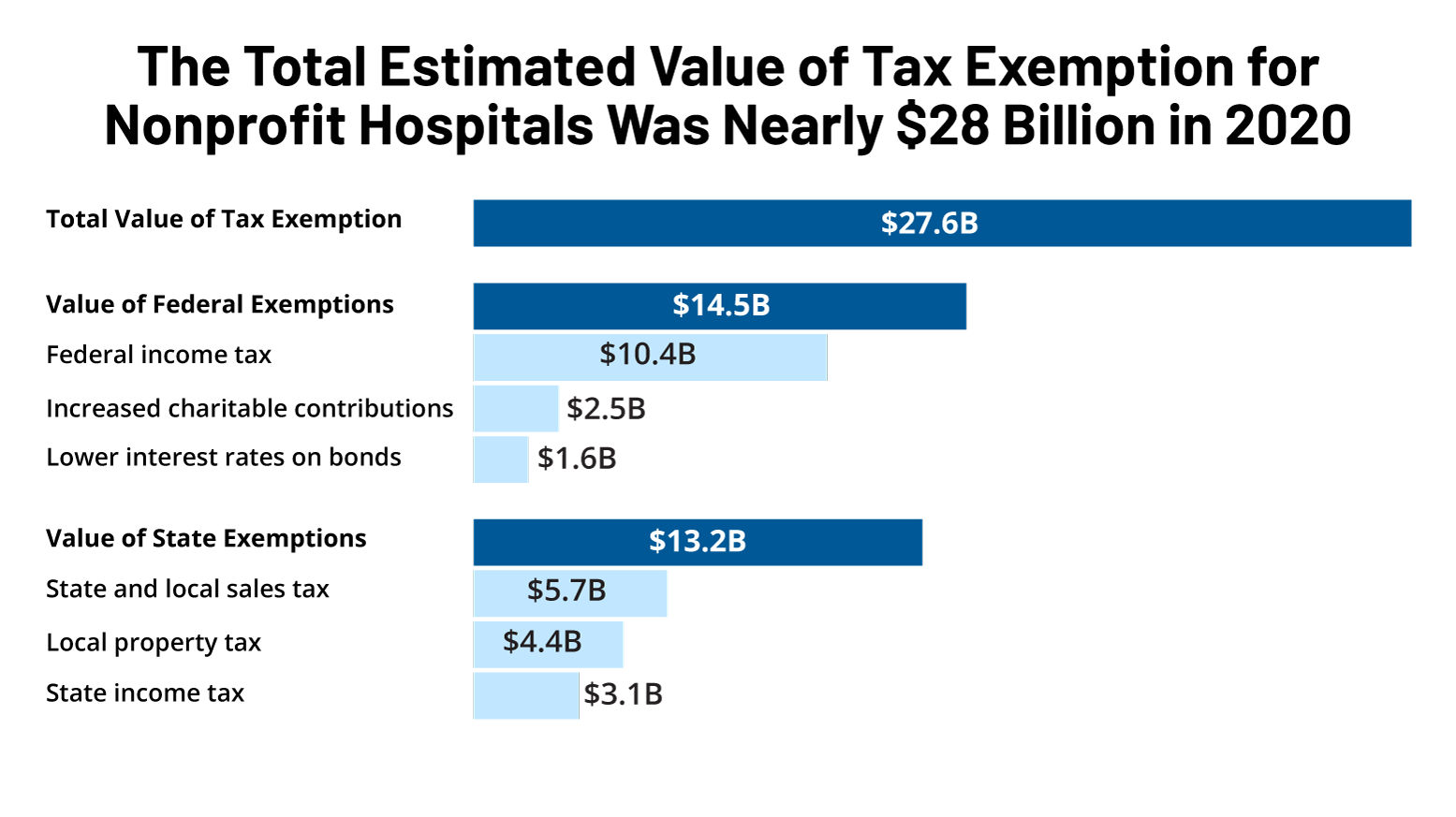

The Estimated Value Of Tax Exemption For Nonprofit Hospitals Was Nearly

Tax Exemption Retirement Plan - A new law effective last year makes the first 6 000 or distributions from retirement plans like IRAs and 401 k s tax exempt for retirees age 65 and older in Alabama