Tax Rebate 2024 Maryland January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to

As Maryland s state energy office the Maryland Energy Administration MEA will be the applicant for two of the residential focused IRA rebate programs the HOMES Residential Energy Efficiency Rebate Program and the High Efficiency Electric Home Rebate Program For the tax year in which the transfer of the real property and associated personal property in Maryland is sold You may elect to receive a refund of excess income tax withheld prior to filing the income tax return Use Form MW506R to apply for a refund of the amount of tax withheld on the 2024 sale or transfer of Maryland real

Tax Rebate 2024 Maryland

Tax Rebate 2024 Maryland

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate.jpg

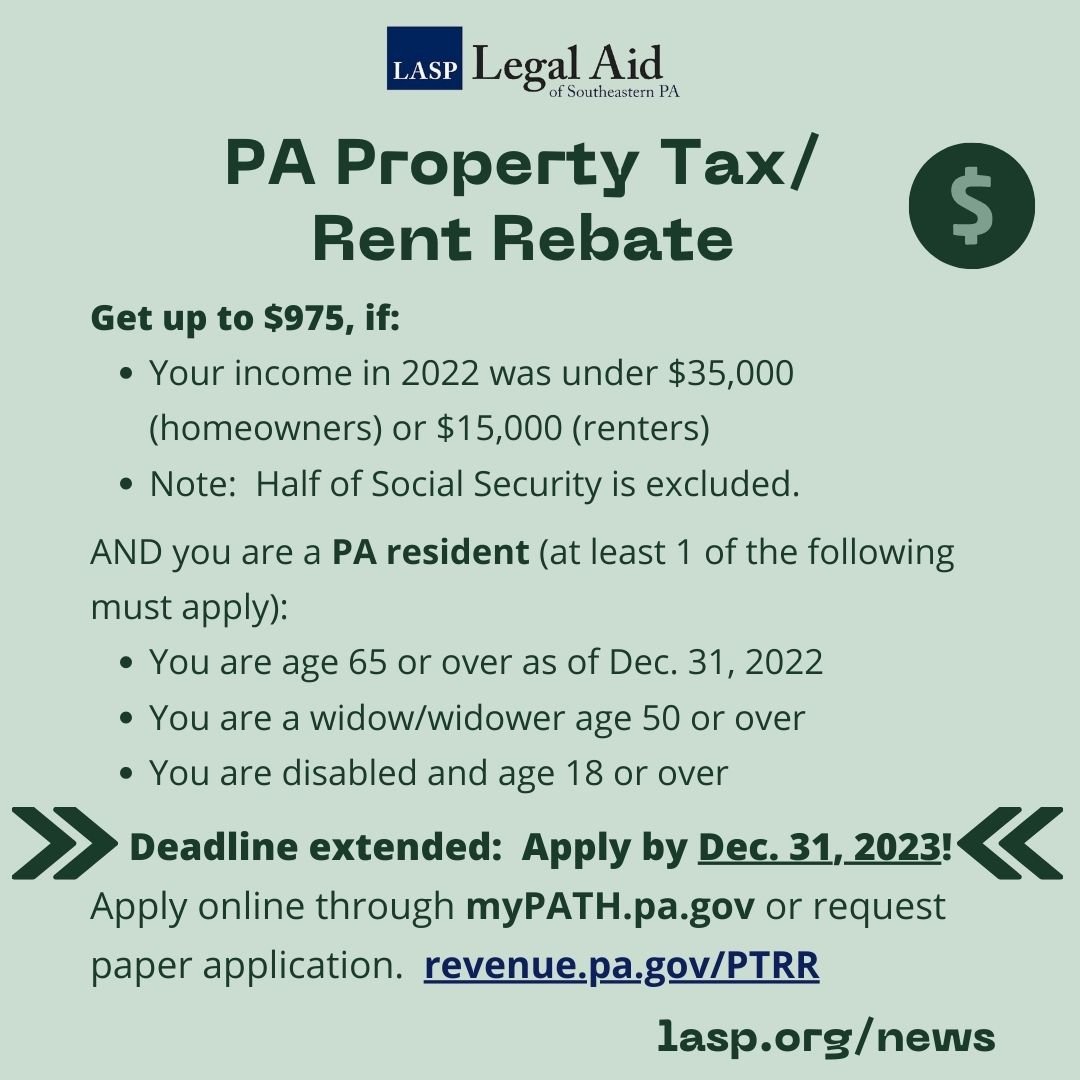

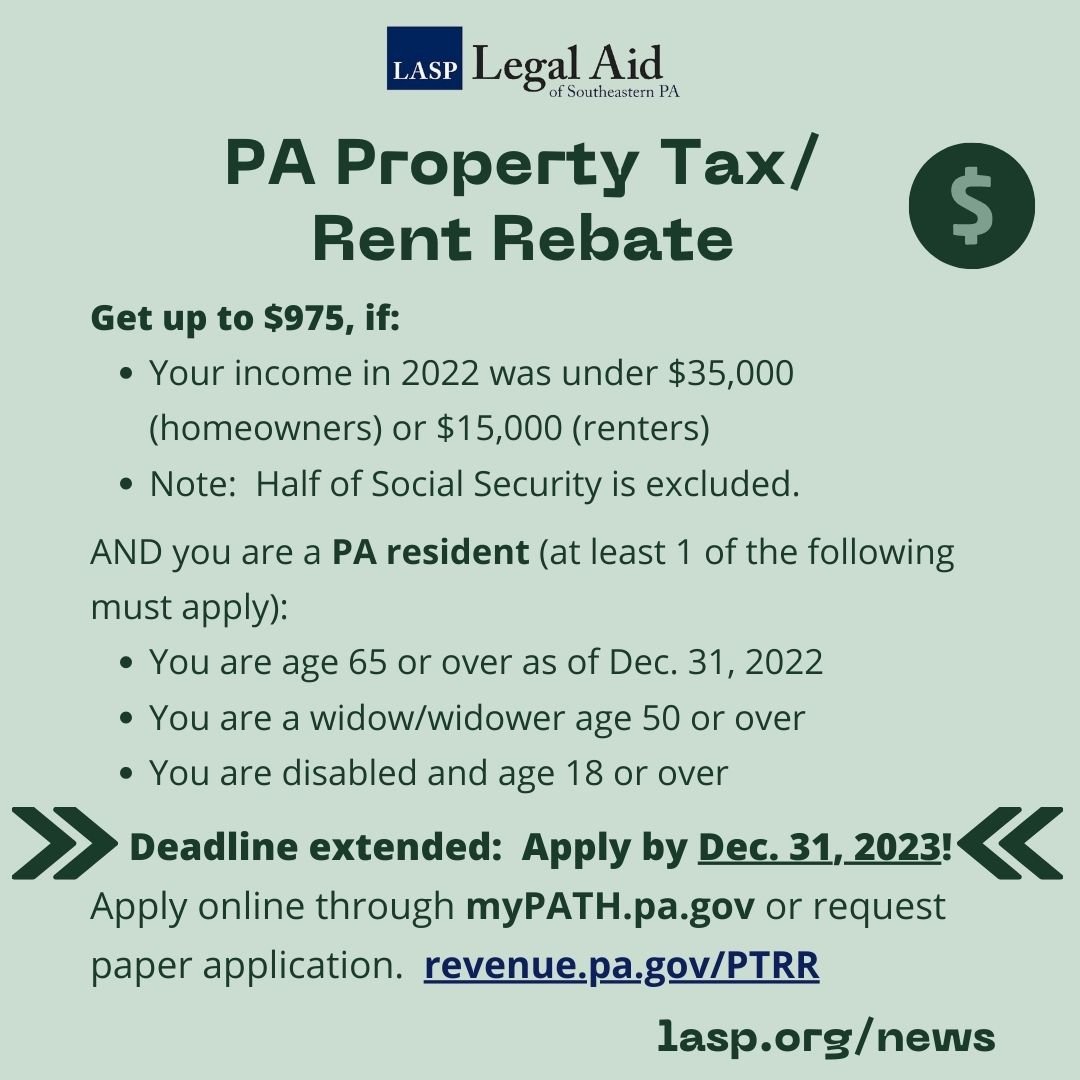

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

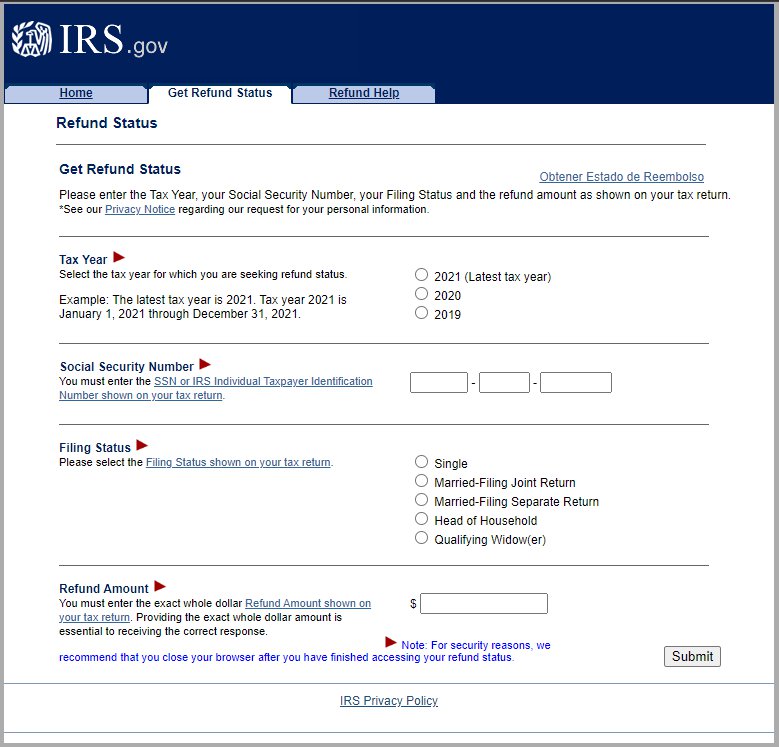

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline IR 2024 20 Jan 25 2024 WASHINGTON The Department of the Treasury and the Internal Revenue Service issued Notice 2024 23 PDF announcing special relief for taxpayers impacted by recent system issues affecting the Maryland Prepaid College Trust as described in the notice Generally federal tax law only allows one tax free rollover in a 12 month period from one qualified tuition program

Beginning on September 1 2023 eligible applicants to the Residential Clean Energy Rebate Program must use the most up to date application form for Fiscal Year 2024 FY24 provided by MEA on the Residential Clean Energy Rebate Program webpage1 or if filling out an electronic application eApp must use the most up to date Applicant Signatu Consumers who purchase qualified alternative fueling equipment for installation at their principal residence in qualified locations on or after January 1 2023 and through December 31 2032 may receive a tax credit of up to 30 of the cost up to 1 000

Download Tax Rebate 2024 Maryland

More picture related to Tax Rebate 2024 Maryland

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Maryland provides a standard Personal Exemption tax deduction of 3 200 00 in 2024 per qualifying filer and 3 200 00 per qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2024 Maryland Single Filer Standard Deduction The standard deduction for a Single Filer in Maryland for 2024 is 2 400 00 Updated Sep 13 2023 11 36am We earn a commission from partner links on Forbes Home Commissions do not affect our editors opinions or evaluations Getty Images Table of Contents Maryland

You can check the status of your current year refund online or by calling the automated line at 410 260 7701 or 1 800 218 8160 Be sure you have a copy of your return on hand to verify information You can also e mail us at taxhelp marylandtaxes gov to check on your refund Example If your income is 11 000 your tax limit is 265 Step 2 Take 15 of the total occupancy rent for the year 2022 Example A monthly rental of 300 would amount to 3 600 a year Fifteen percent of 3 600 is 540 Step 3 Subtract your tax limit amount from the assumed property tax Example 540 15 of occupancy rent 265 tax limit

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

https://www.the-sun.com/wp-content/uploads/sites/6/2022/04/kc-gov-little-comp.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

https://www.kiplinger.com/taxes/state-stimulus-checks

January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to

https://energy.maryland.gov/Pages/HOMESRebates.aspx

As Maryland s state energy office the Maryland Energy Administration MEA will be the applicant for two of the residential focused IRA rebate programs the HOMES Residential Energy Efficiency Rebate Program and the High Efficiency Electric Home Rebate Program

Maryland Income Tax Calculator 2023 2024

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

Illinois Ev Tax Rebate 2023 Tax Rebate

How To Increase The Chances Of Getting A Tax Refund CherishSisters

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Income Tax Rebate Under Section 87A

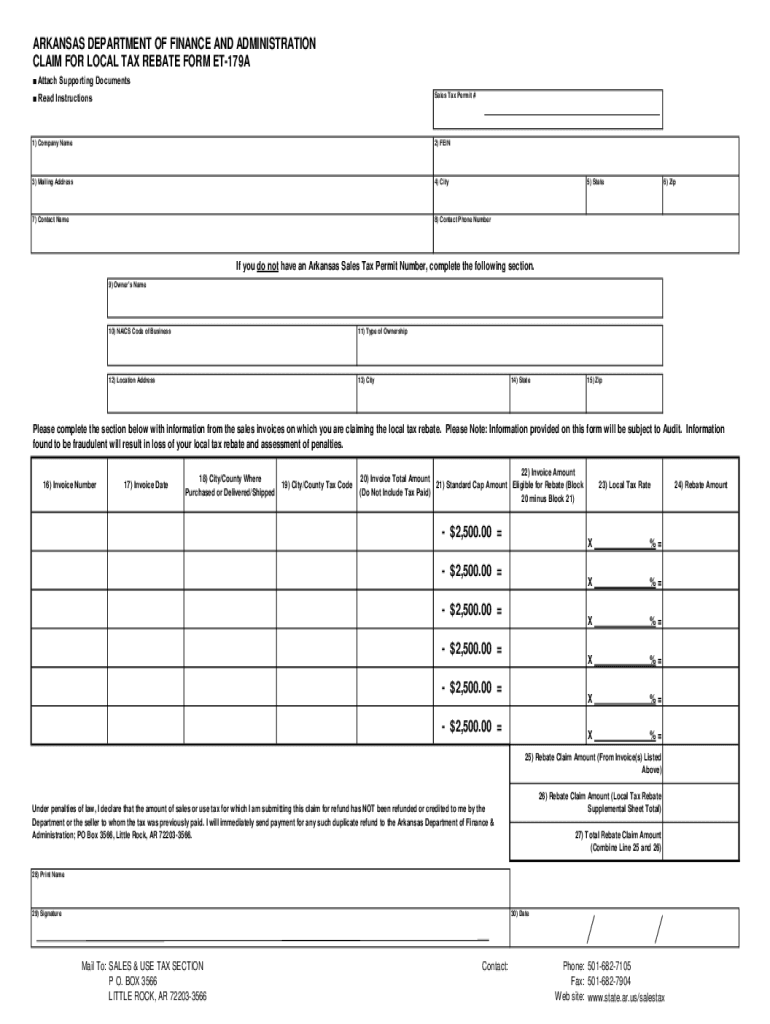

Claim For Local Tax Rebate Arkansas Fill Out And Sign Printable PDF Template SignNow

TAX REBATE Ft The Receipts Podcast OFF THE CUFF PODCAST Listen Notes

Tax Rebate 2024 Maryland - Generally state tax changes take effect either at the start of the calendar year January 1 or the fiscal year July 1 for most states with rate changes for major taxes typically implemented effective January 1 either prospectively as in these cases or retroactively as may happen under legislation enacted in the new year