Tax Rebate Rules In Bangladesh What is the tax rebate As per section 44 2 b of the Income Tax Ordinance 1984 an individual taxpayer will get tax rebate at 15 on investment allowance Now your tax rebate will be BDT 28 620 BDT 190 800X15

We are pleased to present our latest and completely revamped iteration of our tax publication Bangladesh Tax Updated to Finance Act 2024 curated for the guidance of our esteemed Anyone looking to maximum tax rebate must thus follow the new rules before June 30th However the act is yet to be finally approved by the parliament The new income

Tax Rebate Rules In Bangladesh

Tax Rebate Rules In Bangladesh

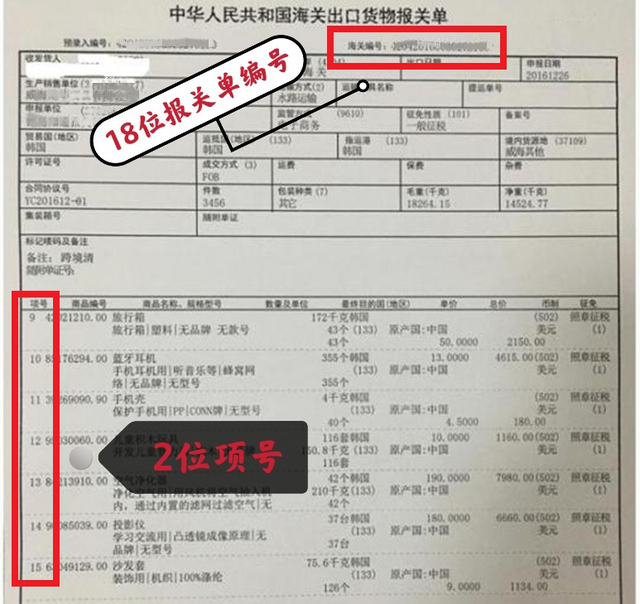

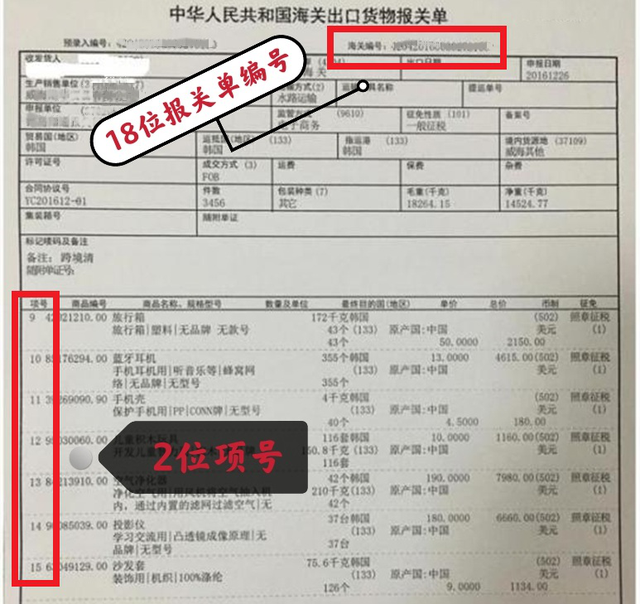

https://biz-crm-waimao.su.bcebos.com/biz-crm-waimao/maichongxing/history/online/article/img/2022/03/04/ed48dca63fc2071ade374ec822b7aafd62d25fba.png

Personality Development Bangladesh

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100063954886671

Migrant Workers Flee Dhaka As Bangladesh Tightens Coronavirus Lockdown

https://img.i-scmp.com/cdn-cgi/image/fit=contain,width=1098,format=auto/sites/default/files/styles/1200x800/public/d8/images/methode/2021/06/28/9377f6e2-d78d-11eb-8921-c363d46ef7af_image_hires_113258.jpg?itok=Hl7a9cfi&v=1624851186

This article provides a detailed guide on how to adjust tax rebates according to the Bangladesh Tax Law of 2023 and the amendments of 2024 along with practical suggestions Government has encouraged taxpayers to invest money and get tax rebate And therefore specified the areas where you could invest for tax rebate From this article we will know where to invest or donate money for

Easily calculate your tax rebate amount on your income Use our online income tax rebate calculator bd tool and get accurate tax amounts Also know about tax rebate rate in 25 tax and additional 10 tax penalty will be payable on the investment amount and No question on the sources of fund invested in securities Investments should be made between 1

Download Tax Rebate Rules In Bangladesh

More picture related to Tax Rebate Rules In Bangladesh

How To Calculate Tax Rebate In Income Tax Of Bangladesh

http://www.jasimrasel.com/wp-content/uploads/2017/08/Calculate-tax-rebate-1024x768.jpg

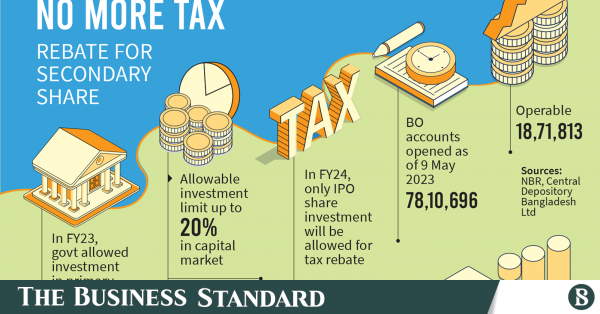

Tax Rebate On Investment In Secondary Stock May Go The Business Standard

https://www.tbsnews.net/sites/default/files/styles/social_share/public/images/2023/05/10/p1_infograph_no-more-tax-rebate-for-secondary-share.png

Tax Rebate Lanka Bangla Asset Management Company Limited

https://lbamcl.com/tax-rebate/wp-content/uploads/2022/06/Untitled-1.png

This Handbook incorporates many of the important provisions of the Income Tax Ordinance 1984 as amended up to the Finance Act 2023 and major changes brought in by the Finance Act 2023 in respect of the Value Added Tax and Basis of Taxation Bangladeshi resident and non resident corporations are subject to tax on their taxable income Tax Losses Tax losses can be carried forward for a maximum period of six

Our Bangladesh Income Tax Calculator for the fiscal year 2024 2025 provides an easy and accurate way to estimate your tax liabilities With the changing tax rules and slabs for Tax exemptions provided by the National Board of Revenue NBR are estimated to rise to Tk 163 000 crore in fiscal 2024 25 as the tax administration looks to ease the pressure

Where To Invest For Tax Rebate In Bangladesh L Learn Everything L

https://i.ytimg.com/vi/dyGNwExk4TU/maxresdefault.jpg

Bangladesh Income Tax Tax Rebate On Investment

https://i.ytimg.com/vi/6TWrWMLs4es/maxresdefault.jpg

https://www.jasimrasel.com › calculate-t…

What is the tax rebate As per section 44 2 b of the Income Tax Ordinance 1984 an individual taxpayer will get tax rebate at 15 on investment allowance Now your tax rebate will be BDT 28 620 BDT 190 800X15

https://kpmg.com › bd › en › home › insights

We are pleased to present our latest and completely revamped iteration of our tax publication Bangladesh Tax Updated to Finance Act 2024 curated for the guidance of our esteemed

Grace Day Bangladesh Dhaka

Where To Invest For Tax Rebate In Bangladesh L Learn Everything L

Military Journal Ri Child Tax Rebate Child Tax Credits Are One Of

Bangladesh Flag Clipart Vector Bangladesh National Flag Waving Ribbon

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

Traderider Rebate Program Verify Trade ID

Traderider Rebate Program Verify Trade ID

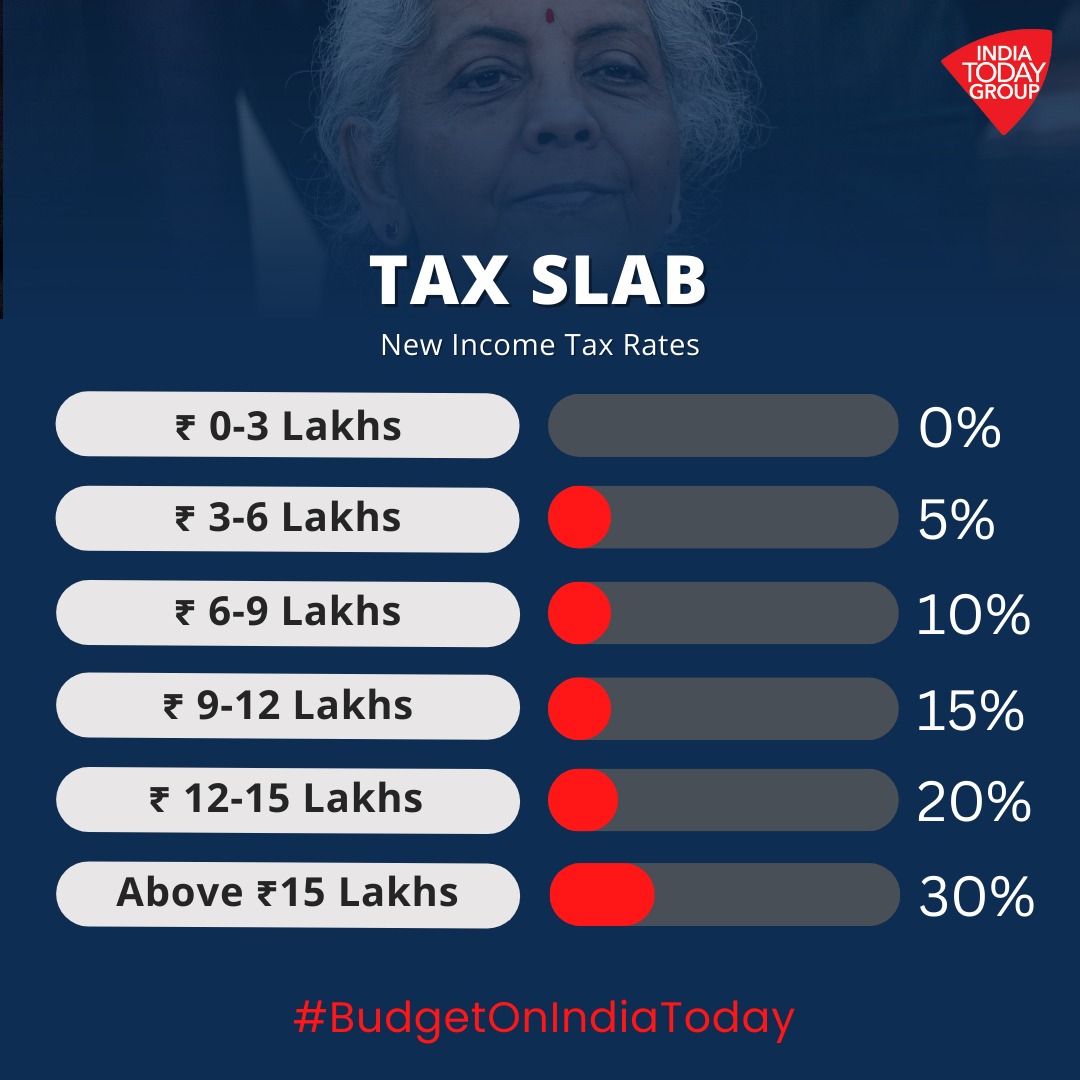

IndiaToday On Twitter Finance Minister nsitharaman Has Proposed A

Tax Rebate

Income Tax Rebate Under Section 87A

Tax Rebate Rules In Bangladesh -