Tax Rebate On Nsc Certificate Web 19 d 233 c 2019 nbsp 0183 32 No Tax deduction at source Certificates can be kept as collateral security to get the loan from banks Investment up to INR 1 50 000 per annum qualifies for IT

Web 19 mai 2022 nbsp 0183 32 19 May 2022 The interest earned or accrued on a National Savings Certificate NSC is taxable For taxation purposes it should be added to the taxable Web 18 juin 2019 nbsp 0183 32 There is no upper limit for investments in the National Saving Certificates but investments of up to Rs 1 5 lakhs in NSC s is liable for

Tax Rebate On Nsc Certificate

Tax Rebate On Nsc Certificate

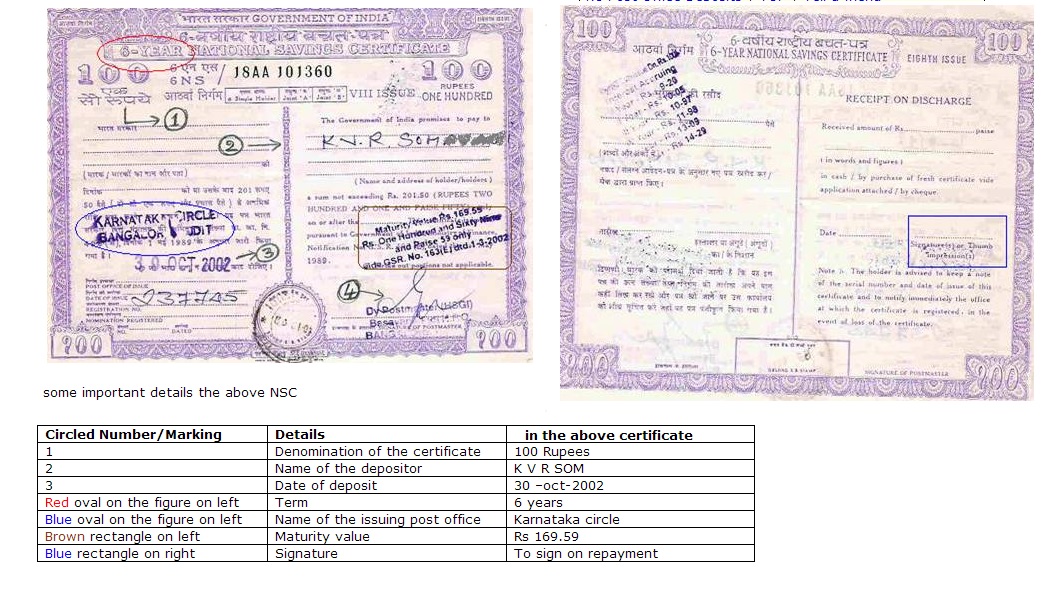

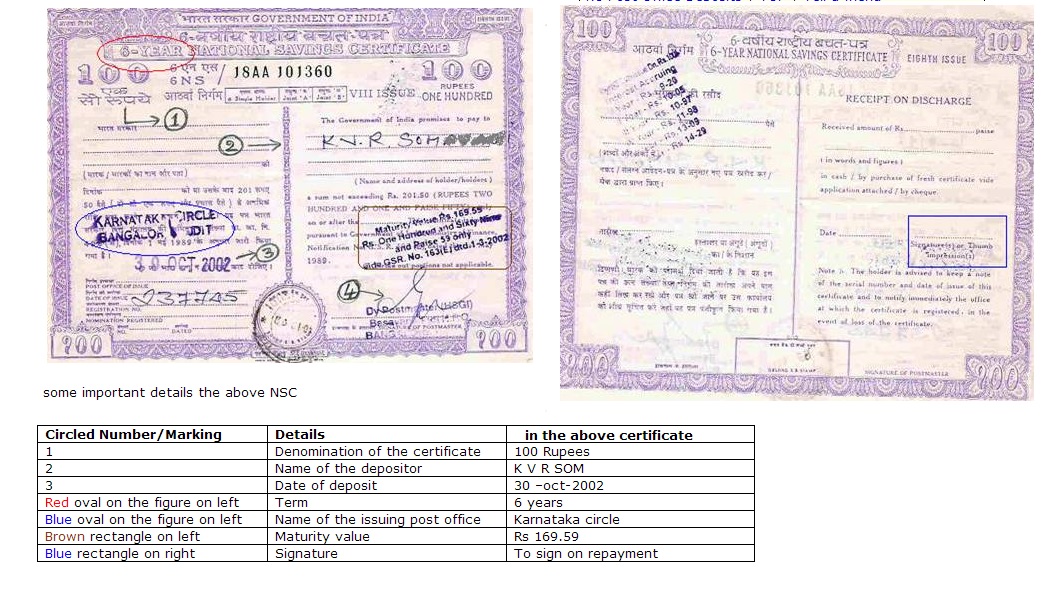

https://image.slidesharecdn.com/cb67cf63-e3c3-4b30-89b6-24b96f6b165c-170122190313/95/nsc-certificatepdf-1-638.jpg?cb=1485111802

National Savings Certificate NSC Benefits Interest Rates And Tax

https://www.wepromote247.com/wp-content/uploads/2020/10/naational-saving-certificate-1024x528.png

NSC Account Yearly Interest Certificate For 80c Rebate YouTube

https://i.ytimg.com/vi/ZQZzPHi90rY/maxresdefault.jpg

Web National Savings Certificate NSC launched to government till encourage people to saves also usage that money for an nations s growth Teaching over NSC Your Rates NSC Web 26 juin 2018 nbsp 0183 32 A Complete Guide to Tax deductions on National Savings Certificate NSC Investments and How to Claim these Deductions In this video we help you understand

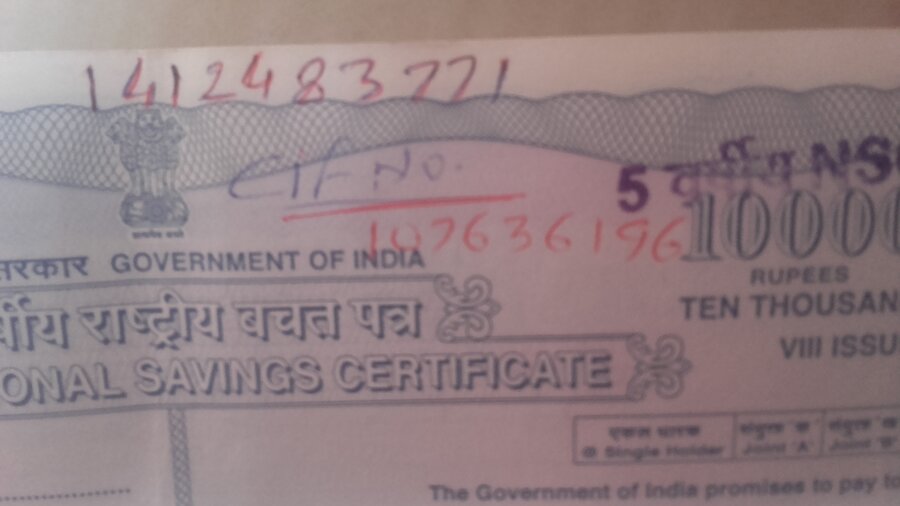

Web 9 mars 2023 nbsp 0183 32 What is NSC NSC National Savings Certificate is a savings scheme that primarily encourages small to mid income investors to invest along with availing tax Web 27 d 233 c 2017 nbsp 0183 32 Tax Benefits under NSC Tax Deduction on Investment Tax Free Interest TDS Free Types of National Saving Certificates 1 Single Holder Type Certificate 2 Joint A Type Certificate 3 Joint B Type

Download Tax Rebate On Nsc Certificate

More picture related to Tax Rebate On Nsc Certificate

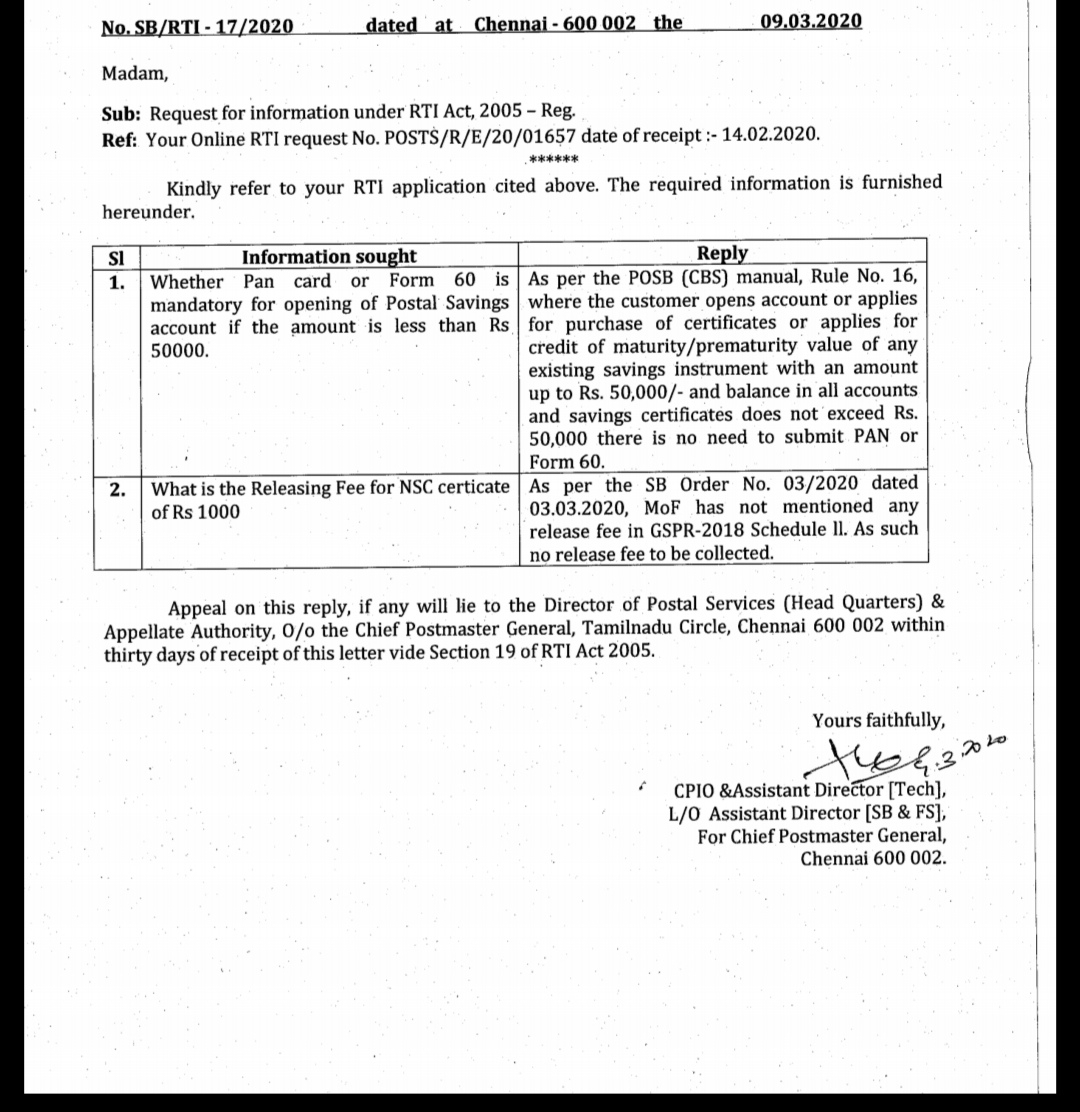

RTI Reply Regarding Releasing Fee For NSC Certificates And Submission

https://1.bp.blogspot.com/-if0I7usaM-o/Xmke6_6vjSI/AAAAAAAAOtM/eP1jQx8PIX8tF7rCZWo0OMZynNzz2XO_gCLcBGAsYHQ/s1600/RTI%2BReply%2BRegarding%2BReleasing%2BFee%2BFor%2BNSC%2BCertificates%2BAnd%2BSubmission%2BOf%2BPAN%2BCard.jpg

National Saving Certificate NSC Tax India

https://1.bp.blogspot.com/-PR4G_KF3CgI/UhWpARwn8AI/AAAAAAAAADo/HZx1n34vgPI/s1600/NSC.jpg

Why NSC Remains The Best Bet For Investors The New Indian Express

http://images.newindianexpress.com/uploads/user/imagelibrary/2018/1/15/w600X300/Why.jpg

Web 22 sept 2022 nbsp 0183 32 Investors can enjoy several tax benefits on the investment amount and the interest earned under Section 80C of the Income Tax Act 1961 Read on to learn more 1 Historical Data of NSC Interest Rate Web 24 ao 251 t 2021 nbsp 0183 32 Tax Implications The sum invested in the NSC is eligible for tax deduction under Section 80C up to the Rs 1 5 lakh limit stipulated in a financial year including the

Web 26 sept 2022 nbsp 0183 32 1 Is the interest rate on NSC fixed 2 Where can I register for NSC 3 What is the lock in period for NSC 4 What is the minimum investment required in NSC 5 What is the maximum investment that Web 11 juil 2022 nbsp 0183 32 Post Office NSC Scheme 2022 details amp tax benefits How to get 5 year tax rebate on NSC Investment BiRaJ Ki BaAtEiN 99 7K subscribers Subscribe 181

National Saving Certificates NSC Eligibility Types Interest

https://allbankingalerts.com/wp-content/uploads/2019/01/Post-Office-NSC-Eligibility-Investment-Tax-Rebate-Features.jpg

Turn Rs 50 000 Into Rs 73 126 With New National Savings Certificate

https://www.financialexpress.com/wp-content/uploads/2019/12/nsc.jpg

https://taxguru.in/income-tax/nsc-tax-benefit.html

Web 19 d 233 c 2019 nbsp 0183 32 No Tax deduction at source Certificates can be kept as collateral security to get the loan from banks Investment up to INR 1 50 000 per annum qualifies for IT

https://www.valueresearchonline.com/stories/50859/what-is-the-tax...

Web 19 mai 2022 nbsp 0183 32 19 May 2022 The interest earned or accrued on a National Savings Certificate NSC is taxable For taxation purposes it should be added to the taxable

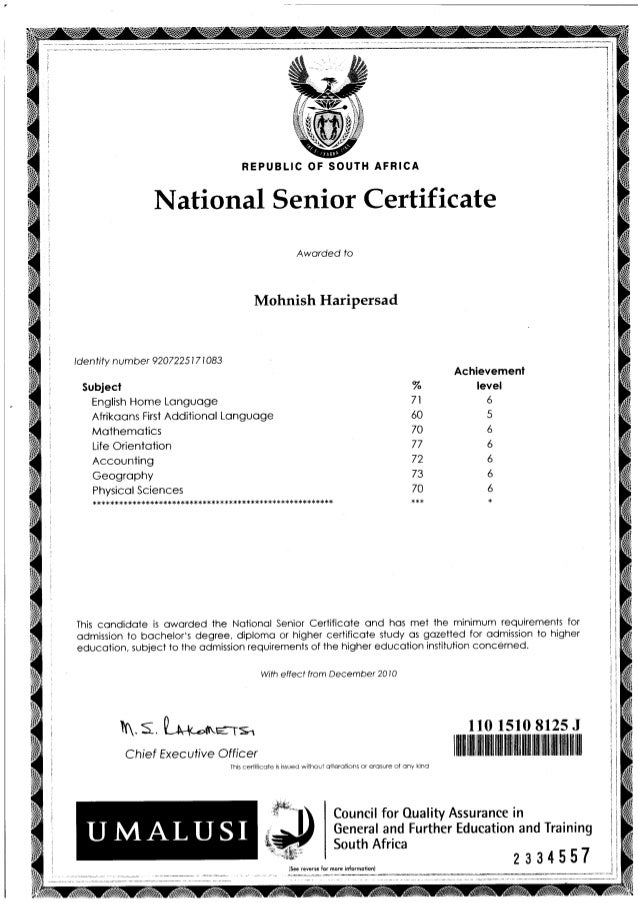

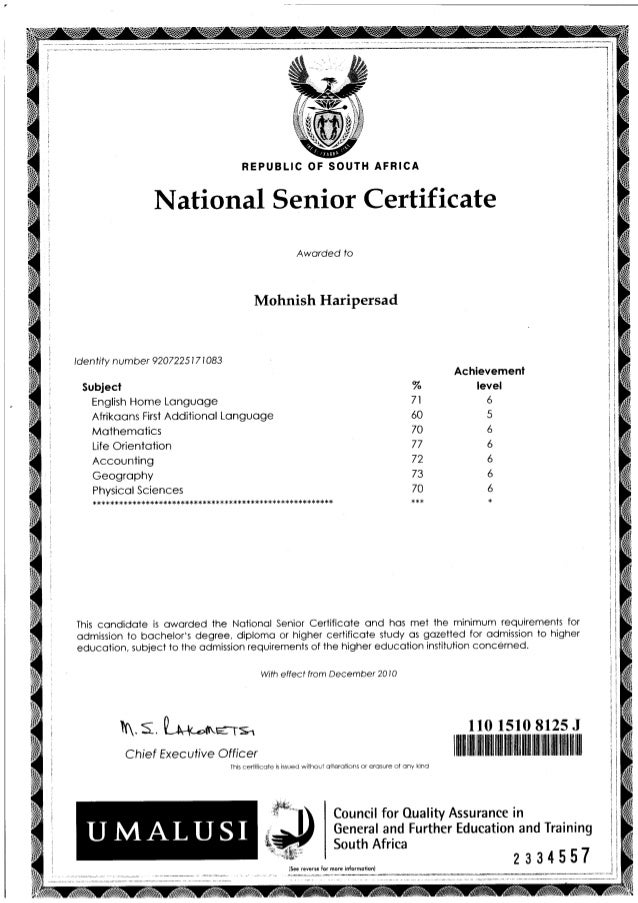

CERTIFIED NSC

National Saving Certificates NSC Eligibility Types Interest

National Savings Certificate NSC Procedure For Applying NSC In India

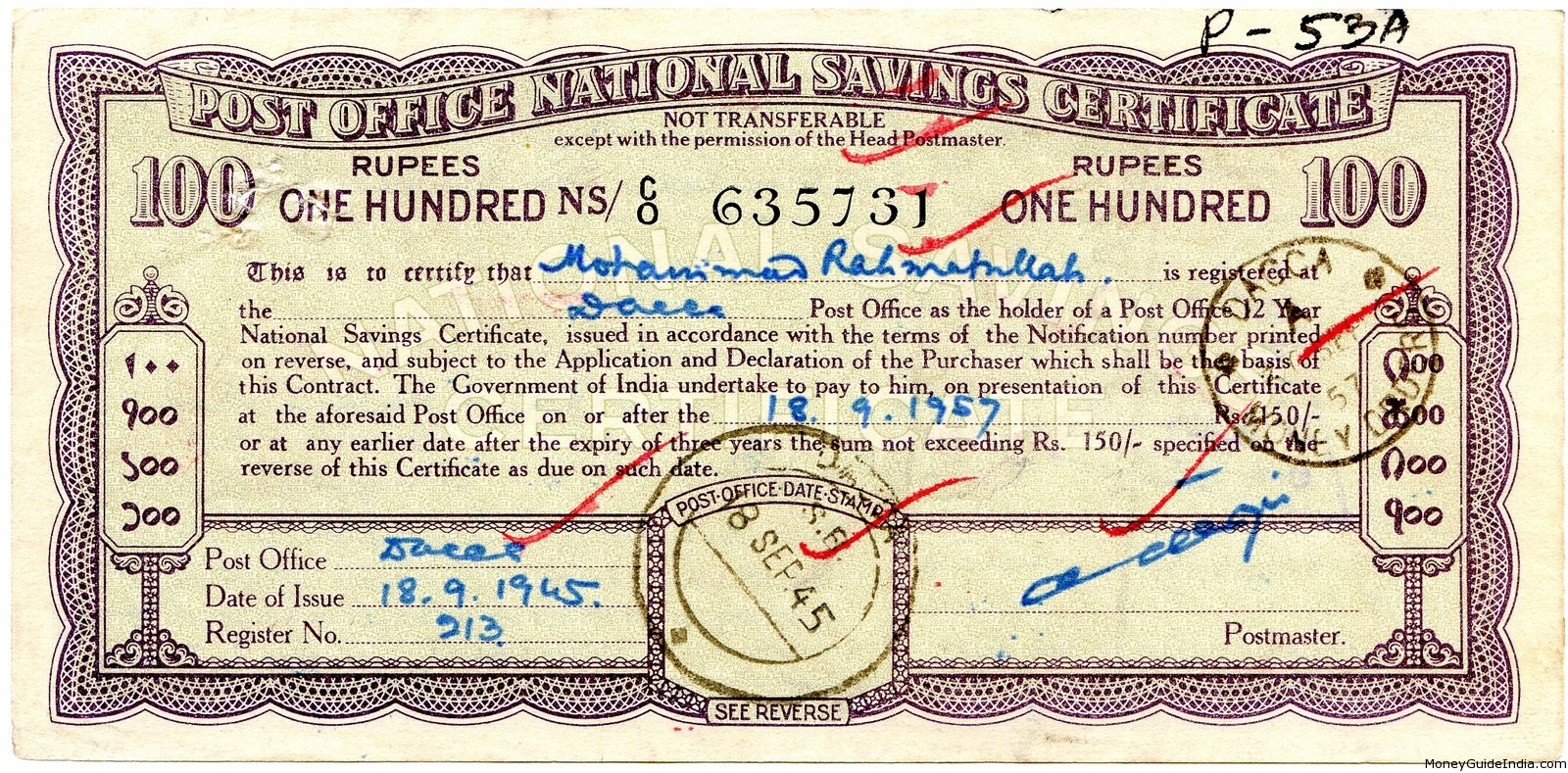

Nsc

National Savings Certificate NSC What How Tax Interest Benefit Tax2win

What Are Post Office NSC Or National Savings Certificate

What Are Post Office NSC Or National Savings Certificate

How To Buy An NSC Online LenDenClub

Indian Post Office About Nsc Certificate

National Saving Certificate Reviews File A Complaint Customer

Tax Rebate On Nsc Certificate - Web National Savings Certificate NSC launched to government till encourage people to saves also usage that money for an nations s growth Teaching over NSC Your Rates NSC