2024 Montana Income Tax Rebate Updates from the 2023 Legislature for Tax Year 2024 Simplification Reduced Tax Rate and Expanded Montana Earned Income Tax Credit Long Term Capital Gains Tax Rate Military Retirement Exemption for Certain Military Retirees Expanded Qualified Endowment Credit De Minimis Filing Requirement for Certain Nonresidents 5 5

Sponsored by Rep Tom Welch R Dillon HB 222 provides a 500 property tax rebate to homeowners for their primary residence in 2023 and 2024 totaling over 280 million in relief This is a bill that is long past due and it s just the first step Rep Welch said We re building the foundation here for future reforms and property tax relief The department says taxpayers can apply for the 2022 property tax rebates through its online TransAction Portal or via a paper form during an application period that runs from Aug 15 2023 to Oct 1 2023 To apply through the TransAction Portal you ll need the following information Your home address

2024 Montana Income Tax Rebate

2024 Montana Income Tax Rebate

https://www.communitytax.com/wp-content/uploads/2020/01/image17.jpg

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

Montana Income Tax Calculator 2023 2024

https://www.taxuni.com/wp-content/uploads/2022/11/Montana-Paycheck-Calculator-TaxUni-Cover-1.jpg

Taxes Gianforte signs 1 billion Republican tax rebate tax cut package into law What the governor called the largest tax cut in Montana history provides rebates up to 2 250 for Montanans who own their homes pays down state debt and invests in highways by Eric Dietrich 03 13 2023 Click to share on Twitter Opens in new window Senate Bill 121 will reduce the top rate of 6 5 to 5 9 effective as previously scheduled on Jan 1 2024 The bill also increases the Montana Earned Income Tax Credit from 3 of the federal credit to 10 Apportionment changes Senate Bill 124 amends the current apportionment formula from three factor with double weighted sales to single

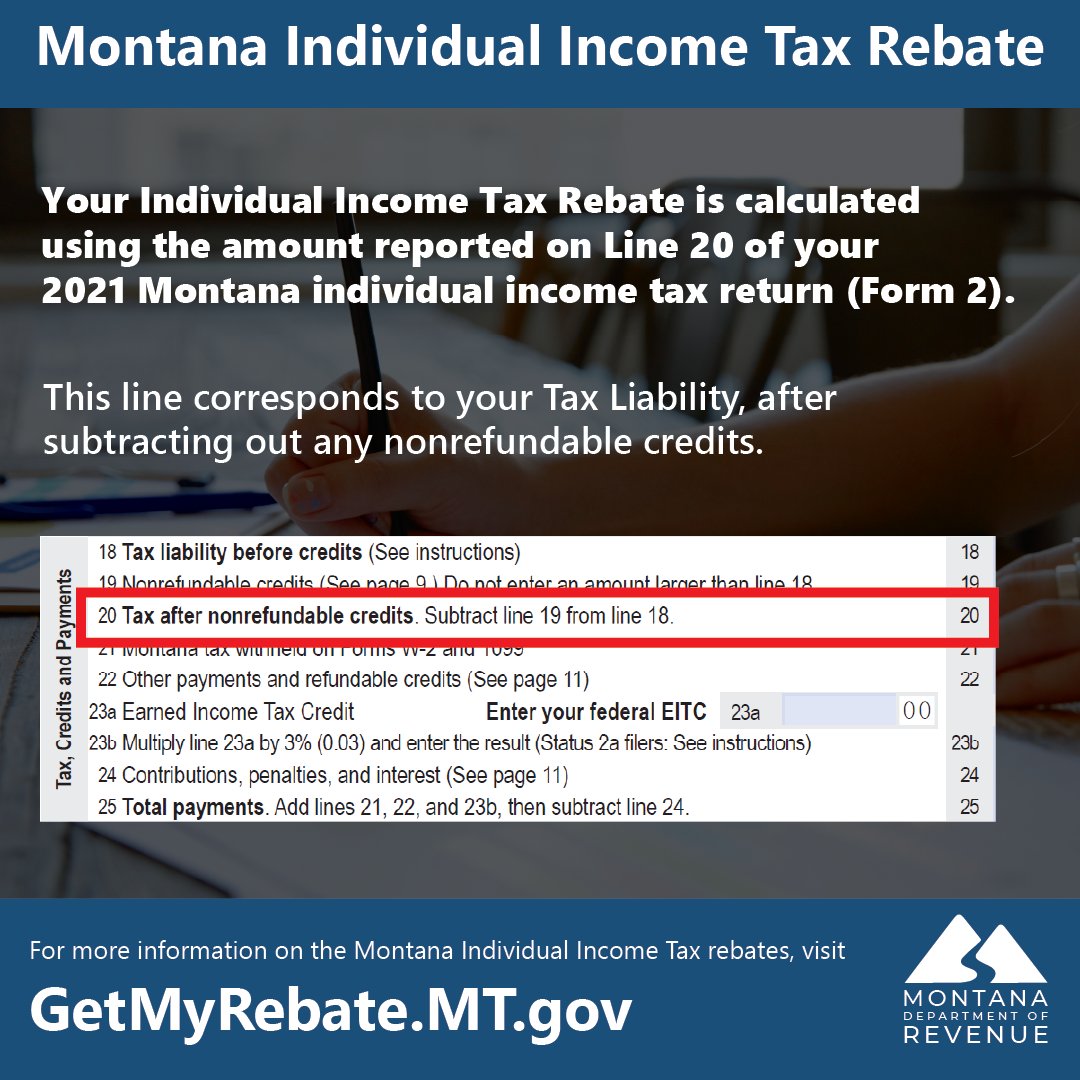

The latest entrant is Montana where lawmakers passed reforms Monday The top income tax rate will fall to 5 9 in 2024 from 6 75 now Gov Greg Gianforte called it the largest tax cut in Montana history and it builds on his 2021 cut that dropped the rate from 6 9 The state s tax code will also collapse to two brackets from seven Montana s GOP controlled Legislature put 764 million into tax rebates refunding residents income and property taxes November 2023 and May 2024 payments line 20 of its 2021 Montana

Download 2024 Montana Income Tax Rebate

More picture related to 2024 Montana Income Tax Rebate

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of What You Should Claim

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2023/03/Personal-Income-Tax-Relief-Malaysia-2023-YA-2022.png?fit=1200%2C628&ssl=1

Montana Income Tax Information What You Need To Know On MT Taxes

https://www.taunyafagan.com/wp/wp-content/uploads/2021/10/2023-Montana-Individual-Income-Tax-Help-Form.png

When Will We Get The Extra Tax Rebate Checks In Montana Details

https://townsquare.media/site/990/files/2023/03/attachment-032923-MT-Tax-Rebate-.jpg?w=980&q=75

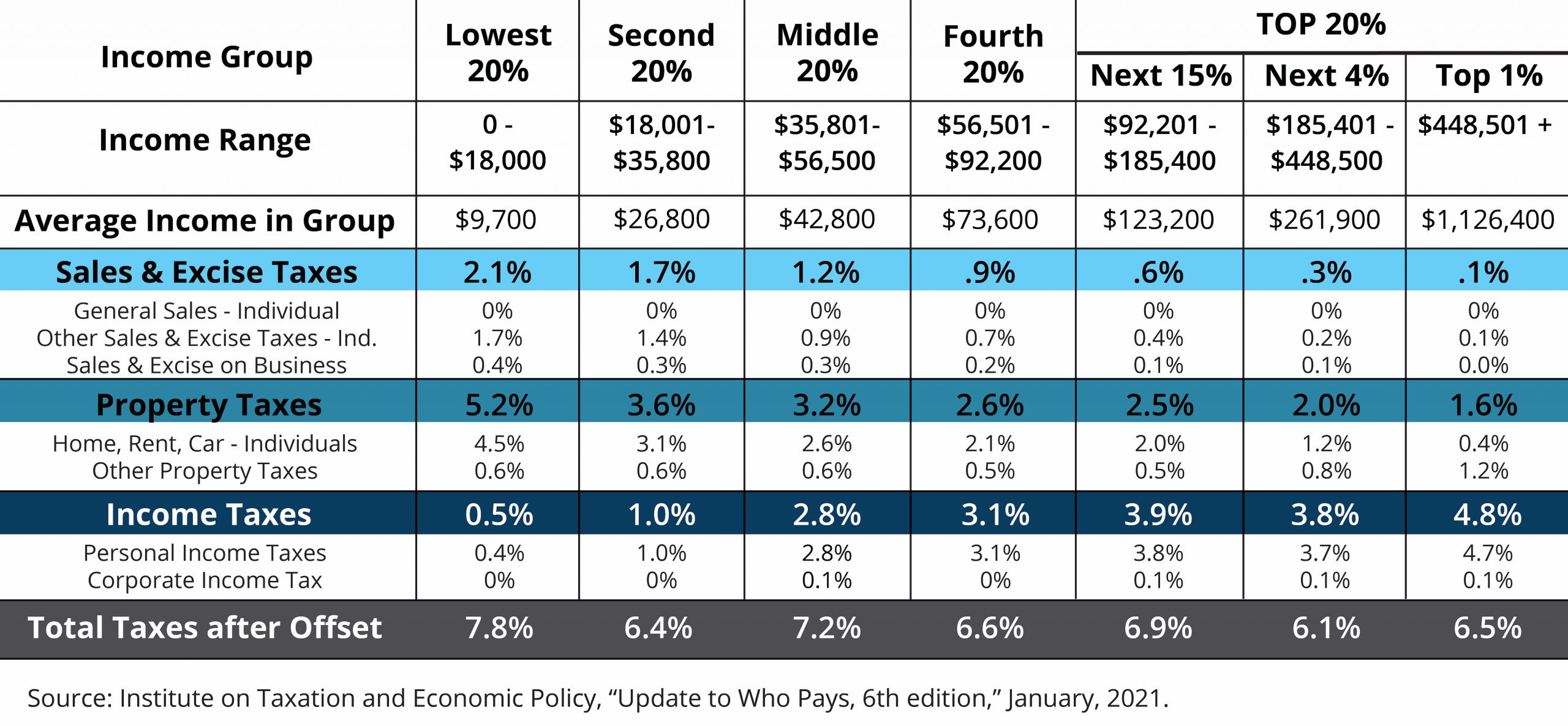

A CALCULATION OF MONTANA INCOME TAX LIABILITY BEFORE AND AFTER SENATE BILL NO 399 i Step 1 Montana Gross Income Calculation c 2023 Legislative Changes While not technically an adjustment to Montana gross income House Bill No 447 2023 provides for exceptions to imposition of income tax on certain nonresidents and withholding by IIT Rebate Qualifications Tax Filings and Residency Montana resident for all of 2021 Jan 1 Dec 31 Filed 2020 and 2021 MT Form 2 by 10 17 2022 2020 either part year or full year resident 2021 full year resident 2021 Form 2 Line 20 must be greater than 0 Can t be claimed as a dependent on another person s 1040 or Form 2

2023 Legislature Billion dollar tax rebate spending package passes budget committee Six bill package would put a sizable chunk of the state s 2 5 billion surplus to property and income tax rebates to Montana taxpayers It advances with Republican support and Democratic critique by Eric Dietrich 01 27 2023 The individual income tax rebate is 1 250 for individual filers and 2 500 for married couples filing jointly The money comes from House Bill 192 which set aside 480 million of the surplus to

The Montana Income Tax Rebate Are You Eligible

https://www.wordenthane.com/wp-content/uploads/2023/06/AdobeStock_602491697-scaled.jpeg

Montana Income Tax Calculator 2023 2024

https://www.taxuni.com/wp-content/uploads/2022/11/Montana-Income-Tax-Calculator-TaxUni-1.jpg

https://mtrevenue.gov/download/112298/?tmstv=1701716155

Updates from the 2023 Legislature for Tax Year 2024 Simplification Reduced Tax Rate and Expanded Montana Earned Income Tax Credit Long Term Capital Gains Tax Rate Military Retirement Exemption for Certain Military Retirees Expanded Qualified Endowment Credit De Minimis Filing Requirement for Certain Nonresidents 5 5

https://news.mt.gov/Governors-Office/Governor_Gianforte_Delivers_Montanans_Largest_Tax_Cut_in_State_History

Sponsored by Rep Tom Welch R Dillon HB 222 provides a 500 property tax rebate to homeowners for their primary residence in 2023 and 2024 totaling over 280 million in relief This is a bill that is long past due and it s just the first step Rep Welch said We re building the foundation here for future reforms and property tax relief

Policy Basics Who Pays Taxes In Montana Montana Budget Policy Center

The Montana Income Tax Rebate Are You Eligible

Income And Property Tax Relief Montana s 675 Rebate For 2023 Explained

Montana Tax Rebate Checks Up To 2 500 Coming In July

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Montana Income Tax Rebate Of Up To 2 500 Coming To Eligible Taxpayers This July Check

Montana Income Tax Rebate Of Up To 2 500 Coming To Eligible Taxpayers This July Check

Facts About Montana s Individual Income Tax AgEconMT

Montana Tax Rebate Package Muscled Through Initial House Votes

Montana Department Of Revenue On Twitter Your Individual Income Tax Rebate Is Calculated Using

2024 Montana Income Tax Rebate - The latest entrant is Montana where lawmakers passed reforms Monday The top income tax rate will fall to 5 9 in 2024 from 6 75 now Gov Greg Gianforte called it the largest tax cut in Montana history and it builds on his 2021 cut that dropped the rate from 6 9 The state s tax code will also collapse to two brackets from seven