Tax Rebate Form 2022 Verkko 5 jouluk 2023 nbsp 0183 32 IRS Statements and Announcements Page Last Reviewed or Updated 05 Dec 2023 Eligible individuals can claim the Recovery Rebate Credit on their Form 1040 or 1040 SR These forms can also be used by people who are not normally required to file tax returns but are eligible for the credit

Verkko Rebate 0 to 8 000 650 8 001 to 15 000 500 Enter the amount from Line 13 of the claim form on this line and circle the corresponding Maximum Rebate amount for your income level Owners use Table A and Renters use Table B 23 PA 1000 2022 05 22 FI 2205110055 2205110055 2205110055 Verkko 23 helmik 2022 nbsp 0183 32 Details On 3 February 2022 the government announced an energy bills rebate to help with the cost of living This includes a 163 150 council tax rebate for households in bands A to D This page

Tax Rebate Form 2022

Tax Rebate Form 2022

http://static1.squarespace.com/static/5d8d4c603aab2563d4a30208/t/62ebf2c02ff2b767de17f485/1659630272071/2022-8-4+one-time+bonus+rebate+-+property+tax+rebate-insta.jpg?format=1500w

Recovery Rebate Form 2021 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

Pennsylvanians Can Now File Property Tax Rent Rebate Program

https://s3.amazonaws.com/static.beavercountyradio.com/wp-content/uploads/2021/01/25060432/unnamed-7-1536x1024.jpg

Verkko 30 kes 228 k 2023 nbsp 0183 32 RENT REBATE PROGRAM 2022 PROPERTY TAX or PA 1000 Booklet 05 22 Rebates for eligible seniors widows widowers and people with disabilities HARRISBURG PA 17128 0503 www revenue pa gov IMPORTANT DATES Application deadline JUNE 30 2023 Rebates begin EARLY JULY 2023 NOTE The department Verkko Property Tax Rent Rebate Program Forms Property Ta x Rent Rebate program forms and instructions for the 2023 claim year are scheduled to be posted on January 16 2024 DEX 41 Application for Property Tax Rent Rebate Due the Decedent DPO 87 myPATH Property Tax Rent Rebate Fact Sheet

Verkko Submit a donation receipt The easiest way to claim your donation tax credit is online in myIR and you ll receive your refund sooner Using myIR means we can work out your tax credit without you having to file a claim when the tax year ends on 31 March Verkko Property Tax Rebate The property tax rebate claim period for tax year 2022 has closed We will begin accepting claims for the rebate for tax year 2023 on August 15 2024 and all claims must be filed by October 1 2024 The Property Tax Rebate is a rebate of up to 675 per year of property taxes paid on a principal residence

Download Tax Rebate Form 2022

More picture related to Tax Rebate Form 2022

Carbon Tax Rebate 2022 Alberta Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/02/Carbon-Tax-Rebate-2022-Income-Information.png

Recovery Rebate Credit Worksheet Explained Support

https://support.taxslayer.com/hc/article_attachments/4415858470797/mceclip3.png

What Is The Recovery Rebate Credit CD Tax Financial

https://cdtax.com/wp-content/uploads/2021/02/Recovery-Rebate-Worksheet-1-1187x1536.png

Verkko General Information Filing a Claim Homestead refunds are not available to renters You must own your home to qualify The Homestead claim K 40H allows a rebate of a portion of the property taxes paid on a Kansas resident s homestead A homestead is the house mobile or manufactured home or other dwelling subject to property tax that Verkko 2022 Montana Property Tax Rebate Claim File online at https tap dor mt gov for direct deposit and faster processing of your rebate Part I Taxpayer and household information First name and initial Last name SSN Form MPTR22 V2 8 2023 Required Mark this box if the taxpayer is deceased Date of Death M M D D Y Y Y Y Personal representative

Verkko Return Form RF Filing Programme For The Year 2022 Return Form RF Filing Programme For The Year 2021 Amendment 4 2021 CGT Return Form RF Filing Programme Download Forms Contact Us English Melayu Malaysia Tax Rebates Year Of Assessment 2001 2008 RM Year Of Assessment 2009 Onwards RM a Verkko Coronavirus Recovery Rebate Credit and Economic Impact Payments Resources and Guidance Page Last Reviewed or Updated 01 May 2023 Share Get up to date information on coronavirus COVID 19 tax relief and economic impact payments stimulus checks for individuals and families

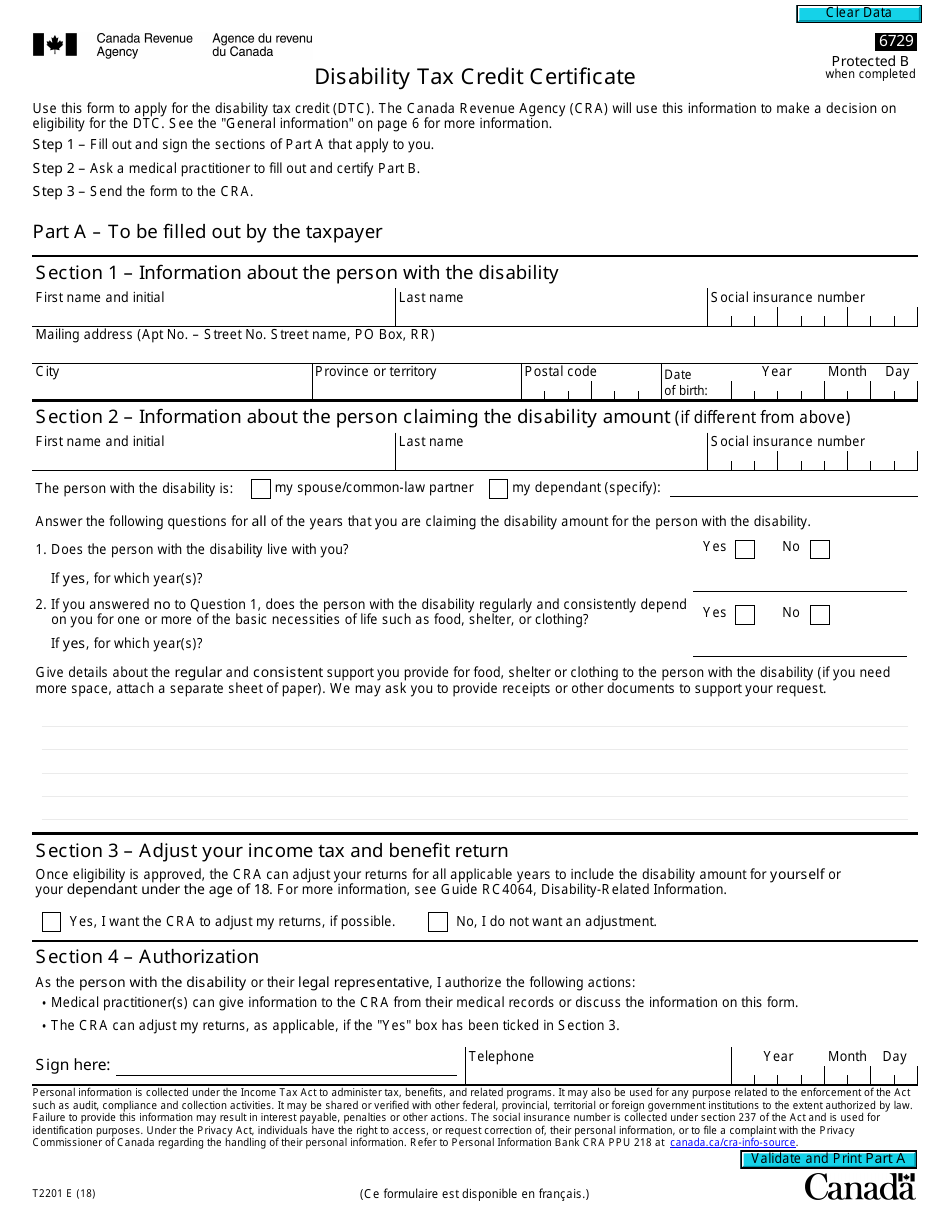

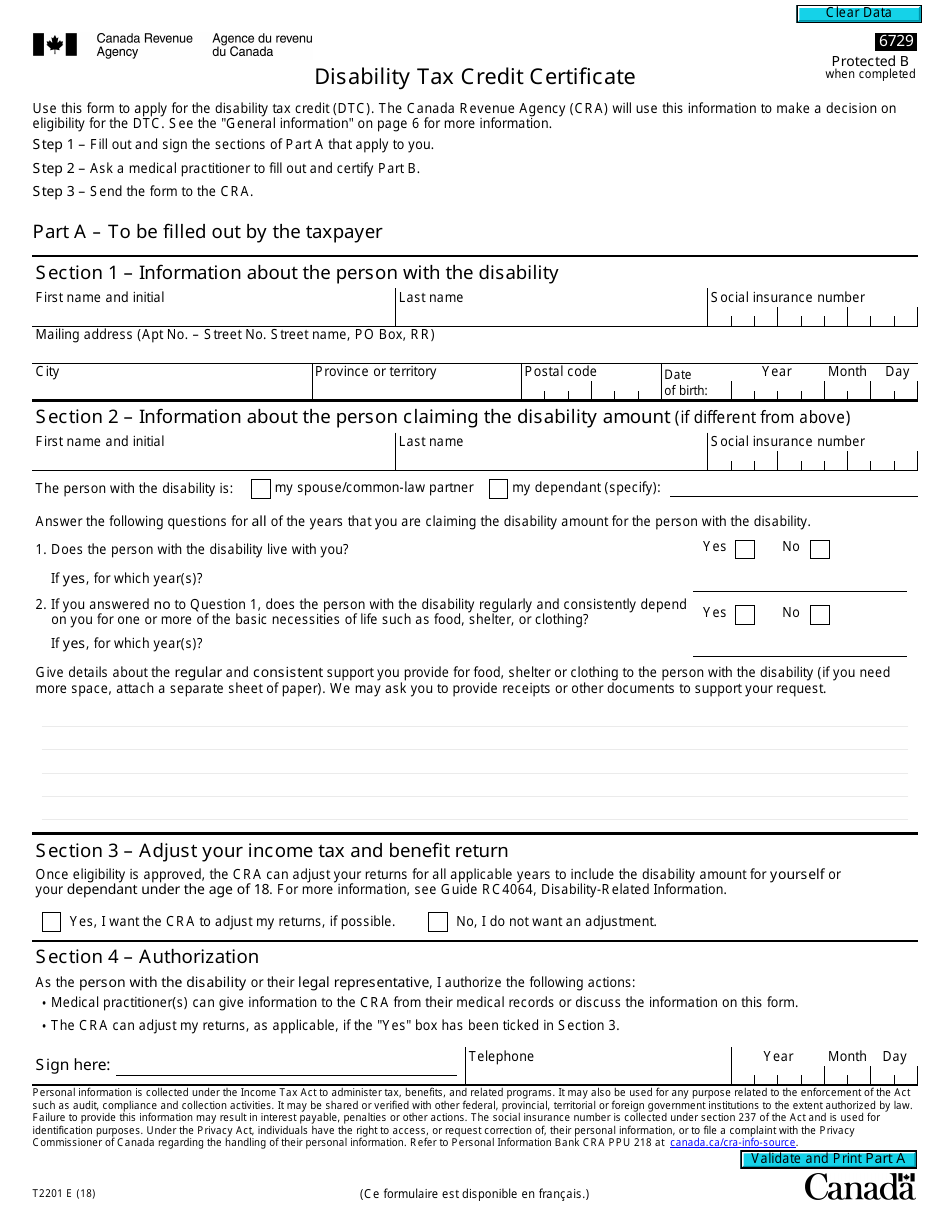

Form T2201 Fill Out Sign Online And Download Fillable PDF Canada

https://data.templateroller.com/pdf_docs_html/1868/18686/1868612/form-t2201-disability-tax-credit-certificate-canada_print_big.png

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

https://www.irs.gov/newsroom/recovery-rebate-credit

Verkko 5 jouluk 2023 nbsp 0183 32 IRS Statements and Announcements Page Last Reviewed or Updated 05 Dec 2023 Eligible individuals can claim the Recovery Rebate Credit on their Form 1040 or 1040 SR These forms can also be used by people who are not normally required to file tax returns but are eligible for the credit

https://www.revenue.pa.gov/FormsandPublications/Formsf…

Verkko Rebate 0 to 8 000 650 8 001 to 15 000 500 Enter the amount from Line 13 of the claim form on this line and circle the corresponding Maximum Rebate amount for your income level Owners use Table A and Renters use Table B 23 PA 1000 2022 05 22 FI 2205110055 2205110055 2205110055

Renters Rebate 2021 Printable Rebate Form

Form T2201 Fill Out Sign Online And Download Fillable PDF Canada

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

Printable Rebate Form For Old Style Beer Printable Forms Free Online

MO MO CRP 2020 Fill Out Tax Template Online US Legal Forms

What Do I Need To Do To Get My Missouri Renters Rebate Back

What Do I Need To Do To Get My Missouri Renters Rebate Back

Property Tax Or Rent Rebate Claim PA 1000 FormsPublications Fill Out

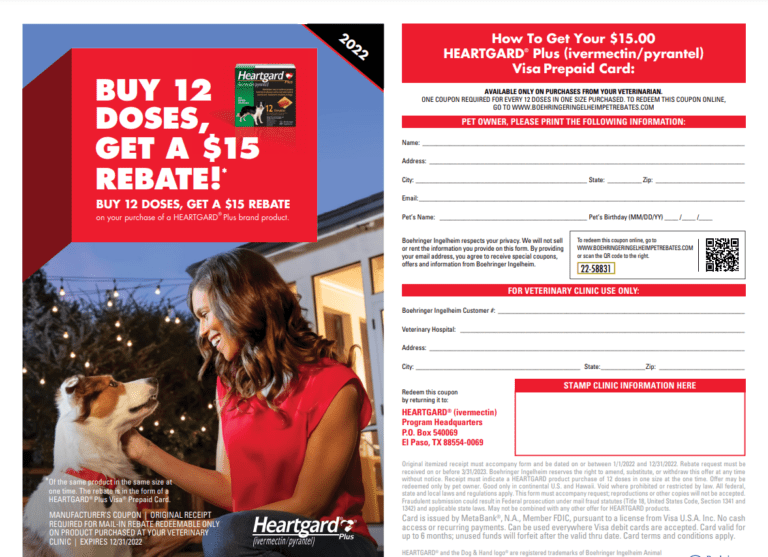

Heartgard Rebate Form 2022 Printable Rebate Form

Property Tax Rebate Application Printable Pdf Download

Tax Rebate Form 2022 - Verkko Property Tax Rebate The property tax rebate claim period for tax year 2022 has closed We will begin accepting claims for the rebate for tax year 2023 on August 15 2024 and all claims must be filed by October 1 2024 The Property Tax Rebate is a rebate of up to 675 per year of property taxes paid on a principal residence