Tax Rebate In Economics Definition The heart of the idea is for the government to reduce consumption of a particular good for example gasoline without hurting the consumer The idea is to tax a good and then turn around and rebate give back all of the

This paper provides an updated overview of tax incentives for business investment It begins by noting that tax competition is likely to be a major force driving countries tax reforms and Tax relief refers to any government program or policy designed to help individuals and businesses reduce their tax burdens or resolve their tax related debts Tax relief may be in the form

Tax Rebate In Economics Definition

Tax Rebate In Economics Definition

https://blog.freetaxfiler.com/wp-content/uploads/2022/09/Tax-Rebate-1.jpg

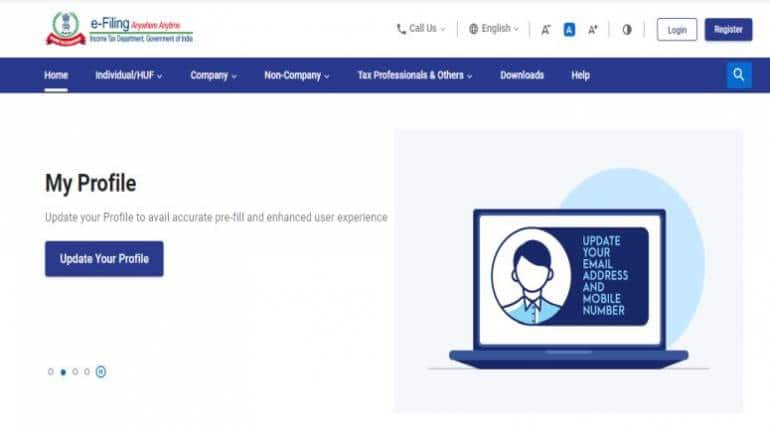

Home Income Tax BD

https://incometaxbd.com/storage/blogs/5533_61b1cfd241e44.png

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

https://i.ytimg.com/vi/IrYTqu6Hohg/maxresdefault.jpg

A subsidy is a direct or indirect payment to individuals or firms usually in the form of a cash payment from the government or a targeted tax cut In economic theory subsidies can be used to Tax rebates are a way for governments to stimulate the economy by getting cash into consumers hands quickly Tax rebates are different from tax refunds as they are issued at any time during the year and

Only one fifth of the survey respondents said that the 2008 tax rebates would lead them to mostly increase spending Most respondents said they would either mostly save the rebate or mostly G7 countries recently agreed on setting a minimum tax for multinational corporations The plan has been described as a historic bid to fix a broken system and help fund the pandemic

Download Tax Rebate In Economics Definition

More picture related to Tax Rebate In Economics Definition

/taxes-word-on-wood-block-on-top-of-coins-stack-869670536-efbe1559282e4a5c87945445dd1b32a3.jpg)

Effective Tax Rate Definition

https://www.investopedia.com/thmb/gYbUOCtBpmIpqEmtj5w7ywsO6uI=/5500x3667/filters:fill(auto,1)/taxes-word-on-wood-block-on-top-of-coins-stack-869670536-efbe1559282e4a5c87945445dd1b32a3.jpg

Here s How To Claim Your Montana Property Tax Rebate

https://townsquare.media/site/1107/files/2023/08/attachment-Tax-Rebate.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

Residents In These States Are Getting Tax Rebate Checks This Month

https://ic-cdn.flipboard.com/cnet.com/79ee5e31415c6256cf8720378c1949abf0506d84/_medium.jpeg

Tax cuts are reductions in taxes paid on income profits sales or assets Obama extended the Bush tax cuts Reagan cut the rates the most From the view of economists a tax is a non penal yet compulsory transfer of resources from the private to the public sector levied on a basis of predetermined criteria and without reference to specific benefits received

An amount of money that is paid back to you if you have paid too much tax More than 2 million taxpayers will receive checks totaling 1 billion because of the federal tax rebate program a Rebate retroactive refund or credit given to a buyer after he has paid the full list price for a product or for a service such as transportation Rebating was a common pricing tactic during

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Rebate Definition Of Rebate YouTube

https://i.ytimg.com/vi/Hk4zfodxV_w/maxresdefault.jpg

https://socialsci.libretexts.org › Bookshel…

The heart of the idea is for the government to reduce consumption of a particular good for example gasoline without hurting the consumer The idea is to tax a good and then turn around and rebate give back all of the

https://www.imf.org › external › pubs › ft › wp

This paper provides an updated overview of tax incentives for business investment It begins by noting that tax competition is likely to be a major force driving countries tax reforms and

Low Income Households Set To Get 150 Council Tax Rebate As Part Of

Income Tax Rebate U s 87A For The Financial Year 2022 23

How To Get Your Tax Back Tax Refund Tax Return Tax Rebate

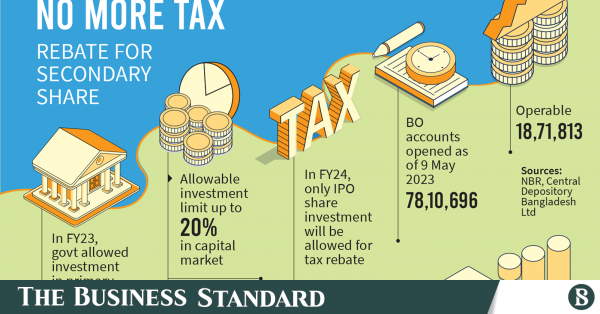

Tax Rebate On Investment In Secondary Stock May Go The Business Standard

Right To A Tax Rebate For Whom Is It Available And How To Use It

Facts About The 150 Council Tax Rebate

Facts About The 150 Council Tax Rebate

What Is A Tax Return Purpose Of A Tax Return Market Business News

Budget Session Tax 5 Tax Rebate Limit 7

Tax Rebate On HRA

Tax Rebate In Economics Definition - A subsidy is a direct or indirect payment to individuals or firms usually in the form of a cash payment from the government or a targeted tax cut In economic theory subsidies can be used to