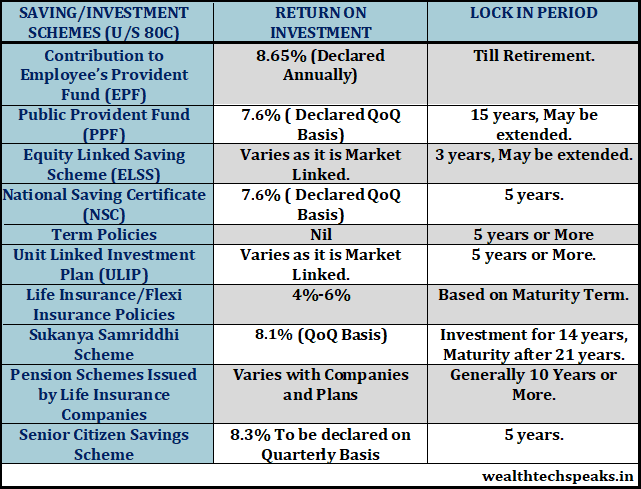

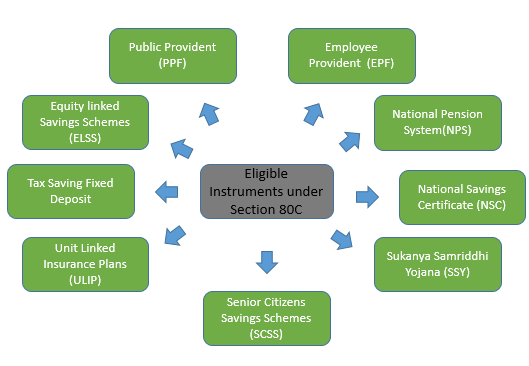

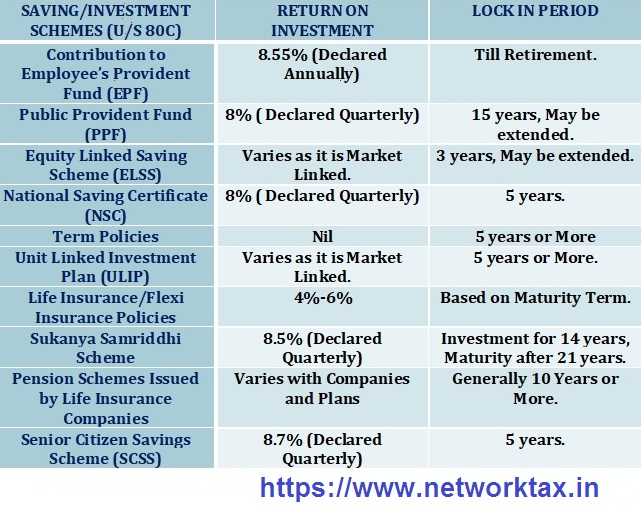

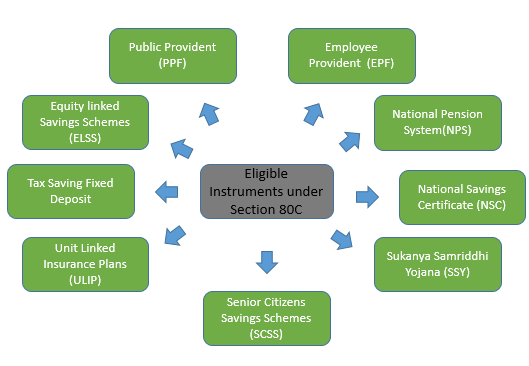

Tax Rebate 80c Web Section 80C is a tax saving provision under the Indian Income Tax Act 1961 It allows taxpayers to claim deductions on specified investments and expenses such as Public Provident Fund PPF Employee Provident

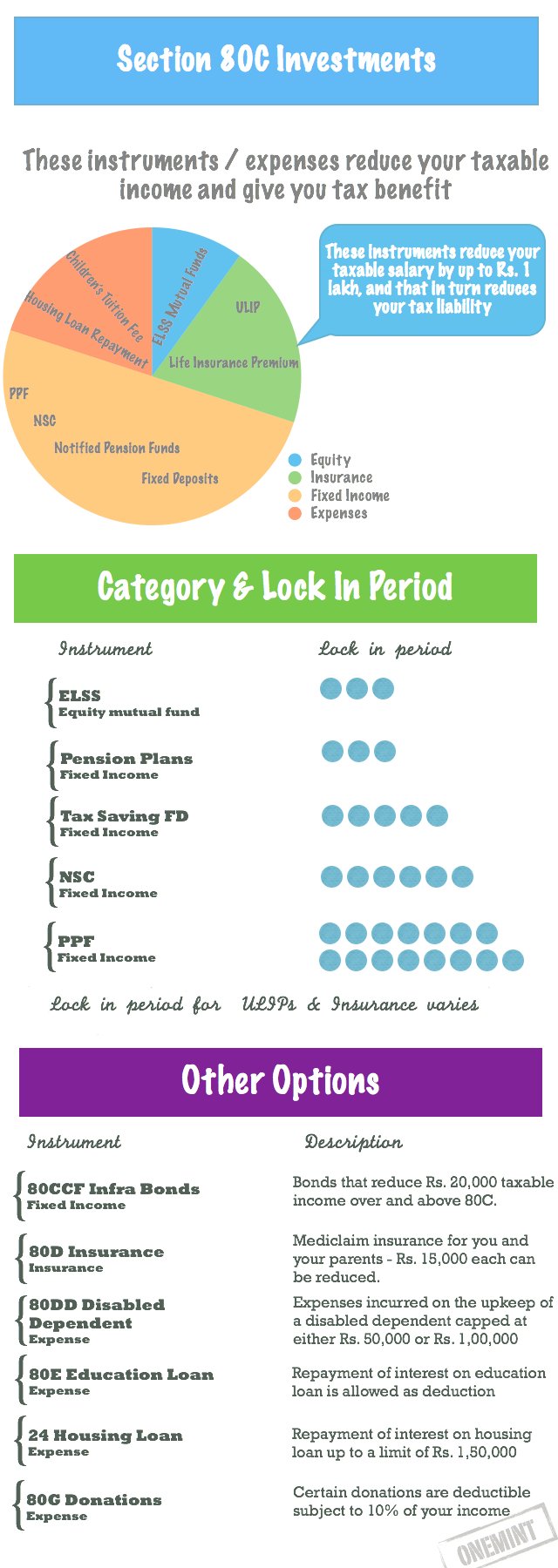

Web 30 janv 2022 nbsp 0183 32 Premium qualifies for deduction under section 80C maturity proceeds or death claim is tax free when the annual premium does not exceed 2 5 lakh and Web 11 janv 2023 nbsp 0183 32 Section 80C Deduction Terms and conditions for home buyers to avail of benefits under Section 80C How to maximise tax rebate under Section 80C

Tax Rebate 80c

Tax Rebate 80c

https://myinvestmentideas.com/wp-content/uploads/2018/04/80C-Deductions-list-min.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

80C TO 80U DEDUCTIONS LIST PDF

https://wealthtechspeaks.in/wp-content/uploads/2017/04/Tax-Deduction-Under-Section-80C.png

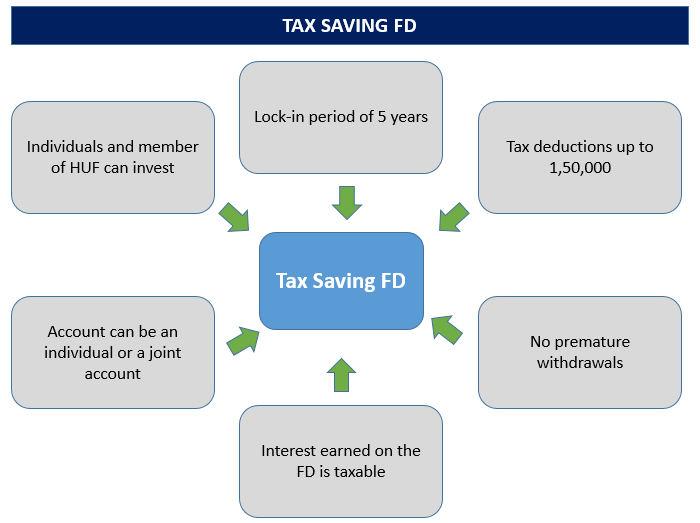

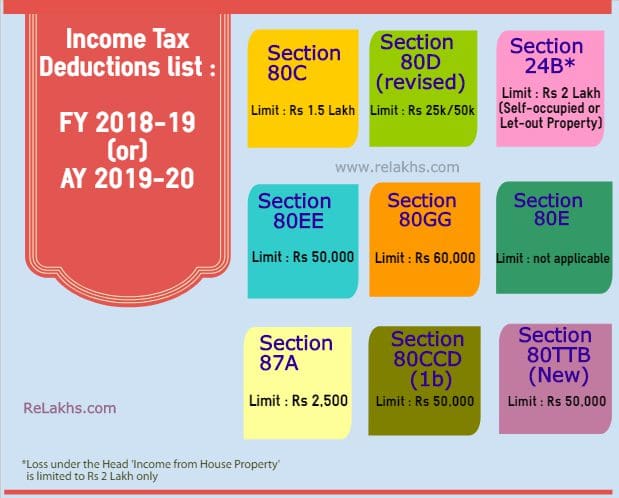

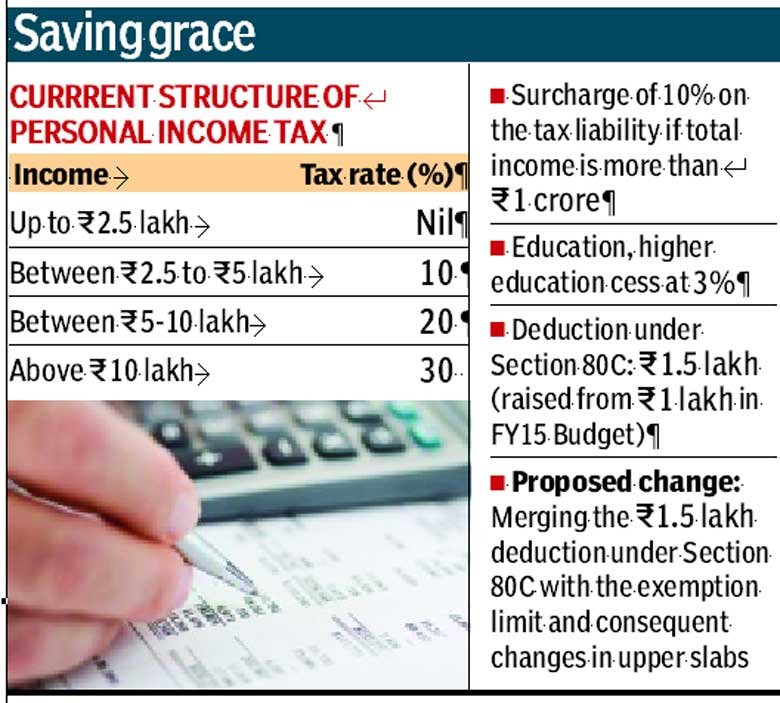

Web 3 janv 2023 nbsp 0183 32 Rebate under section 80C is only available for HUF and individuals Apart from 80C there are other options available under the Web 3 ao 251 t 2023 nbsp 0183 32 Features of Income Tax Deduction u s 80 Section 80C This section provides a deduction of up to Rs 1 5 lakh for investments in specified instruments such as EPF PPF NSC ELSS tax saving fixed

Web Section 80C Investment in ELSS Fund or Tax Saving Mutual Fund is considered as the best tax saving option These funds are specially designed to give you dual benefit of saving taxes and getting higher Web 12 juil 2023 nbsp 0183 32 Under Section 80C a taxpayer can claim an exemption for the investments made and expenses incurred up to Rs 1 5 lakh in a financial year The investments

Download Tax Rebate 80c

More picture related to Tax Rebate 80c

80ccc Pension Plan Investor Guruji

https://enskyar.com/img/Blogs/Tax-deduction-under-section-80C-80CCC-and-80CCD.jpg

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

List Of Deductions Under Section 80C Finserv MARKETS

https://www.bajajfinservmarkets.in/content/dam/bajajfinserv/banner-website/term-insurance/support-page/tax-fd.png

Web 26 d 233 c 2022 nbsp 0183 32 1 Tax saving with NPS under Section 80CCD 1B Taxpayers can save additional tax by investing up to 50 000 in NPS This is over and above the benefit Web 6 f 233 vr 2022 nbsp 0183 32 Ways to get the Section 80C tax rebate by Taxtimes February 6 2022 It is that time of the year again when many taxpayers go shopping for tax saving investment

Web 21 sept 2022 nbsp 0183 32 The Income Tax Act of 1961 allows a maximum deduction of 1 50 000 per annum under Section 80C which includes other tax deductibles like insurance premiums interest on education or housing Web 22 sept 2022 nbsp 0183 32 Is 80CCD included in 80C No Section 80C pertains to deductions that can be claimed for certain investments while Section 80CCD pertains specifically to NPS and

TAX DEDUCTION UNDER SECTION 80C Subrata Tax Blog

https://1.bp.blogspot.com/-y7QODHgwf2w/XSb2v478AII/AAAAAAAAANM/3QtXS1n2C2wFgKrONw3Y-Iuu-kThJdC7gCLcBGAs/s1600/cdeductionspng-1512457321752.png

Common Tax Benefits Under Section 80C Of Income Tax Act 1961 With

https://1.bp.blogspot.com/-tTRSJgMDHwI/Xztks0LxITI/AAAAAAAAOK8/PgW2yccVGZAPqu4JgxjY4437sXpdArODgCNcBGAsYHQ/s1600/picture%2Bfor%2Bincome%2Btax%2B80C.jpg

https://www.etmoney.com/blog/guide-to-secti…

Web Section 80C is a tax saving provision under the Indian Income Tax Act 1961 It allows taxpayers to claim deductions on specified investments and expenses such as Public Provident Fund PPF Employee Provident

https://www.livemint.com/money/personal-finance/seven-ways-to-get-the...

Web 30 janv 2022 nbsp 0183 32 Premium qualifies for deduction under section 80C maturity proceeds or death claim is tax free when the annual premium does not exceed 2 5 lakh and

Section 80C Tax Saving Instruments Infographic OneMint

TAX DEDUCTION UNDER SECTION 80C Subrata Tax Blog

Exemption In Lieu Of 80C Tax Benefits

Income Tax Act Tax Saving Under Section 80C Deduction Bare Act

Income Tax For Under Construction House The Property Files

12 Ways To Save Taxes Other Than 80C Omozing

12 Ways To Save Taxes Other Than 80C Omozing

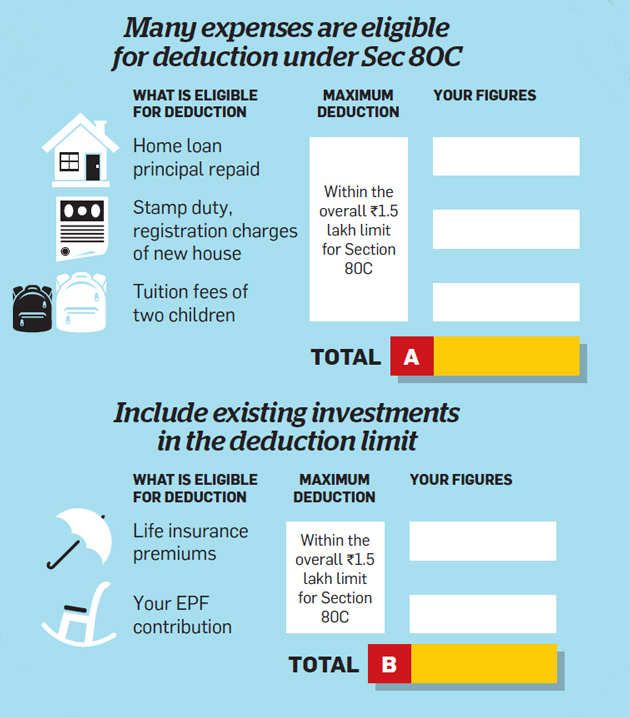

Have You Utilised The Sec 80C Tax Saving Limit Fully Find Out The

How To Get Tuition Tax Credit QATAX

Tax Benefit Investment Know About Section 80C Deductions

Tax Rebate 80c - Web 1 f 233 vr 2023 nbsp 0183 32 Going by the current income tax slab and rates the deduction under section 80C can help an individual paying tax at 31 2 per cent to save tax of Rs 46 800 This tax