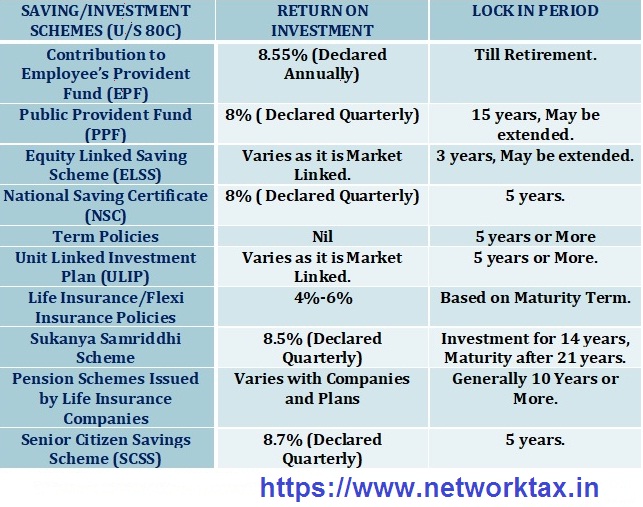

Tax Rebate U S 89 1 Web 11 mai 2023 nbsp 0183 32 How to claim tax relief on Salary Arrears under Section 89 1 Arrears or Salary advances are taxable in the year of receipt The income tax department allows tax relief u s 89 of the Income Tax Act to

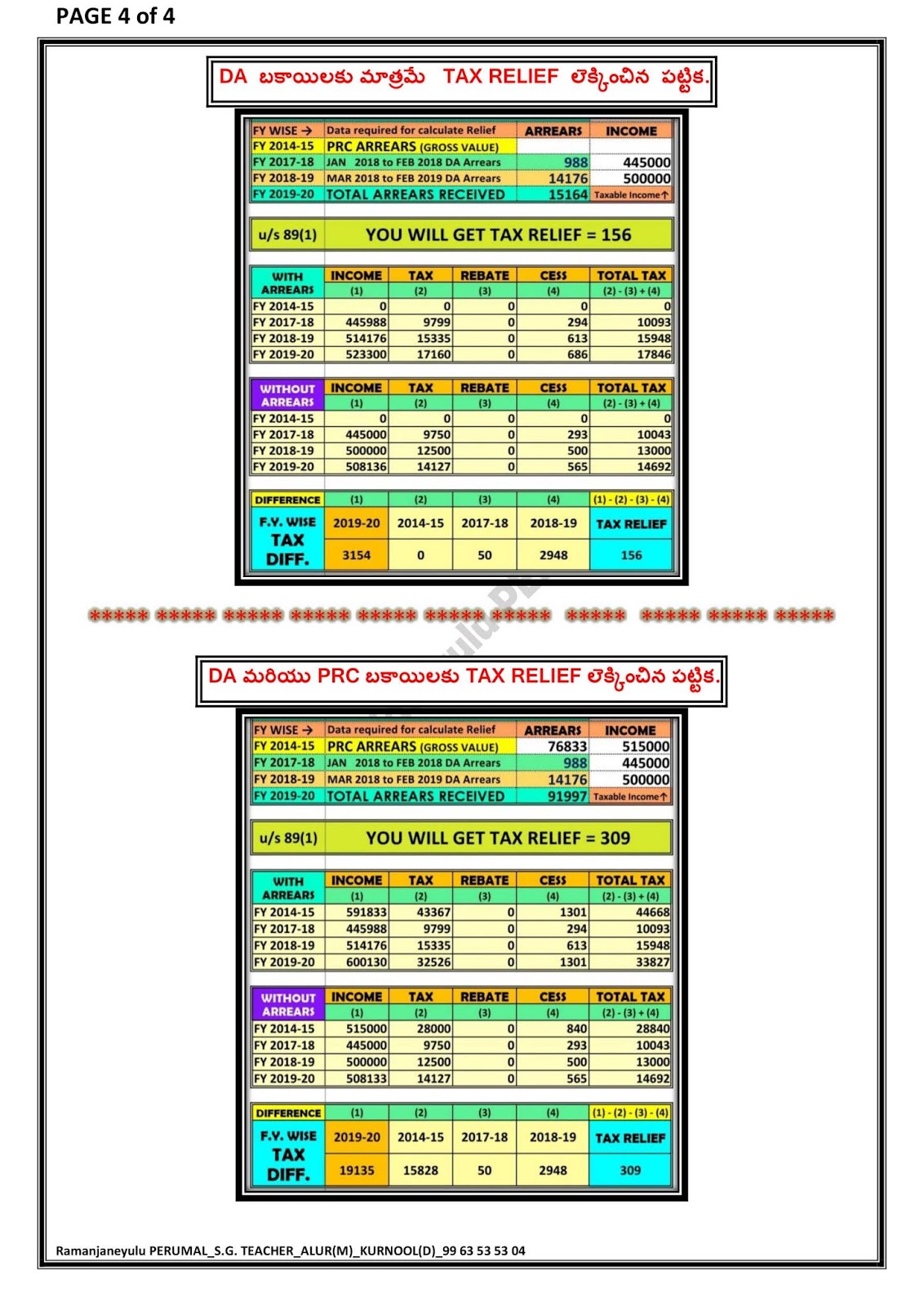

Web Form 10E Calculator Compute Tax Relief u s 89 1 for the FY 2017 18 to FY 2020 21 Calculate Tax Income Tax for FY 2017 18 2018 19 2019 20 2020 21 with amp without Web 1 oct 2021 nbsp 0183 32 CA ROHIT VISHNOI 10 7K subscribers Subscribe 21K views 1 year ago arrear u Incometax How to calculate arrears Tax relief on arrear u s 89 1 AY 21

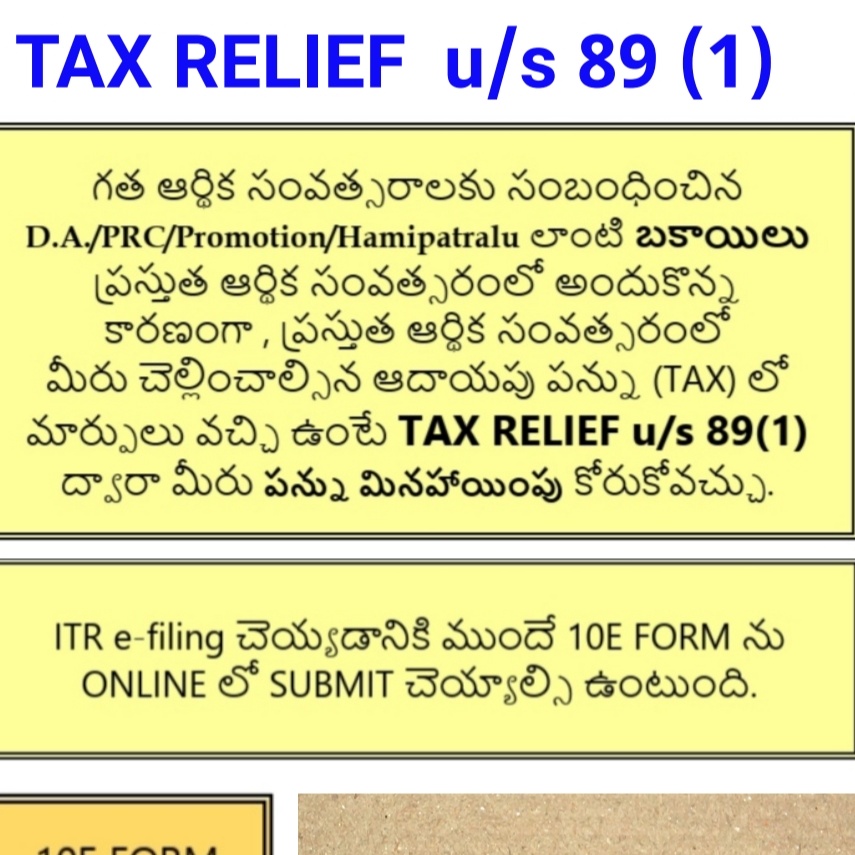

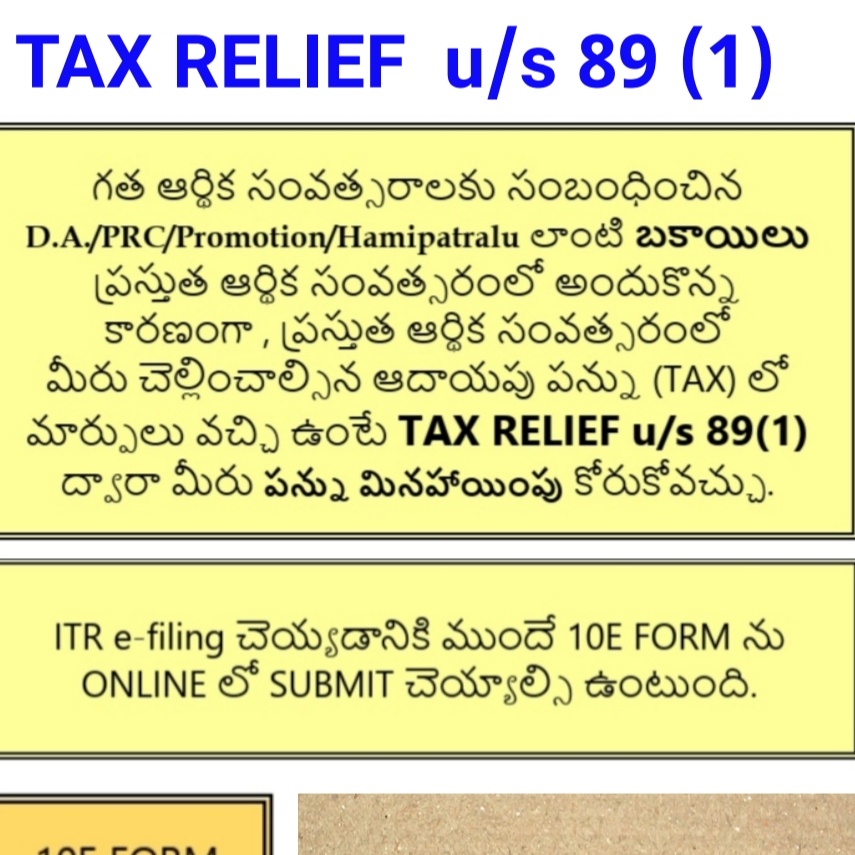

Tax Rebate U S 89 1

Tax Rebate U S 89 1

https://1.bp.blogspot.com/-tZFrTAS5gvo/XhUd-5p6j3I/AAAAAAAALfQ/Bb1lpmHCvMk08MD2EPLY5qHVFx-Gt0TlgCNcBGAsYHQ/s1600/Picture%2B5%2Bof%2BArrears%2BRelief%2BCalculator%2B%2B19-20.jpg

TAX RELIEF U S 89 1 You Can Read The FILE Above For A Full

https://1.bp.blogspot.com/-mGVyFlaKZmg/YDEX-u40vLI/AAAAAAAAht8/N3zA4fpxAKofXgvy3dc9JOcETOI5uxvQwCLcBGAsYHQ/s855/Screenshot_20210220-193707__01.jpg

TAX RELIEF U s 89 1 Explination By Ramanjaneyulu Perumal MANNAMweb

https://1.bp.blogspot.com/-7V-zRWTIUZ8/XgN7pdCaCnI/AAAAAAAASss/xUIPqe83E4wV5IDJzRmiCHS2gvndYPAWACLcBGAsYHQ/s1600/Image_4.jpeg

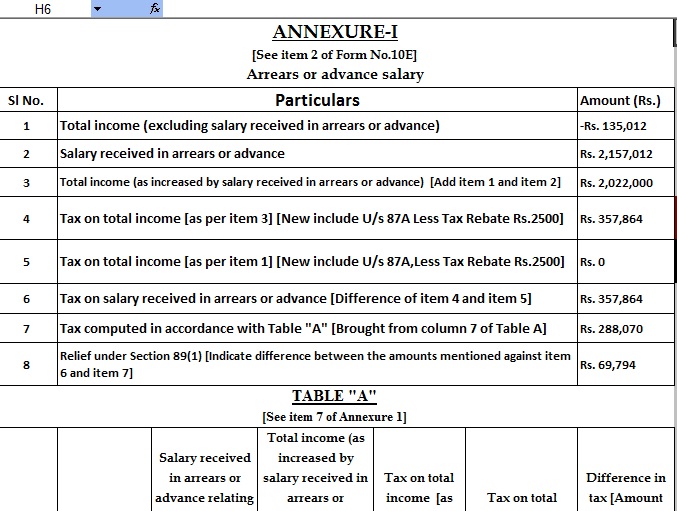

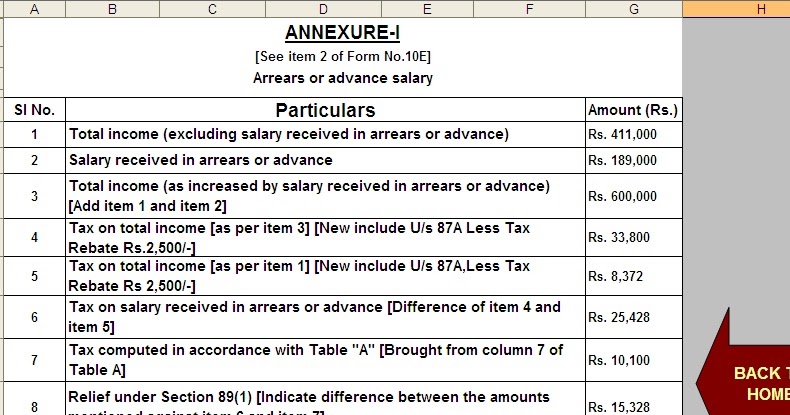

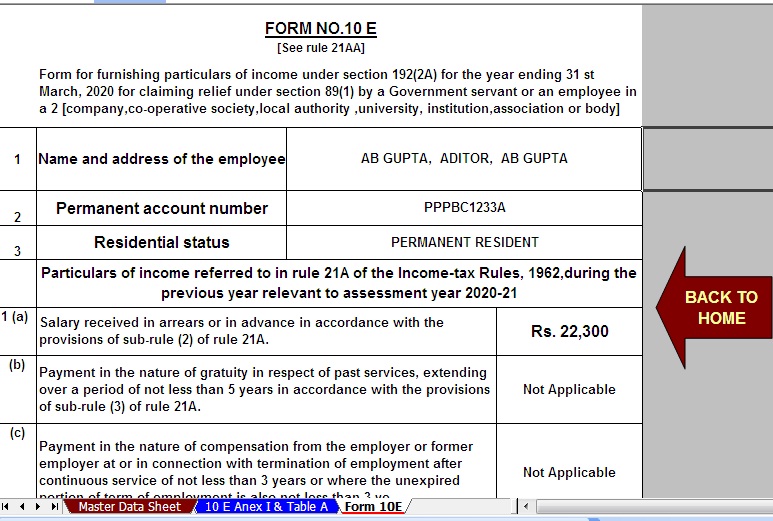

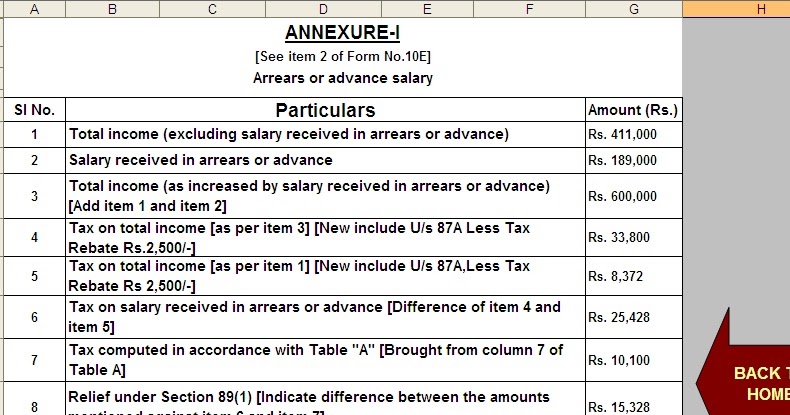

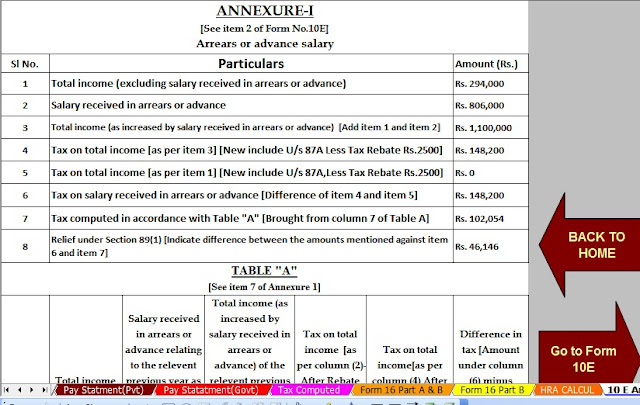

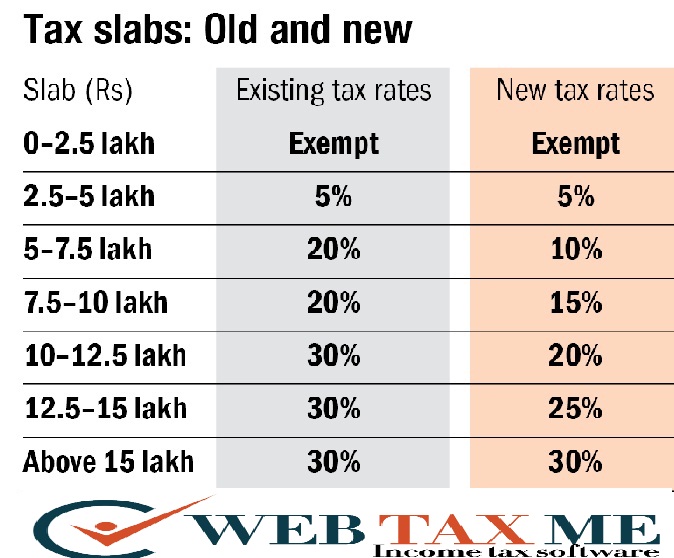

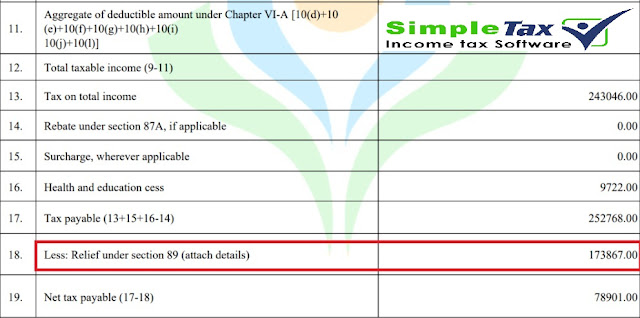

Web Amount in Rs Salary received in arrear Rule 21A 2 Enter details Gratuity received for past services extending a period of not less than 5 years but less than 15 years Rule Web Here are the steps to calculate relief under section 89 1 of the Income tax Act 1961 Calculate tax payable on total income including arrears in the year in which it is received Calculate tax payable on total income

Web Section 89 1 Relief of Salary Tax is calculated on a taxpayer s total income earned or received during the financial year If the assessee has received a potion of his salary in arreas or in advance or received a Web 27 f 233 vr 2020 nbsp 0183 32 Relief under section 89 1 for arrears of salary are available in the following cases Salary received in advance or as arrears Gratuity Compensation on Termination

Download Tax Rebate U S 89 1

More picture related to Tax Rebate U S 89 1

Download Auto Calculate Income Tax Arrears Relief Calculator U s 89 1

https://1.bp.blogspot.com/-Ipsw29iUnkc/XuXc-jYh0sI/AAAAAAAANdM/-Y63uNNLCDYYME4lvkjYUc1f27RxYOyjgCNcBGAsYHQ/s1600/2.jpg

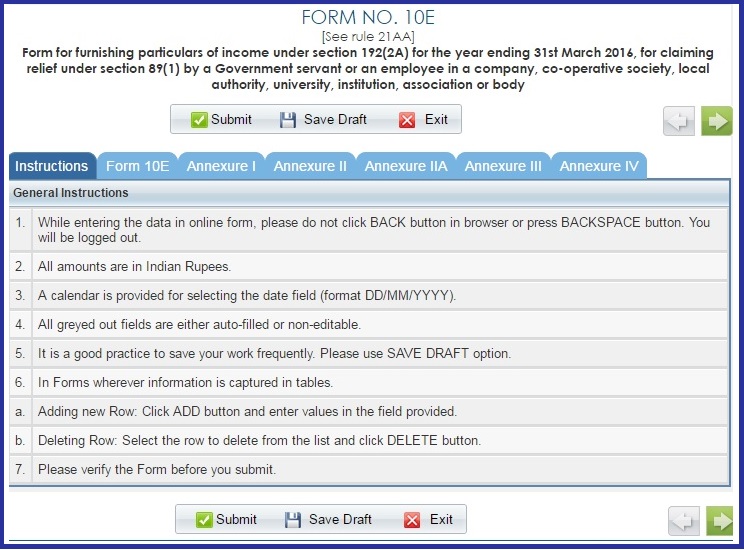

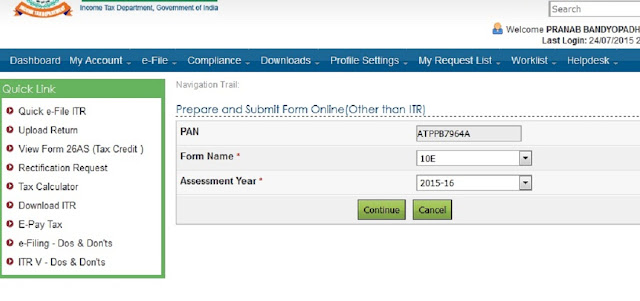

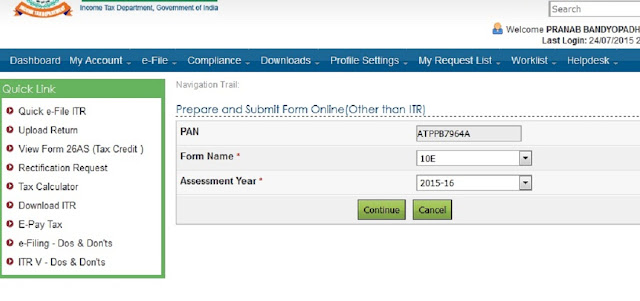

Now It Is Compulsory To Upload 10E Form For Claim Relief U s 89 1 To

https://2.bp.blogspot.com/-wrcqm6PmAiE/VhU1EyN4OmI/AAAAAAAADPY/y4q-1wC5op0/w1200-h630-p-k-no-nu/other.gif

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

https://1.bp.blogspot.com/-FA5sF9RVbPs/X1BnDNbfM8I/AAAAAAAAOSk/xMZjeJeXwBQcSU_kLIeub9xWgP1PLULrgCNcBGAsYHQ/s1600/New%2BTax%2BSlab%2Bfor%2BA.Y.2021-22.jpg

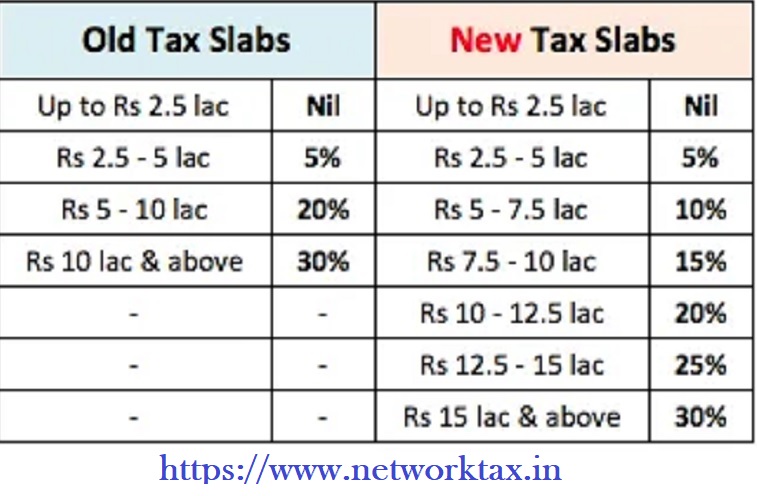

Web 30 nov 2021 nbsp 0183 32 Automated Income Tax Arrears Relief Calculator U s 89 1 with Form 10 E for the F Y 2021 22 a pay structure that can help you reduce your tax burden Although Web 26 ao 251 t 2021 nbsp 0183 32 As per Section 89 1 tax deduction relief is provided by recalculating tax for the year in which arrears are received and the year to which the arrears pertain and the

Web 3 ao 251 t 2023 nbsp 0183 32 An employee must meet certain conditions to claim relief under Section 89 1 Salary is received in arrears or in advance Salary received for more than 12 Web 10 mars 2014 nbsp 0183 32 This relief is called relief u s 89 1 We have uploaded Calculator to calculate relief Under section 89 1 of the Income Tax Act 1961 in respect of Arrears of

Download Automated Form 16 Part B For F Y 2018 19 Income Tax Arrears

https://3.bp.blogspot.com/-zDuoVzX6UWs/XE1nwSG7-II/AAAAAAAAIfY/3LIrMIVsBVABav5qyCtD1x1EpdKeu0TrgCLcBGAs/w1200-h630-p-k-no-nu/89%2BArrears%2BPage%2B2.jpg

Tds Tax India Form 10E Or Relief U s 89 1 For Financial Year 2011 12

http://3.bp.blogspot.com/-xJWCWgVqDao/T73IAoz2y2I/AAAAAAAAA2Q/i--qluBNYlc/s1600/Untitled2.gif

https://learn.quicko.com/salary-arrears-taxabi…

Web 11 mai 2023 nbsp 0183 32 How to claim tax relief on Salary Arrears under Section 89 1 Arrears or Salary advances are taxable in the year of receipt The income tax department allows tax relief u s 89 of the Income Tax Act to

https://maxutils.com/income/calculate-tax-relief-us89

Web Form 10E Calculator Compute Tax Relief u s 89 1 for the FY 2017 18 to FY 2020 21 Calculate Tax Income Tax for FY 2017 18 2018 19 2019 20 2020 21 with amp without

INCOME TAX ARREARS REBATE FORM 10E U S 89 1 Edu Plus Official

Download Automated Form 16 Part B For F Y 2018 19 Income Tax Arrears

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

Second Home Loan Tax Implication And Benefit With Automated Arrears

Auto Fill Income Tax Arrears Relief Calculator U S 89 1 Form 10 E

How To E filing For Upload 10E Form For Claim Relief U s 89 1 To The

How To E filing For Upload 10E Form For Claim Relief U s 89 1 To The

DOWNLOAD 89 1 ARREARS RELIEF CALCULATOR F Y 2021 22 And A Y 2022 23

TAX RELIEF U s 89 1 Explination By Ramanjaneyulu Perumal MANNAMweb

Automated Excel Based Arrears Relief Calculator With Form 10E For A Y

Tax Rebate U S 89 1 - Web Here are the steps to calculate relief under section 89 1 of the Income tax Act 1961 Calculate tax payable on total income including arrears in the year in which it is received Calculate tax payable on total income