Tax Incentives For Geothermal Geothermal Heat Pumps Tax Credit The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods 30 for property placed in service after December 31 2016 and before January 1 2020 26 for property placed in service after December 31 2019 and before January 1 2022 30 for property placed in service

Under the Inflation Reduction Act of 2022 IRA the federal tax credit for residential geothermal system installations was increased from 26 to 30 effective January 1 2023 The 30 tax credit runs through 2032 and then gradually reduces until expiring in 2034 For investment in renewable energy projects including fuel cell solar geothermal small wind energy storage biogas microgrid controllers and combined heat and power properties Credit Amount Generally 6 of qualified investment basis 30 if PWA requirements are met 1 4 5 6 8

Tax Incentives For Geothermal

Tax Incentives For Geothermal

https://www.freshbooks.com/wp-content/uploads/2022/04/tax-incentives-examples.jpg

FEDERAL TAX INCENTIVES For Commercial Geothermal Heat Pumps DocsLib

https://data.docslib.org/img/4471205/federal-tax-incentives-for-commercial-geothermal-heat-pumps.jpg

PowerEngineers To Lead Geothermal Part Of Bn US Army Program

https://www.thinkgeoenergy.com/wp-content/uploads/2012/04/Geothermal_Resource_US2009_NREL1.jpg

WaterFurnace geothermal systems qualify for a federal US tax credit helping you save even more heating cooling and providing hot water for your home The incentive represents 26 of systems installed throughout 2022 as a credit to your taxes dropping to 22 at the start of 2023 If you re installing geothermal all you have to do is fill out a form instructions here stating the amount you

The most common state level incentives for the development of geothermal energy were tax incentives As seen in Table 1 there are no less than 27 tax based incentives for the development of geothermal resources The tax based incentives fall under the different categories of personal corporate sales and property taxes with The law classifies geothermal heat pumps as energy property allowing building owners to claim an investment tax credit ITC for spending on the property as well as eligibility for accelerated depreciation

Download Tax Incentives For Geothermal

More picture related to Tax Incentives For Geothermal

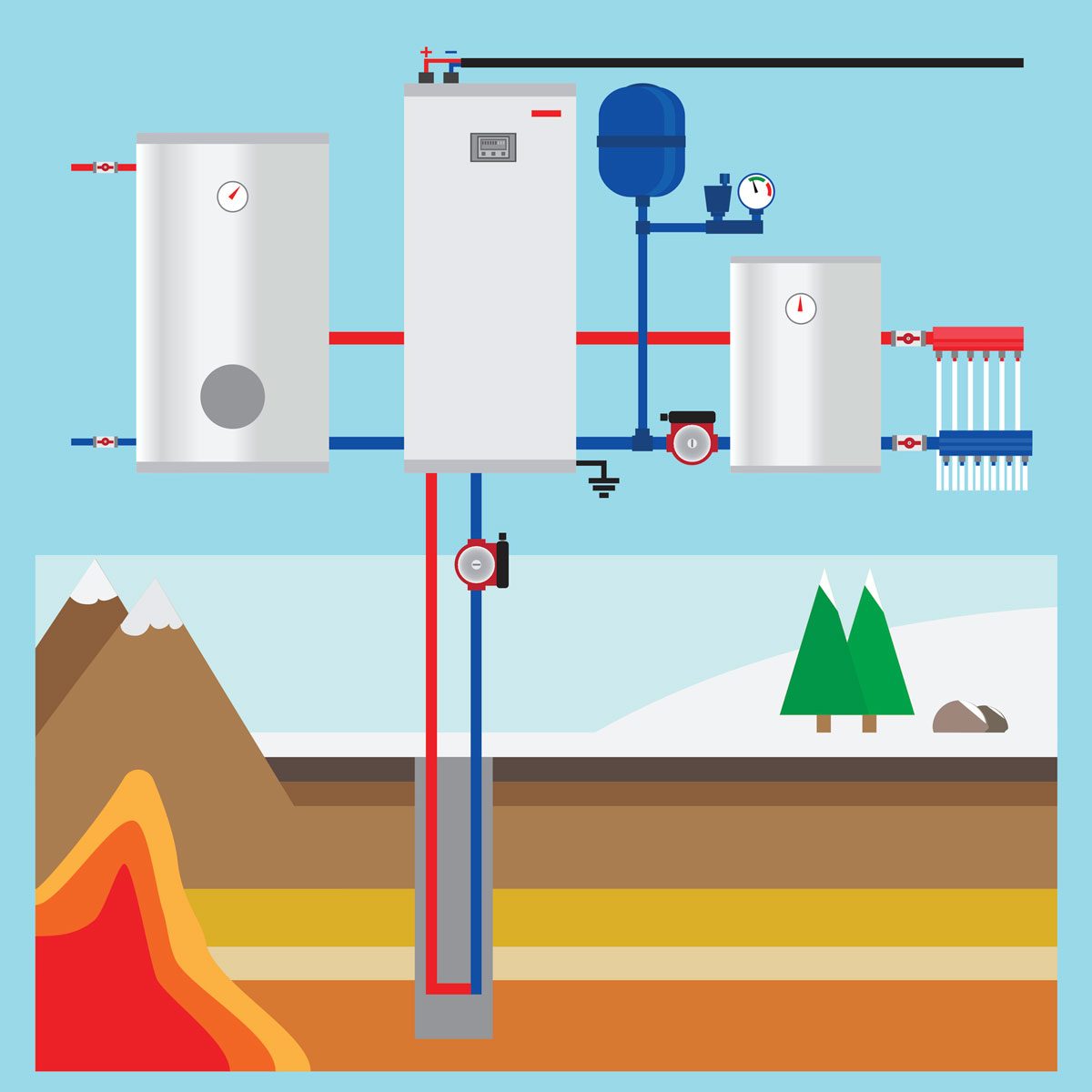

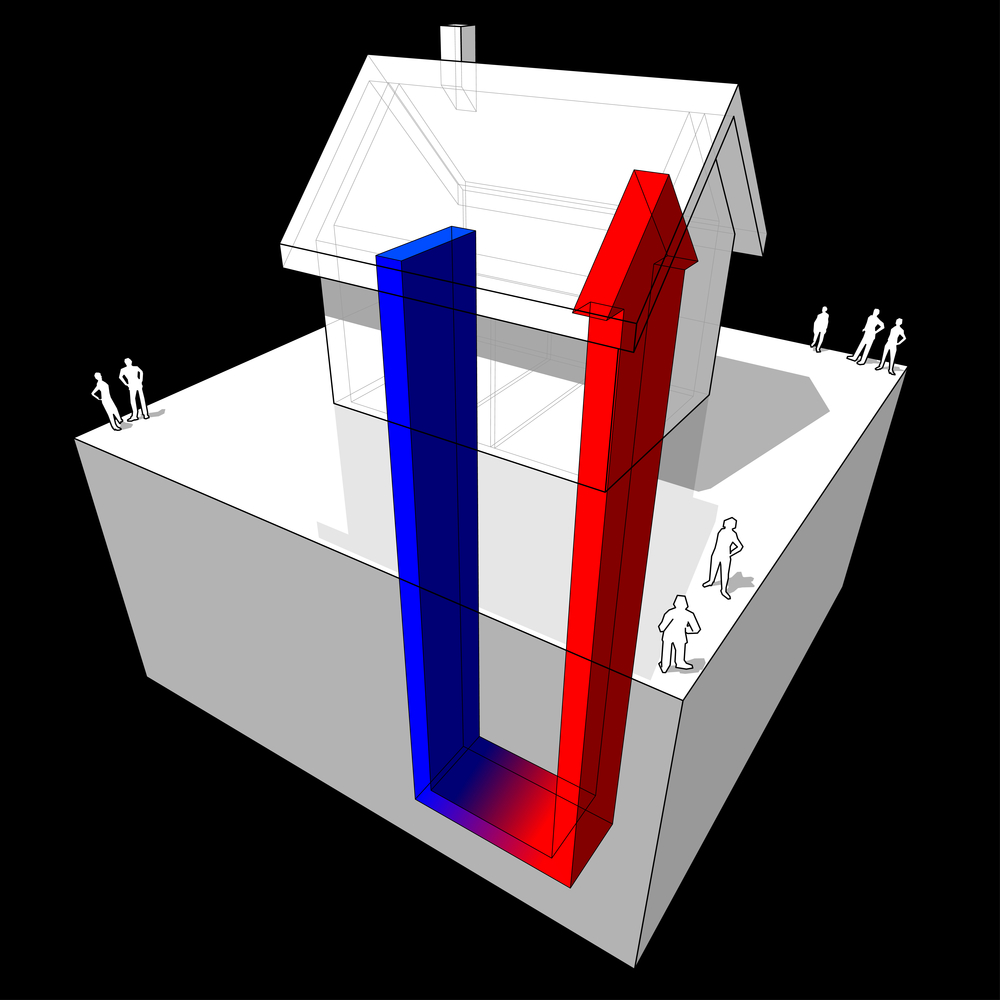

What Is Geothermal Energy And How Can I Heat Cool My House With It

https://www.climatemaster.com/images/18.7cc2eb121759c8cc7ca13148/1607529176517/what is geothermal home.jpg

Geothermal Energy Tapping Into The Earth s Heat

https://news.mit.edu/sites/default/files/images/202206/MIT-Quaise-01-press.jpg

A Guide To Geothermal Heat Pumps Family Handyman

https://www.familyhandyman.com/wp-content/uploads/2020/06/geothermal-heat-pump-GettyImages-547233216.jpg?w=1200

What is the 2021 geothermal tax credit Helping provide incentives for homeowners to make energy efficiency home improvements the federal government and some local utility companies offer tax credits as a way to offset the costs of these repairs or changes and they ve just extended their timeline The tax incentives have proven so popular that the law s final price tag is likely to be higher Geothermal heat pumps 48 840 Battery storage technology 48 180 Biomass stoves and boilers

IR 2024 202 Aug 7 2024 WASHINGTON The Department of the Treasury and the Internal Revenue Service today issued statistics on the Inflation Reduction Act clean energy tax credits for tax year 2023 The Inflation Reduction Act or IRA extended and expanded tax credits PDF that allow taxpayers to claim residential and energy efficient home To offset the high upfront cost of geothermal heat pump installation and to incentivize renewable energy integration within commercial businesses the federal government issued a tax credit for geothermal systems

Tax Incentives For Buying Geothermal Geothermal Kits PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/tax-incentives-for-buying-geothermal-geothermal-kits.jpg

Geothermal Energy Geothermal Energy

https://i.pinimg.com/originals/1b/5b/2b/1b5b2bb22e346c8cae48da09f846c165.jpg

https://www.energystar.gov/about/federal-tax...

Geothermal Heat Pumps Tax Credit The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods 30 for property placed in service after December 31 2016 and before January 1 2020 26 for property placed in service after December 31 2019 and before January 1 2022 30 for property placed in service

https://www.wipfli.com/insights/articles/cre-tax...

Under the Inflation Reduction Act of 2022 IRA the federal tax credit for residential geothermal system installations was increased from 26 to 30 effective January 1 2023 The 30 tax credit runs through 2032 and then gradually reduces until expiring in 2034

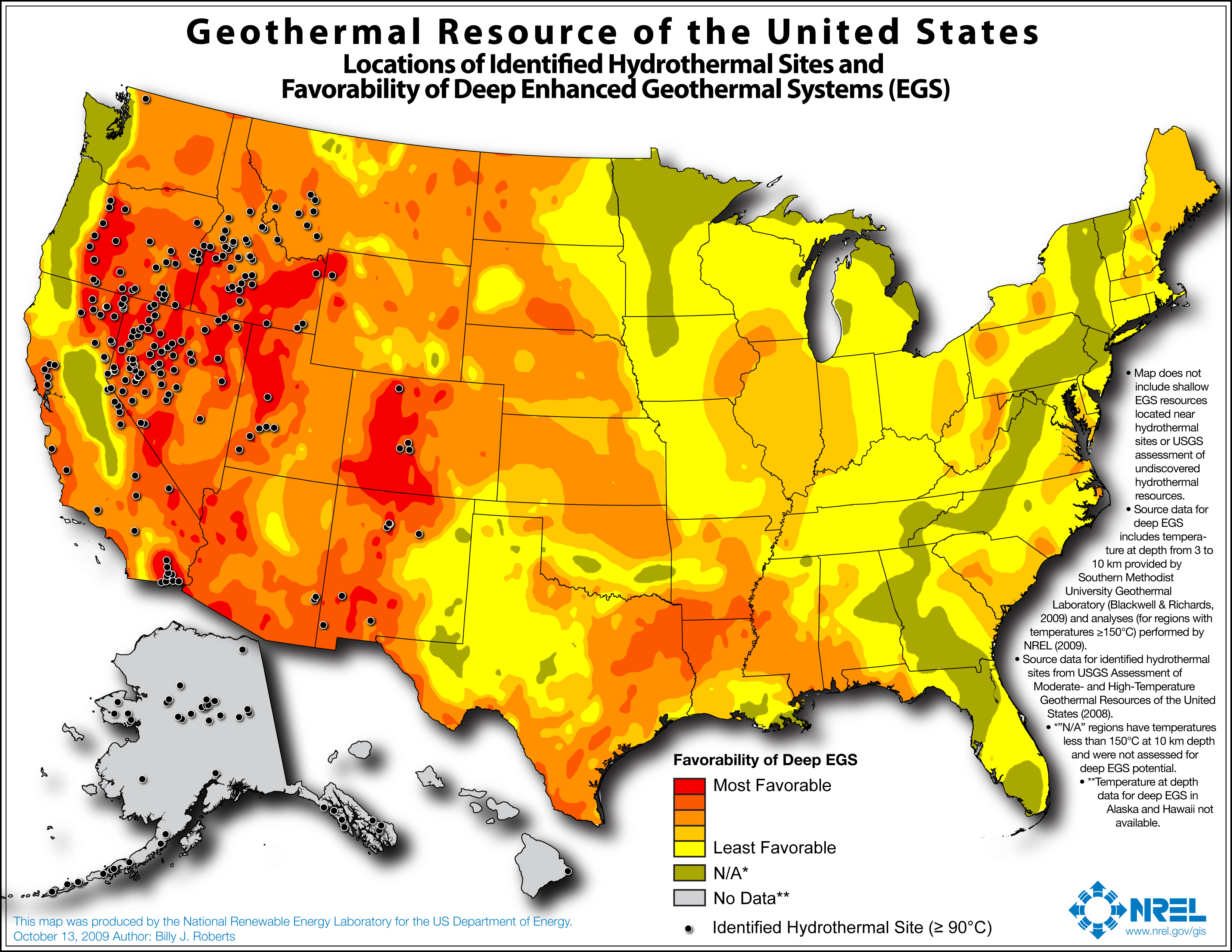

Geothermal Energy United States DOE Study Releases Untapped Potential

Tax Incentives For Buying Geothermal Geothermal Kits PumpRebate

Geothermal Tax Credits Incentives

Geothermal Tax Incentives 2022 Geothermal Heating And Cooling

3 Common Misconceptions About Geothermal Systems

Tax Credits And Other Incentives For Geothermal Systems WaterFurnace

Tax Credits And Other Incentives For Geothermal Systems WaterFurnace

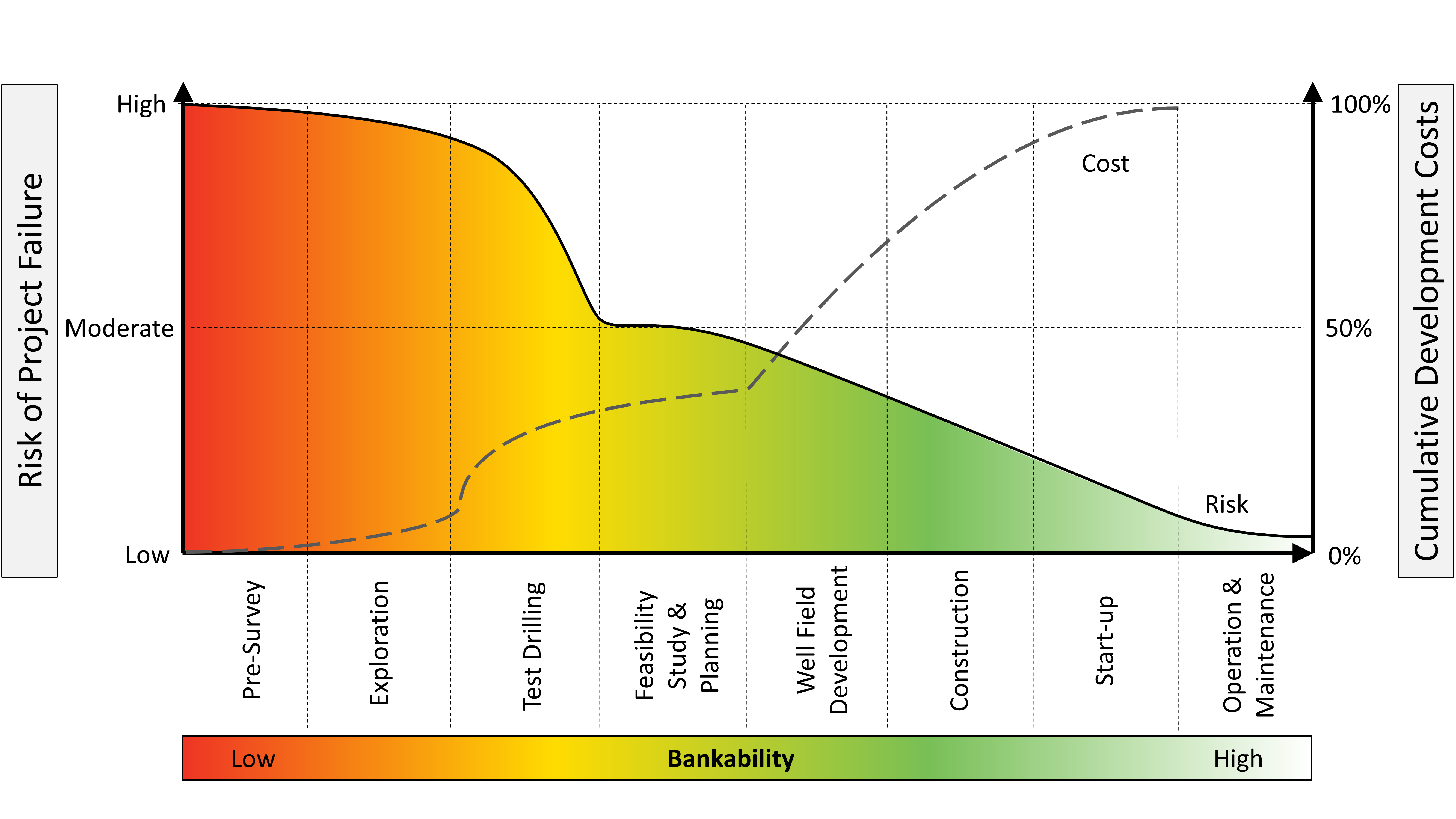

The Costs Of Geothermal Power Plant

Geothermal Heat Pumps In Scranton Wilkes Barre PA T E Spall

The Tax Incentives Assistance Project TIAP Solar And Geothermal Heat

Tax Incentives For Geothermal - WaterFurnace geothermal systems qualify for a federal US tax credit helping you save even more heating cooling and providing hot water for your home