Tax Rebate Under 80c For Senior Citizens Under Section 80C of the Income Tax Act 1961 individuals are eligible for tax deductions on investments up to Rs 1 5 lakh If the total interest in all SCSS accounts exceeds

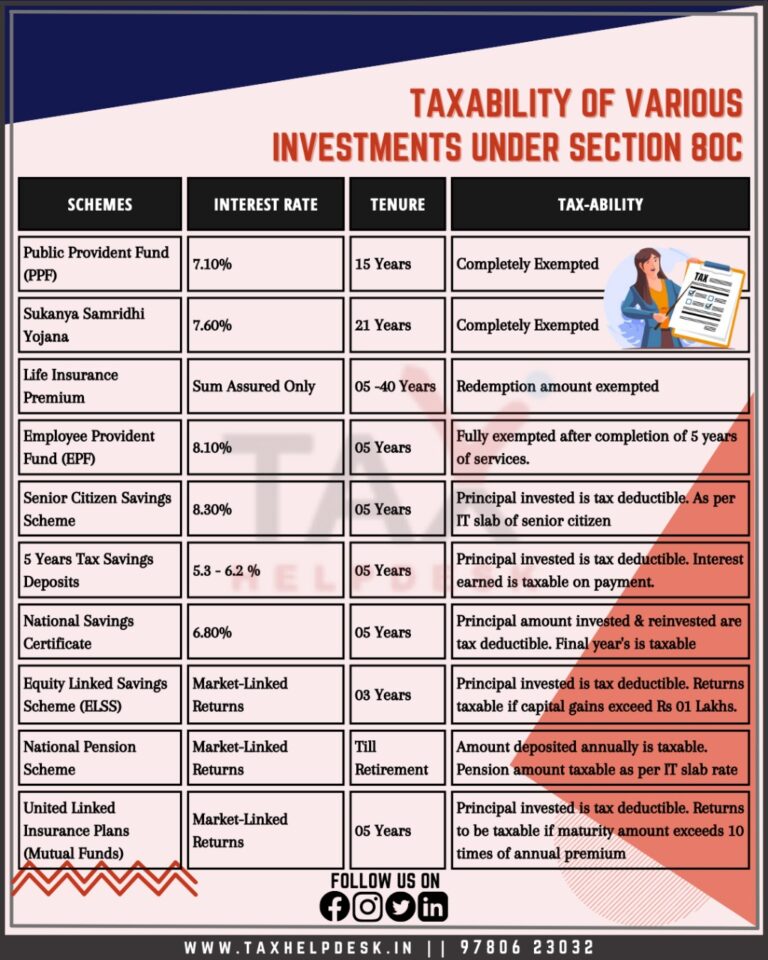

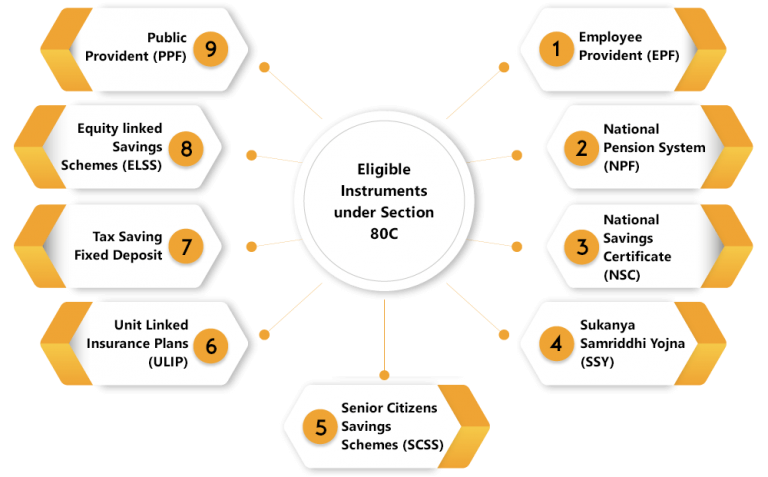

Section 80C of the Income Tax Act allows senior citizens to claim deductions and reduce their taxable income Eligible investments for deductions under 80C include options like Public Provident Fund Sukanya Samriddhi Yojana and Opening a Post Office Savings Scheme account is simple with minimal documentation needed offering tax rebates under Section 80C The schemes have varied

Tax Rebate Under 80c For Senior Citizens

Tax Rebate Under 80c For Senior Citizens

https://i.ytimg.com/vi/ZQZzPHi90rY/maxresdefault.jpg

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

https://i.ytimg.com/vi/Q6z6wI7m9Eo/maxresdefault.jpg

Post office schemes for senior citizens girl child tax benefits under

https://static.india.com/wp-content/uploads/2021/07/post-office-schemes-2021-tax-benefits-under-80-c.jpg

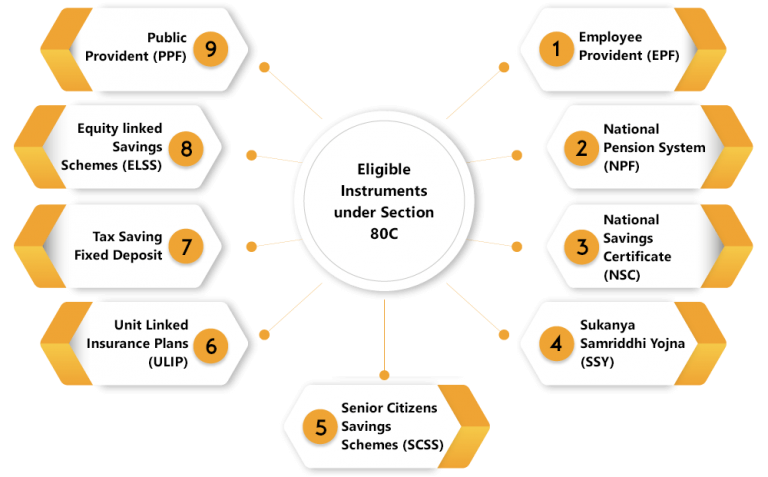

Combined deductions apart from standard deductions for senior citizens tax deductions under Section 80C 80CCC and 80CCD 1 up to 1 5 lakh Section 80D health Taxability The amount invested is eligible for deduction under section 80C but the withdrawals and interest are taxable Senior citizens can claim tax benefits of up to Rs 50 000 on the interest amount earned u s

The senior citizen must submit a declaration in Form 12BBA to the specified bank providing details of income and deductions under applicable sections like Section 80C 80D The Senior Citizen Savings Scheme offers an interest rate of 8 per year for deposits placed in the January December quarter Every quarter the interest is due and completely taxable The plan doesn t offer any interest

Download Tax Rebate Under 80c For Senior Citizens

More picture related to Tax Rebate Under 80c For Senior Citizens

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

What Are The Tax Saving Investments Other Than Section 80C For Senior

https://images.livemint.com/img/2022/12/28/600x338/IT6_1612424458287_1612424463943_1672231565227_1672231565227.jpg

Understand About Taxability Of Various Investments Under Section 80C

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Investments-under-Section-80C-768x960.jpeg

A credit for taxpayers aged 65 or older OR retired on permanent and total disability and received taxable disability income for the tax year AND with an adjusted gross While ELSS is not a quick money making option it helps build wealth gradually over time while also offering tax benefits under Section 80C Caution Note For senior citizens the

Any investments made towards Senior Citizens Saving Scheme or SCSS are eligible for tax exemption up to the maximum allocated 80C limit i e Rs 1 5 lakh Individuals above the age Senior citizens can benefit from Section 80TTB introduced in Finance Budget 2018 allowing a deduction of up to Rs 50 000 on specified interest income The section is applicable

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

https://1.bp.blogspot.com/-Ke4rAxpKLcE/XePaYI8rcnI/AAAAAAAALKI/-yZ-xBI_4fojq9hdLG6dgXgOF6VVPgeoQCNcBGAsYHQ/s1600/Tax%2BSlab%2Bfor%2BF.Y.%2B2019-20.jpg

NPS Tax Benefit Sec 80C And Additional Tax Rebate YouTube

https://i.ytimg.com/vi/GM4v-mSMqVQ/maxresdefault.jpg

https://cleartax.in › senior-citizen-savings-scheme

Under Section 80C of the Income Tax Act 1961 individuals are eligible for tax deductions on investments up to Rs 1 5 lakh If the total interest in all SCSS accounts exceeds

https://greatsenioryears.com

Section 80C of the Income Tax Act allows senior citizens to claim deductions and reduce their taxable income Eligible investments for deductions under 80C include options like Public Provident Fund Sukanya Samriddhi Yojana and

Best Deposit Scheme For Senior Citizens In India with 80C Tax Benefit

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Unlock The Benefits Of Section 80C Under Chapter VI A

Section 80D Deductions For Medical Health Insurance For Fy 2021 22

What Is Income Tax Limit For Property Tax And Insurance

Deduction Of 80C 80CCC 80CCD Under Income Tax

Deduction Of 80C 80CCC 80CCD Under Income Tax

Section 80C Deduction For Tax Saving Investments Learn By Quicko

Deduction U s 80C 80CCC 80CCD 80D Income Tax 80c

Budget 2014 Impact On Money Taxes And Savings

Tax Rebate Under 80c For Senior Citizens - Combined deductions apart from standard deductions for senior citizens tax deductions under Section 80C 80CCC and 80CCD 1 up to 1 5 lakh Section 80D health