Tax Rebate On Two Home Loans Web 21 mars 2021 nbsp 0183 32 Whether you have one home loan or more the deduction allowable under Section 80 C for repayment of home loan is restricted

Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result Web You can claim deduction for interest payable on a loan taken for purchase construction repair or renovation of any property whether commercial or residential under Section 24 b This deduction on interest payment is

Tax Rebate On Two Home Loans

Tax Rebate On Two Home Loans

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Income Tax Rebate On Home Loan Fy 2019 20 A design system

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

How To Get A Second Home Loan For Rental Income

https://www.comparepolicy.com/blogs/wp-content/uploads/2018/01/Home-Loan-Benefits.png

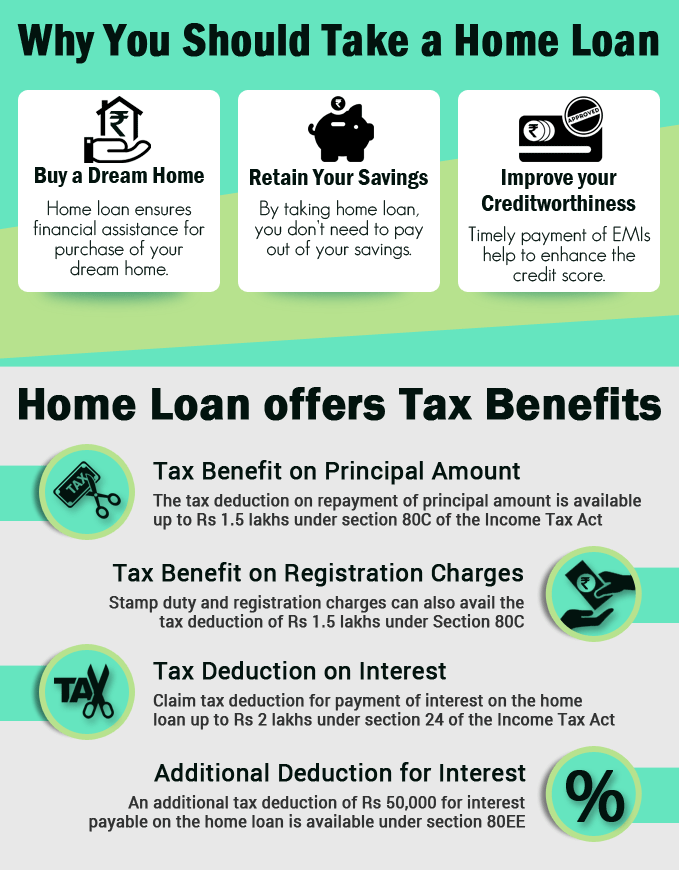

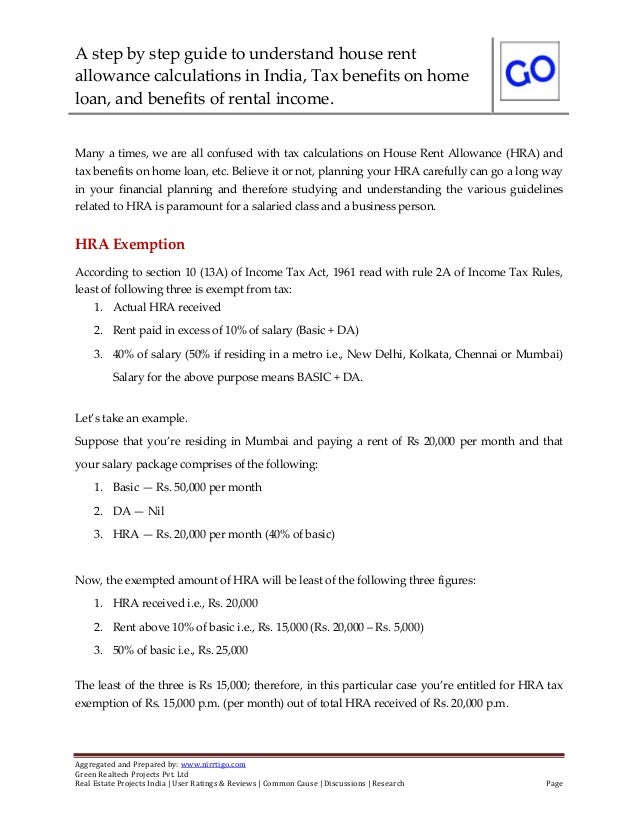

Web 11 janv 2023 nbsp 0183 32 Yes you claim deductions on two home loans within the specific limit under Section 24 Rs 2 lakhs per annum if the properties are self occupied Only for your first home you can claim benefits under either under Section 80EE or 80EEA For your second home no deduction is available on the principal payment Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan amount repayment you may claim tax benefit on stamp duty

Web 24 d 233 c 2019 nbsp 0183 32 Yes it is possible to get tax benefit on the second home loan in the same financial year The tax benefit on two home loans taken for the purchase of two self occupied properties can be claimed under Web 13 janv 2021 nbsp 0183 32 Under Section 24B of the Income Tax I T Act you can claim deduction for interest payable on a loan repair renovation or construction But if you own only one house which is self occupied the

Download Tax Rebate On Two Home Loans

More picture related to Tax Rebate On Two Home Loans

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

https://i.pinimg.com/originals/07/68/e8/0768e843fce468a6a866abfdec4820d1.jpg

How To Calculate Tax Rebate On Home Loan Grizzbye

https://i.pinimg.com/originals/d6/36/61/d63661b5b0c87074392f22a20217bd58.jpg

Web 21 d 233 c 2022 nbsp 0183 32 You can apply for a tax rebate on Home Loan repayment That is why people prefer home loans for purchasing or renovating their houses Since this is a long term commitment borrowers sometimes Web You can deduct a typical 30 percent interest on a home loan and municipal taxes from that You can deduct up to Rs 2 lakhs from your other sources of income Home Loan Eligibility Calculator Home First Finance Company Watch on Tax Benefits for Second Home Loan Those who own two homes are eligible for a bevy of tax breaks

Web 24 janv 2022 nbsp 0183 32 If you want to understand how to get tax benefits on a second home loan you need to be aware of the deductions available u s 80C of Income Tax Act Under this section one can claim a deduction of up to Rs 1 5 lakh on principal repayment Note that income tax benefit on a 2nd home loan will be available up to this limit only Web 9 janv 2021 nbsp 0183 32 From FY 19 20 onwards in the Finance Act 2019 government has allowed a major relief u s 23 and 24 of the Income Tax Act 1961 by allowing the taxpayers to declare in their tax return the value of their Two houses as self occupied on a NIL basis

What Does Rebate Lost Mean On Student Loans

https://studentloanhero.com/wp-content/uploads/f21d66bc-bb4b-4eb4-8ba2-066e3aa6040a_pasted20image200.png

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

https://www.livemint.com/money/personal-fina…

Web 21 mars 2021 nbsp 0183 32 Whether you have one home loan or more the deduction allowable under Section 80 C for repayment of home loan is restricted

https://www.icicibank.com/blogs/home-loan/t…

Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result

Illinois Tax Rebate Tracker Rebate2022

What Does Rebate Lost Mean On Student Loans

What Are The Best Ways To Manage Tax Rebates

Realtors Seek Tax Rebate On House Loans

How To Calculate Tax Rebate On Home Loan Grizzbye

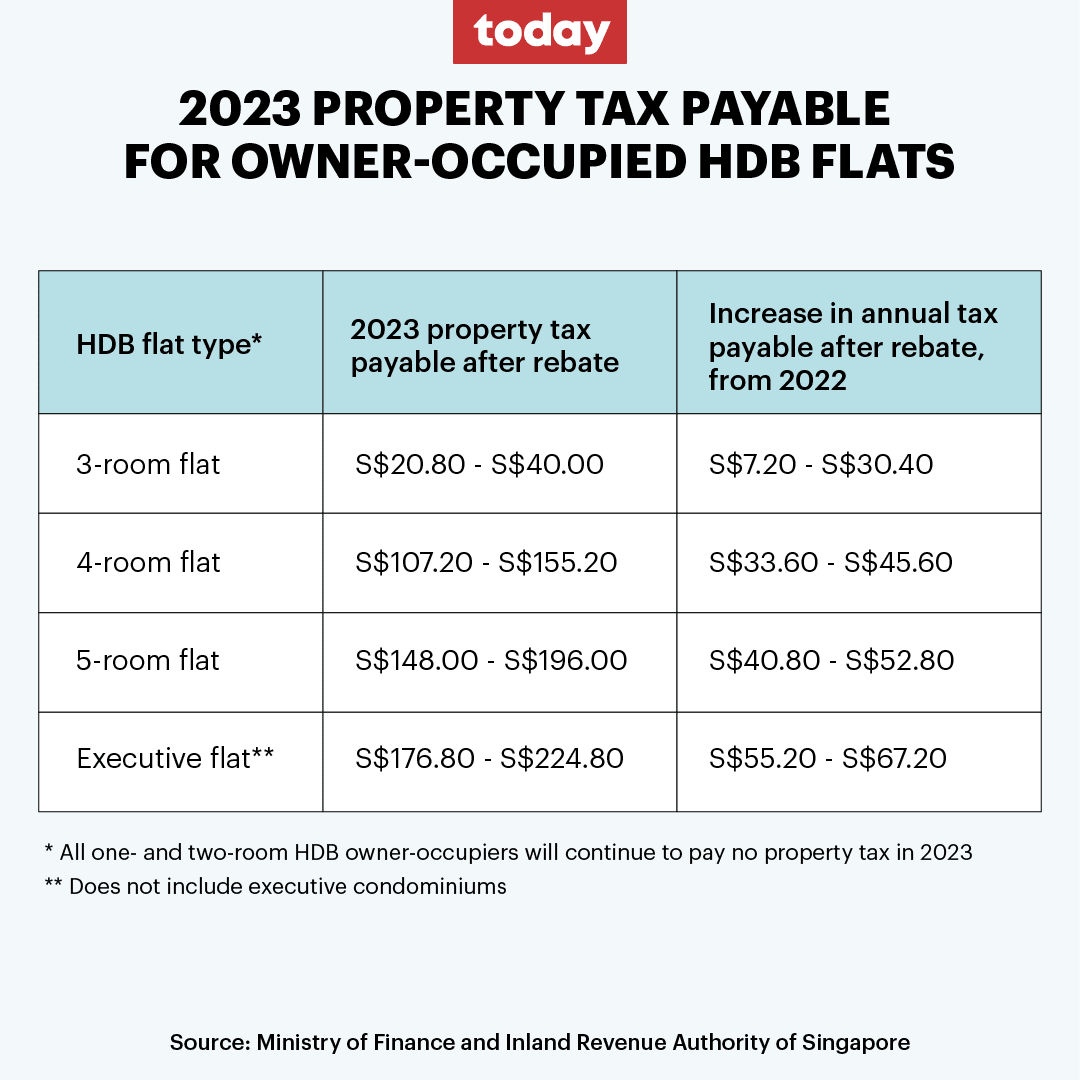

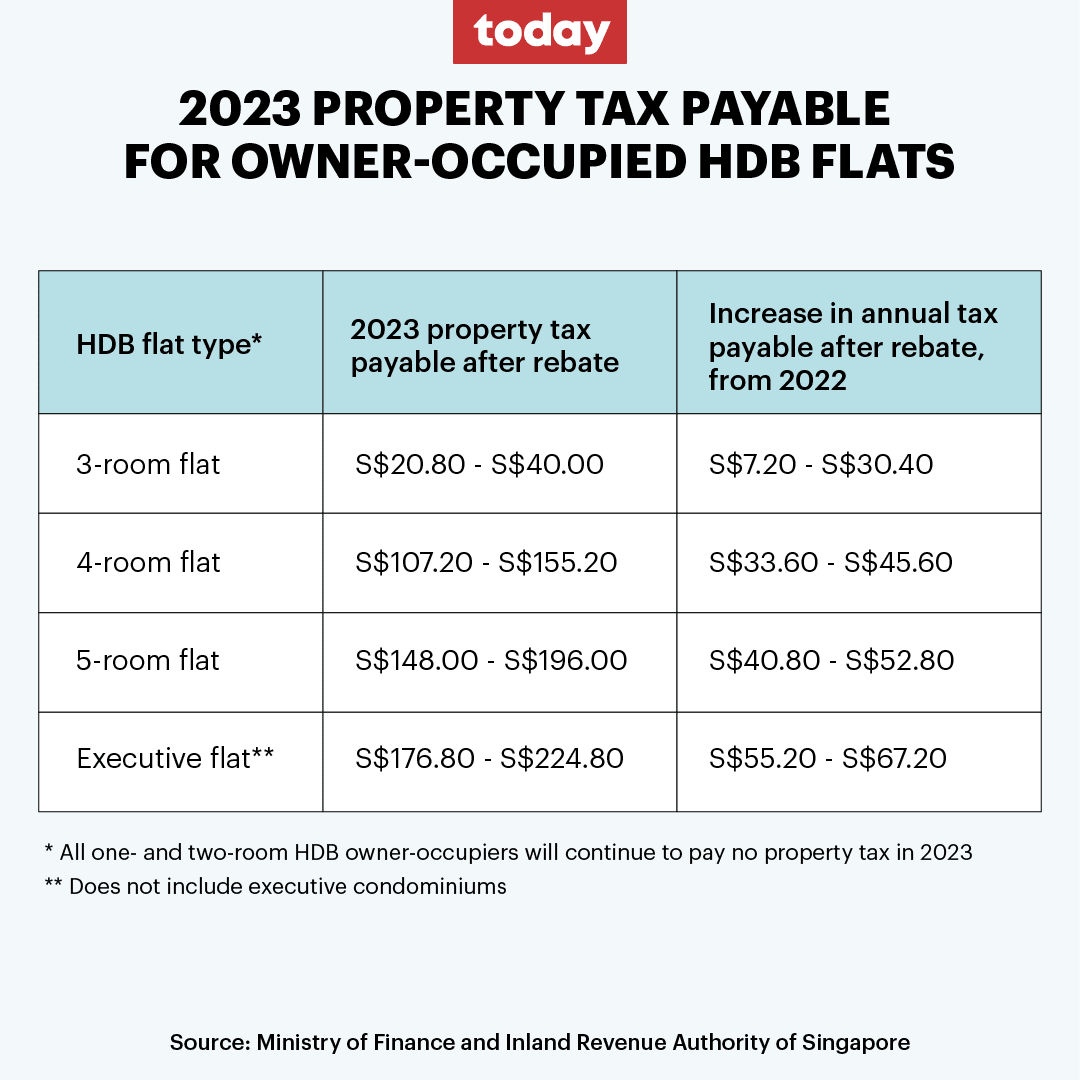

Most Residential Properties To Incur Higher Tax From Jan 1 2023

Most Residential Properties To Incur Higher Tax From Jan 1 2023

Microfinance Loan Application Form

Home Loan Tax Benefits In India Important Facts

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Tax Rebate On Two Home Loans - Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750 000 For taxpayers who use married filing separate status the