Tax Free Childcare If you re a parent registered for Tax Free Childcare or free childcare if you re working sign in to pay into your account reconfirm your eligibility update your details

Get Tax Free Childcare step by step Check if you re eligible for Tax Free Childcare how to apply and how to pay your childcare provider Show all steps All about Government help with childcare costs including 15 to 30 hours free childcare Tax Free Childcare tax credits Universal Credit vouchers and support while you study

Tax Free Childcare

Tax Free Childcare

http://www.qualitychildcare.ltd.uk/wp-content/uploads/funding2.jpg

NICMA News

https://nicma.org/CMSPages/GetFile.aspx?guid=0086776c-de1e-4135-81a5-b96a29375ace

Parents Encouraged To Take Advantage Of Tax Free Childcare Scheme DSR

https://tax-refunds.co.uk/wp-content/uploads/2019/02/Tax-Free-Childcare-HMRC-1024x512.jpg

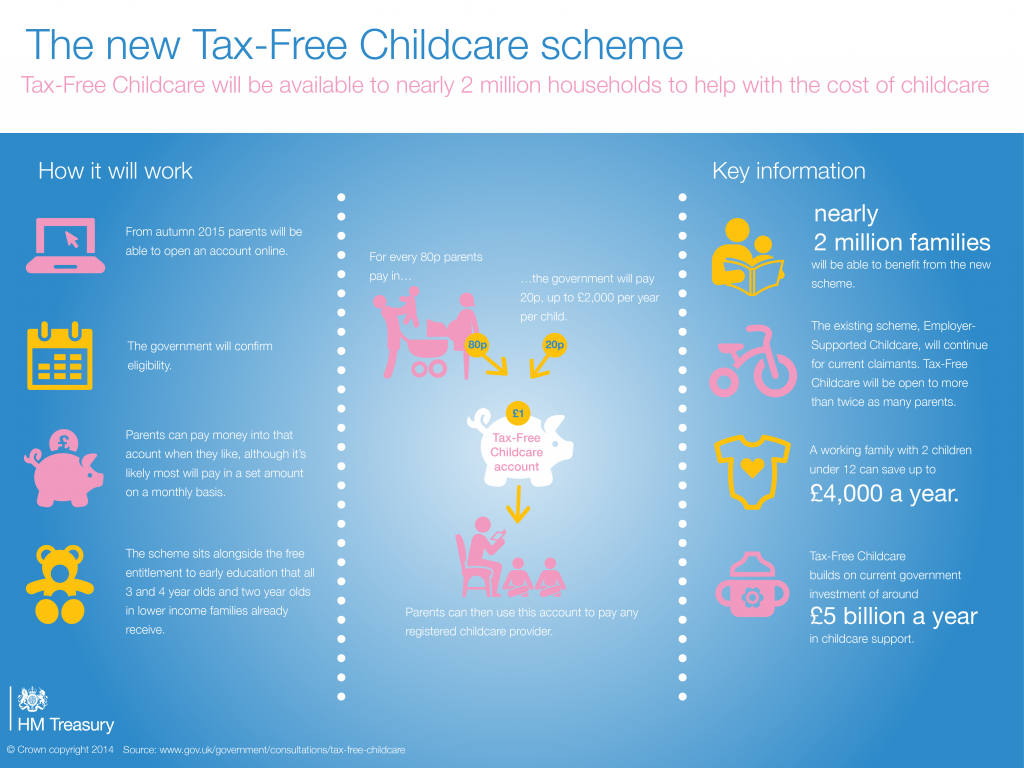

Tax Free Childcare is for working families including those self employed You can get up to 500 every 3 months up to 2 000 a year for each of your children to help with the costs of How to use Tax Free Childcare For every 8 you pay in the government will automatically add 2 up to the value of 2 000 per child per year or 4 000 for disabled children Check you re

13 May Parents of children from nine months old can now apply for 15 hours of free childcare The government hopes the scheme will get more parents back to work but Tax free childcare is a government scheme that pays working parents a 25 top up based on what they pay for childcare You can get up to a maximum of 2 000 a year which is given when parents pay out at least 10 000 The scheme was launched in April 2017 and is the main option for parents who are in work Am I eligible

Download Tax Free Childcare

More picture related to Tax Free Childcare

New Tax free Childcare Scheme Will Start Early 2017

http://www.earlyyearscareers.com/eyc/wp-content/uploads/2016/03/13237890915_ae1eb21696_o-e1458214310425.png

Tax Free Childcare For The Self Employed Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2023/01/Tax-Free-Childcare.png

Tax Free Childcare Accountants Etc

https://accountantsetc.com/wp-content/uploads/2019/01/tax-free-childcare.png

Tax Free Childcare is a government scheme that helps with childcare costs up to a maximum of 2 000 for each eligible child each year 4 000 if your child is disabled Tax Free Childcare is a UK wide scheme covering England Scotland Wales and Northern Ireland The scheme is open to all parents of children under 12 or under 17 if disabled Apply for Tax Free Childcare Use this service to apply for a childcare account You can use your account to pay your childcare provider This service is also available in Welsh Cymraeg

[desc-10] [desc-11]

Tax Free Childcare Opens To All Parents With Children Under 12

https://payrollhub.co.uk/wp-content/uploads/2017/11/DFQB_PKV0AAIm1o.jpg

Tax free Childcare Informanagement UK

https://www.informanagement.co.uk/wp-content/uploads/2018/02/35406932_l-e1589198855965.jpg

https://www.gov.uk/sign-in-childcare-account

If you re a parent registered for Tax Free Childcare or free childcare if you re working sign in to pay into your account reconfirm your eligibility update your details

https://www.gov.uk/get-tax-free-childcare

Get Tax Free Childcare step by step Check if you re eligible for Tax Free Childcare how to apply and how to pay your childcare provider Show all steps

Gareth Hughes Co Chartered Accountants Llandudno Junction Conwy

Tax Free Childcare Opens To All Parents With Children Under 12

Tax Free Childcare Scheme Aidhan Financial

Tax Free Childcare At Playbox Playbox Day Nursery Pre School

Tax free Childcare Login How Do I Sign In And How Much Can I Claim

Tax Free Childcare Hive Business Chartered Accountants

Tax Free Childcare Hive Business Chartered Accountants

New tax free Childcare Scheme

What Is Tax Free Childcare MHA Carpenter Box Financial Advisers

Tax Free Childcare And Free Childcare

Tax Free Childcare - Tax free childcare is a government scheme that pays working parents a 25 top up based on what they pay for childcare You can get up to a maximum of 2 000 a year which is given when parents pay out at least 10 000 The scheme was launched in April 2017 and is the main option for parents who are in work Am I eligible