Tax Rebate Under Section 87a Means Web 3 lignes nbsp 0183 32 14 sept 2019 nbsp 0183 32 This rebate helps reduce the income tax liability of taxpayers It is a benefit provided by the

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus Web 26 avr 2022 nbsp 0183 32 Taxpayers can reduce their tax liability through the rebate under Section 87A of the Income Tax Act Individuals can claim the rebate if the total income after

Tax Rebate Under Section 87a Means

Tax Rebate Under Section 87a Means

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

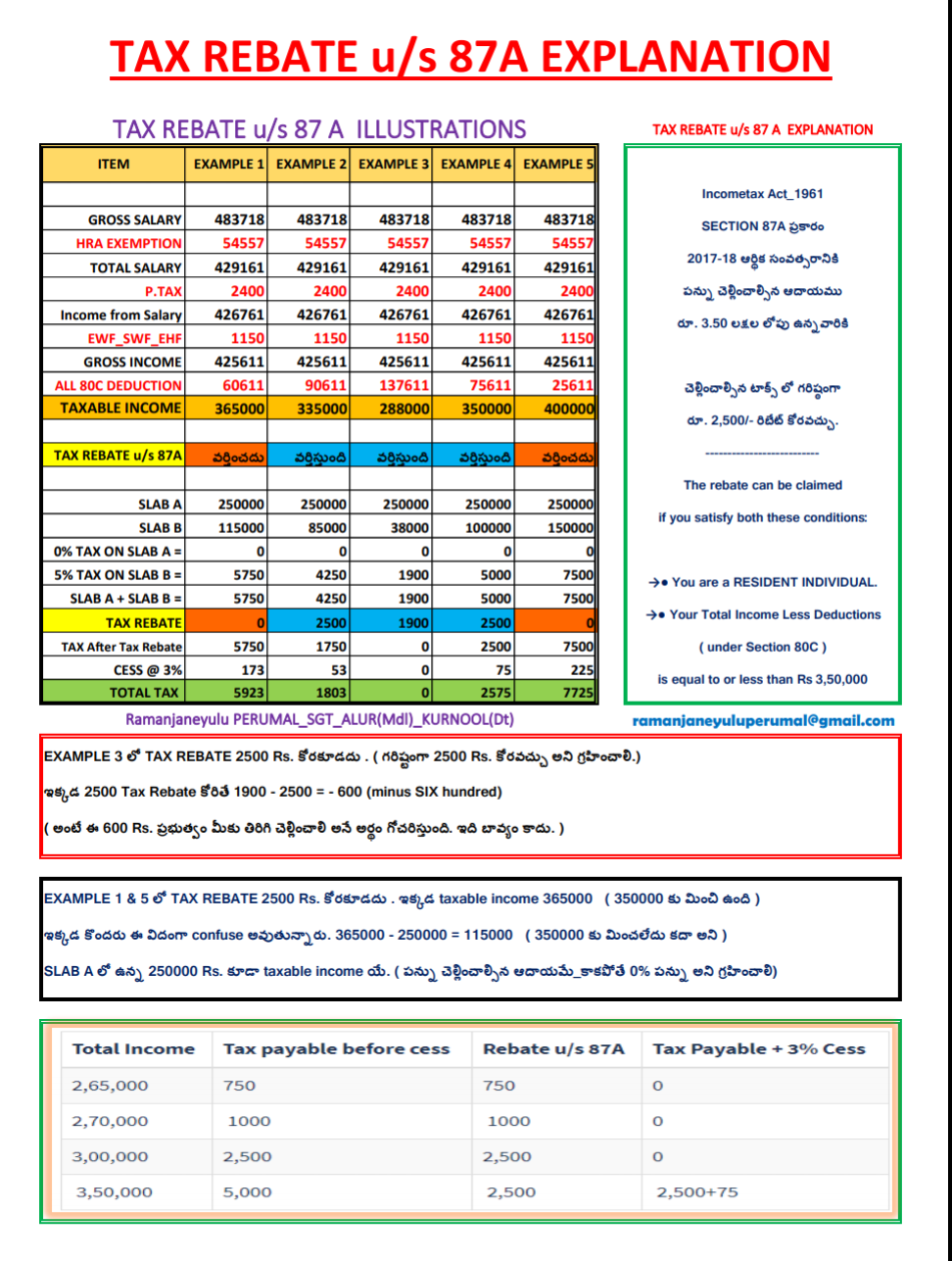

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

https://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Section 87A Tax Rebate Under Section 87A Rebates Financial

https://i.pinimg.com/736x/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

Web Income Tax Applicable Rebate under Section 87A Total Tax Payable Rs 3 lakhs Rs 2 500 Rs 2 500 Nil Rs 3 1 lakhs Rs 3 000 Rs 2 500 Rs 500 Rs 3 2 lakhs Rs Web To calculate rebate under section 87A calculate your gross income and subtract the available deductions under Sections 80C to 80U Now if your net taxable income is

Web 1 What is Section 87A rebate limit The limit for Section 87A varies for the old and new tax regimes Under the old tax regime the limit is set to an income of INR 5 Web Individuals can enjoy a tax rebate under Section 87A when they earn a net taxable income within 5 00 000 in a given financial year Eligible candidates can claim a tax rebate of

Download Tax Rebate Under Section 87a Means

More picture related to Tax Rebate Under Section 87a Means

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

https://enterslice.com/learning/wp-content/uploads/2019/06/image-91.png

Rebate Of Income Tax Under Section 87A YouTube

https://i.ytimg.com/vi/lgmblbkc7Qs/maxresdefault.jpg

Tax Rebate Under Section 87A All You Need To Know YouTube

https://i.ytimg.com/vi/JM0j9VqDYfI/maxresdefault.jpg

Web The available tax rebate under Section 87A of the Income Tax Act 1961 offers the benefit of nil taxation if you have a limited income However before claiming the rebate here Web 2 f 233 vr 2023 nbsp 0183 32 If your net taxable income is up to INR 5 00 000 then you are eligible to claim a rebate under section 87A The maximum tax rebate available under section 87A is

Web 25 ao 251 t 2020 nbsp 0183 32 Rebate under section 87A will be lower of 100 of income tax liability or Rs 2 500 In other words if the tax liability exceeds Rs 2 500 rebate will be available to Web What is Tax Rebate Under Section 87 A Steps to Claim Rebate Who is Eligible Things to Consider FAQs Understanding Rebate Under Section 87 A Income tax rules in India

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/07/DECODING-SECTION-87A.png

https://tax2win.in/guide/section-87a

Web 3 lignes nbsp 0183 32 14 sept 2019 nbsp 0183 32 This rebate helps reduce the income tax liability of taxpayers It is a benefit provided by the

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus

Rebate Of Income Tax Under Section 87A YouTube

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Income Tax Rebate Under Section 87A

Tax Rebate 2017 18 Clarification Under Section 87 A Teachers9 Com

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Income Tax Rebate U s 87A For The Financial Year 2022 23

Section 87A Tax Rebate FY 2019 20 Tax Wealth Tax Tax Deductions

Income Tax Rebate Under Section 87A

Tax Rebate Under Section 87a Means - Web To calculate rebate under section 87A calculate your gross income and subtract the available deductions under Sections 80C to 80U Now if your net taxable income is