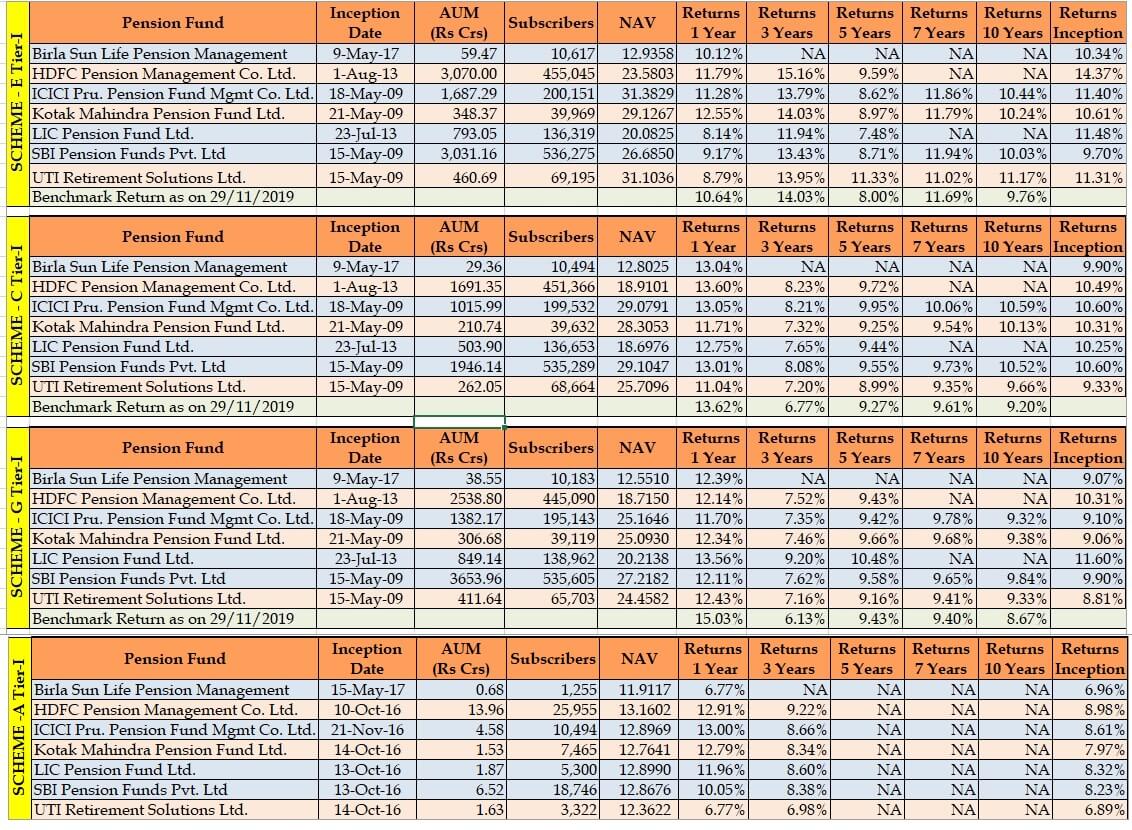

Tax Rebate On Nps Tier 1 Web 6 mars 2023 nbsp 0183 32 You should be aware of the following NPS tier 1 and tier 2 tax benefits while investing Under Section 80CCE all NPS Tier 1 subscribers can claim a deduction of up

Web Under Section 80CCD 1 of the Income Tax Act NPS offers a tax exemption of up to Rs 1 5 lakh In case a company provides an NPS facility the employer s contribution to NPS Web 16 sept 2022 nbsp 0183 32 It is administered by the Pension Fund Regulatory and Development Authority PFRDA NPS Tier 1 accounts are the primary accounts for employees working in the government and private sectors

Tax Rebate On Nps Tier 1

Tax Rebate On Nps Tier 1

https://www.jagoinvestor.com/wp-content/uploads/files/Tax-Benefits-of-contributing-in-NPS.png

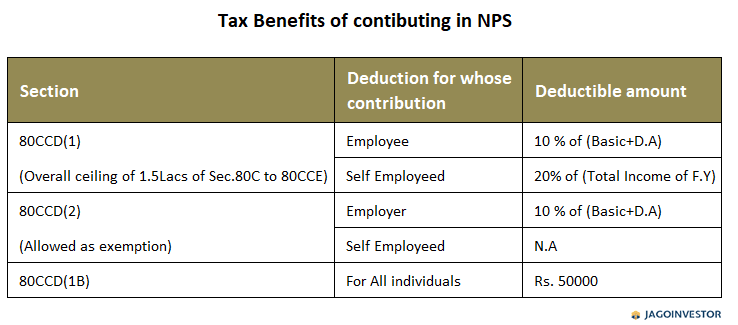

How Much Return Has The NPS Given In Tier 1 In The Last 4 Years Quora

https://qph.fs.quoracdn.net/main-qimg-d8b8a72fa1ad1ae159fbf315ff77b442

Nps returns tier 1 account

https://bemoneyaware.com/wp-content/uploads/2015/05/nps-returns-tier-1-account.jpg

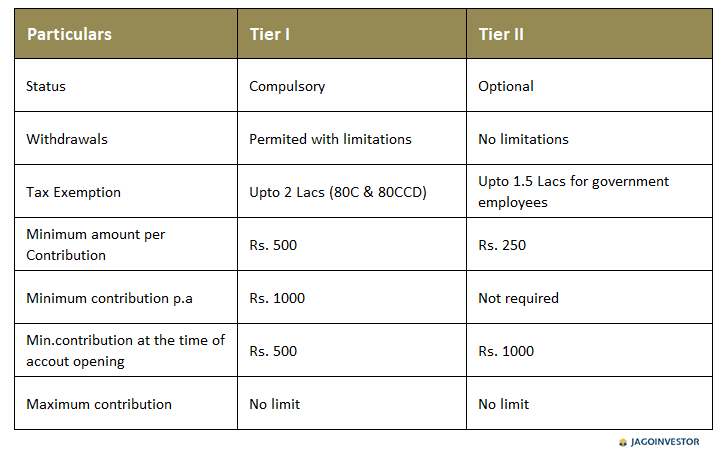

Web What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible Web 7 f 233 vr 2020 nbsp 0183 32 Tax Benefit on NPS Tier 1 and or 2 NPS has two Tiers 1 and 2 NPS Tier 1 is the long term investment which has restricted withdrawals and meant primarily for retirement planning On maturity

Web 6 avr 2023 nbsp 0183 32 In accordance with Section 80C of the Income Tax Act NPS Tier 1 accounts are eligible for a deduction of up to 1 5 lakh from taxable income and an additional deduction of up to Web 22 sept 2022 nbsp 0183 32 NPS Returns Check NPS Return Rate of Tier 1 amp Tier 2 accounts NPS taxation amp comparison of National Pension Scheme NPS return with other pension schemes Skip to the content One time Offer

Download Tax Rebate On Nps Tier 1

More picture related to Tax Rebate On Nps Tier 1

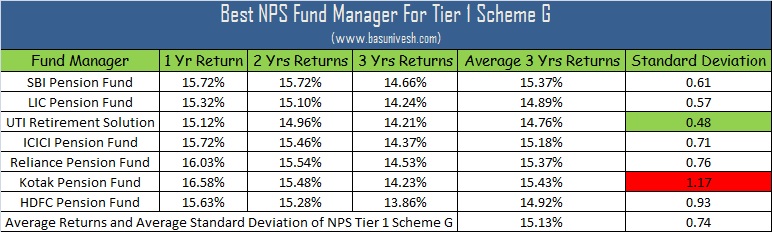

NPS Returns For 2019 Who Is Best NPS Fund Manager

https://www.basunivesh.com/wp-content/uploads/2019/05/NPS-Returns-for-2019-Tier-1-C-Scheme.jpg

Your Employer s Contribution To NPS Can Make A Huge Difference

https://4.bp.blogspot.com/-ARdbRhlLIVQ/WRwDcrdb2HI/AAAAAAAAQrM/V_MeDWhbAvkaflKs7FCZ8-tNMIR3uupFQCLcB/s1600/nps-tier1-tier2-difference.jpg

NPS Returns For 2016 Who Is Best NPS Fund Manager BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2016/10/Best-NPS-Fund-Manager-3.jpg

Web 24 f 233 vr 2020 nbsp 0183 32 NPS Tier 1 Maturity proceeds on Retirement is Tax exempt After attaining 60 years of age you are allowed to withdraw 60 of the total Corpus amount and at least 40 of the accumulated wealth in the NPS Web Also you can withdraw up to 50 of the corpus if you have completed 25 years of service You can claim tax benefits under Section 80 CCD 1 Section 80CCD 1B and Section

Web Taxation Process of Funds in the NPS Tier 1 Account Tax Rebate for Salaried Individuals Salaried individuals can contribute up to 10 of their salary Basic DA to NPS Tier 1 Web 16 mars 2023 nbsp 0183 32 This means you can invest up to Rs 2 lakhs in an NPS Tier 1 account and claim a deduction for the full amount i e Rs 1 50 lakh under Sec 80 CCD 1 and Rs

NPS Returns For 2017 Who Is Best NPS Fund Manager BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2017/05/NPS-Returns-for-2017-Tier-1-Scheme-G.jpg

NPS Calculator Best NPS Fund Manager 2019

https://moneyexcel.com/wp-content/uploads/2019/03/NPS-Funds-Scheme-G-Tier1.png

https://cleartax.in/s/nps-tier-1-vs-nps-tier-2

Web 6 mars 2023 nbsp 0183 32 You should be aware of the following NPS tier 1 and tier 2 tax benefits while investing Under Section 80CCE all NPS Tier 1 subscribers can claim a deduction of up

https://www.hdfcbank.com/personal/resources/learning-centre/invest/how...

Web Under Section 80CCD 1 of the Income Tax Act NPS offers a tax exemption of up to Rs 1 5 lakh In case a company provides an NPS facility the employer s contribution to NPS

NPS Cheers Investors With Double digit Returns In 2020 Should You

NPS Returns For 2017 Who Is Best NPS Fund Manager BasuNivesh

How To Make Online Contributions To NPS Tier I And Tier II Accounts

nps How To Withdrawal NPS 25 Amount To Tier 1 Account Online

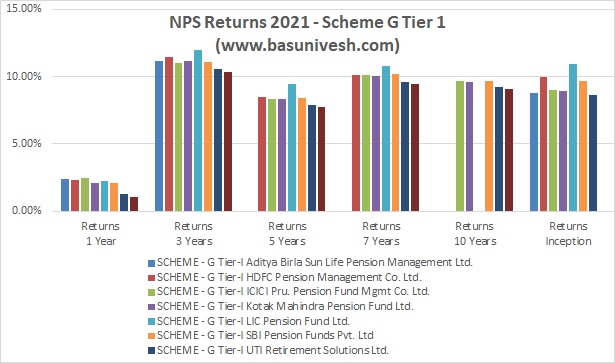

NPS Returns For 2021 Who Is The Best NPS Fund Manager BasuNivesh

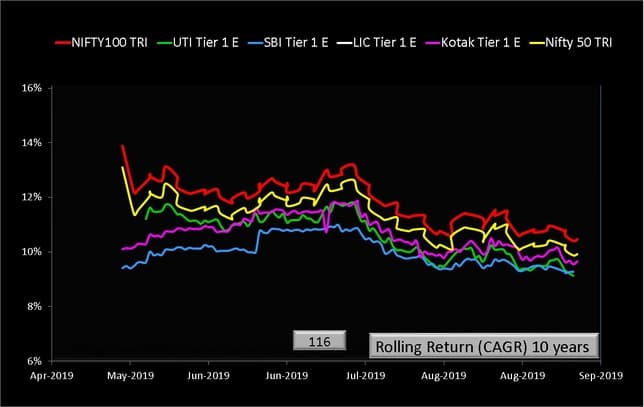

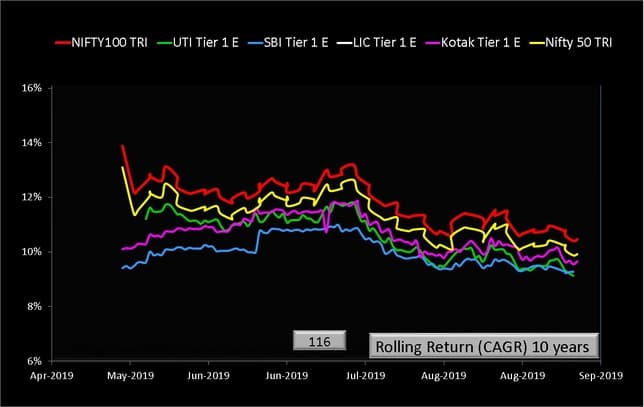

NPS Tier 1 Equity Scheme Performance Vs Nifty 50 And Nifty 100

NPS Tier 1 Equity Scheme Performance Vs Nifty 50 And Nifty 100

Did You Know That You Can Still Save Taxes On NPS Tier 1 In The New Tax

NPS Performance Debt Schemes Give Double digit Returns Equities

NPS National Pension Scheme A Beginners Guide For Rules Benefits

Tax Rebate On Nps Tier 1 - Web What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible