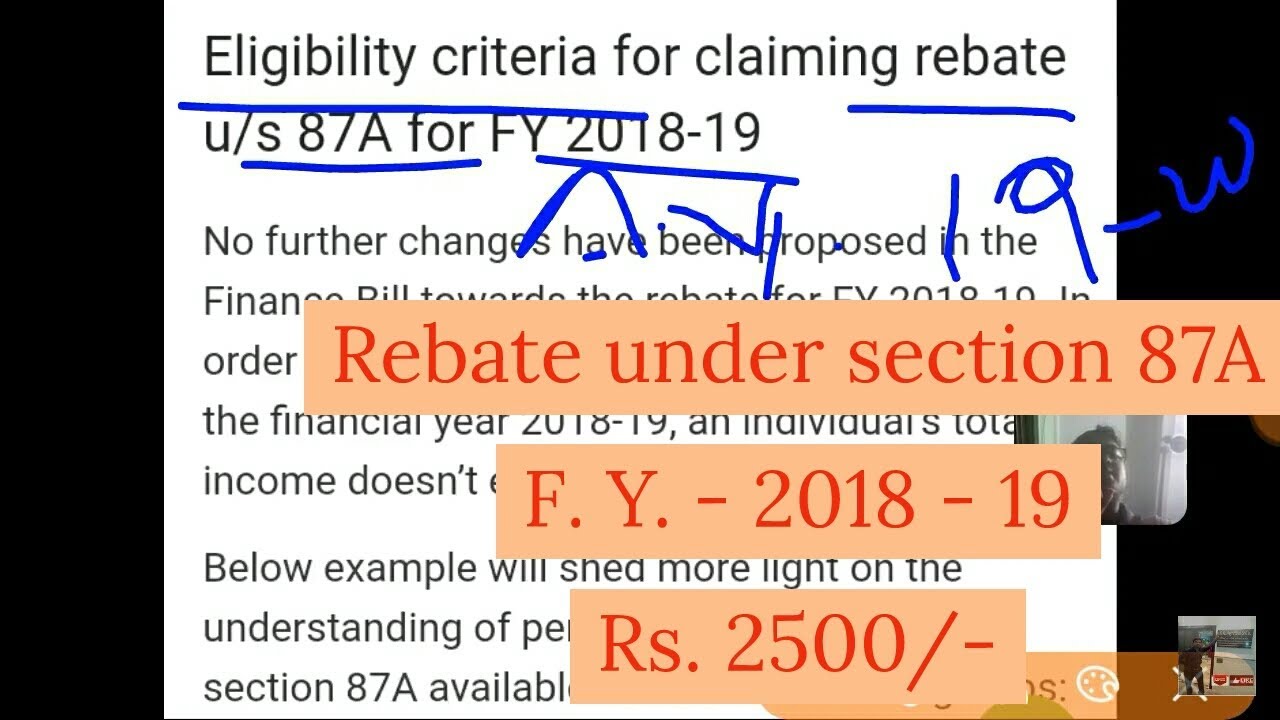

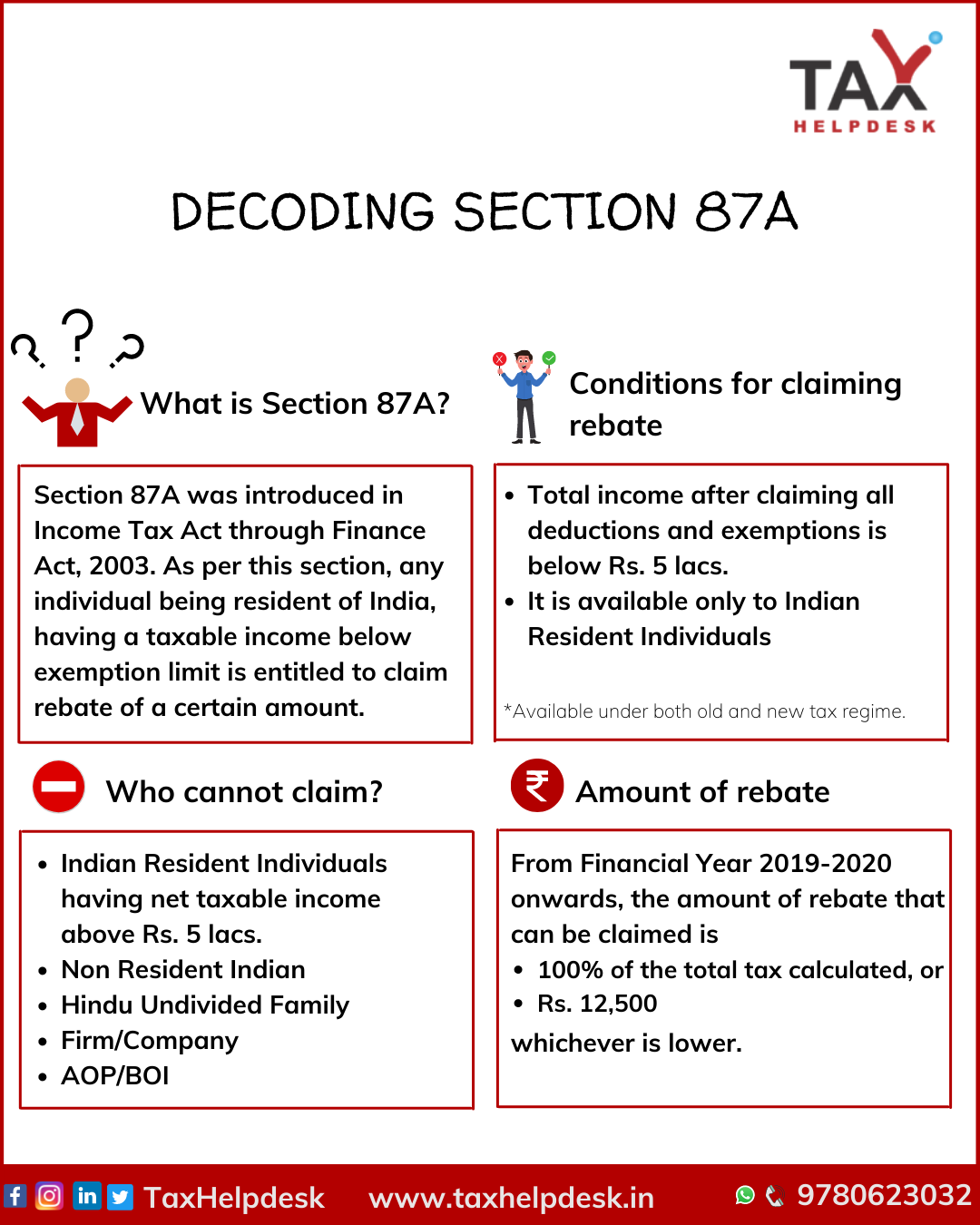

Tax Rebate U S 87a For Senior Citizen Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax

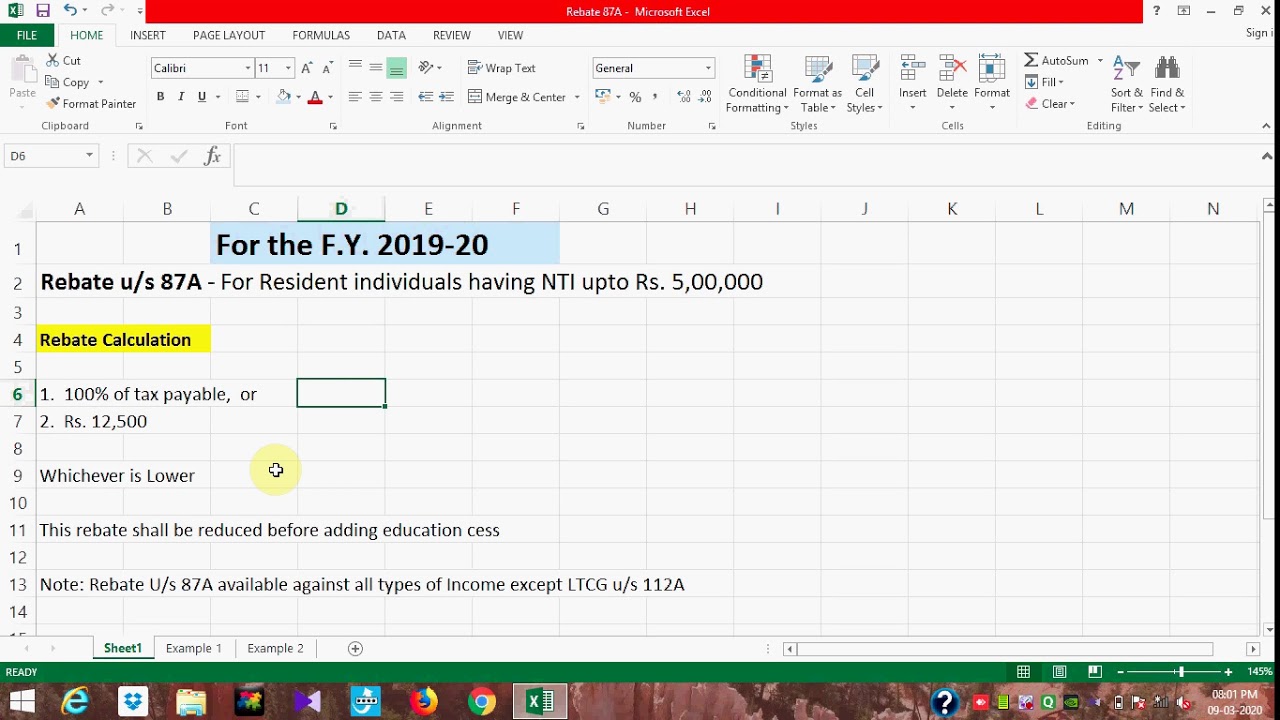

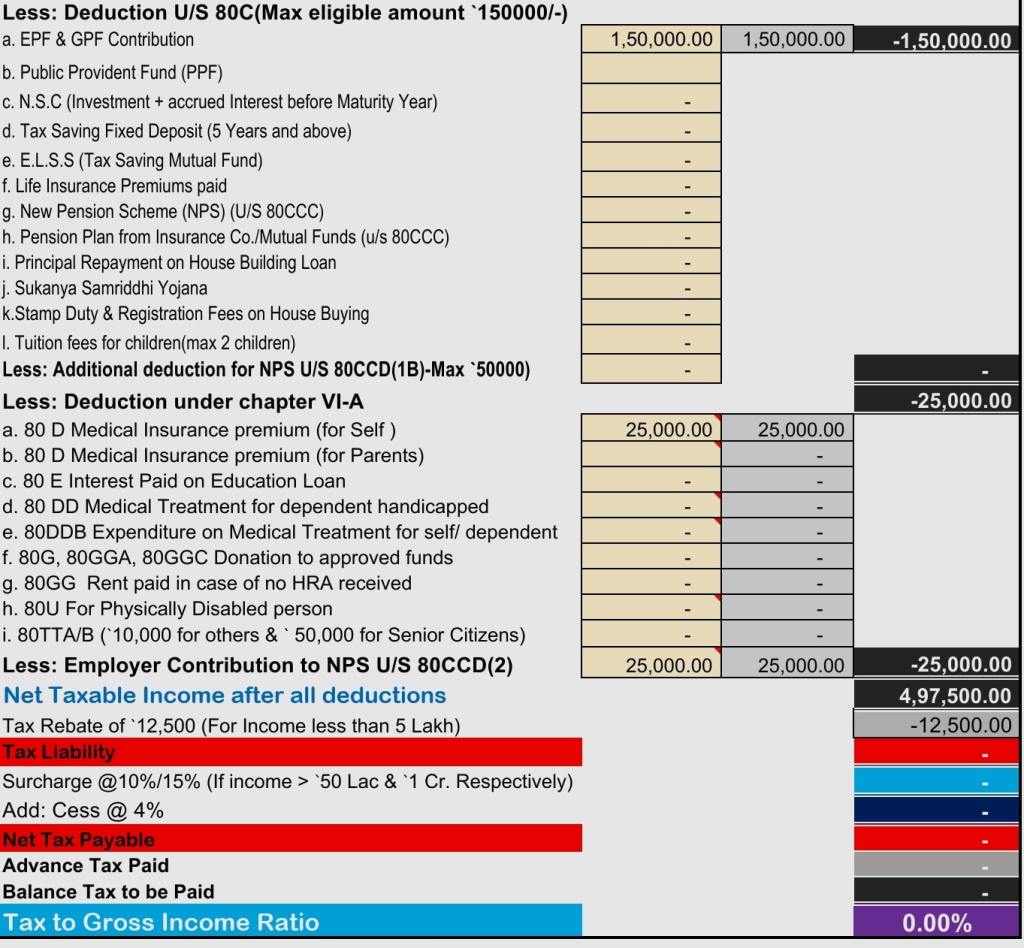

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under Web Rebate u s 87A for FY 2021 22 AY 2022 23 Income tax rebate u s 87A is the same for the FY 2021 22 AY 2022 23 amp FY 2020 21 AY 2021 22 As per section 87A if a

Tax Rebate U S 87a For Senior Citizen

Tax Rebate U S 87a For Senior Citizen

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

https://financialcontrol.in/wp-content/uploads/2018/06/Rebate-87A.jpg

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

https://i.ytimg.com/vi/KqZNdnxM0Bo/maxresdefault.jpg

Web 21 sept 2022 nbsp 0183 32 Understanding Rebate Under Section 87 A Income tax rules in India are based on a progressive tax system so tax payers with higher income pay more tax Web 6 f 233 vr 2023 nbsp 0183 32 Senior citizens between 60 years and 80 years of age can avail tax rebate under section 87A Super senior citizens above 80 years are not eligible to claim tax rebate under section 87A For FY 2020 21

Web 25 janv 2022 nbsp 0183 32 Super senior citizens i e individuals over 80 years of age are not eligible to claim rebate under Section 87A The rebate amount of Rs 12 500 is the maximum Web Tax Rebate Under Section 87A The income tax rebate provided in Section 87A is offered for people who have a salary below the pre defined limit Basically this act is there to

Download Tax Rebate U S 87a For Senior Citizen

More picture related to Tax Rebate U S 87a For Senior Citizen

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Rebate U s 87A For F Y 2018 2019 Taxable Income Not Exceed 3 5

https://i.ytimg.com/vi/OS6nlwtzz-A/maxresdefault.jpg

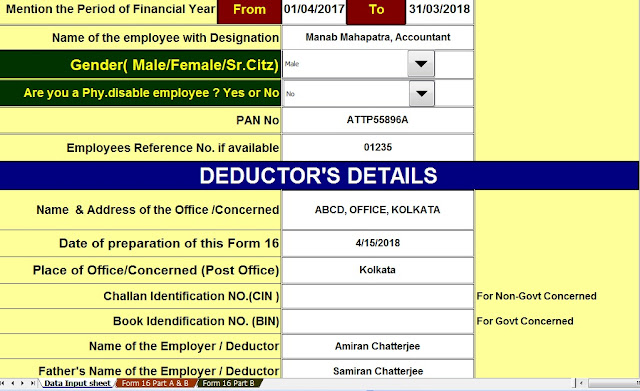

Rebate U S 87A For FY 2017 18 AY 2018 19 All You Need To Know With

https://3.bp.blogspot.com/-naU0LtBHqSk/WhrfJ053CUI/AAAAAAAAF5k/ccFv6o7m8jE-ljtYFcq6HqIQ46KgQ9y-gCLcBGAs/s640/One%2Bby%2BOne%2BForm%2B16%2BPage%2B1.jpg

Web 4 juin 2023 nbsp 0183 32 Presently rebate is allowed u s 87A of Rs 12 500 in old regime of Income Tax if any resident individual whose total income during the previous year does not exceed Rs 5 00 000 Rebate is available Web Rebate u s 87 A Resident individual whose Total Income is not more than 5 00 000 is eligible for a Rebate of 100 of income tax or 12 500 whichever is less This Rebate

Web 1 f 233 vr 2023 nbsp 0183 32 While senior citizens aged between 60 and 80 years can avail of the rebate us 87A super senior citizens aged over 80 years are not eligible to claim this benefit Web 8 d 233 c 2021 nbsp 0183 32 Reduce your section 80C to 80U deductions and calculate your gross total income If your earnings are less than Rs 5 lakh you may be eligible for a tax rebate

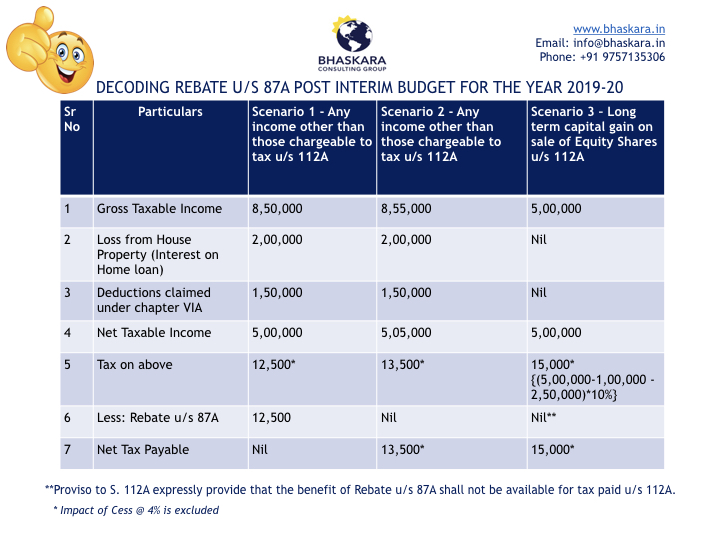

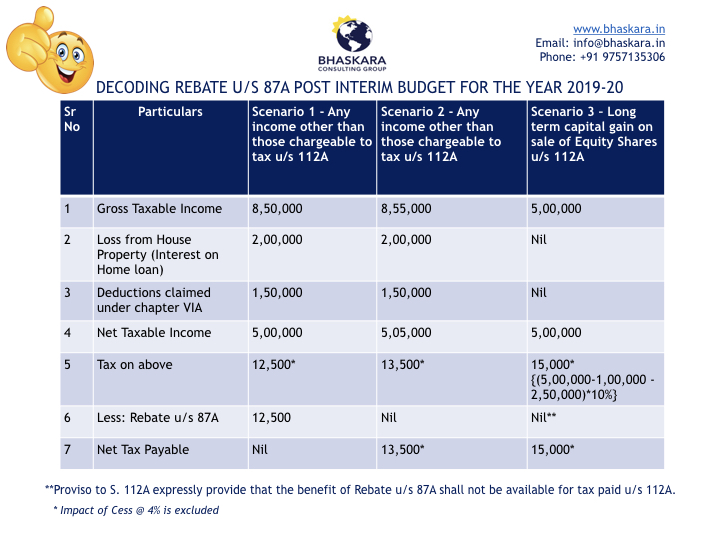

Decoding Rebate U s 87A Post Interim Budget For The F Y 2019 20

http://bhaskara.in/wp-content/uploads/2019/02/87A-Rebate-Provisions.jpeg.001.jpeg

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax

https://tax2win.in/guide/section-87a

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Decoding Rebate U s 87A Post Interim Budget For The F Y 2019 20

REBATE U s 87A Under Income Tax B Ca Cs Cma And Ignou Exams With

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

Rebate U s 87A YouTube

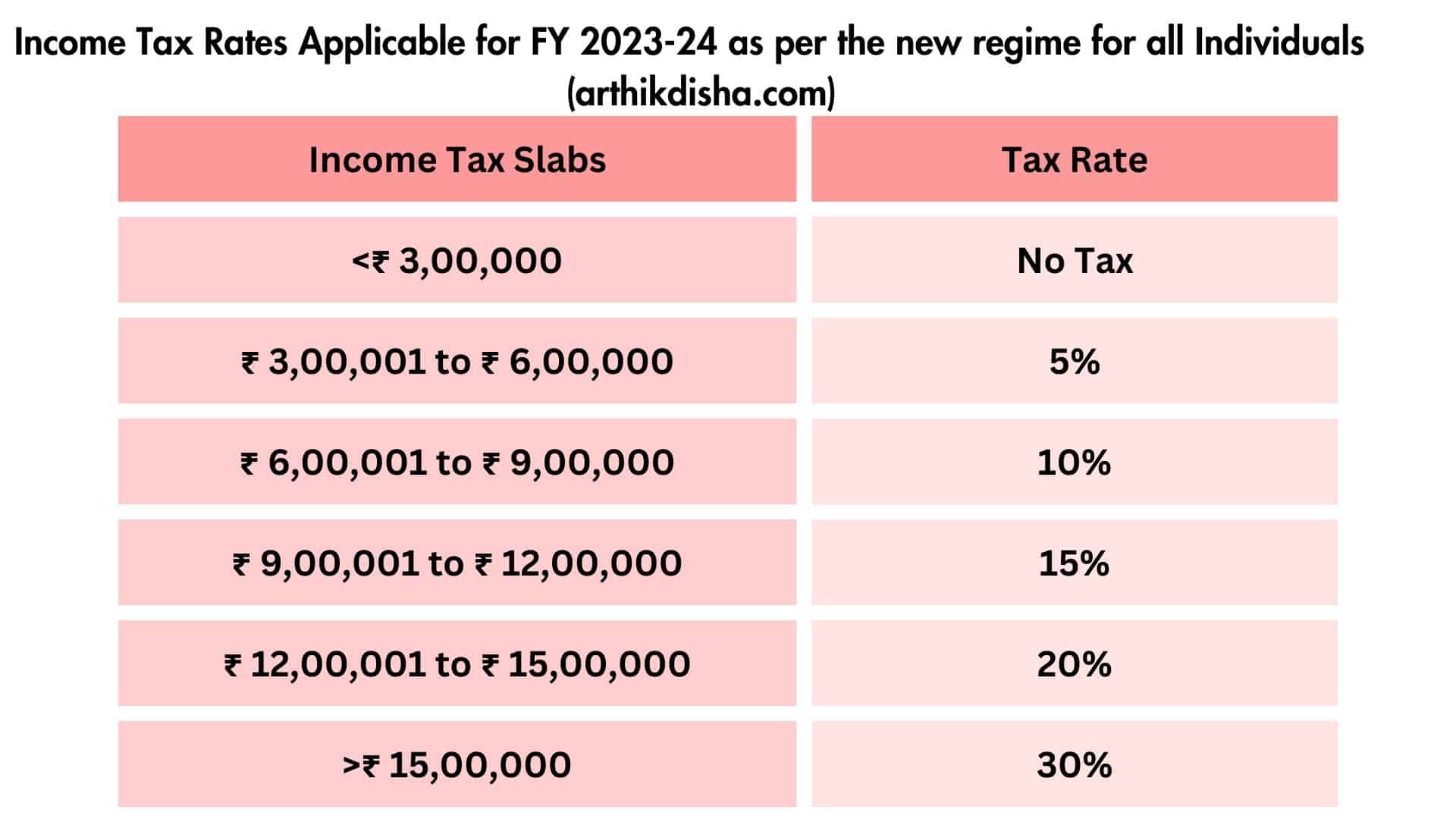

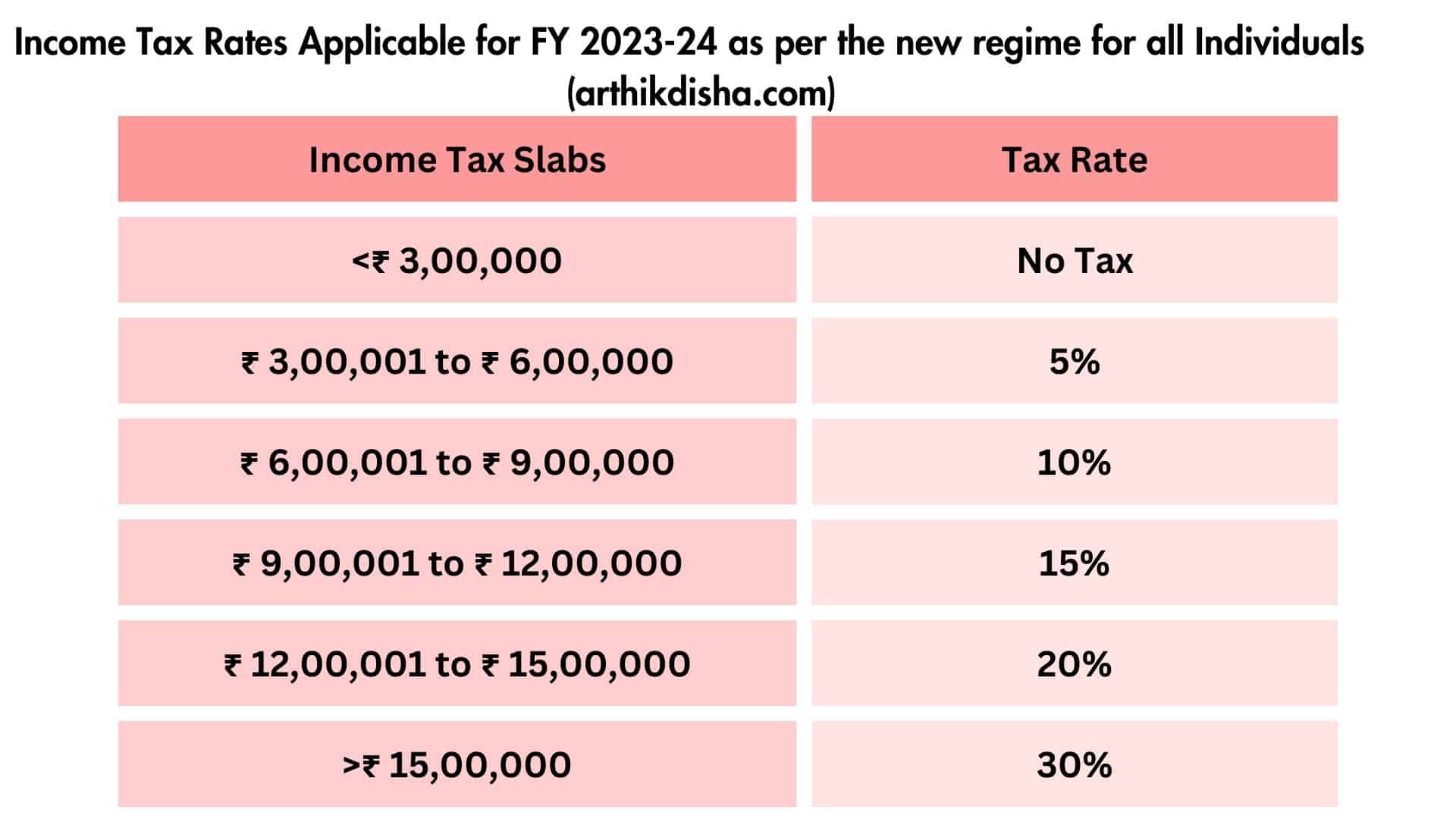

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Tds Slab Rate For Ay 2019 20

Tax Rebate U S 87a For Senior Citizen - Web 4 nov 2016 nbsp 0183 32 Senior citizens who are above the age of 60 are not eligible to file for a tax rebate However the good news is that the income tax slab for AY 2018 19 has hiked