Sars Rebates 2024 EMPLOYEES TAX 2024 TAX YEAR PAYE GEN 01 G18 QUICK REFERENCE CARD In his Budget Speech on 22 February 2023 the Minister of Finance announced new tax rates tax rebates tax thresholds and other tax amendments for individuals Details of these proposals are listed below and employers must update their payroll systems accordingly

For the 2024 tax year i e the tax year commencing on 1 March 2023 and ending on 29 February 2024 the following rebates apply Primary rebate ZAR 17 235 for all natural persons Secondary rebate ZAR 9 444 if the taxpayer is 65 years of age or over Tertiary rebate ZAR 3 145 if the taxpayer is 75 years of age or over Contacts News Print With effect from 26 January 2024 up to and including 25 January 2026 26 January 2024 New GG R Amendment to Part 2 of Schedule No 4 by the creation of temporary rebate provisions under item 460 03 for the importation of meat and edible offal of the species Gallus Domesticus classifiable under tariff subheading 0207 1 ITAC Report No 726

Sars Rebates 2024

Sars Rebates 2024

https://3474263.fs1.hubspotusercontent-na1.net/hub/3474263/hubfs/SARS Diesel Rebates.png?quality=low&width=1125&name=SARS Diesel Rebates.png

SARS Will Use Info From Solar Installers To Make Sure You Qualify For Tax Rebates YouTube

https://i.ytimg.com/vi/LGNojQNetdw/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgVChLMA8=&rs=AOn4CLC3lcHh_1vcoREHeOFRIukTONeQfA

CONNECT Webinar Learnership Incentives And SARS Tax Rebates YouTube

https://i.ytimg.com/vi/GQj9meumrY4/maxresdefault.jpg

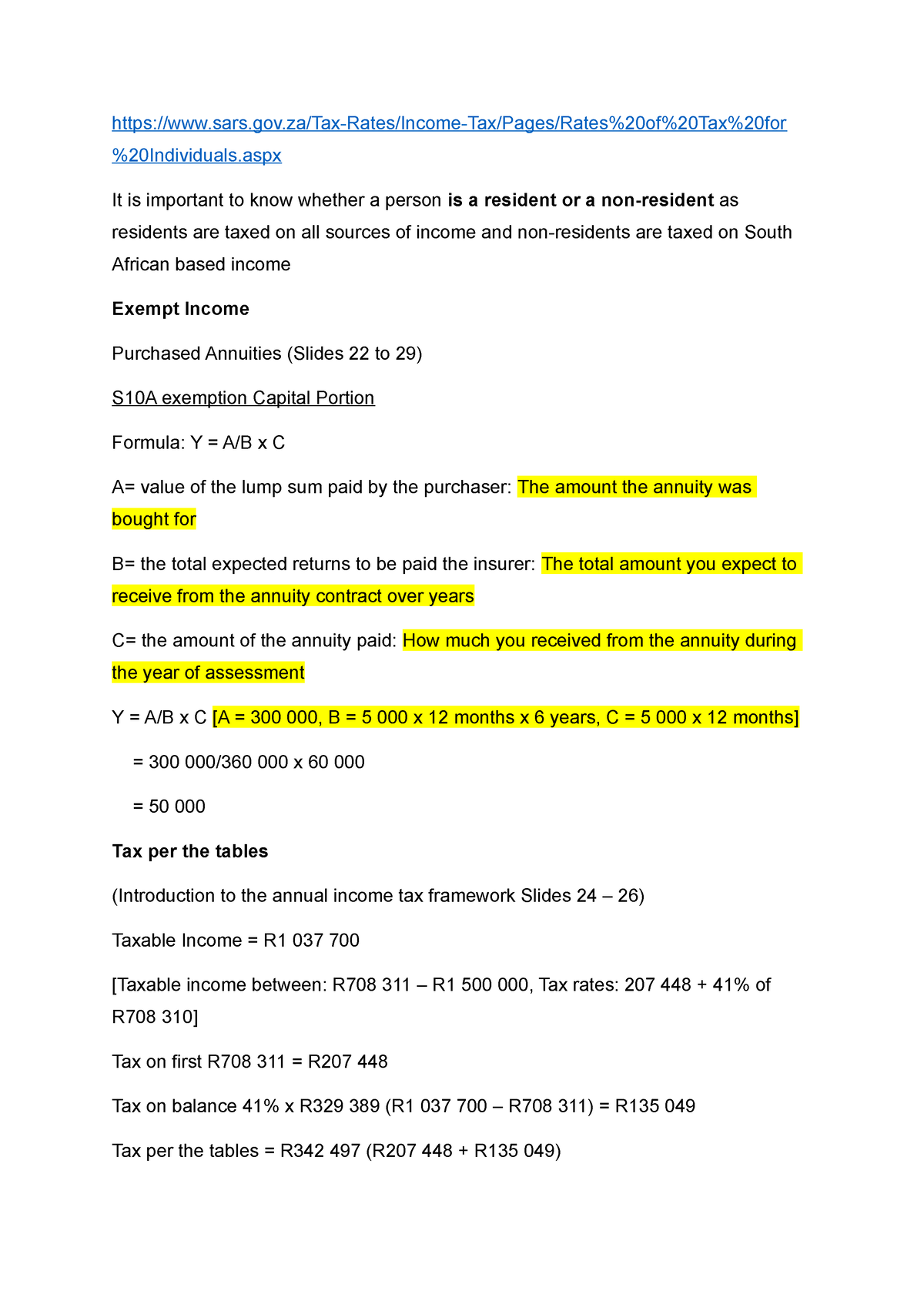

HEALTH PROMOTION LEVY The increase of the health promotion levy on beverages to 2 3 cents per gram of sugar is delayed until 1 April 2025 TAX REVENUE 2023 2024 Personal Income Tax R640 3 bn VAT R471 5 bn Corporate Income Tax R336 1 bn Customs Excise Duties R137 9 bn Fuel Levies R90 4 bn Other R111 3 bn GENERAL COMMENTARY Date 2024 01 26 In terms of section 75 of the Customs and Excise Act 1964 By the deletion of the following Rebate Item Tariff Heading Rebate Code CD Description Extent of Rebate 311 18 63 09 01 04 41 Worn clothing and other worn articles of textile materials containing 35 per cent or more by mass of cotton fibres excluding

Rebate Item Tariff Heading Rebate Code CD Description Extent of Rebate 460 15 7211 29 01 06 67 Flat rolled products of iron or non alloy steel of a width of less than 600 mm not clad plated or coated not further worked than cold rolled cold reduced other with a thickness of 0 3 mm or more but not exceeding a thickness of 1 6 mm with a 01 March 2023 29 February 2024 Income Tax Tables Car Allowance Fixed Cost Income tax tables with rebates and car allowance fix cost tables for the 2024 tax year as provided by SARS

Download Sars Rebates 2024

More picture related to Sars Rebates 2024

National Budget Speech 2022 SimplePay Blog

https://www.simplepay.co.za/blog/assets/images/tax-rate-tables.png

Maths Literacy 2020 SARS Tax Rates Medical Aid Credits And Rebates YouTube

https://i.ytimg.com/vi/-xp1jKhllDc/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGBMgQSh_MA8=&rs=AOn4CLDazQro7wvygopQpGHO-I7ttKTFQA

CAT Rebates W L Inc

https://wl-parts.com/wp-content/uploads/2021/10/Cat-Rebates-WL-Flyer.png

Rebate Code CD Description Extent of Rebate 460 16 8536 90 90 01 08 88 Electrical apparatus for making connections to or in electrical circuits for a voltage not exceeding 1000 V other for use in international submarine optic fibre cable infrastructure at such times in such quantities and subject to such conditions as the Rebate Item Tariff Heading Rebate Code CD Description Extent of Rebate 460 15 7208 26 02 06 67 Flat rolled products of iron or non alloy steel of a width of 600 mm or more in coils not further worked than hot rolled pickled of a thickness of 3 mm or more but less than 4 75 mm in such quantities at such times and subject to such

In 2024 Gov Josh Shapiro said that older residents would receive more financial help courtesy of his signed Act 7 of 2023 The law expanded the Property Tax Rent Rebate to provide a larger A Quick Overview of SARS Tax Tables 2024 2022 The most common rebate applied by SARS is according to age There are 3 different levels Primary rebate under 65 years Secondary rebate between 65 and 75 years Tertiary rebate 75 years and above Tables for tax rebates

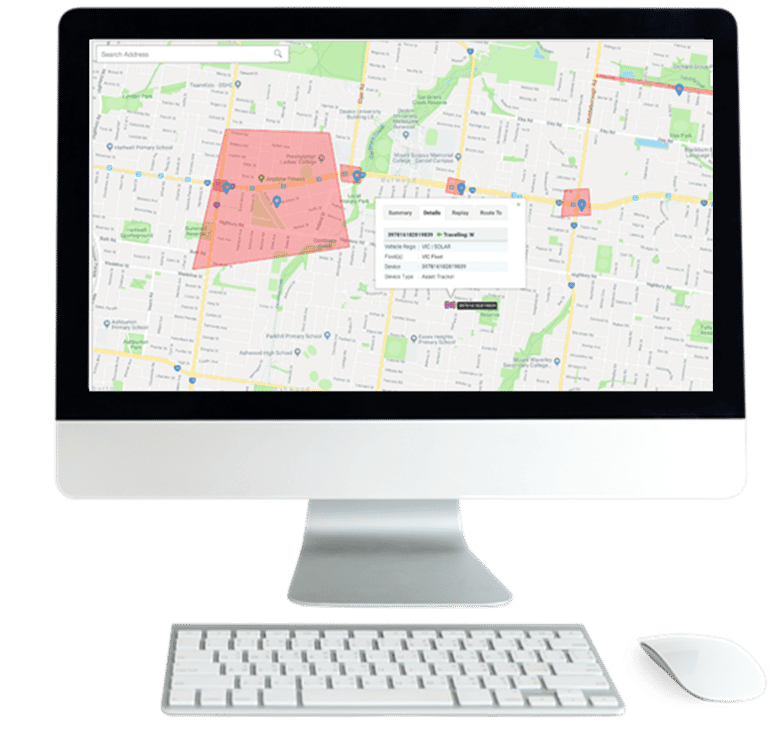

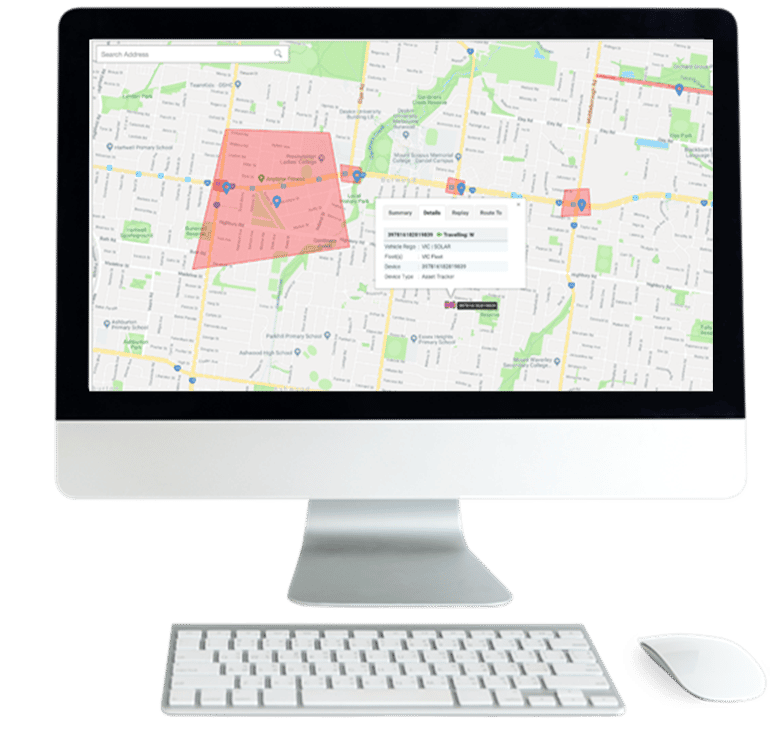

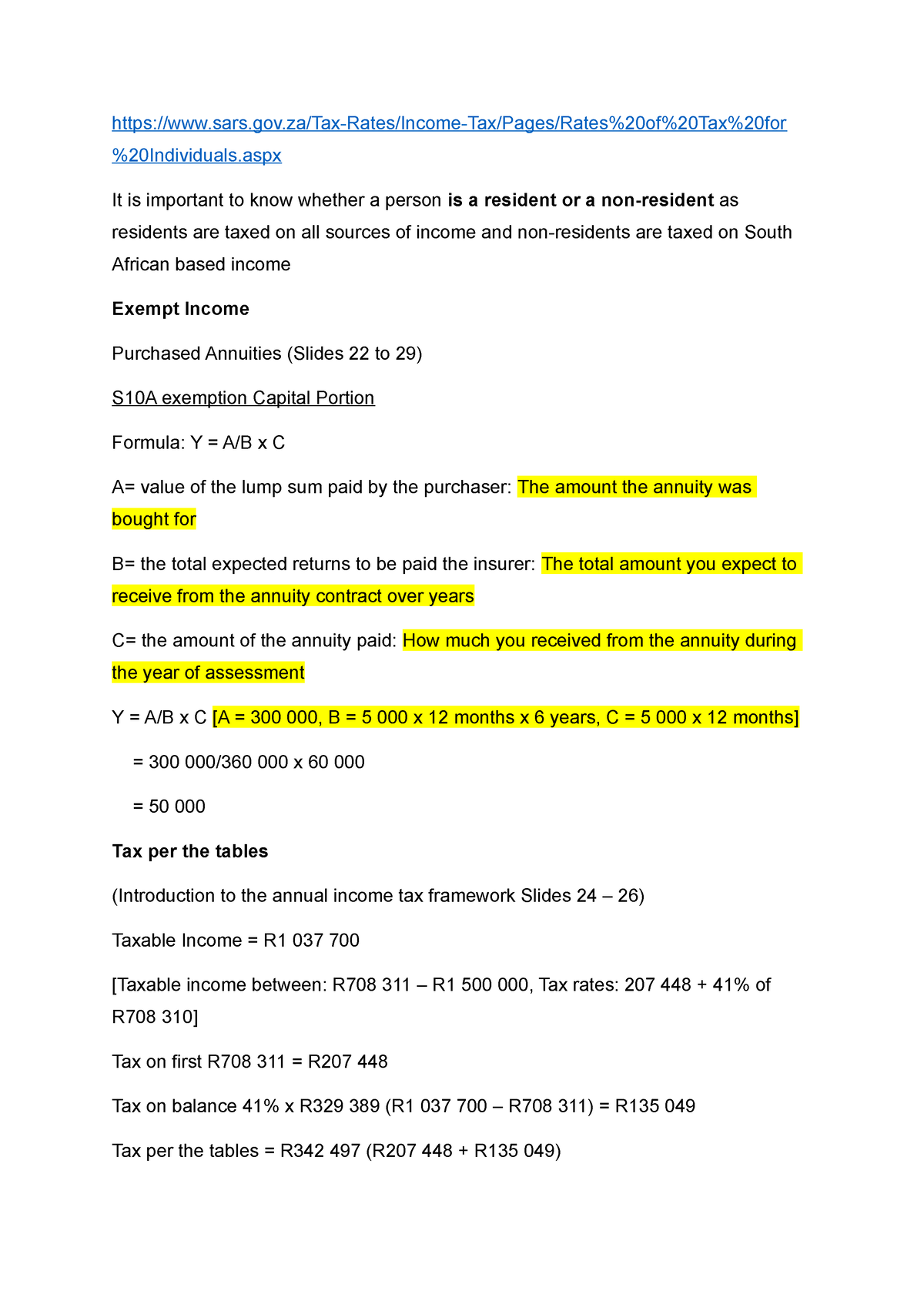

Exempt Income And Rebates Sars gov Tax Rates Income Tax Pages Rates 20of 20Tax 20for Studocu

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/d0eaa0d2da14dc0d0d8ac2ad6427f127/thumb_1200_1698.png

Rebates For Seniors Mark Coure MP

https://markcoure.com.au/images/news/seniors-rebates-photo.png

https://www.sars.gov.za/wp-content/uploads/Ops/Guides/PAYE-GEN-01-G18-Guide-for-Employers-iro-Employees-Tax-for-2024-External-Guide.pdf

EMPLOYEES TAX 2024 TAX YEAR PAYE GEN 01 G18 QUICK REFERENCE CARD In his Budget Speech on 22 February 2023 the Minister of Finance announced new tax rates tax rebates tax thresholds and other tax amendments for individuals Details of these proposals are listed below and employers must update their payroll systems accordingly

https://taxsummaries.pwc.com/south-africa/individual/other-tax-credits-and-incentives

For the 2024 tax year i e the tax year commencing on 1 March 2023 and ending on 29 February 2024 the following rebates apply Primary rebate ZAR 17 235 for all natural persons Secondary rebate ZAR 9 444 if the taxpayer is 65 years of age or over Tertiary rebate ZAR 3 145 if the taxpayer is 75 years of age or over Contacts News Print

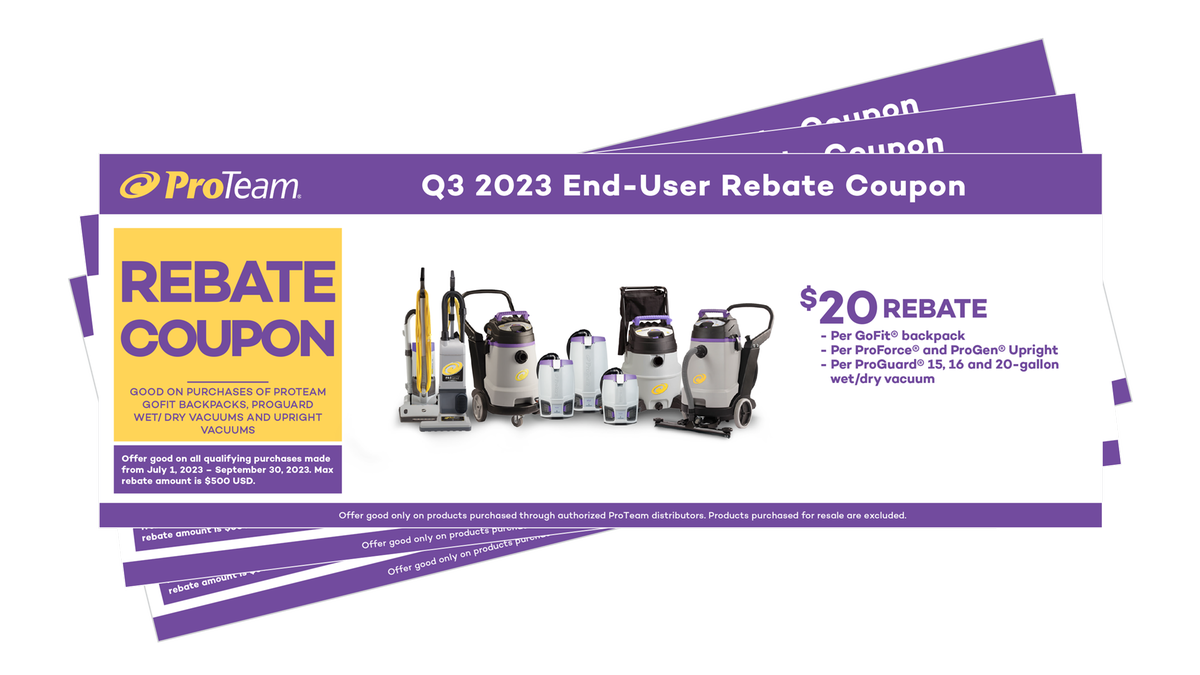

Manufacturer Rebates CleanFreak

Exempt Income And Rebates Sars gov Tax Rates Income Tax Pages Rates 20of 20Tax 20for Studocu

Smith Wesson Shield EZ Holiday Rebate H H Shooting Sports Oklahoma City

How Do Home Rebates Work DC MD VA Home Rebates

SARS Tax Season 2018 Deadline Reminder YouTube

Milwaukee Tool Rebates Printable Rebate Form

Milwaukee Tool Rebates Printable Rebate Form

Energy Rebates Don t Leave Money On The Table Schmidt Associates

Primary Rebate South Africa Printable Rebate Form

.png)

Why Are Rebates And Rebate Management Important For Manufacturers And Distributors Enable

Sars Rebates 2024 - 2016 tax year is 1 March 2015 29 February 2016 2015 tax year is 1 March 2014 28 February 2015 2014 tax year is 1 March 2013 28 February 2014 Information is recorded from current tax year to oldest e g 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 etc To see tax rates from 2014 5 see the Archive Tax Rates webpage