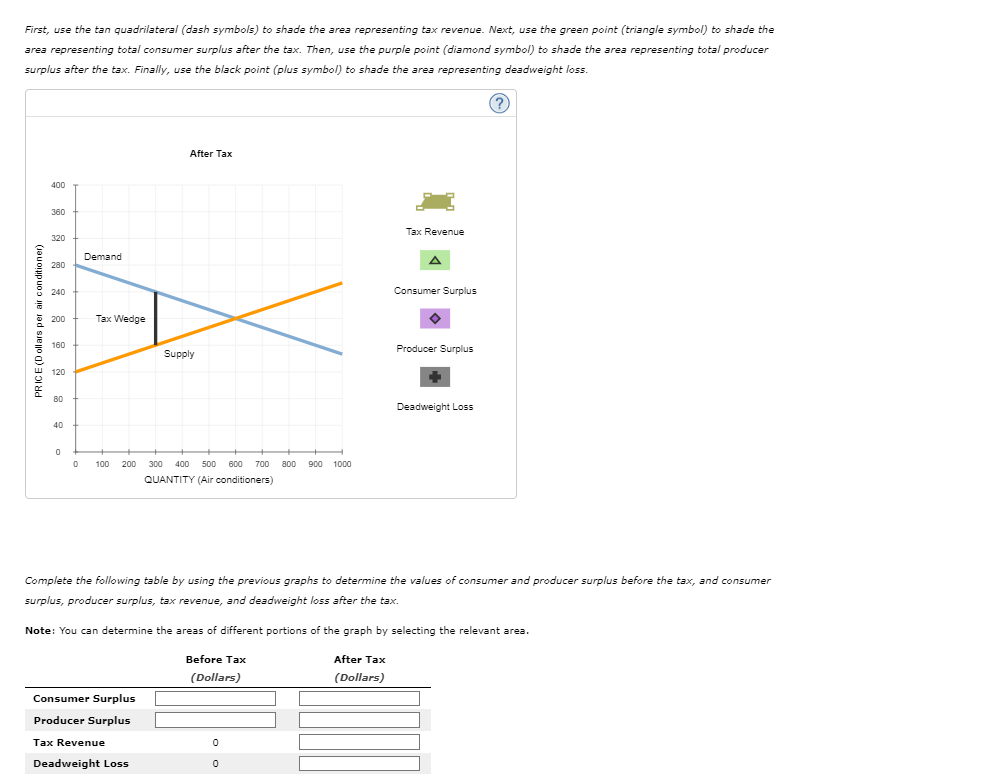

Tax Incentives For Air Conditioning Units Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 Learn about the federal government s tax credit program for high efficiency heating and cooling equipment and review regional programs for qualifying HVAC systems

Tax Incentives For Air Conditioning Units

/GettyImages-1217241370-bc9d0541a69e43a09c6fce467bf77dc9.jpg)

Tax Incentives For Air Conditioning Units

https://www.treehugger.com/thmb/Cf2MADM_Y-QLIWqMIShR6hylt1M=/3000x2000/filters:fill(auto,1)/GettyImages-1217241370-bc9d0541a69e43a09c6fce467bf77dc9.jpg

Condenser Unit Wall Kits

https://armaflo.com/wp-content/uploads/2019/08/canti-kit-1-1024x1024.png

8 Ways To Make Your Air Conditioning Unit More Efficient The Leading

https://www.acs-aircon.co.uk/wp-content/uploads/2023/04/air-conditioning-maintenance-in-Surrey.jpg

How To Qualify For and Claim HVAC Tax Rebates You can claim your residential energy tax incentive when you file your federal income taxes For federal tax returns filed between 2023 and 2032 you are eligible to claim a credit equal to 30 of the cost of your installation Government rebates for air conditioning and heating in 2024 make it easier and more affordable for homeowners to upgrade to energy efficient HVAC systems By taking advantage of these programs you can reduce your upfront costs and enjoy long term savings on your energy bills

In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

Download Tax Incentives For Air Conditioning Units

More picture related to Tax Incentives For Air Conditioning Units

Air Conditioning What Size Do I Need AAC

https://aac.uk.net/wp-content/uploads/2021/07/Air-Conditioning-What-Size-Do-I-Need.jpg

How Air Conditioning Units Work AAC

https://aac.uk.net/wp-content/uploads/2021/07/how-do-air-conditioning-units-work.jpg

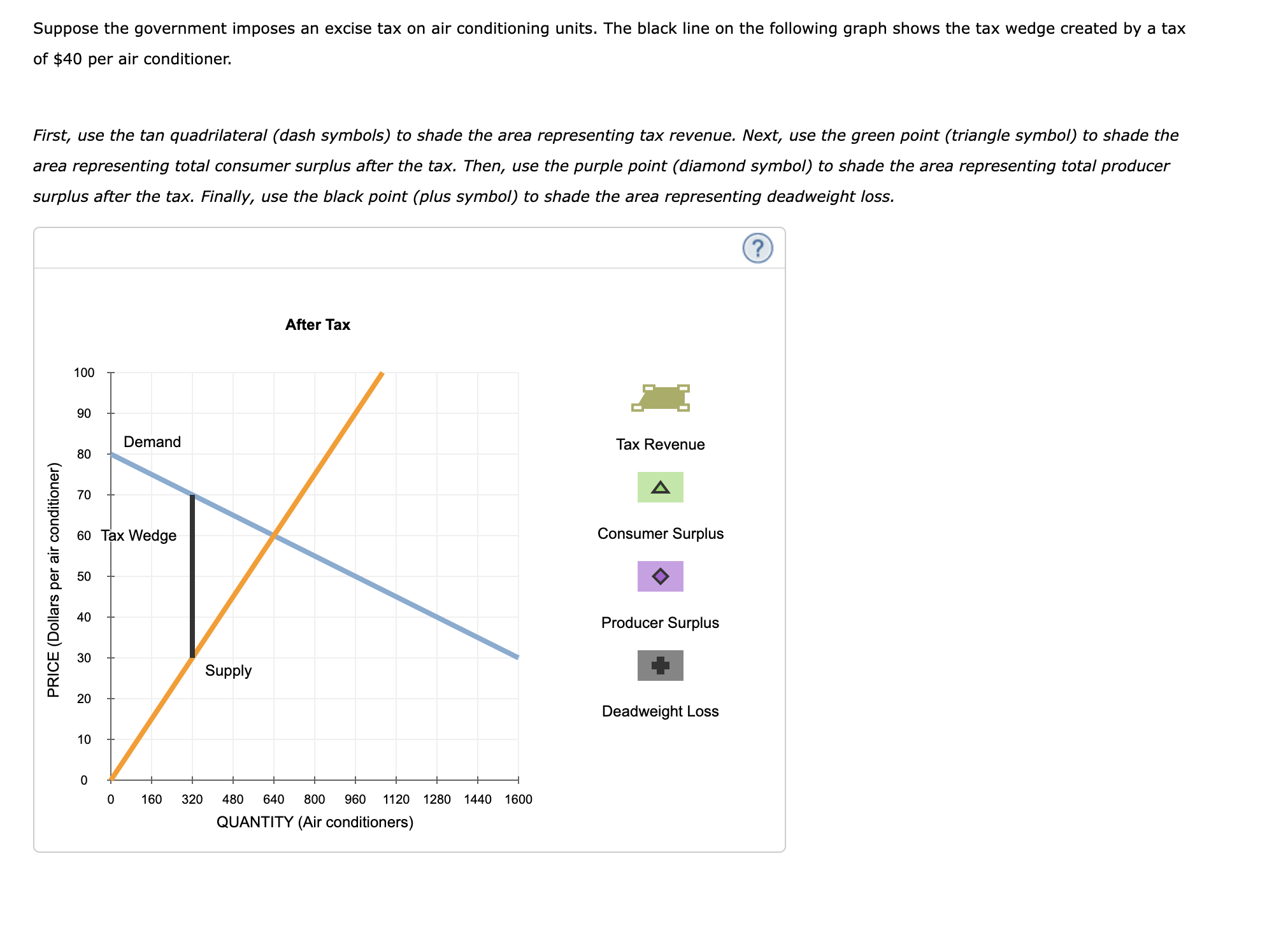

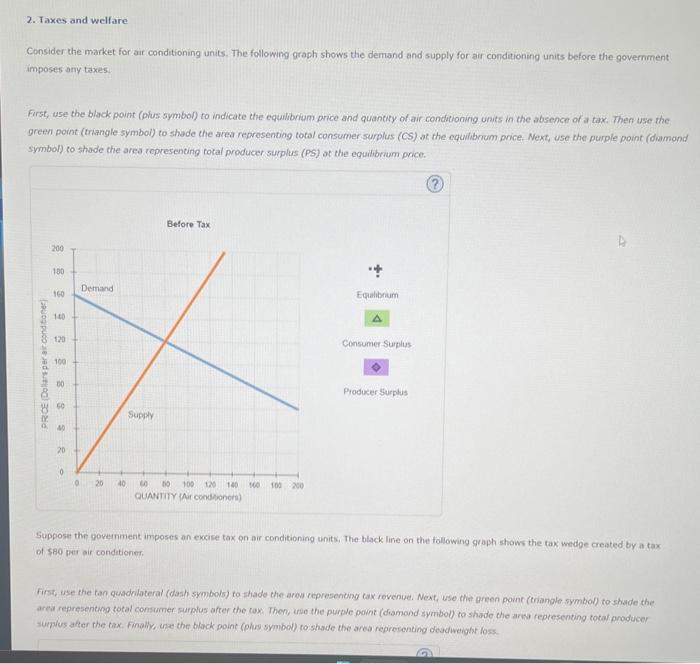

Solved Consider The Market For Air Conditioning Units The Chegg

https://media.cheggcdn.com/media/7f4/7f4e37c0-a51c-42db-90d0-5c7c7f279f19/phpdQepZg

Efficient air conditioners 30 of cost up to 600 Efficient heating equipment Efficient water heating equipment 30 of cost up to 600 Other Energy Efficiency Upgrades Electric panel or circuit upgrades for new electric equipment 30 of cost up to 600 Insulation materials Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for qualified heat pumps

A broad selection of high efficiency heating and cooling equipment is eligible for the tax credits Many of Lennox products ranging from air conditioners and heat pumps to gas furnaces and mini splits qualify for the 25C tax credit View Qualifying Equipment The rebates can help you save money on select home improvement projects that can lower your energy bills DOE estimates these rebates will save households up to 1 billion annually on energy bills and support over 50 000 U S jobs

Air Conditioning Units Manufacturer Grebo Buyfromturkey

https://buyfromturkey.co/wp-content/uploads/2022/04/Air-Conditioning-Units-Manufacturer-2.jpg

The Inner Workings Of Air Conditioning A Comprehensive Guide

https://powerhousecc.org/storage/2020/05/519-valuable-recommendations.jpeg

/GettyImages-1217241370-bc9d0541a69e43a09c6fce467bf77dc9.jpg?w=186)

https://www.energystar.gov/about/federal-tax...

Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022

Consider The Market For Air Conditioning Units The Chegg

Air Conditioning Units Manufacturer Grebo Buyfromturkey

Air Conditioning Maintenance Komoka Ontario Peter Inch Associates

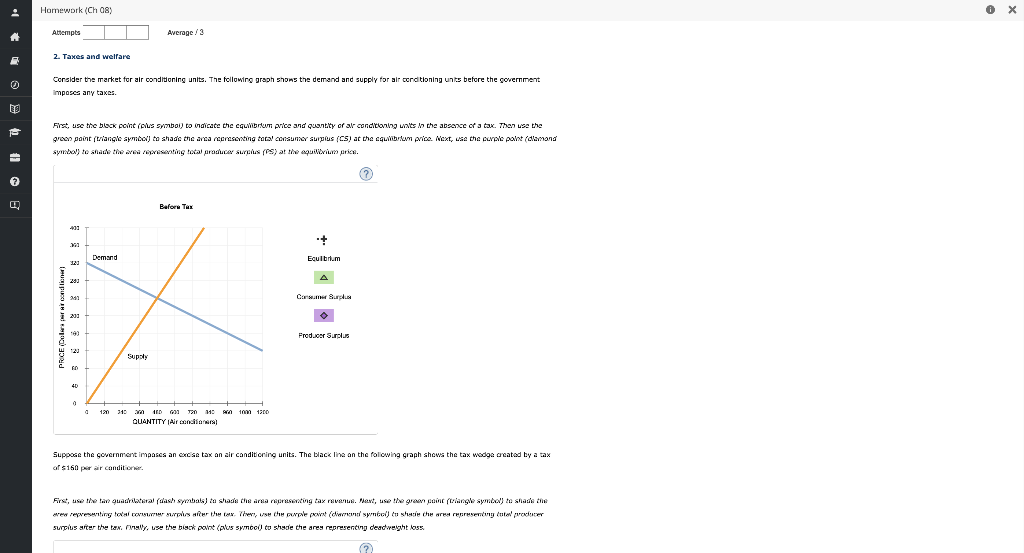

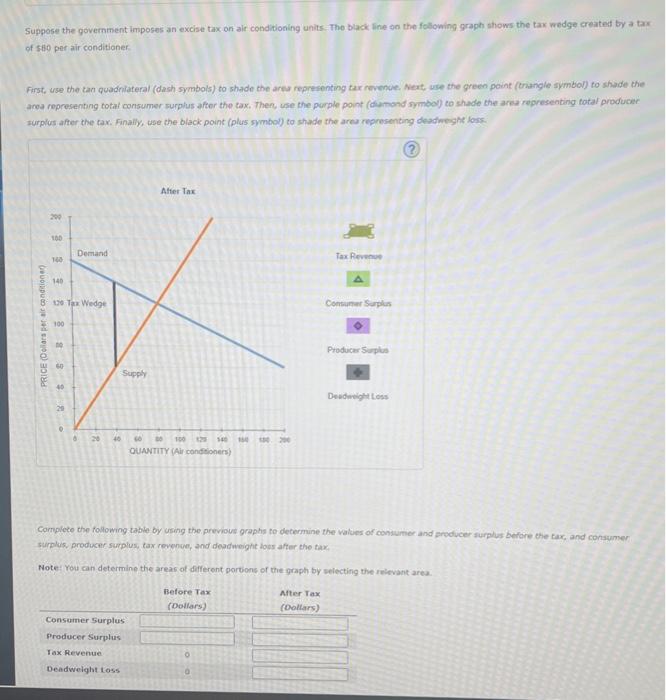

Solved 2 Taxes And Welfare Consider The Market For Air Chegg

Solved Consider The Market For Air Conditioning Units The Chegg

Air Conditioning Repair Ada MI Air Conditioning Service

Air Conditioning Repair Ada MI Air Conditioning Service

Frequently Asked Air Conditioning Service Questions Minuteman Heating

Solved 2 Taxes And Welfare Consider The Market For Air Chegg

Redcliffe s Coolest Choice Elevate Your Comfort With Air Conditioning

Tax Incentives For Air Conditioning Units - Government rebates for air conditioning and heating in 2024 make it easier and more affordable for homeowners to upgrade to energy efficient HVAC systems By taking advantage of these programs you can reduce your upfront costs and enjoy long term savings on your energy bills