Tax Rebate Singapore Corporate In view of cost of living concerns a PIT Rebate of 50 of tax payable will be granted to all tax resident individuals for YA 2024 The rebate will be capped at 200

SINGAPORE Companies will receive a 50 per cent corporate income tax rebate capped at 40 000 in the year of assessment 2024 This is part of a 1 3 billion package to help Corporate tax changes proposed include Corporate income tax CIT rebate of 50 and a CIT rebate cash grant of 2 000 Singapore dollars SGD for eligible companies subject

Tax Rebate Singapore Corporate

Tax Rebate Singapore Corporate

https://cdn1.npcdn.net/image/16455009486814b66de718d60548210c07af1f078b.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

Singapore Corporate Income Tax Rebate What Do You Need To Know

https://premiatnc.com/sg/wp-content/uploads/2023/03/Singapore-Corporate-Income-Tax-Rebate-scaled.jpg

Income Tax Rebate Astonishingceiyrs

https://www.aseanbriefing.com/news/wp-content/uploads/2018/08/asb-Partial-Tax-Exemption-Scheme-for-Companies-Available-for-All-Companies-YA-2018-002.jpg

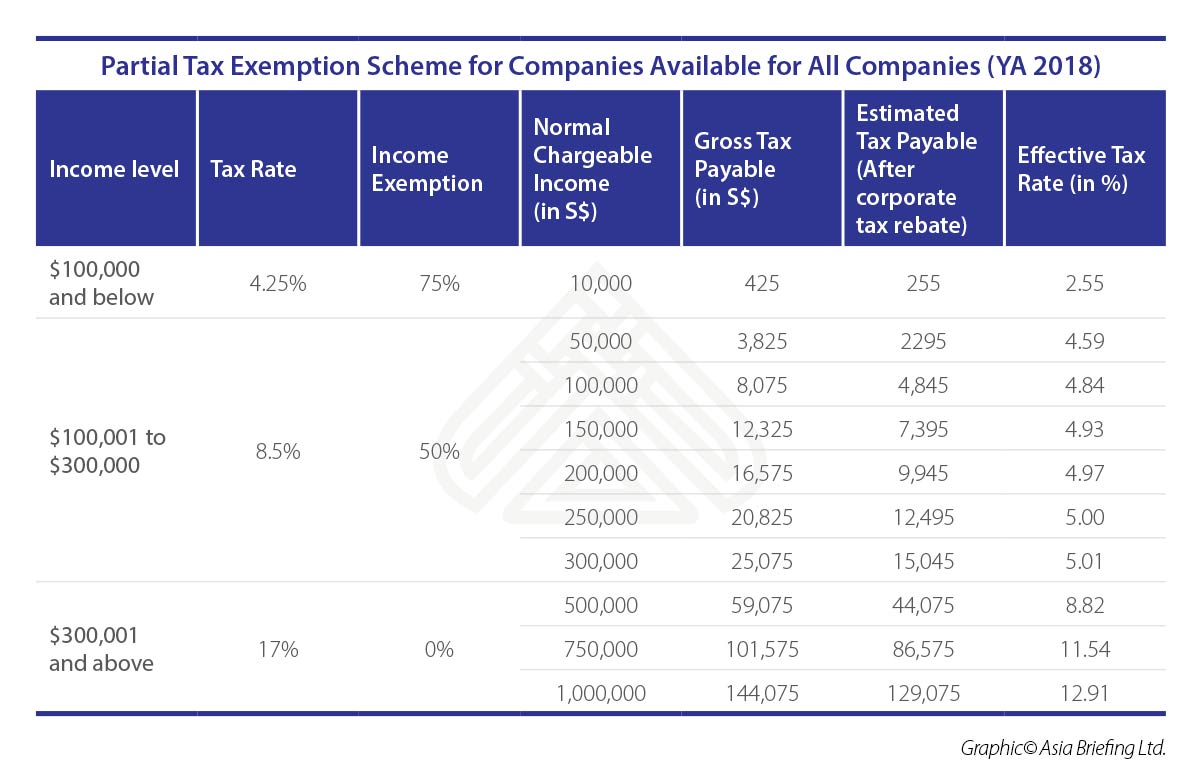

Corporate income tax CIT Rebate and CIT cash grant for Year of Assessment YA 2024 All companies will enjoy a 50 corporate income tax rebate capped at SGD 40 000 and net of any CIT cash grant First companies will receive a 50 per cent corporate income tax rebate capped at S 40 000 in the Year of Assessment 2024

Corporate Income Tax CIT Rebate for the Year of Assessment YA 2024 CIT Rebate of 50 of tax payable will be granted for YA 2024 Companies that have employed at least one local The Budget provides for a 50 CIT rebate for all companies capped at SGD40 000 to help them manage the rising costs Typically such rebates are applied

Download Tax Rebate Singapore Corporate

More picture related to Tax Rebate Singapore Corporate

10 Tax Deductions For Self Employed Persons That You May Be Missing Out

https://dollarsandsense.sg/business/wp-content/uploads/2022/04/2nd_10-Tax-Deductions-For-Self-Employed-Persons-That-You-May-Be-Missing-Out-On-infographic_12-Apr-683x1024.jpg

Editorial Whitmer Tax Rebate A Hike In Disguise

https://www.detroitnews.com/gcdn/presto/2023/01/24/PDTN/9b1ece71-f6ef-4686-8dcb-1af6686a9b0e-012423-tm-Retirement_Taxes-138.jpg?crop=5288,2975,x0,y0&width=3200&height=1801&format=pjpg&auto=webp

Tax Rebate RM20 000 X 3 Years On Investment Holding Company Apr 20

https://cdn1.npcdn.net/image/1618905210e3b8bb075144f9faf8856b273237113c.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

Corporate Income Tax income CIT Rebate tax corporate Provides support for eligible companies to manage rising costs through CIT Rebate and CIT Rebate Cash Grant As announced during Singapore s Budget 2024 a Corporate Income Tax CIT Rebate of 50 will be granted to all taxpaying companies This includes both tax

Singapore Budget 2024 introduced a new concessionary tax rate tier and the Overseas Humanitarian Assistance Tax Deduction Scheme Learn how these changes could affect Comprising three main components a new 1 3 billion Enterprise Support Package aims to help Singapore businesses manage rising costs through A Corporate

Menards Price Adjustment Rebate Form October 2022 RebateForMenards

https://i0.wp.com/www.rebateformenards.com/wp-content/uploads/2022/10/menards-price-adjustment-rebate-form-october-2022.jpg?resize=1536%2C1510&ssl=1

Right To A Tax Rebate For Whom Is It Available And How To Use It

https://fbs-tax.com/wp-content/uploads/2023/04/photo.png

https://www.iras.gov.sg/docs/default-source/budget...

In view of cost of living concerns a PIT Rebate of 50 of tax payable will be granted to all tax resident individuals for YA 2024 The rebate will be capped at 200

https://www.straitstimes.com/singapore/…

SINGAPORE Companies will receive a 50 per cent corporate income tax rebate capped at 40 000 in the year of assessment 2024 This is part of a 1 3 billion package to help

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct

Menards Price Adjustment Rebate Form October 2022 RebateForMenards

Facts About The 150 Council Tax Rebate

TAX REBATE Ft The Receipts Podcast OFF THE CUFF PODCAST Listen Notes

How To Apply For A PA Property Tax Rebate Or Rent Rebate Spotlight PA

What Are Corporate Tax Exemptions In Singapore

What Are Corporate Tax Exemptions In Singapore

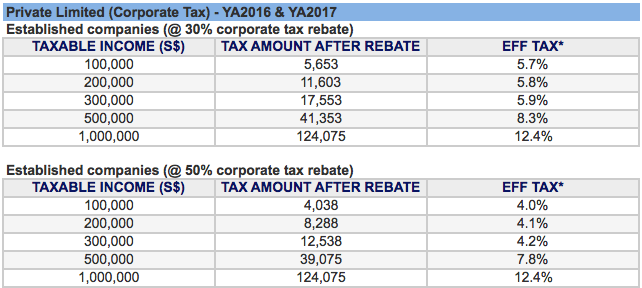

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

Tax Rebate

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

Tax Rebate Singapore Corporate - The tax exemptions for income from funds managed in Singapore and the existing GST remission for funds are extended to qualifying VCC A 10 concessionary