Tax Rebate On Donation India Web 28 d 233 c 2020 nbsp 0183 32 A donor can claim 50 or 100 amount donated to the charity depending on the institution the donation was made to How much of the amount donated can be claimed as a deduction and whether with

Web 11 juin 2019 nbsp 0183 32 Yes NRI can claim tax deduction for donations made to Indian NGO u s 80G Though the amount deposited should be in INR but some trusts also accept the Web 27 avr 2018 nbsp 0183 32 As per 80G you can deduct your donations to Central and State Relief Funds NGOs and other charitable institutions from your total income to arrive at your

Tax Rebate On Donation India

Tax Rebate On Donation India

https://i.pinimg.com/originals/09/16/c1/0916c1073f539bbd72c3d659172f148b.jpg

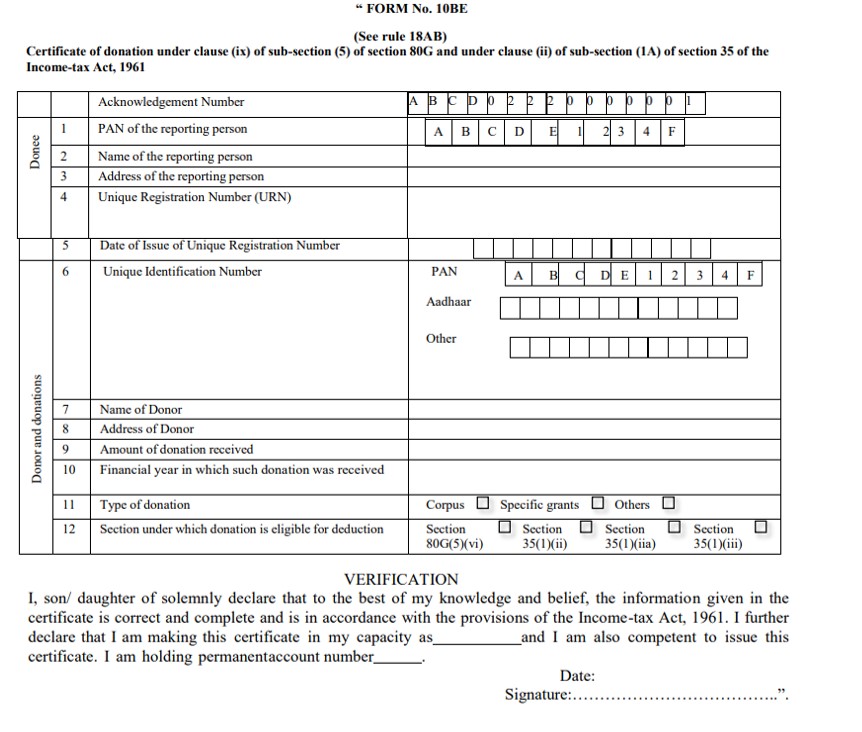

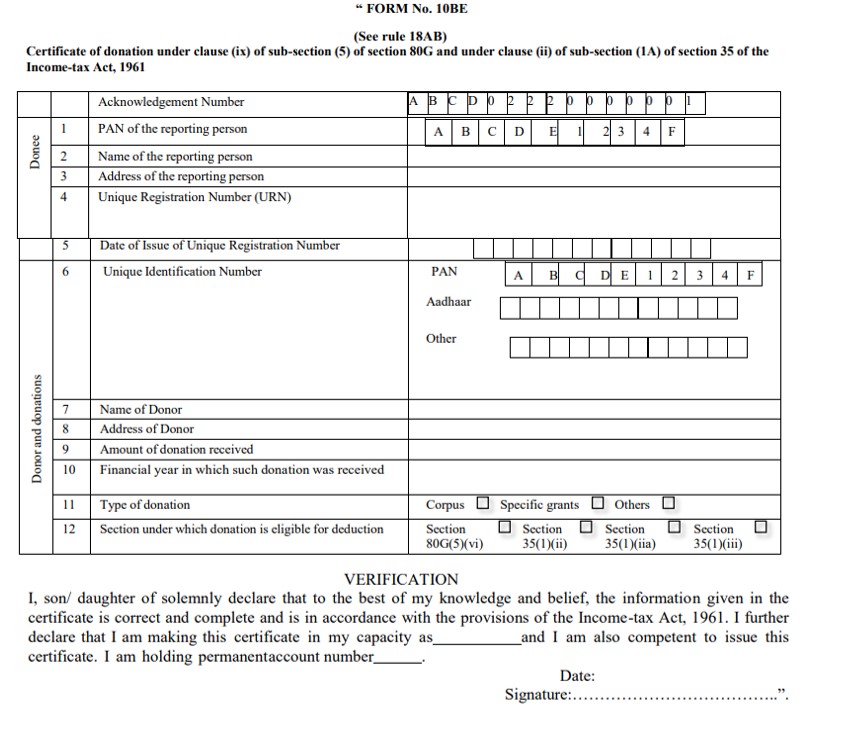

Form 10BD Statement Of Donation FinancePost

https://financepost.in/wp-content/uploads/2022/04/form-10BE.jpg

Trick Of The Trade How Sadhguru s Isha Foundation Evades Paying Taxes

https://gumlet.assettype.com/newslaundry/2021-05/434efef2-e3f8-4f4b-b9dd-3cd8bc514564/donation_receipt.jpg?auto=format%2Ccompress

Web 5 juil 2021 nbsp 0183 32 Donations made to help people tide over the covid 19 pandemic can help you save income tax as well Here is a look at how Section 80G of the Income tax Act Web 16 f 233 vr 2017 nbsp 0183 32 Effective from the assessment year 2018 19 a person can avail a maximum deduction of Rs 2 000 if the donation is made in cash However there is no maximum limit on the deduction amount if the

Web 9 f 233 vr 2023 nbsp 0183 32 Section 80G registration of Income Tax Act 1961 allows a reduction either in the form of deduction or rebate to those individuals who make donation to listed funds Web 23 sept 2021 nbsp 0183 32 i the development of infrastructure for sports and games or ii the sponsorship of sports and games in India How much is the deduction available

Download Tax Rebate On Donation India

More picture related to Tax Rebate On Donation India

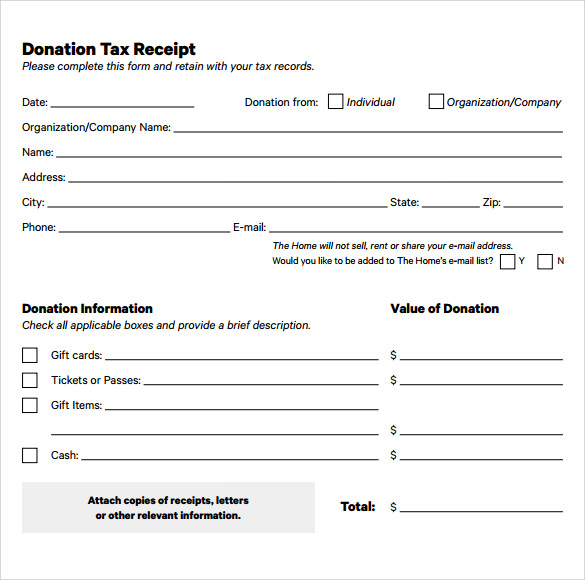

7 Donation Receipt Templates And Their Uses

https://neufutur.com/wp-content/uploads/2018/06/7-Donation-Receipt-Templates-and-Their-Uses-3-1.jpeg

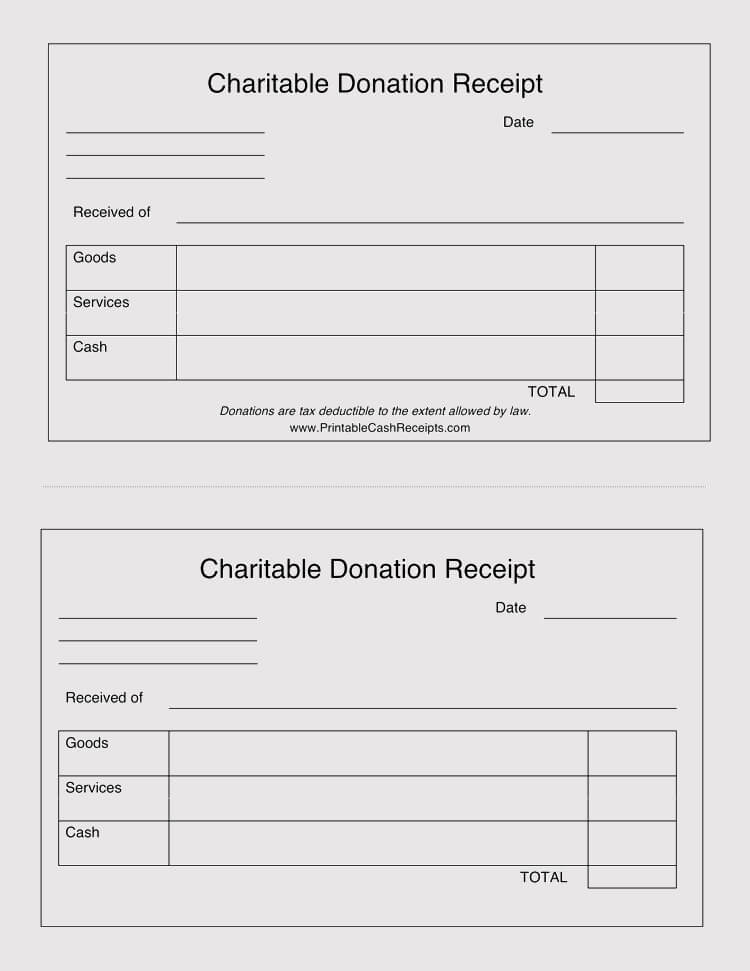

501c3 Donation Receipt Template Addictionary 501c3 Donation Receipt

https://nationalgriefawarenessday.com/wp-content/uploads/2018/01/charitable-donation-receipt-template-donation-receipt-tax-form.jpg

Random Thoughts Does Donating Money Actually Save You More Money From

https://medicine.nus.edu.sg/giving/wp-content/uploads/sites/8/2020/04/Illustration-3-5-1024x558-1.jpg

Web Donations with 50 Deduction Without any qualifying limit Donations made towards trusts like Prime Minister s Drought Relief Fund National Children s Fund Indira Gandhi Web Donations above 500 to Akshaya Patra will be eligible for a 50 deduction from one s taxable income under Section 80G of the Income Tax Act By contributing to Akshaya

Web 26 avr 2023 nbsp 0183 32 The only extra donation methods that qualify for a tax deductible under Section 80GGB are demand draughts cheques and electronic payments Contributions Web Section 80G of the income tax Act allows donations made to specified relief funds and charitable institutions as a deduction from gross total income before arriving at taxable

Tax Rebate For Individual Deductions For Individuals reliefs

https://cdn.techgyd.com/tax-rebate.jpg

Ads responsive txt Goodwill Donation Form For Taxes Fresh Goodwill

https://www.flaminke.com/wp-content/uploads/2018/09/goodwill-donation-form-for-taxes-fresh-goodwill-donation-worksheet-fresh-tax-receipt-for-donations-full-of-goodwill-donation-form-for-taxes-724x1024.jpg

https://serudsindia.org/tax-benefits-charity-in…

Web 28 d 233 c 2020 nbsp 0183 32 A donor can claim 50 or 100 amount donated to the charity depending on the institution the donation was made to How much of the amount donated can be claimed as a deduction and whether with

https://tax2win.in/guide/80g-deduction-donations-to-charitable-institutions

Web 11 juin 2019 nbsp 0183 32 Yes NRI can claim tax deduction for donations made to Indian NGO u s 80G Though the amount deposited should be in INR but some trusts also accept the

Donation Letter For Taxes Template In PDF Word In 2022 Donation

Tax Rebate For Individual Deductions For Individuals reliefs

How To Download BJP Donation Receipt Get Your BJP Donation Receipt In

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

Free Printable Donation Receipt Template Printable Blog

Tax Deduction Rebate On Donation Jan Jagriti Sewa Samiti

Tax Deduction Rebate On Donation Jan Jagriti Sewa Samiti

Tax Deduction Rebate On Donation Jan Jagriti Sewa Samiti

Clothing Donation Form Template Latesttrailersongs

Tax Rebate On Donation India - Web 9 f 233 vr 2023 nbsp 0183 32 Section 80G registration of Income Tax Act 1961 allows a reduction either in the form of deduction or rebate to those individuals who make donation to listed funds