Tax Exemptions For Salaried Employees What are Exemptions Under Section 10 Here is a list of exempted income under Section 10 Section 10 13A of the Income Tax Act covers House Rent Allowance HRA

Regime taxpayers have the option to claim various tax deductions and exemptions In case of non business cases option to choose the regime can be exercised every year directly in the There are multiple deductions and exemptions available in the Income tax Act 1961 which individuals can take advantage to save taxes on the income earned during FY 2023 24

Tax Exemptions For Salaried Employees

Tax Exemptions For Salaried Employees

https://www.kanakkupillai.com/learn/wp-content/uploads/2019/04/ban-760x570.jpg

Income tax Exemptions For Salaried Employees 5min Guide

https://weinvestsmart.com/wp-content/uploads/2021/06/Income-tax-exemptions-for-salaried-employees-768x401.jpg

8 Useful Income Tax Exemptions For Salaried Employees ABC Of Money

https://www.adityabirlacapital.com/abc-of-money/-/media/Project/ABCL/Internal_Images_526x230/526x230/TX/8-Important-Tax-Exemptions-for-Salaried-Professionals_526_230_M_TX_092.png

1 House Rent Allowance HRA The employer s provision for covering the accommodation expenses of the employee known as HRA can be either partially or fully exempt from The salary threshold to be exempt just jumped from 35 568 per year to 43 888 With a higher threshold for exemption more workers are entitled to 1 5 times pay for overtime work

Like every year the salaried taxpayers are looking at the Modi government to provide substantial income tax relief with changes in the new income tax regime standard deduction etc India More than eight decades ago the Fair Labor Standards Act FLSA established overtime protections to help discourage employers from overworking their employees and to hire more

Download Tax Exemptions For Salaried Employees

More picture related to Tax Exemptions For Salaried Employees

Income Tax Exemptions For Salaried Employees 2024

https://www.wishfin.com/blog/wp-content/uploads/2021/04/Income-Tax-Exemptions-for-Salaried-Employees.jpg

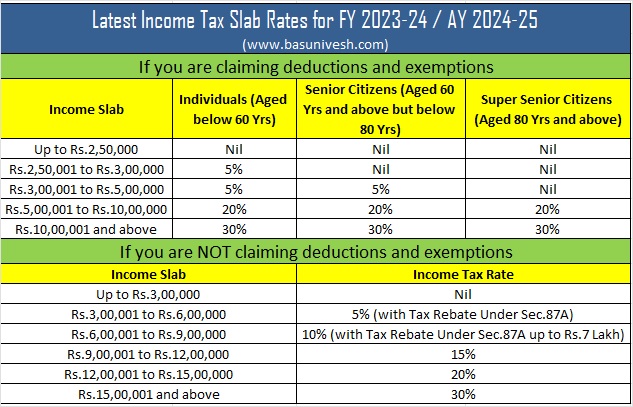

Revised Latest Income Tax Slab Rates FY 2023 24

https://www.basunivesh.com/wp-content/uploads/2023/02/Revised-Latest-Income-Tax-Slab-Rates-FY-2023-24.jpg

Tax Exemptions Deductions For Salaried Employees AU Small Finance Bank

https://www.aubank.in/know-income-tax-exemptions-and-deductions-for-salaried-emp-banne-Tax-Exemptions-for-Salaried-Employees_db.jpg

You need to submit a P11D for each employee in receipt of benefits and or non exempt expenses unless you registered with us online before 6 April 2023 to tax them through your The Income Tax Act 1961 mandates certain income tax allowances exemptions for the salaried class These exemptions thus can help salaried individuals save a significant

A salaried employee can avail of many financial benefits to cut down their personal tax burden that are offered to them in the form of allowances These allowances are offered on a monthly Explore taxability of various allowances exemptions and deductions for salaried employees in India Learn about fully and partially taxable allowances exemptions for HRA and deductions

List Of Allowances Exemptions Relevant To Salaried Employees TAXCONCEPT

https://i0.wp.com/taxconcept.net/wp-content/uploads/2021/12/WhatsApp-Image-2021-12-10-at-12.22.57-PM.jpeg?fit=700%2C410&ssl=1

Salaried Employees Get Tax Relief On Rent Free Accommodation INDToday

https://indtoday.com/wp-content/uploads/2023/09/Income-Tax-Exemptions-For-S-1024x576.jpg

https://cleartax.in/s/section-10-of-income-tax-act

What are Exemptions Under Section 10 Here is a list of exempted income under Section 10 Section 10 13A of the Income Tax Act covers House Rent Allowance HRA

https://www.incometax.gov.in/iec/foportal/help/...

Regime taxpayers have the option to claim various tax deductions and exemptions In case of non business cases option to choose the regime can be exercised every year directly in the

5 Tax Saving Tips For Salaried Employees How To Save Maximum Tax For

List Of Allowances Exemptions Relevant To Salaried Employees TAXCONCEPT

Exempt Income Income Exempt From Tax As Per Section 10

The Exempt Vs The Non Exempt Employees The Fair Labor Standards Act

13161 Pdf Tax Saving Strategies A Study On Financial Planning For

Tax Planning Tips For Salaried Employees ComparePolicy

Tax Planning Tips For Salaried Employees ComparePolicy

8 Simple Tips For Salaried Employees To Gain Income Tax Exemptions

Tax Planning Of Salaried Employees Goyal Mangal Company

7 Useful Income Tax Exemptions For The Salaried

Tax Exemptions For Salaried Employees - 1 House Rent Allowance HRA The employer s provision for covering the accommodation expenses of the employee known as HRA can be either partially or fully exempt from