Tax Rebate Malaysia 2024 For tax paying individuals in Malaysia these income tax reliefs might be missing in 2024 for the Year of Assessment 2023 here s what you need to know

The incentive is for a period of 5 consecutive years Announced to be extended until 2024 A non citizen individual receiving a monthly salary of at least RM35 000 and holding key C Suite positions in a new company approved as a Global Services Hub limited to 3 non citizen individuals This is why under budget 2024 tax paying Malaysians can claim up to RM7000 if they re pursuing their Bachelors Masters or PhD level degrees Additionally those pursuing any short courses or studies for upskilling and self enhancement can claim up to RM2000 tax relief 4 Tax Relief for Dependent Parents

Tax Rebate Malaysia 2024

Tax Rebate Malaysia 2024

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2023/03/Personal-Income-Tax-Relief-Malaysia-2023-YA-2022.png?fit=1200%2C628&ssl=1

Everything You Should Claim As Income Tax Relief Malaysia 2023 YA 2022

https://ringgitplus.com/en/blog/wp-content/uploads/2023/03/everything-you-should-claim-as-tax-relief-2023_ya2022_1.jpg

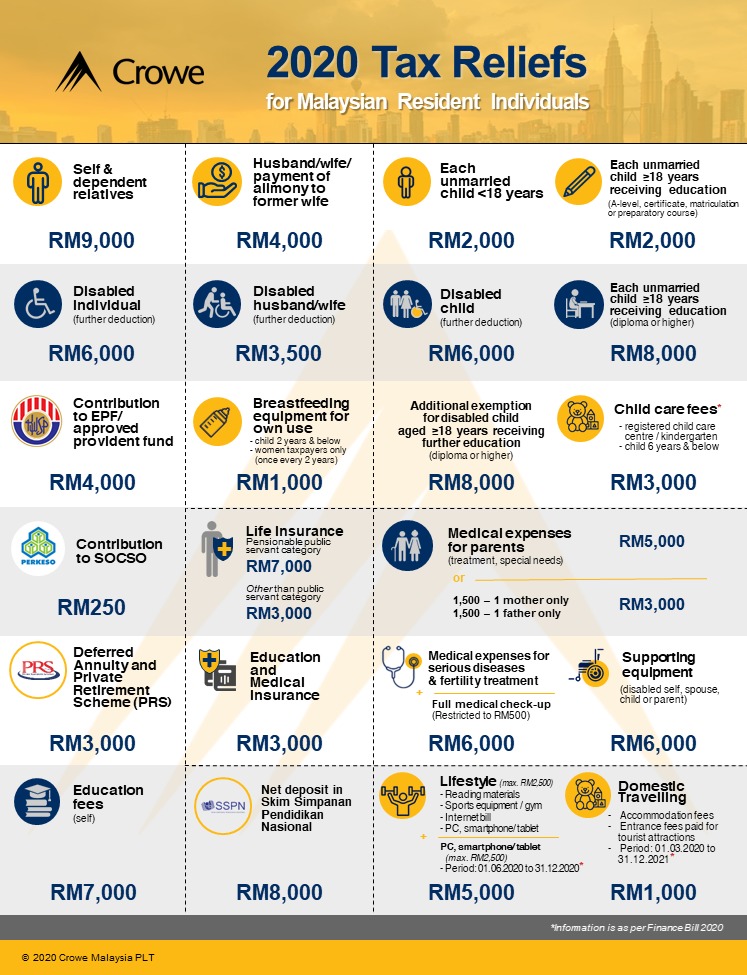

Malaysia Personal Income Tax Relief 2020 Walang Merah

https://d3q48uqppez4lq.cloudfront.net/wp-content/uploads/2020/12/malaysia-tax-relief-2020-mypf.png

This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practice It incorporates key proposals from the 2024 Malaysian Budget Malaysia regulation update on tax reliefs for employees effective from 01 January 2024 Changes in tax reliefs The applicable forms TP1 TP3 has also been revised in this regard Changes for C Suite employees C Suite employees are offered a flat tax rate of 15 on employment income for three consecutive years

Effective 1 Jan 2024 A 10 sales tax is placed on imported low value goods LVGs worth RM500 or less excluding cigarettes tobacco products intoxicating liquors and smoking pipes as these items are already subject to import duty excise duty and sales tax Individual for chargeable income less until RM35 000 can get a tax rebate of RM400 Wife Husband separate assessment can each get a tax rebate of RM400 if both have chargeable income of less than RM35 000 Wife Husband joint assessment can get a tax rebate of RM800 for joint income until RM35 000

Download Tax Rebate Malaysia 2024

More picture related to Tax Rebate Malaysia 2024

Infographic Of 2020 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia PLT

https://www.crowe.com/my/-/media/crowe/firms/asia-pacific/my/crowemy/news/2020-tax-reliefs-infographic.jpeg?rev=60ff6360601b498c8b7c65bbc8022f85&hash=D7C2C68D68241F99C1D574A949A66C1F

Window To Enjoy Tax Reliefs Closing The Star

https://cdn.thestar.com.my/Content/Images/Digital_0212_TAXRELIEF_2.jpg

Personal Tax Relief Y A 2023 L Co Accountants

https://landco.my/wp-content/uploads/2023/07/Personal-Tax-Relief-2023-731x1024.png

Malaysia s prime minister and finance minister presented the second Budget from the Unity Government on 13 October 2023 with a theme Economic Reforms Empowering the People 1 The 2024 Budget focuses on supporting the national economy and people s well being in a progressive and equitable manner while setting the Malaysian taxpayers are gearing up for tax season 2024 focusing on new relief claims and compliance tips to maximize returns and avoid penalties PETALING JAYA With the tax season upon us Malaysian taxpayers are seeking ways to file efficiently while maximizing returns focusing on the latest relief claims under Budget 2024

16th October 2023 5 min read Image Reuters Budget 2024 has been tabled by Prime Minister Datuk Seri Anwar Ibrahim last Friday with a record allocation of RM393 8 billion up from the previous amount of RM388 1 billion allocated for the revised Budget 2023 How to Declare Income Manual Online ITRF Deadlines Tax Reliefs Rebates Donations Gifts Tax Rate Type of Assessment Business Code Payment Others Year of Assessment 2023 Last updated on 6th November 2023 Year of Assessment 2022 Year of Assessment 2021 Year of Assessment 2020 Year of Assessment 2019 Year of Assessment 2018

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Company Tax Relief 2023 Malaysia Printable Forms Free Online

https://ringgitplus.com/en/blog/wp-content/uploads/2023/03/SPC-4467_IncomeTax-2022.png

https://althr.my/resources/income-tax-reliefs-2024-malaysia

For tax paying individuals in Malaysia these income tax reliefs might be missing in 2024 for the Year of Assessment 2023 here s what you need to know

https://www.pwc.com/my/en/publications/mtb/personal-income-tax.html

The incentive is for a period of 5 consecutive years Announced to be extended until 2024 A non citizen individual receiving a monthly salary of at least RM35 000 and holding key C Suite positions in a new company approved as a Global Services Hub limited to 3 non citizen individuals

Company Secretary Malaysia Johor KualaLumpur Penang SSM Sdn Bhd Registration

Property Tax Rebate Pennsylvania LatestRebate

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Georgia Income Tax Rebate 2023 Printable Rebate Form

Georgia Income Tax Rebate 2023 Printable Rebate Form

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

Income Tax Rebate Under Section 87A

Tax Rebate Malaysia 2024 - Malaysia regulation update on tax reliefs for employees effective from 01 January 2024 Changes in tax reliefs The applicable forms TP1 TP3 has also been revised in this regard Changes for C Suite employees C Suite employees are offered a flat tax rate of 15 on employment income for three consecutive years