Tax Free Fd Limit Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax deduction by investing in a tax saving

ELIGIBILITY FEES CHARGES Minimum Amount Rs 100 in Multiples of Rs 100 Maximum amount Rs 1 5 Lakhs in a FY Tenure 5 Years Lock In Can be booked Like other fixed deposits senior citizens enjoy 0 25 to 0 5 higher returns on their tax saving fixed deposit investments than regular customers Tax saver FD

Tax Free Fd Limit

Tax Free Fd Limit

http://blog.freetaxfiler.com/wp-content/uploads/2022/06/logo-dark.png

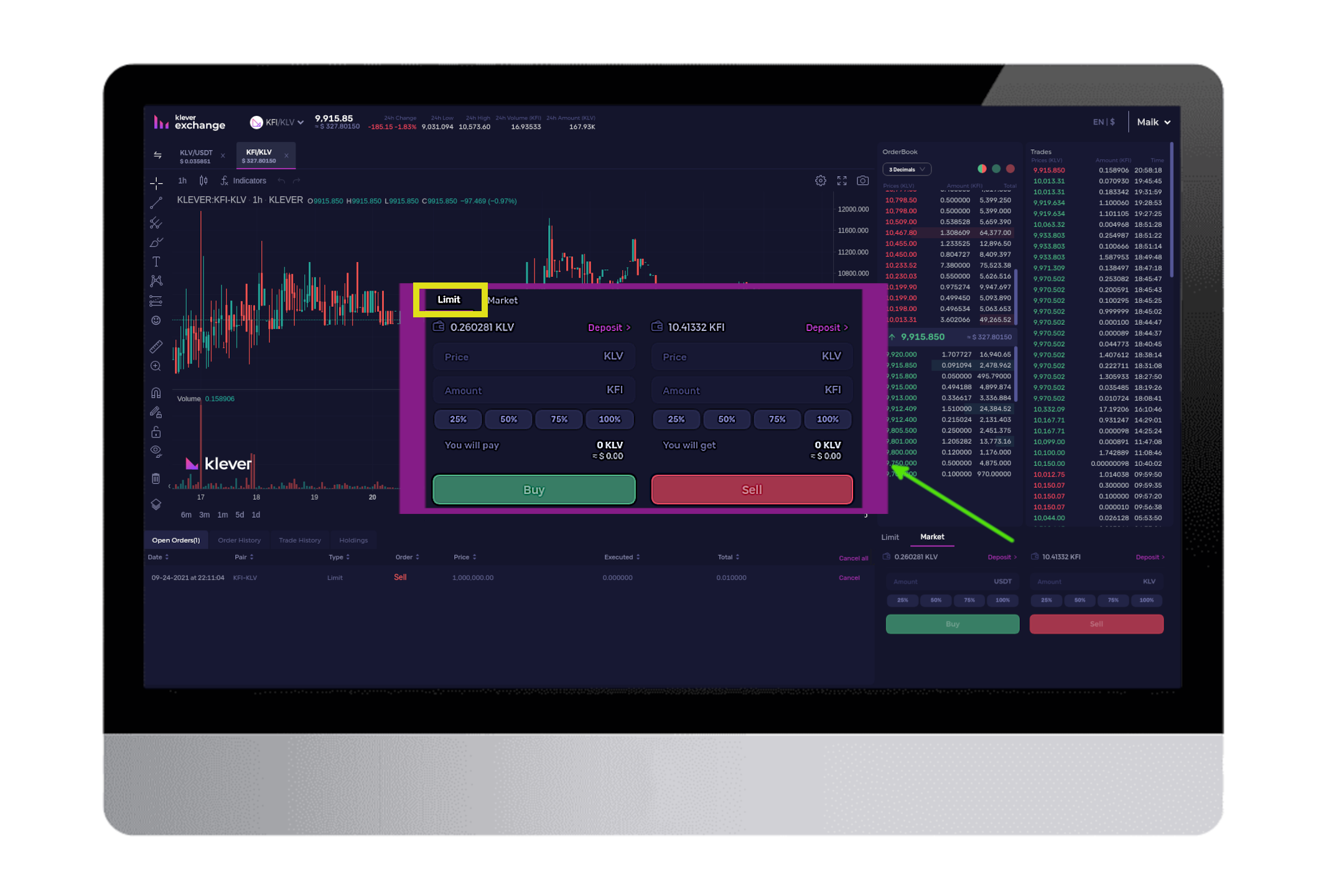

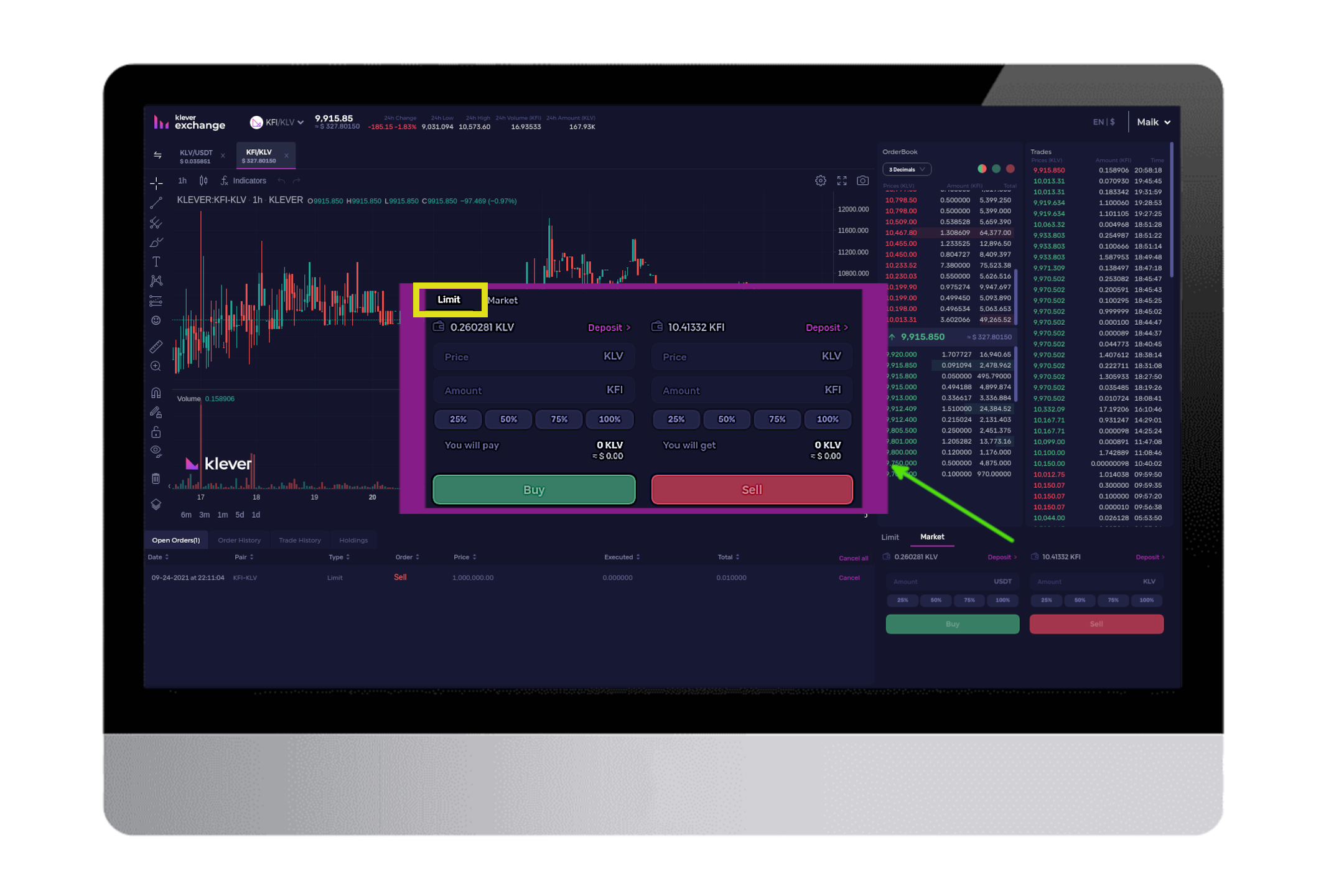

Apa Itu Limit Order Dukungan Klever

https://klever.zendesk.com/hc/article_attachments/4409380658068/Limit_Orders.png

Prepare And File Form 2290 E File Tax 2290

https://www.roadtax2290.com/images/3-3d.png

This limit has been increased from the FY 2018 19 limit of Rs 10 000 In case of FDs banks deduct tax at source at the rate of 10 if the interest income for the year is more than Rs 40 000 Kindly note that How much tax can I save with a tax saving FD The amount of tax you can save will depend on the tax bracket you are in and the sum you invest in the FD If you are in the highest

Apply Now 6 55 INTEREST ON FD Tax Saving Fixed Deposit Deductions under 80C Section 80C of the Income Tax Act provides tax payers the facility to lower The maximum deposit one can do in a financial year is Rs 1 50 000 The tenure lock in is 5 to 10 years Nomination facility is available Points to remember while investing in Tax

Download Tax Free Fd Limit

More picture related to Tax Free Fd Limit

No Limit Transportation

https://trailerdocket.com/assets/logo-f8e2645768094c1e234621b65862a6990c925f23bfb8153199ab1ecfcee6dd47.png

Materi Soal Dan Pembahasan Lengkap Limit Matematika Mobile Legends Riset

https://i1.wp.com/mathcyber1997.com/wp-content/uploads/2018/09/LIMIT2.png

https://c.pxhere.com/images/38/2b/139c5771ccf68374d3fc7581ece3-1444833.jpg!d

The amount invested in a Tax Saver FD is eligible for tax exemption under Section 80C The maximum investment limit is Rs 1 50 000 per year In case of Joint Account holders the How much of FD is tax free Who should invest in a tax saving FD Banking Mantra View All Articles Open 5 year Tax Saving FD at Bank of Baroda save tax with high interest

A tax saving FD lets you avail of income tax exemption under Section 80C of the IT Act 1961 The Fixed Deposit income tax exemption can be claimed on investment of up to Tax Saver Fixed Deposit Get attractive Fixed Deposit Interest Rate on your lump sum investment as well as the benefit of tax saving with Axis Bank s Tax Saver Fixed Deposit

Tax Reduction Company Inc

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100064489757770

NFocus Tax Service LLC Clearwater FL

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100066776658734

https://www.paisabazaar.com/fixed-deposit/tax...

Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax deduction by investing in a tax saving

https://www.hdfcbank.com/personal/save/deposits/...

ELIGIBILITY FEES CHARGES Minimum Amount Rs 100 in Multiples of Rs 100 Maximum amount Rs 1 5 Lakhs in a FY Tenure 5 Years Lock In Can be booked

Simplicontent

Tax Reduction Company Inc

Tax Policy And The Family Cornerstone

Zero Tax

New York Lenders Brace For Potential Mezzanine Preferred Equity Clip

1080x1812px Free Download Taxes Keyboard Showing Tax Taxation

1080x1812px Free Download Taxes Keyboard Showing Tax Taxation

Tax Return Legal Image

Tax Settings Bahawalpur

How Long You Should Live In Your Home Before You Sell It

Tax Free Fd Limit - You can get tax deductions of up to 1 50 000 under Section 80C of the Income Tax Act of 1961 for your investment in a fixed deposit However to qualify for Section 80c