Tax Rebate For Wfh Web If you pay the 20 basic rate of tax and claim tax relief on 163 6 a week you would get 163 1 20 per week in tax relief 20 of 163 6 You ll usually get tax relief through a change to your

Web 13 mai 2021 nbsp 0183 32 13 May 2021 HM Revenue and Customs HMRC is accepting tax relief claims for working from home due to coronavirus during 2021 to 2022 More than Web 17 mai 2022 nbsp 0183 32 Applying for the HMRC working from home tax relief 2021 22 and the year before that since most of us became eligible for WFH tax relief in 2020 could mean you

Tax Rebate For Wfh

Tax Rebate For Wfh

https://pbs.twimg.com/media/FUor-IJWAAIaY-m?format=jpg&name=900x900

Osita Mba On Twitter 16 It Was Only After HMRC Sent The Claimants

https://pbs.twimg.com/media/FUosAwkWYAAXyEC?format=jpg&name=medium

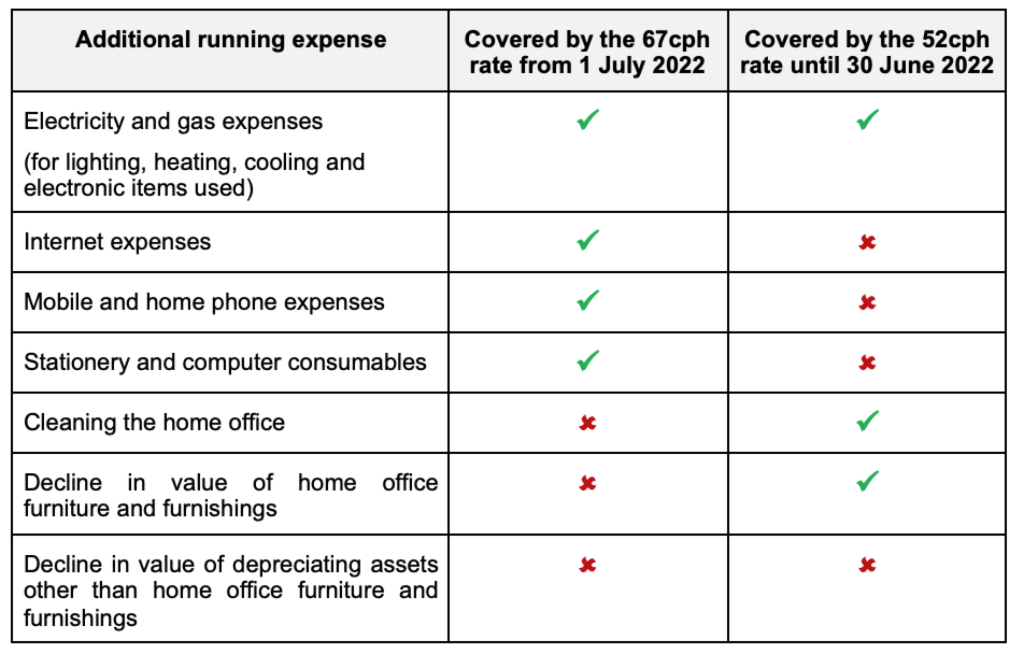

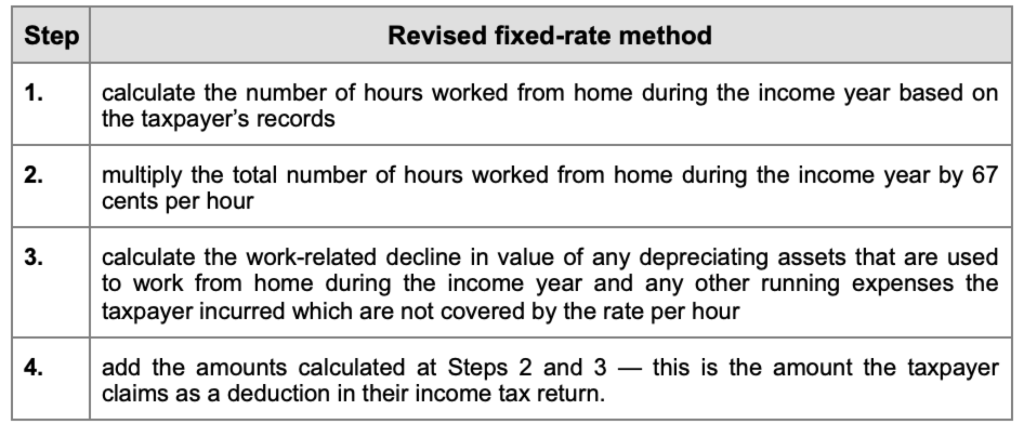

The ATO s New Working From Home Deduction Rules TaxBanter Pty Ltd

https://taxbanter.com.au/wp-content/uploads/2023/02/Table-1-WFH-blog-1024x654.png

Web 14 mai 2022 nbsp 0183 32 For basic rate taxpayers the relief was worth 20 of the 163 6 163 1 20 a week Higher rate taxpayers could claim 40 of the 163 6 163 2 40 a Web 27 avr 2021 nbsp 0183 32 The new tax year started on 6th April 2021 and despite the fact that working from home WFH has become the new normal for millions of people told to work

Web En 2022 j ai engag 233 des frais professionnels de t 233 l 233 travail 224 domicile MAIS je n ai pas per 231 u d allocation pour frais de t 233 l 233 travail 224 domicile Je n opte pas pour la d 233 duction des frais Web 18 mars 2022 nbsp 0183 32 L exon 233 ration d imp 244 t sur le revenu des allocations vers 233 es par l employeur pour les frais de t 233 l 233 travail Selon une 233 tude men 233 e par le cabinet de

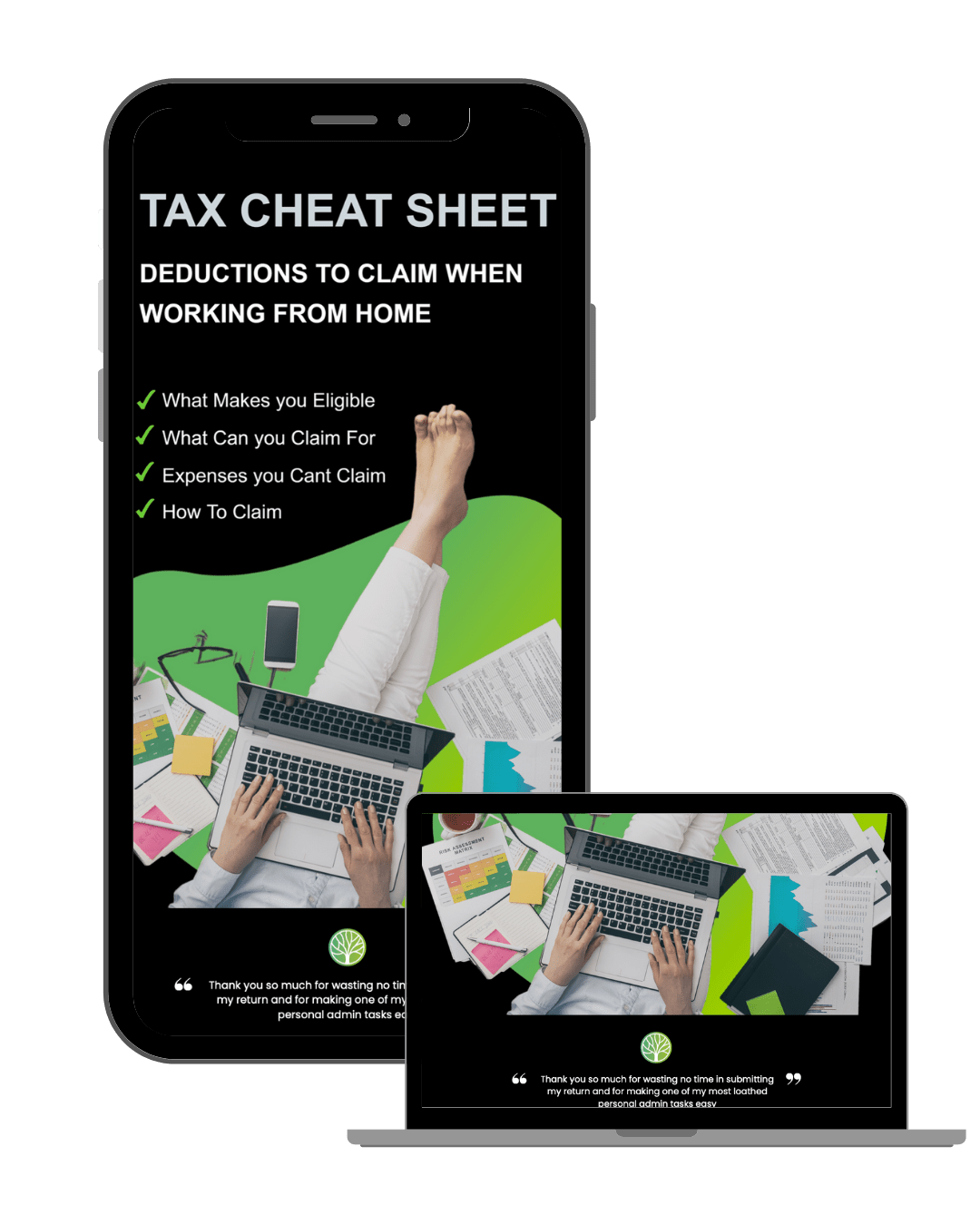

Download Tax Rebate For Wfh

More picture related to Tax Rebate For Wfh

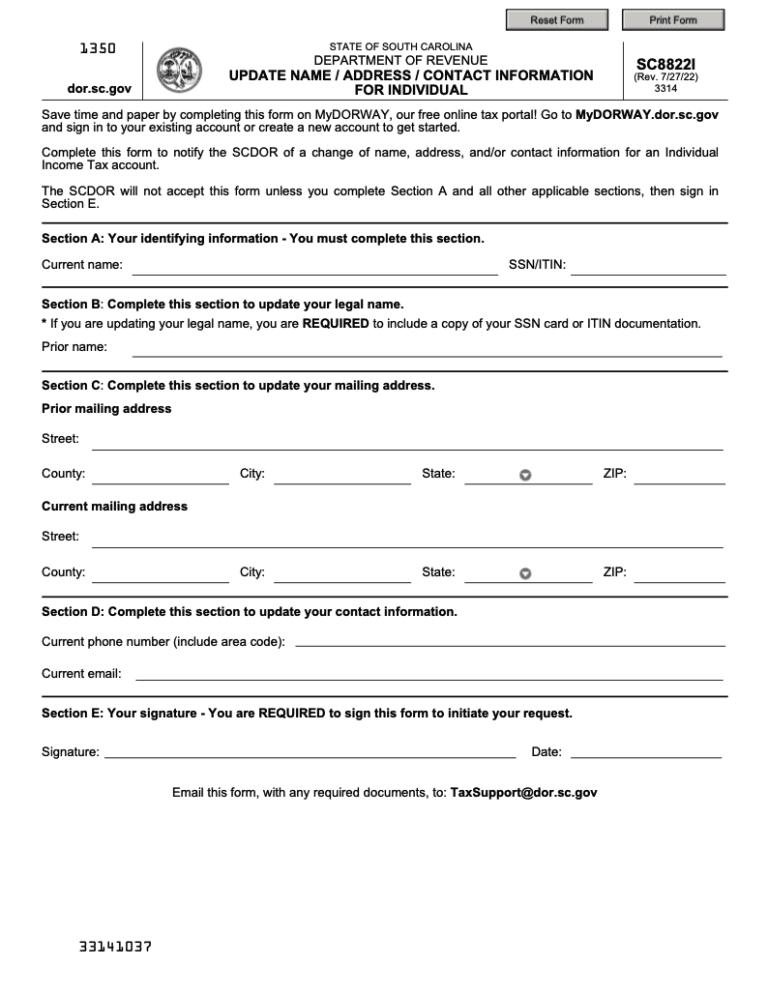

Working From Home Tax Rebate Form 2022 Printable Rebate Form

https://www.printablerebateform.com/wp-content/uploads/2021/07/Work-from-Home-Tax-Rebate-Form-2021.jpg

WFH Tax Claim My Tax Rebate

https://www.mytaxrebate.co.uk/wp-content/uploads/2022/09/linkedin-sales-solutions-hMLDD0Gyd4A-unsplash-1536x1025.jpg

Taxpayer Alert ATO To Crack Down On Landlords Short term Rentals And

https://assets-us-01.kc-usercontent.com/fa776f1a-4d27-4a6b-ae1c-2ce928f9647d/662858c4-68e2-4f20-8753-48ab7ef3ef92/tax-cropped.png

Web 7 avr 2021 nbsp 0183 32 The maximum amount reimbursed on which tax relief is allowed is 163 4 per week up to 5 April 2020 and 163 6 per week thereafter Alternatively employers can reimburse Web 30 mars 2022 nbsp 0183 32 163 6 a week tax relief for working from home for 2022 23 30 March 2022 The CIPP has received confirmation from Her Majesty s Revenue and Customs HMRC that

Web 18 janv 2023 nbsp 0183 32 From the current tax year 2022 23 onwards employees who are eligible can still make a claim for tax relief for working from home The claim can be made in self Web 25 janv 2023 nbsp 0183 32 If you re self employed If you work from home rather than from a business premises you can either add work related expenses when you file your 2022 23 tax

Claiming Tax Back When Working From Home Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/wfh.jpeg

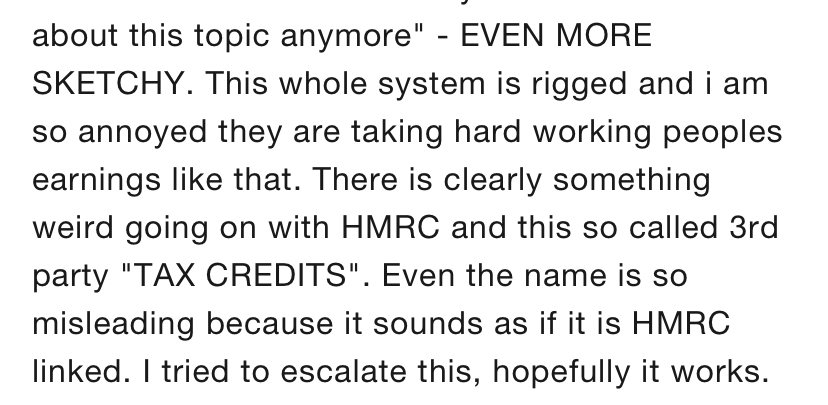

The WFH Tax Rebate Firms That Claim For You But Pocket Half The Cash

https://i.dailymail.co.uk/1s/2022/02/08/21/53940849-10490483-image-a-14_1644356596237.jpg

https://www.gov.uk/tax-relief-for-employees/working-at-home

Web If you pay the 20 basic rate of tax and claim tax relief on 163 6 a week you would get 163 1 20 per week in tax relief 20 of 163 6 You ll usually get tax relief through a change to your

https://www.gov.uk/government/news/working-from-home-customers-m…

Web 13 mai 2021 nbsp 0183 32 13 May 2021 HM Revenue and Customs HMRC is accepting tax relief claims for working from home due to coronavirus during 2021 to 2022 More than

Work From Home Deductions Personal Tax Specialists

Claiming Tax Back When Working From Home Tax Rebates

The ATO s New Working From Home Deduction Rules TaxBanter Pty Ltd

Washington State Tax Rebate Printable Rebate Form

What Are The Best Ways To Manage Tax Rebates

Retirement Income Tax Rebate Calculator Greater Good SA

Retirement Income Tax Rebate Calculator Greater Good SA

The WFH Tax Rebate Firms That Claim For You But Pocket Half The Cash

Federal Tax Rebates Electric Vehicles ElectricRebate

Working From Home Tax Deductions BlueRock

Tax Rebate For Wfh - Web 14 mai 2022 nbsp 0183 32 For basic rate taxpayers the relief was worth 20 of the 163 6 163 1 20 a week Higher rate taxpayers could claim 40 of the 163 6 163 2 40 a