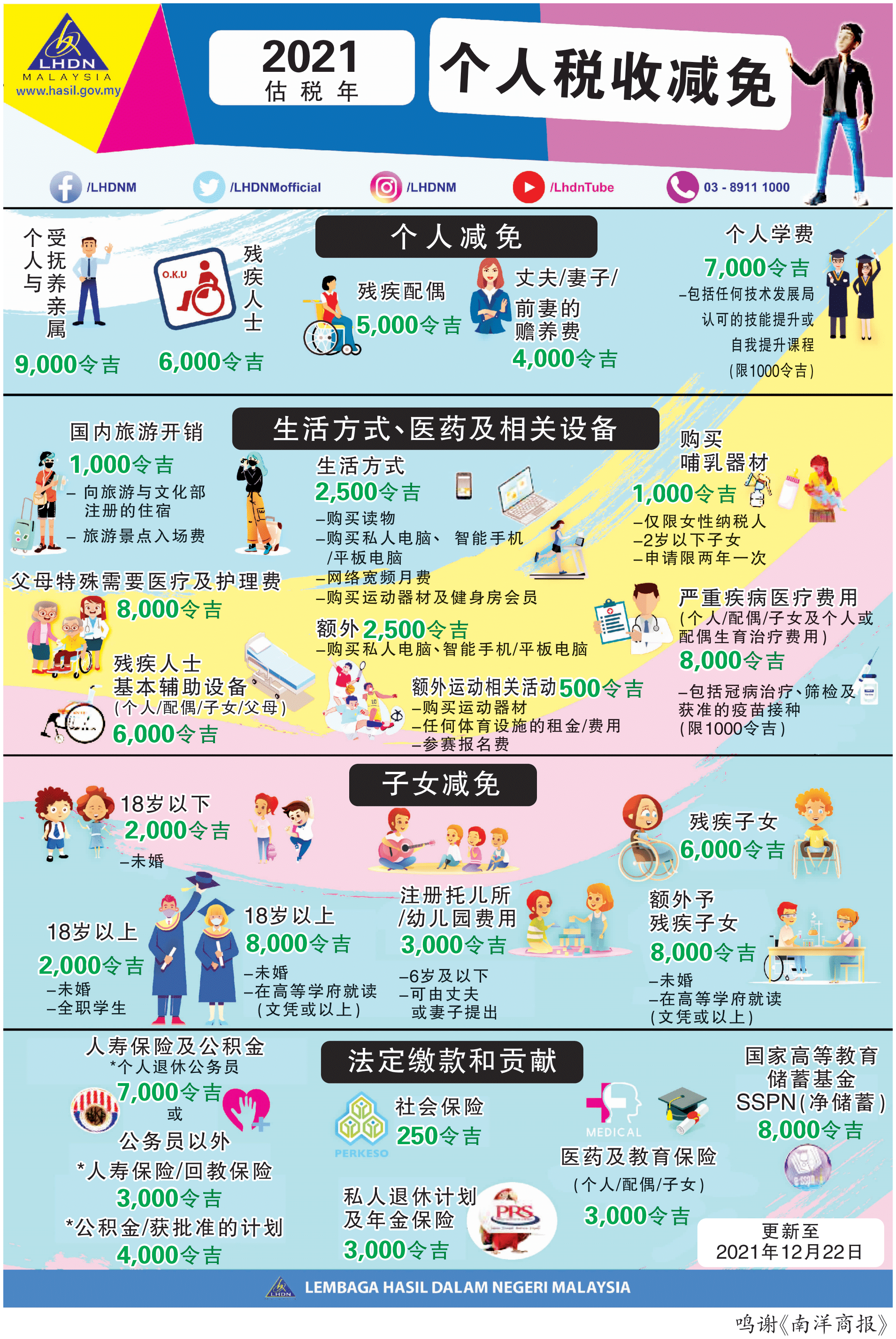

Tax Rebate For Individual 2022 Malaysia Individual Relief Types Amount RM 1 Self and Dependent Special relief of RM2 000 will be given to tax payers earning on income of up to RM8 000 per month aggregate income of up

It directly affects your amount of tax charged 1 Tax rebate for self Rebate RM400 If your chargeable income after tax relief and deductions do not exceed RM35 000 Tax reliefs let you reduce your chargeable income your income that will determine what tax rate you are charged with Here are the full details of all the tax reliefs that you can claim for YA 2022 1 Individual dependent

Tax Rebate For Individual 2022 Malaysia

Tax Rebate For Individual 2022 Malaysia

https://ringgitplus.com/en/blog/wp-content/uploads/2022/03/income-tax_everything-you-should-claim_ya2021.jpg

2020 Tax Relief For Malaysian Resident Individuals YouTube

https://i.ytimg.com/vi/pa5oGCettKo/maxresdefault.jpg

What Is 87 A Rebate Free Tax Filer Blog

https://blog.freetaxfiler.com/wp-content/uploads/2022/09/Tax-Rebate-1.jpg

There are the types of tax rebates available Individual for chargeable income less until RM35 000 can get a tax rebate of RM400 Wife Husband separate assessment can each get a tax rebate of RM400 if 1 Automatic individual relief RM9 000 You re eligible for an automatic tax deduction of RM9 000 just by filling in the LHDN e Filing form As the name suggests this will be done automatically by the system 2 Further

Tax relief for SOCSO contributions is increased to RM350 and expanded to include employee s contributions through the Employment Insurance System RM4 000 tax relief for EPF Tax Rebate 5 1 Tax rebate is given to an individual who is resident in Malaysia for the basis year for a YA in accordance with subsection 6A 2 2A and 3 of the ITA to reduce the amount of

Download Tax Rebate For Individual 2022 Malaysia

More picture related to Tax Rebate For Individual 2022 Malaysia

Personal Tax Relief 2022 Latest CN Advisory

https://cnadvisory.my/wp-content/uploads/2023/03/personal-tax-relief-2022-scaled.jpg

Tax Rebate For Individuals Swaper Investing Blog

https://swaper.com/blog/wp-content/uploads/SWAPER_blogpost_tax_1920x1080.png

Council Tax Rebate 2022 Council Issues THIRD Date To Pay 150

https://cdn.images.express.co.uk/img/dynamic/23/1200x712/1610234_1.jpg

If you re a Malaysian resident you ll need to file a return if your income for the year 2022 was more than RM34 000 If you re a non resident you re taxed at a flat rate of 30 per cent and are not eligible to enjoy any As you can see in the infographic above you will be eligible for a tax rebate of RM400 for yourself if your chargeable income does not exceed RM35 000 Zakat and fitrah too can be claimed as tax rebates for the actual

The following categories of individuals are taxed at 15 on the employment income A qualified person defined who is a knowledge worker residing and working in Iskandar Malaysia and Personal Tax Reliefs in Malaysia Reliefs are available to an individual who is a tax resident in Malaysia in that particular YA to reduce the chargeable income and tax liability Companies

Everything You Should Claim As Income Tax Relief Malaysia 2023 YA 2022

https://ringgitplus.com/en/blog/wp-content/uploads/2023/03/SPC-4467_IncomeTax-2022.png

Here s How You Can Claim The 2022 Council Tax Rebate Holeys

https://holeys.co.uk/wp-content/uploads/2022/02/Blog-image-24.2.22.jpg

https://www.hasil.gov.my/en/individual/individual...

Individual Relief Types Amount RM 1 Self and Dependent Special relief of RM2 000 will be given to tax payers earning on income of up to RM8 000 per month aggregate income of up

https://ringgitplus.com/en/blog/income-tax/...

It directly affects your amount of tax charged 1 Tax rebate for self Rebate RM400 If your chargeable income after tax relief and deductions do not exceed RM35 000

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of

Everything You Should Claim As Income Tax Relief Malaysia 2023 YA 2022

Older Disabled Residents Can File For Property Tax Rent Rebate Program

Resident Individual Tax Relief YA 2021 WSY Associates

2022 Pa Property Tax Rebate Forms PropertyRebate

Rent Rebate Missouri Printable Rebate Form

Rent Rebate Missouri Printable Rebate Form

2022 Tax Brackets DhugalKillen

Income Tax Rate Malaysia 2023 Calculator Printable Forms Free Online

Senarai Pelepasan Cukai Pendapatan LHDN Untuk E Filing 2021 tahun

Tax Rebate For Individual 2022 Malaysia - It has a direct impact on the amount of tax you pay 1 Tax rebate for self Rebate RM400 You will be entitled to this rebate of RM400 on the tax charged if your chargeable