Tax Rebate For Salaried Person Web 7 avr 2021 nbsp 0183 32 L employeur doit appliquer le pr 233 l 232 vement 224 la source PAS sur les revenus des salari 233 s Il doit respecter les taux transmis par les services des imp 244 ts au moyen

Web La taxe sur les salaires est due par les employeurs qui emploient des salari 233 s et qui ne sont pas soumis 224 la TVA Ils doivent 233 galement 234 tre 233 tablis en m 233 tropole ou dans un Web 27 d 233 c 2022 nbsp 0183 32 For salaried employees Section 10 of the Income Tax details a wide range of allowances that can be used to reduce their tax outgo Let us examine some

Tax Rebate For Salaried Person

Tax Rebate For Salaried Person

https://i.ytimg.com/vi/5GtnCAoSl-4/maxresdefault.jpg

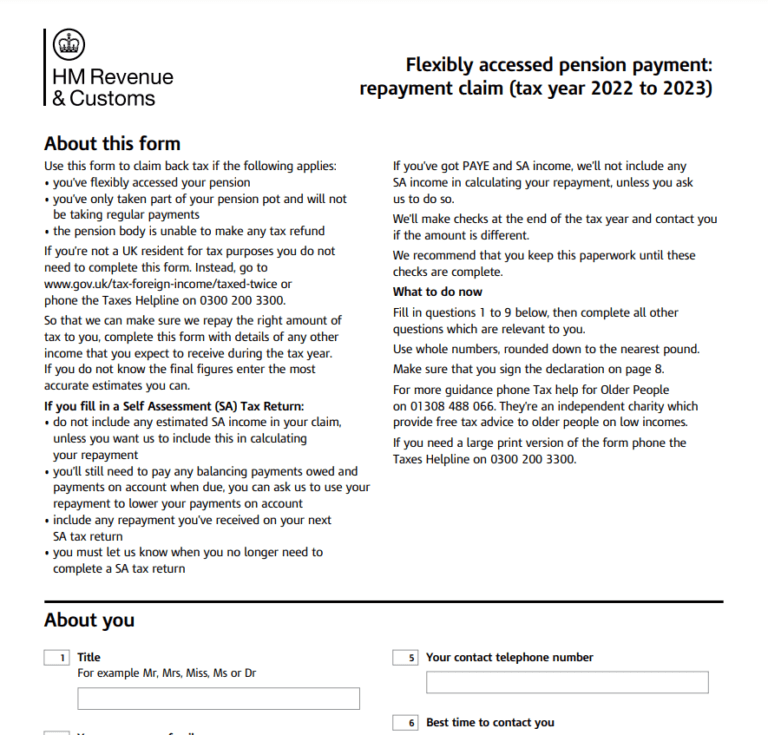

P55 Tax Rebate Form Business Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/P55-Tax-Rebate-Form-768x735.png

Best Tax Saving Guide Complete Tax Planning For Salaried Persons

https://i.ytimg.com/vi/yCLAm1r8-j4/maxresdefault.jpg

Web 8 juin 2023 nbsp 0183 32 Vous avez des frais professionnels d 233 penses de transport du domicile au lieu de travail de v 234 tements sp 233 cifiques 224 l emploi exerc 233 etc et vous souhaitez les Web Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less

Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount Web 8 juin 2023 nbsp 0183 32 Le bar 232 me sert 224 calculer le montant de l imp 244 t Pour d 233 terminer le montant 224 payer il faut appliquer un taux 224 chaque tranche de revenu

Download Tax Rebate For Salaried Person

More picture related to Tax Rebate For Salaried Person

Tulsa Sales Tax Rebate Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/27/773/27773189/large.png

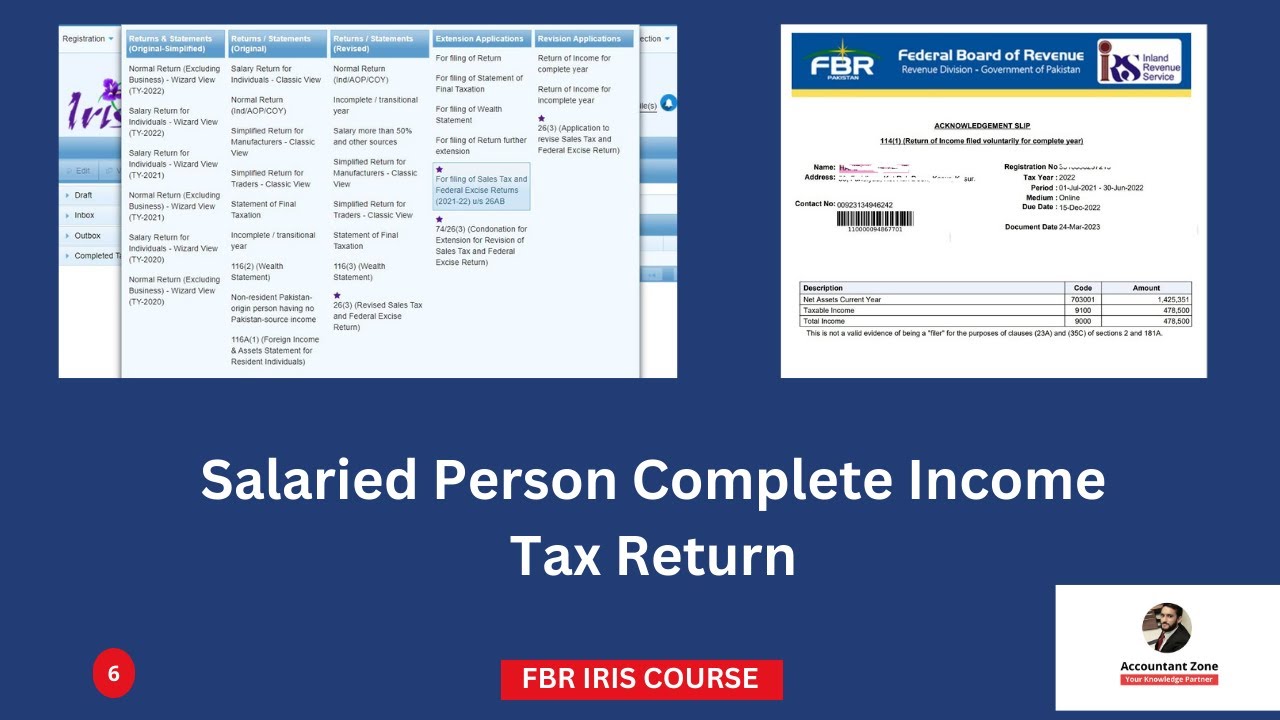

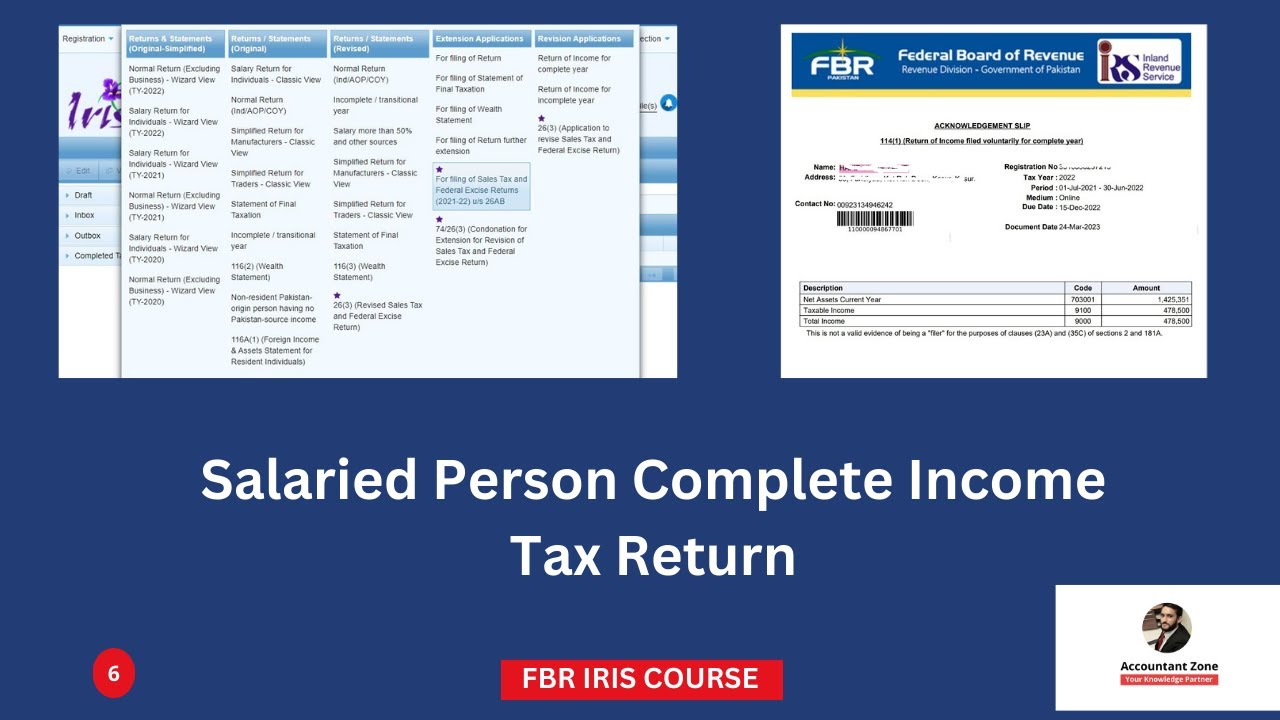

E Filing Of Income Tax Return For Salaried Persons YouTube

https://i.ytimg.com/vi/Phtz45CHBiA/maxresdefault.jpg

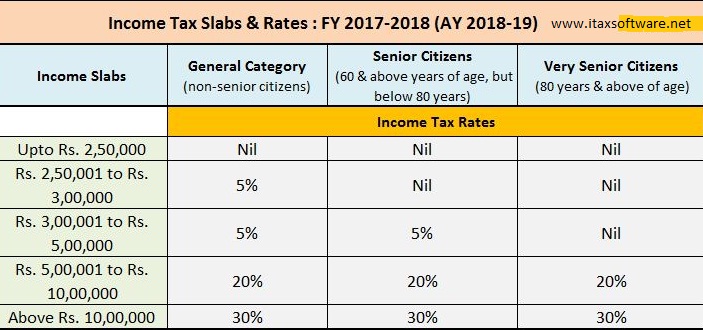

New Slabs Of Tax For Salaried Person Income Tax On Salary Tax On

https://i.ytimg.com/vi/DkqfaYhkuwc/maxresdefault.jpg

Web 15 f 233 vr 2023 nbsp 0183 32 Given below are the various tax saving options for salaried individuals under the old tax regime to save income tax for the current FY 2022 23 Common deductions Web 21 f 233 vr 2023 nbsp 0183 32 Employees incur expenses on books newspapers periodicals journals and so on The income tax law allows an employee to claim a tax free reimbursement of

Web 30 juil 2020 nbsp 0183 32 Tax rebate is very important for individual taxpayer as it reduces the tax liability significantly And finally we will know how to calculate tax liability by applying the Web Toutes les sommes et tous les avantages attribu 233 s en contrepartie ou 224 l occasion du travail sont soumis 224 cotisations Il s agit notamment du salaire des heures suppl 233 mentaires

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000

https://economictimes.indiatimes.com/img/62914496/Master.jpg

Download Automated All In One TDS On Salary For West Bengal Govt

https://2.bp.blogspot.com/-MLBWDjPvYf8/WeK9d3Zq1gI/AAAAAAAAFm4/nn4jY1sdLfIGhTRoRIaLDxhJFsuLJLh4wCLcBGAs/s1600/Tax%2BSlab%2Bfor%2BF.Y.17-18.jpg

https://www.service-public.fr/particuliers/vosdroits/F34732

Web 7 avr 2021 nbsp 0183 32 L employeur doit appliquer le pr 233 l 232 vement 224 la source PAS sur les revenus des salari 233 s Il doit respecter les taux transmis par les services des imp 244 ts au moyen

https://entreprendre.service-public.fr/vosdroits/F22576

Web La taxe sur les salaires est due par les employeurs qui emploient des salari 233 s et qui ne sont pas soumis 224 la TVA Ils doivent 233 galement 234 tre 233 tablis en m 233 tropole ou dans un

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000

How To File ITR 1 For AY 2021 22 Explained In Hindi Salaried Person

Standard Deduction For Salaried Employees Transport Medical Reimbursem

List Of Benefits Available To Salaried Persons AY 2023 24 S N

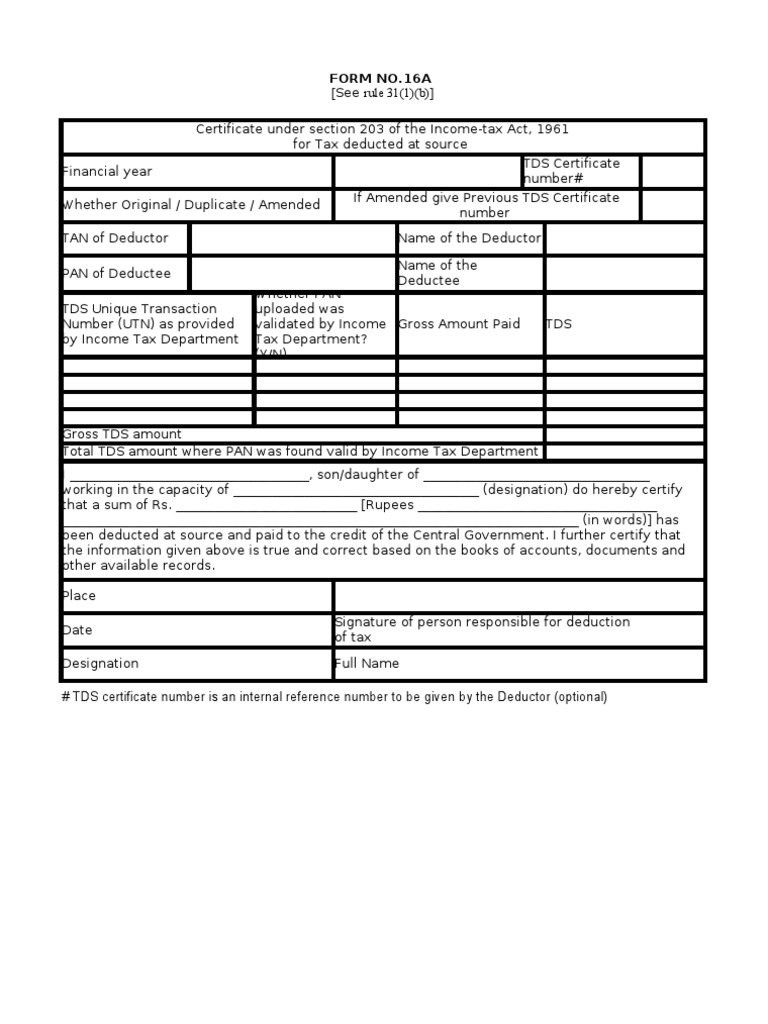

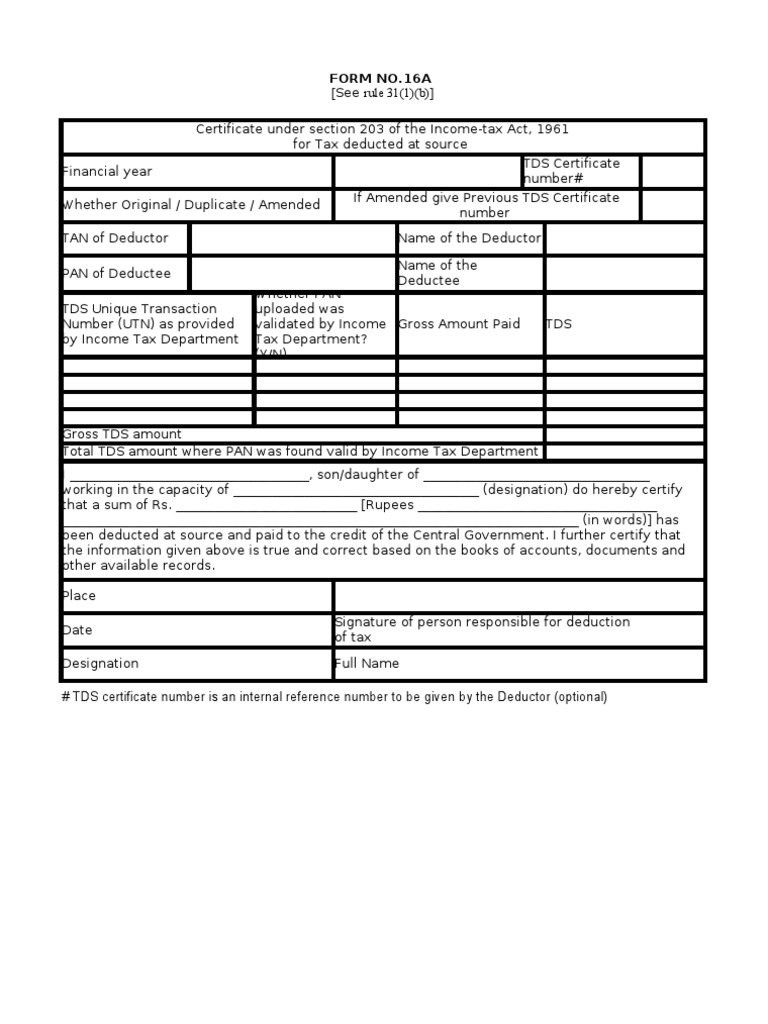

Form 16 For Salaried Person Tax Refund Income Tax In India

Form 16 For Salaried Person Tax Refund Income Tax In India

Tax Rate Card 2022 23 Icmap 2022 Tax Rates For Salaried Persons

Salaried Person Tax Tankhwa Dar Tabqay Per 160 Arab Kay Taxes Lagany

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Tax Rebate For Salaried Person - Web 8 juin 2023 nbsp 0183 32 Vous avez des frais professionnels d 233 penses de transport du domicile au lieu de travail de v 234 tements sp 233 cifiques 224 l emploi exerc 233 etc et vous souhaitez les