Tax Rebate Idaho September 2023 Web 4 janv 2023 nbsp 0183 32 Idaho t axpayers are set to receive a payment of up to 600 in the first quarter of 2023 The Gem State is giving the rebate to anyone who was a state resident

Web 5 mai 2023 nbsp 0183 32 What is House Bill 292 and why is it important House Bill 292 aims to reduce property taxes for all property owners using three methods The first is creating a Web 22 sept 2022 nbsp 0183 32 If you re still waiting for a 300 tax rebate promised by the Idaho Legislature Updated September 05 2023 3 02 PM Canyon County Defeated county

Tax Rebate Idaho September 2023

Tax Rebate Idaho September 2023

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Idaho-2023-Tax-Rebate.jpg?w=1046&h=550&ssl=1

Idaho Income Tax Rebates To Be Available Soon

https://npr.brightspotcdn.com/dims4/default/e79a7e1/2147483647/strip/true/crop/2040x1145+0+0/resize/880x494!/quality/90/?url=http:%2F%2Fnpr-brightspot.s3.amazonaws.com%2F08%2F59%2F085b68c14cdcae5d006ff594a088%2Fidaho-state-income-tax-form-screenshot.png

SC State Tax Rebate 2023 Eligibility And Claiming Process Explained

https://printablerebateform.net/wp-content/uploads/2023/02/SC-State-Tax-Rebate-2023-768x994.png

Web 28 nov 2022 nbsp 0183 32 Idaho lawmakers approved a bill proposed by Idaho Gov Brad Little during a special session in September that would direct 500 million a quarter of the state s 2 billion tax surplus Web 23 ao 251 t 2022 nbsp 0183 32 Most taxpayers can calculate how much their rebate will be by taking 10 of the number that is on line 20 of form 40 Idaho State Tax Commission You can

Web 4 oct 2022 nbsp 0183 32 BOISE Idaho Oct 4 2022 Idahoans who qualify for the 2022 Special Session rebate can now track their payment online at tax idaho gov rebate To get the Web 1 sept 2022 nbsp 0183 32 Proposition 1 also known as the Quality Education Act would raise more than 320 million annually by creating a new income tax bracket for Idaho taxpayers

Download Tax Rebate Idaho September 2023

More picture related to Tax Rebate Idaho September 2023

Carbon Tax Rebates Coming To Provinces That Rejected Federal Plan

https://img.huffingtonpost.com/asset/5cd5713b2000005b009759c6.png?ops=1200_630

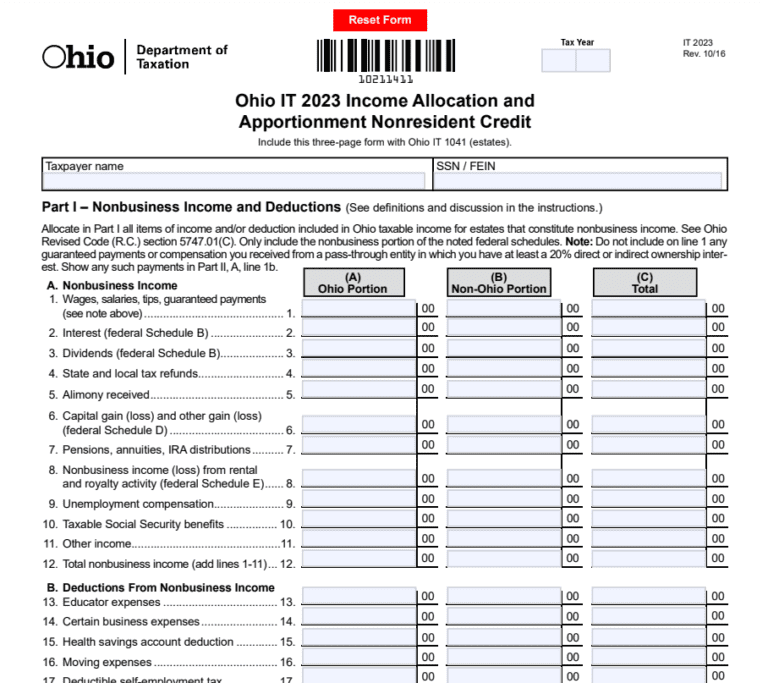

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Ohio-Tax-Rebate-2023-768x683.png

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Minnesota-Tax-Rebate-2023-768x679.png

Web 3 f 233 vr 2022 nbsp 0183 32 The median annual income in Idaho is 55 785 according to data from the U S Census Bureau That income level would see a 328 rebate and about a 113 Web 9 sept 2023 nbsp 0183 32 State stimulus check 2023 update Clarity from the IRS on so called state stimulus checks is essential because millions of taxpayers across the U S have

Web 30 juin 2023 nbsp 0183 32 Idaho is giving eligible taxpayers two rebates in 2022 2022 Special Session rebate On September 1 2022 a Special Session of the Idaho Legislature passed and Web 16 f 233 vr 2023 nbsp 0183 32 Updated February 17 2023 11 11 AM At his 2022 State of the State address Gov Brad Little proposes 1 billion in tax relief over a five year period for Idaho

National Budget Speech 2023 SimplePay Blog

https://www.simplepay.co.za/blog/assets/images/blog-image.png

Montana Tax Rebate 2023 Benefits Eligibility How To Apply

https://printablerebateform.net/wp-content/uploads/2023/04/Montana-Tax-Rebate-2023-768x684.png

https://www.washingtonexaminer.com/news/tax-rebate-idaho-taxpayers...

Web 4 janv 2023 nbsp 0183 32 Idaho t axpayers are set to receive a payment of up to 600 in the first quarter of 2023 The Gem State is giving the rebate to anyone who was a state resident

https://idahofiscal.org/understanding-2023-property-tax-relief

Web 5 mai 2023 nbsp 0183 32 What is House Bill 292 and why is it important House Bill 292 aims to reduce property taxes for all property owners using three methods The first is creating a

Up To 600 Tax Rebates 2023 From 500 Million Pot In Idaho See Who

National Budget Speech 2023 SimplePay Blog

Know New Rebate Under Section 87A Budget 2023

Budget 2023 My Tax Rebate

Most Residential Properties To Incur Higher Tax From Jan 1 2023

Kansas Tax Rebate 2023 Eligibility Application Deadline Printable

Kansas Tax Rebate 2023 Eligibility Application Deadline Printable

Tax Rebate 2022 Residents In Idaho Have Until Dec 31 To Apply To

Govt Increases Income Tax Rebate To 7 Lakh Under New Tax Regime Tax

Alcon Choice Rebate Code 2023 Printable Rebate Form

Tax Rebate Idaho September 2023 - Web 19 avr 2022 nbsp 0183 32 The Tax Commission is issuing rebates to taxpayers in the order it received 2021 income tax returns with about 25 000 going out weekly Taxpayers need to file the