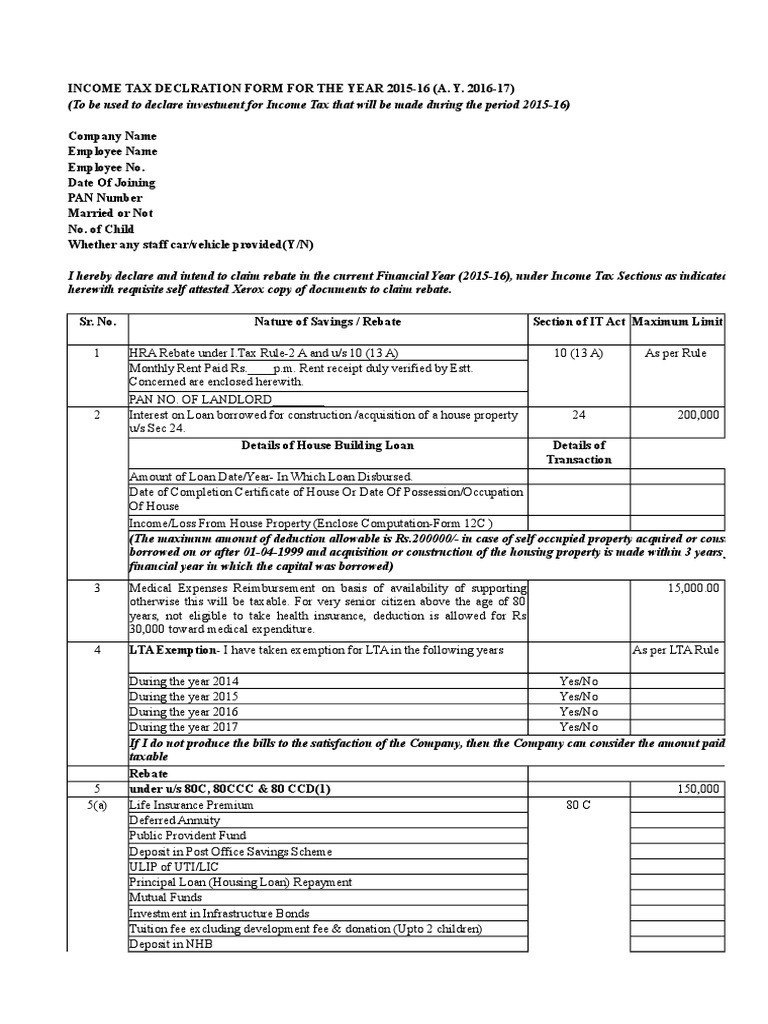

Tax Rebate On Interest Paid On Housing Loan Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section

Web 25 mars 2016 nbsp 0183 32 20 OF TOTAL Rs 56 741 74 Principle and Interest on Home Loan paid during the current financial year in which I got the Web The housing loan EMI consists of principal amount as Rs 1 50 000 deductible under section 80C and interest amount as Rs 2 000 00 deductible under section 24 of the

Tax Rebate On Interest Paid On Housing Loan

Tax Rebate On Interest Paid On Housing Loan

https://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

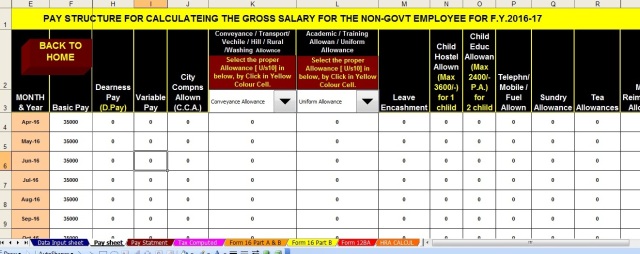

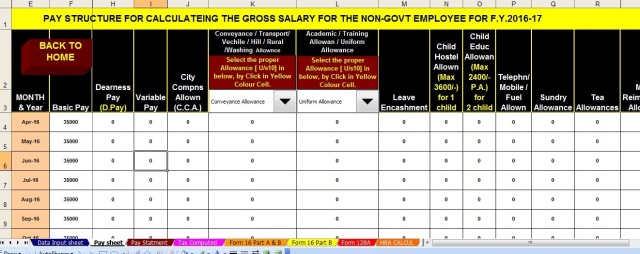

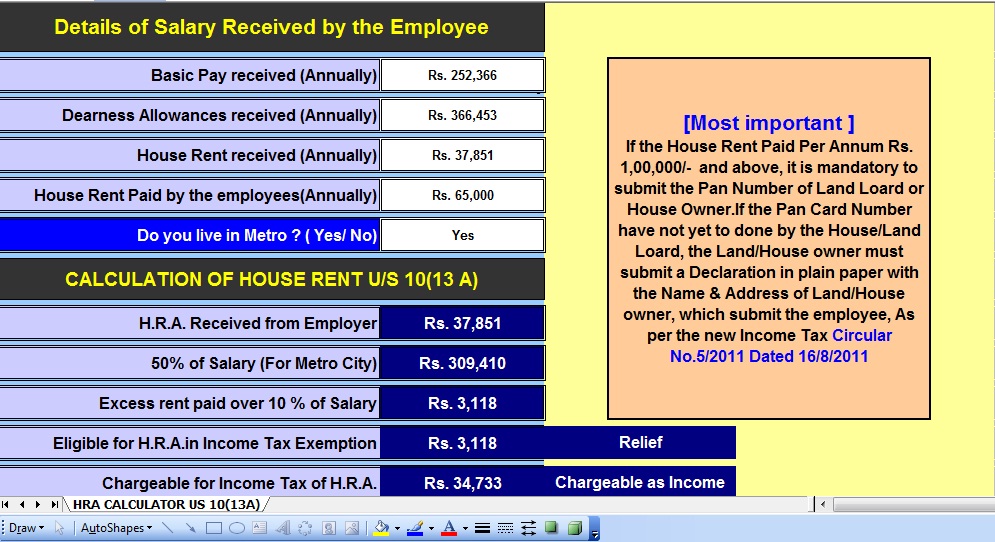

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

https://tdstax.files.wordpress.com/2016/12/599a0-non2bgovt2bemployees.jpg?w=640&h=254

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

https://tdstax.files.wordpress.com/2016/12/8bb32-non2bgovt2bemployees2b2.jpg

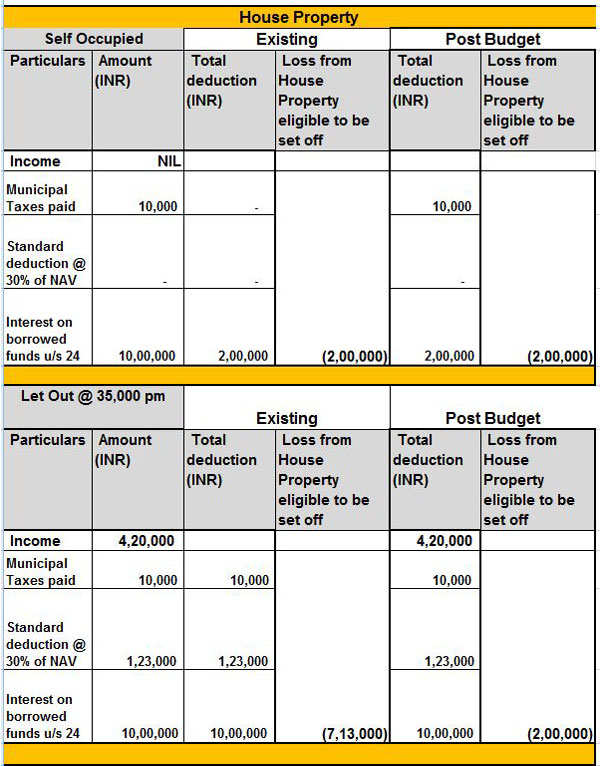

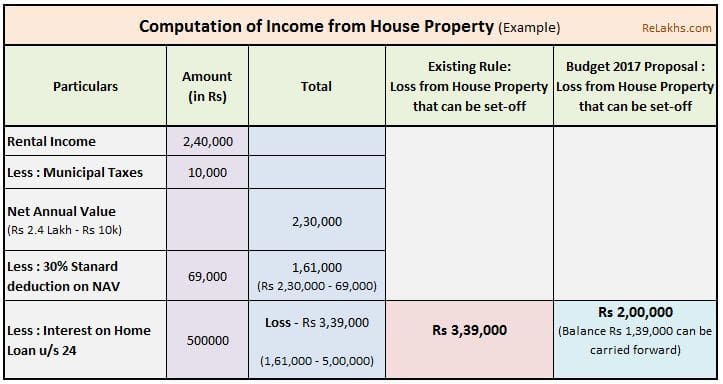

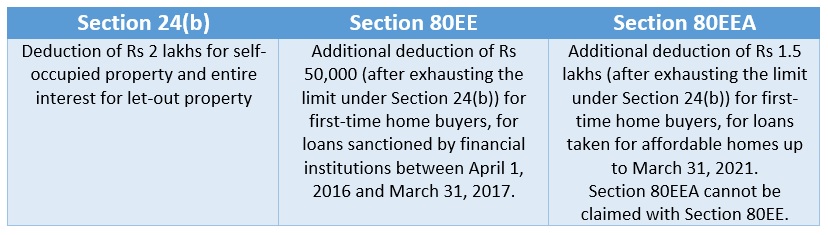

Web You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh Web 13 janv 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can

Web 1 f 233 vr 2021 nbsp 0183 32 The tax benefits for interest payment and principal repayment of home loan can be claimed by both only if they are joint owners as well as a co borrowers servicing Web 26 oct 2021 nbsp 0183 32 One such important deduction available is on interest paid on a home loan taken for a rented out property The rule foregoes tax benefit on a home loan on a self occupied property The tax

Download Tax Rebate On Interest Paid On Housing Loan

More picture related to Tax Rebate On Interest Paid On Housing Loan

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

https://1.bp.blogspot.com/-1hmzbVNZKYo/XSHkKoX1yfI/AAAAAAAAJ48/rH6dqw_ChNcMLHBhRqZVUOtTkyFQPjeOQCLcBGAs/s1600/Picture-4%2Bof%2BArrears%2BRelief%2BCalculator%2B19-20.jpg

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Budget Has Severely Curbed The Tax Benefit On The Interest Paid On

http://img.etimg.com/photo/56914831/house-tax.jpg

Web 4 janv 2023 nbsp 0183 32 A mortgage calculator can help you determine how much interest you paid each month last year You can claim a tax deduction for the interest on the first Web 15 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

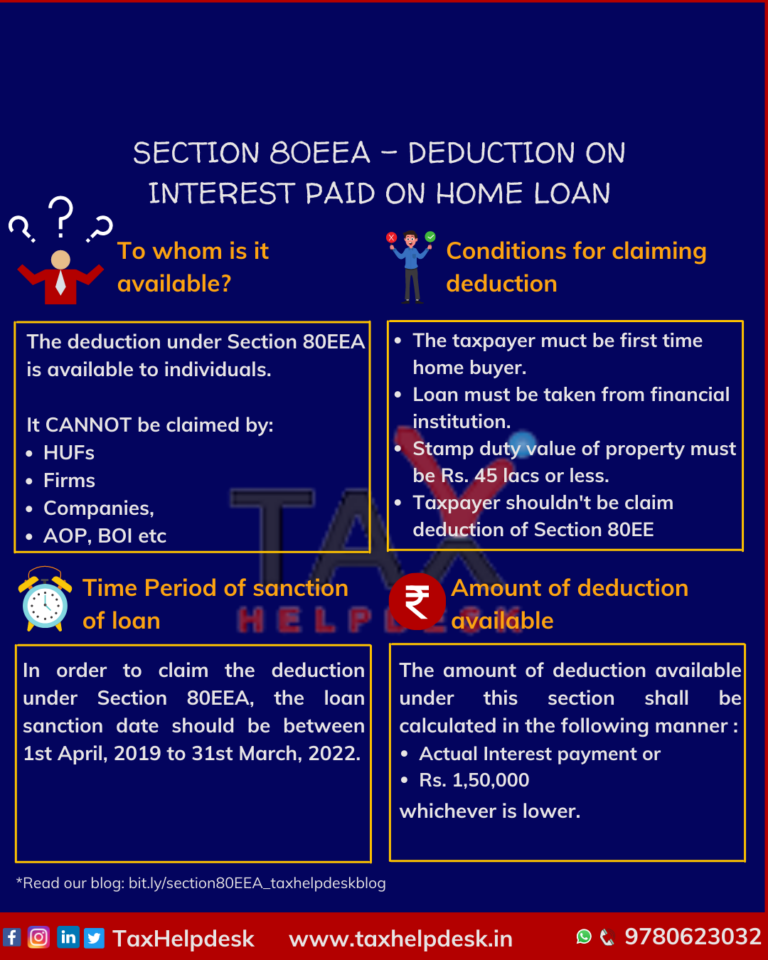

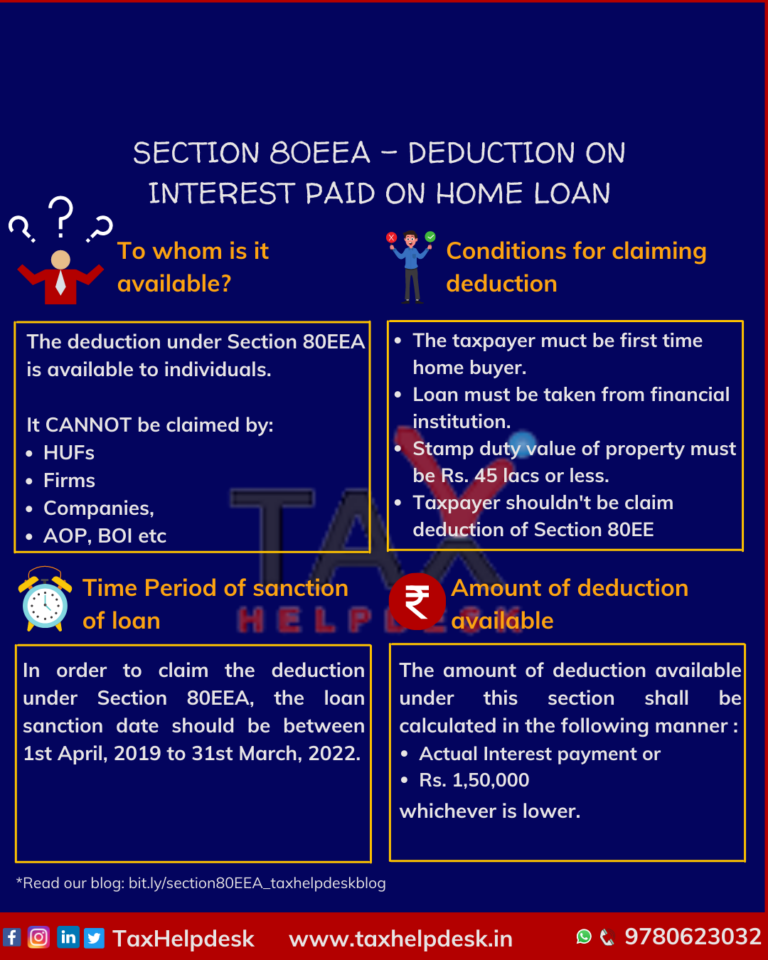

Web 5 sept 2023 nbsp 0183 32 Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get Rs 1 50 lakh income Web However home buyers claim benefits on interest paid even in the pre construction period under special circumstances The Section 80EEA of the Income Tax Act allows you to

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/08/Section-80EEA-Deduction-on-interest-paid-on-home-loan-768x960.png

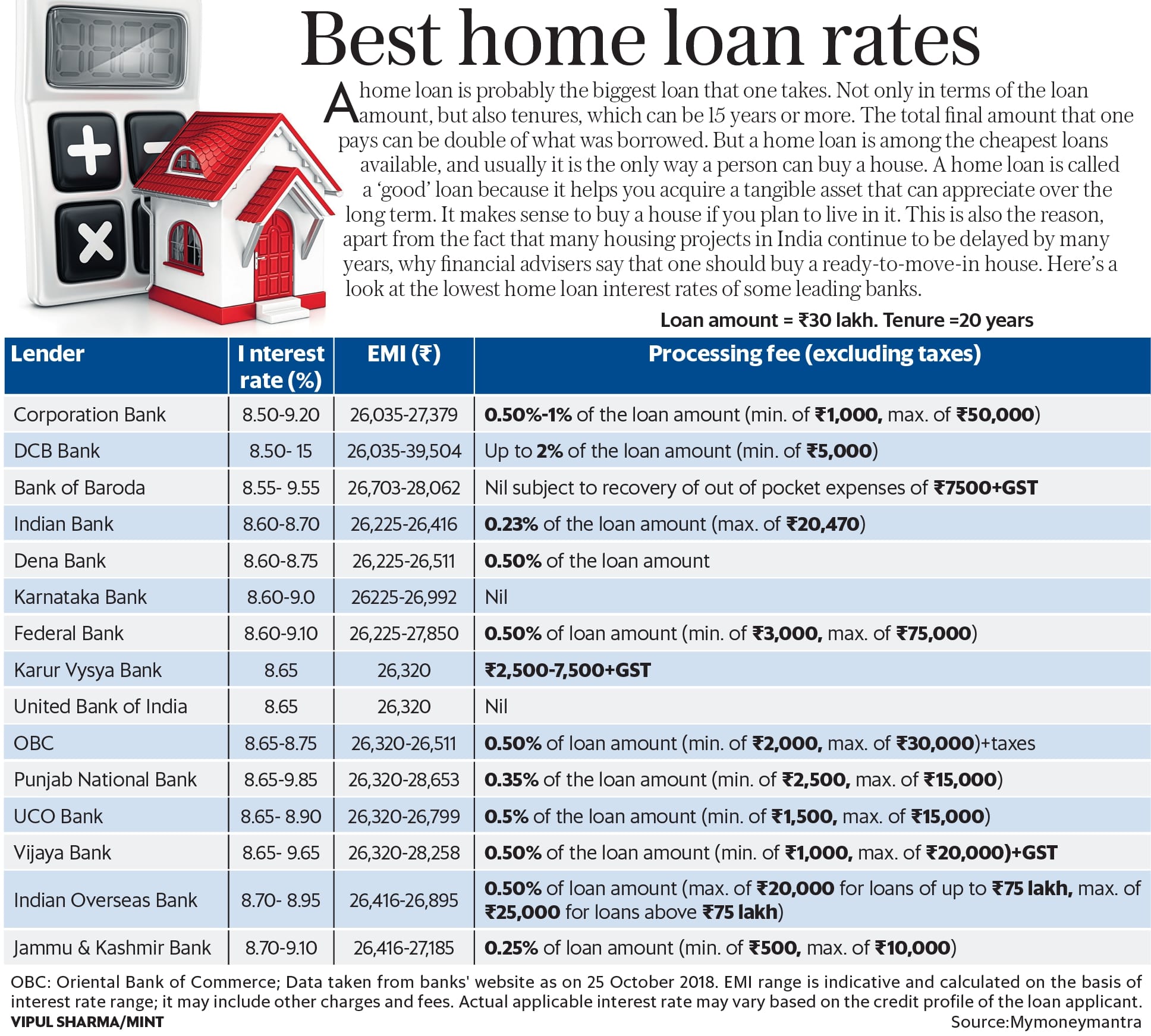

Are Home Loan Interest Rates Going Up Funaya Park

https://i.pinimg.com/originals/b7/04/0f/b7040fce085c54337a780ffde783f042.jpg

https://cleartax.in/s/section-80ee-income-tax-deduction-for-interest...

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section

https://blog.saginfotech.com/tax-benefit-on-h…

Web 25 mars 2016 nbsp 0183 32 20 OF TOTAL Rs 56 741 74 Principle and Interest on Home Loan paid during the current financial year in which I got the

The Best Home Loan Rates Being Offered Right Now Livemint

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable

54 FORM FOR HOME MORTGAGE INTEREST DEDUCTION DEDUCTION HOME MORTGAGE

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Tax Advantages Of Limited Partnerships

Tax Advantages Of Limited Partnerships

Housing Loans Tax Exemption On Interest Paid On Housing Loan

FORM 12C HOUSING LOAN DOWNLOAD

Unemployment Tax Calculator JeremyMaiya

Tax Rebate On Interest Paid On Housing Loan - Web 13 janv 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can