Tax Rebate Threshold For Medical Expenses Web Detailed explanation of new law 1 16 The definition of adjusted taxable income for rebates family tier 1 threshold medical expense rebate higher phase in limit medical

Web You must reduce your eligible medical expenses if you receive a reimbursement from either a government a public authority a society an association a fund If you receive a Web 22 ao 251 t 2023 nbsp 0183 32 The amount of the deduction is limited to the amount by which your unreimbursed medical expenses exceed 7 5 of your adjusted gross income AGI So

Tax Rebate Threshold For Medical Expenses

Tax Rebate Threshold For Medical Expenses

https://www.pdffiller.com/preview/63/408/63408520/large.png

.png)

Medical Expense Deduction 2020 Ruxoler

https://uploads-ssl.webflow.com/5e57eb33765372f7d30e19f9/5e60276cf755ee1ecad92ae8_How%2520to%2520Calculate%2520Your%2520Adjusted%2520Gross%2520Income%2520(AGI).png

T17 0092 Reduce Threshold For Medical Expense Deduction From 10 0 To

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/model-estimates/images/t17-0092.gif?itok=d1m9hpxi

Web 25 oct 2022 nbsp 0183 32 For tax years 2022 and 2023 individuals are allowed to deduct qualified and unreimbursed medical expenses that are greater than 7 5 of their adjusted gross Web 1 8 In 2012 13 the offset was 20 per cent of net medical expenses over 2 120 for single taxpayers with adjusted taxable income for rebates of 84 000 or less and families with

Web 12 janv 2023 nbsp 0183 32 The Deduction and Your AGI Threshold You can calculate the 7 5 rule by tallying up all your medical expenses for the year then subtracting the amount equal to 7 5 of your AGI For example if your Web The NMETO allows Australian residents to annually claim a tax rebate to offset out of pocket medical expenses incurred above a certain threshold The threshold is

Download Tax Rebate Threshold For Medical Expenses

More picture related to Tax Rebate Threshold For Medical Expenses

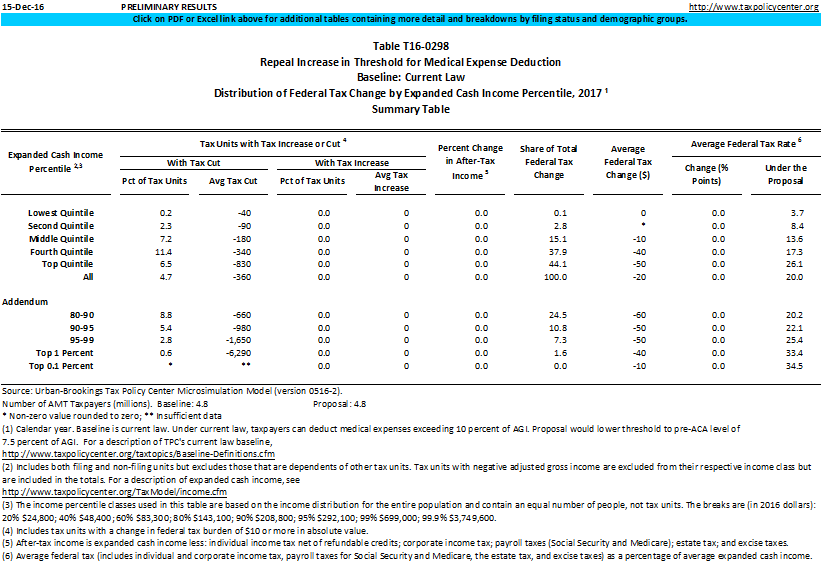

T16 0298 Repeal Increase In Threshold For Medical Expense Deduction

https://www.taxpolicycenter.org/sites/default/files/model-estimates/images/t16-0298_0.gif

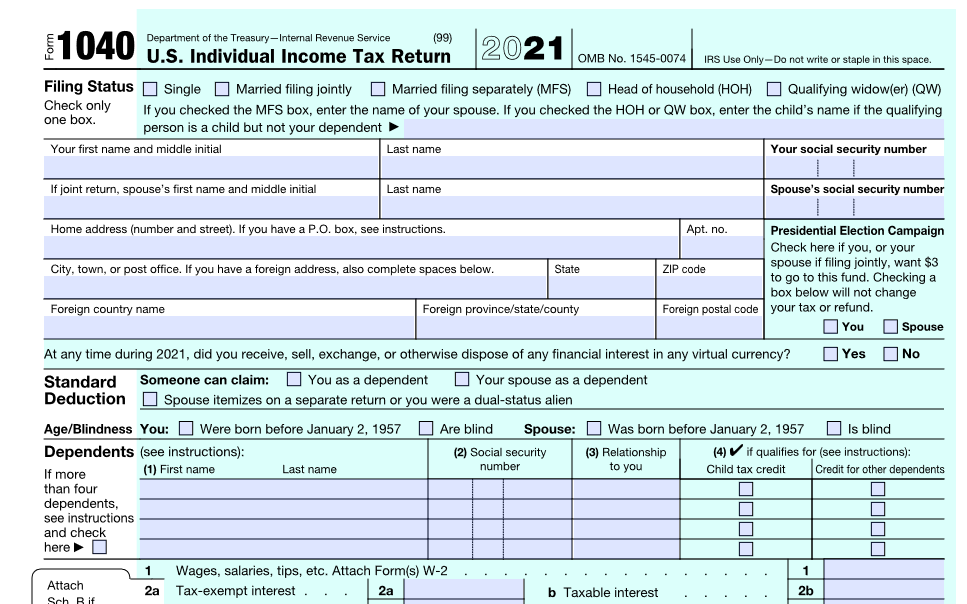

Squeezing Under The Medical Deduction Threshold

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/03/Form_1040_2021.622f88619009d.png

T17 0093 Reduce Threshold For Medical Expense Deduction From 7 5 To 5

https://www.taxpolicycenter.org/sites/default/files/model-estimates/images/t17-0093.gif

Web 31 mars 2023 nbsp 0183 32 For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income is Web 16 nov 2022 nbsp 0183 32 An Additional Medical Expenses Tax Credit also known as an AMTC is a rebate which in itself is non refundable but which is used to reduce the normal tax a

Web Find out more about the medical expenses tax offset Work out the amount of medical expenses offset you can claim for the 2015 16 to 2018 19 income years Last Web The income thresholds used to calculate the Medicare levy surcharge and private health insurance rebate have increased from 1 July 2023 Before 1 July 2023 they remained

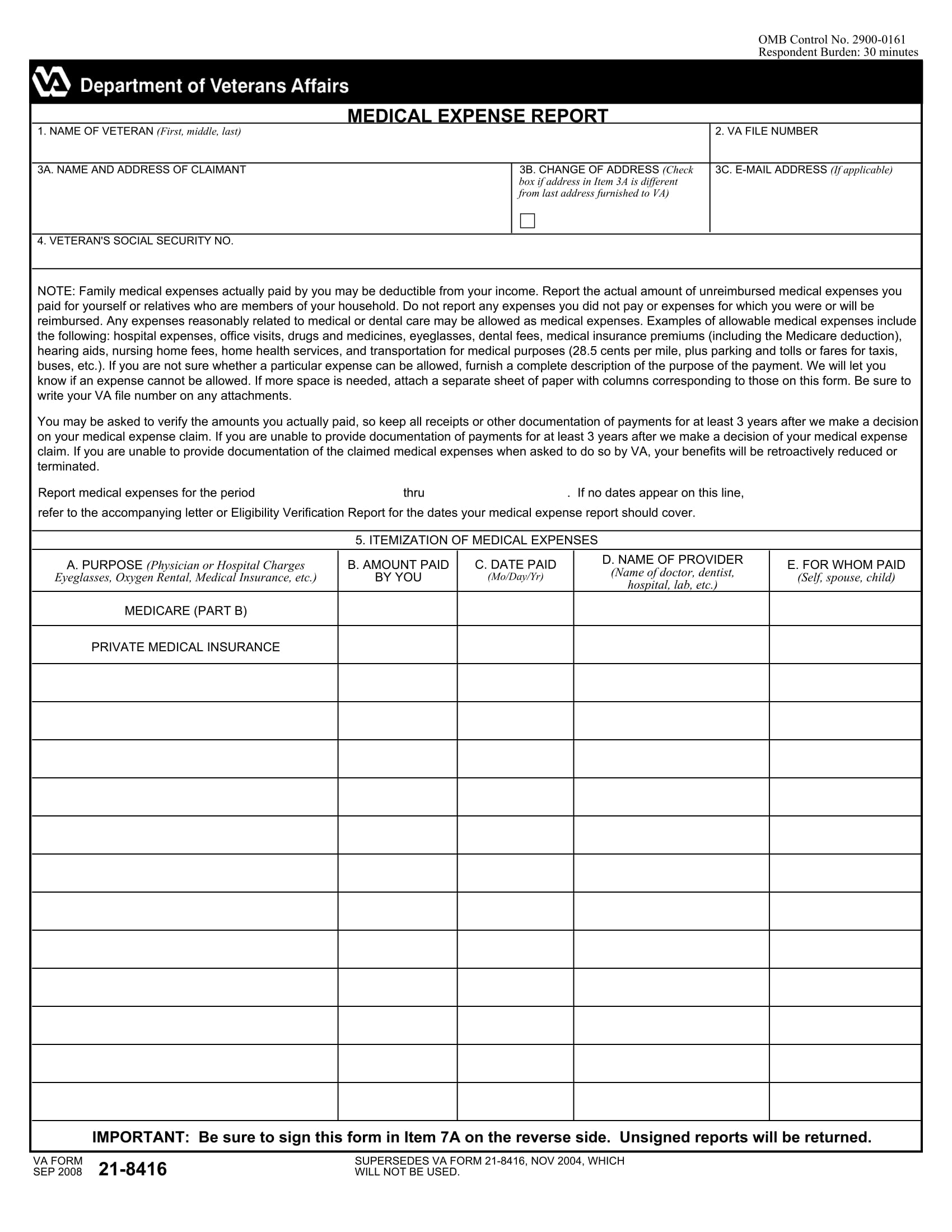

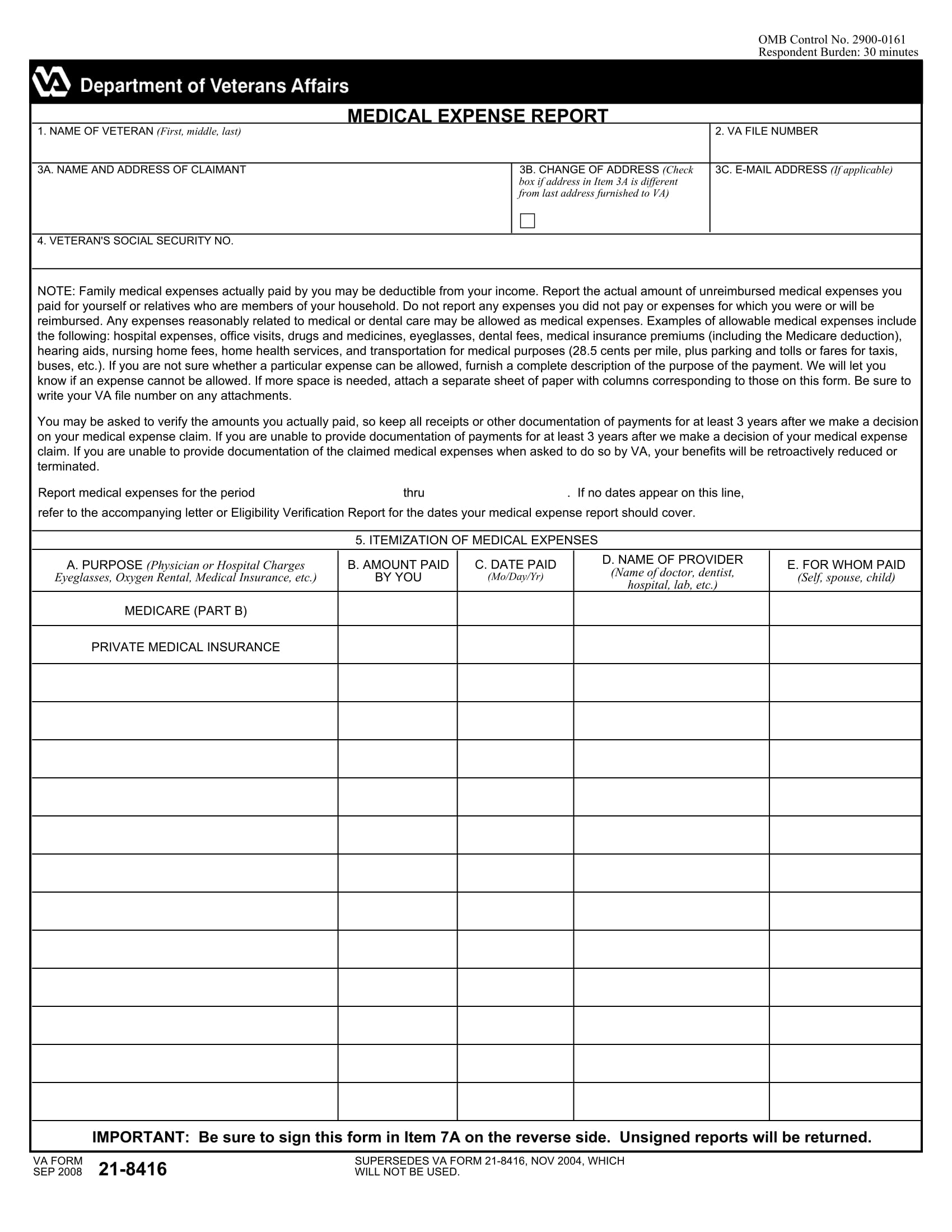

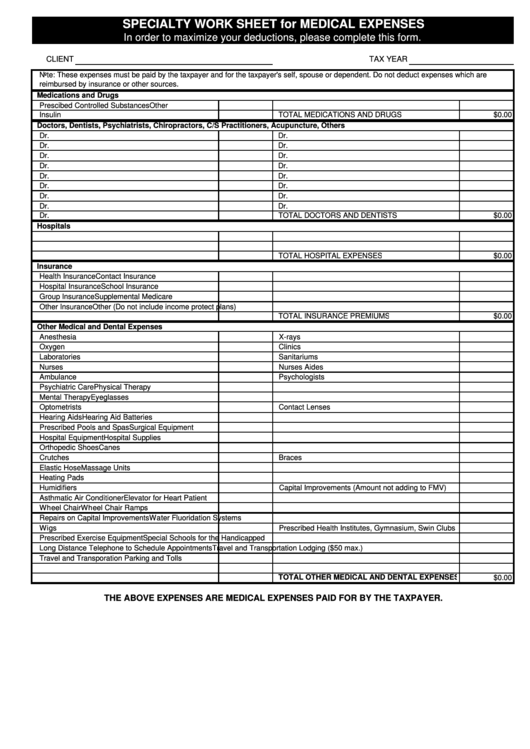

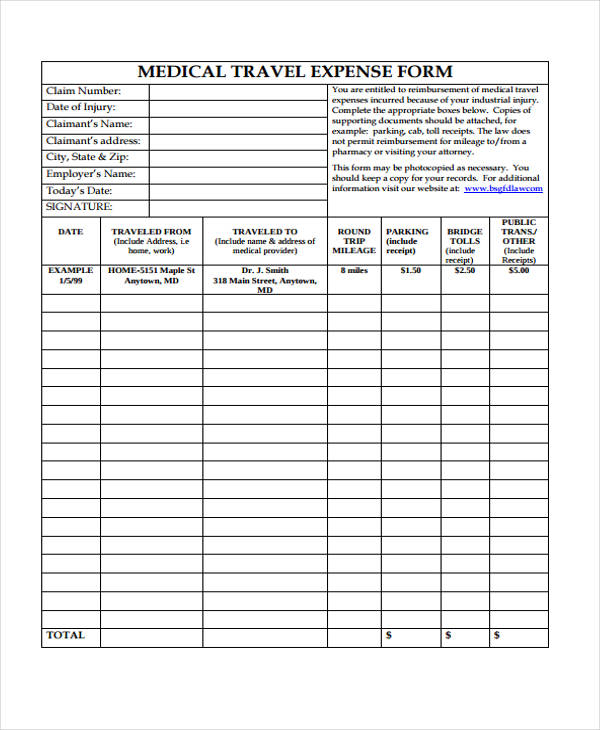

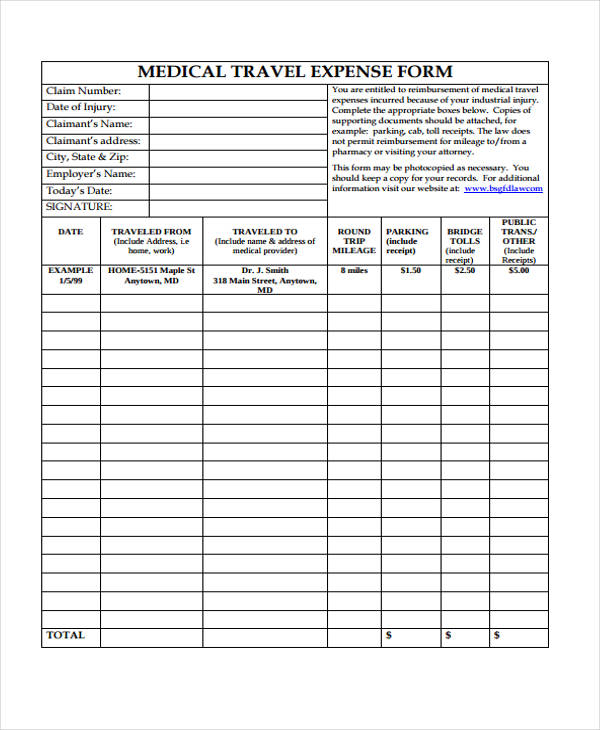

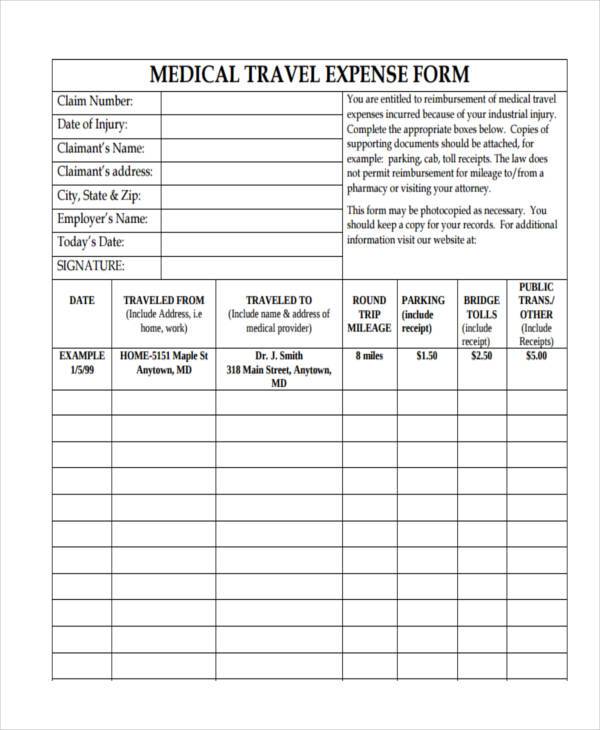

FREE 13 Expense Report Forms In MS Word PDF Excel

https://images.sampleforms.com/wp-content/uploads/2017/11/Medical-Expense-Report-Form-1.jpg

Http www anchor tax service financial tools deductions medical

https://i.pinimg.com/originals/93/fc/e8/93fce8e4872e20094e9c7743332faf81.jpg

https://treasury.gov.au/sites/default/files/2019-03/Means_Te…

Web Detailed explanation of new law 1 16 The definition of adjusted taxable income for rebates family tier 1 threshold medical expense rebate higher phase in limit medical

.png?w=186)

https://www.ato.gov.au/.../Tax-offsets/Medical-expenses-tax-offset

Web You must reduce your eligible medical expenses if you receive a reimbursement from either a government a public authority a society an association a fund If you receive a

FREE 11 Medical Expense Forms In PDF MS Word

FREE 13 Expense Report Forms In MS Word PDF Excel

Top 9 Medical Expense Spreadsheet Templates Free To Download In PDF Format

EXCEL TEMPLATES Spreadsheet To Track Medical Expenses

FREE 44 Expense Forms In PDF MS Word Excel

FREE 11 Medical Expense Forms In PDF MS Word

FREE 11 Medical Expense Forms In PDF MS Word

FREE 44 Expense Forms In PDF MS Word Excel

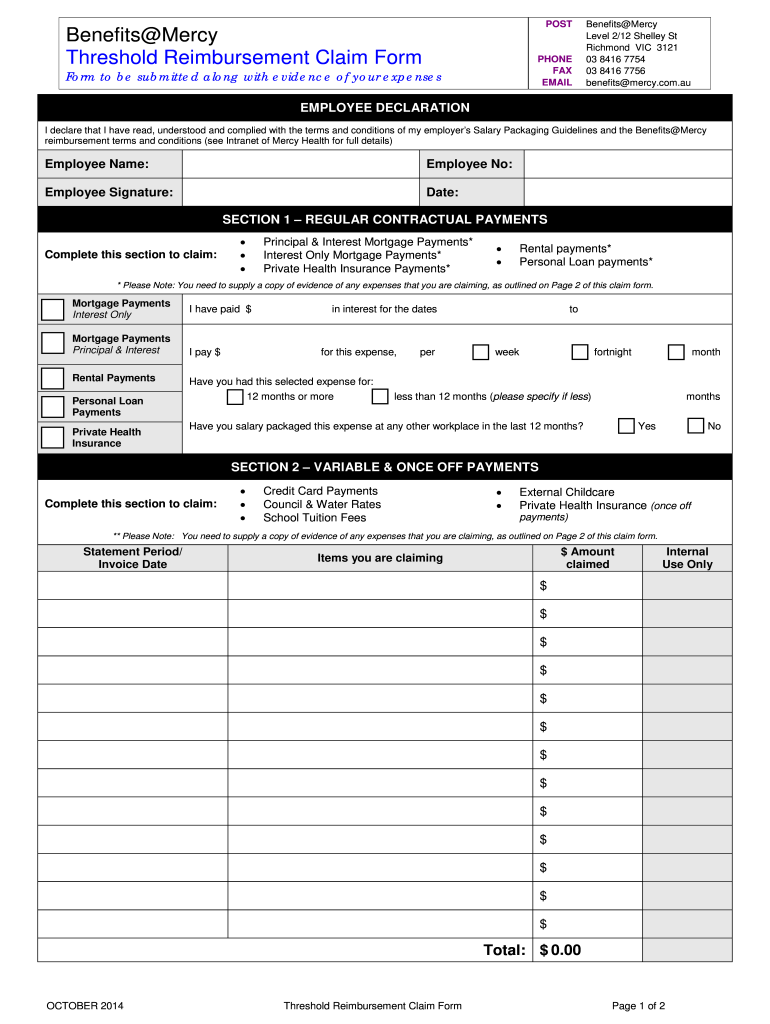

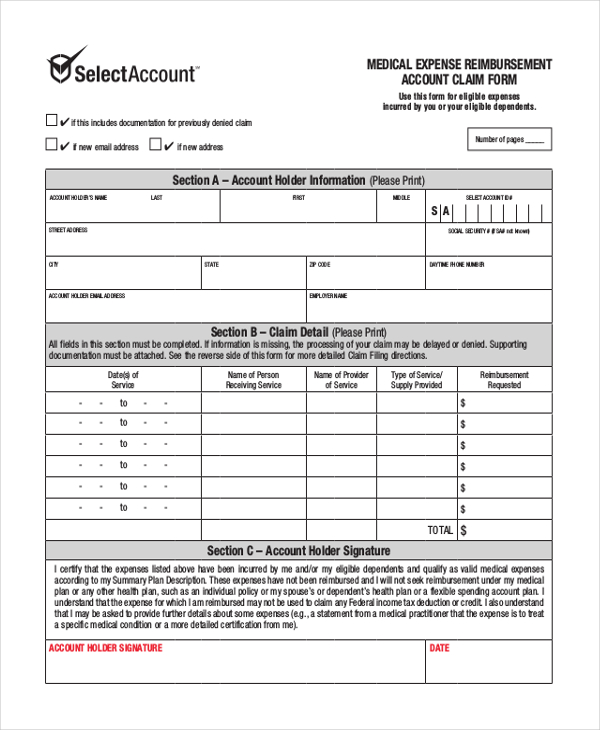

FREE 12 Sample Medical Reimbursement Forms In PDF Excel Word

EXCEL TEMPLATES Medical Bill Tracker

Tax Rebate Threshold For Medical Expenses - Web 25 oct 2022 nbsp 0183 32 For tax years 2022 and 2023 individuals are allowed to deduct qualified and unreimbursed medical expenses that are greater than 7 5 of their adjusted gross