Tax Rebate Vs Tax Return Web 7 juin 2009 nbsp 0183 32 Tax Return vs Tax Refund vs Tax Rebate Now that tax season is in full swing many personal finance bloggers are delving into the field of taxation to offer tips

Web 1 d 233 c 2022 nbsp 0183 32 The eligibility requirements for tax rebates vary widely but generally taxpayers do not have to wait until they file next year s tax return to receive payment In many cases your tax rebate check isn t directly Web 19 janv 2023 nbsp 0183 32 Your tax return will include your gross income which is different from your AGI how much you ve already paid toward taxes

Tax Rebate Vs Tax Return

Tax Rebate Vs Tax Return

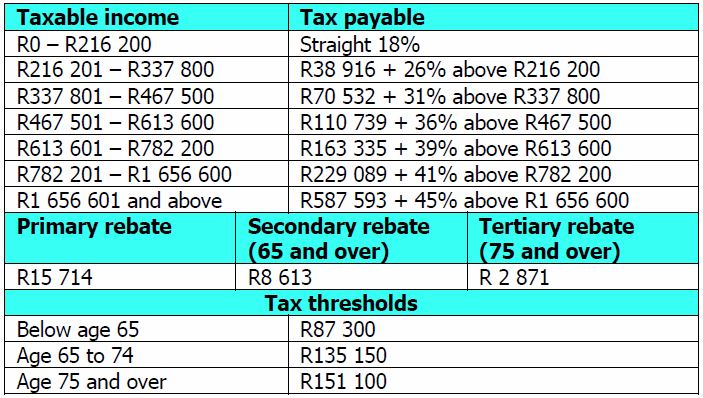

https://www.nexia-sabt.co.za/wp-content/uploads/2021/03/Tax-Table-and-Rebates-2021-2022.jpg

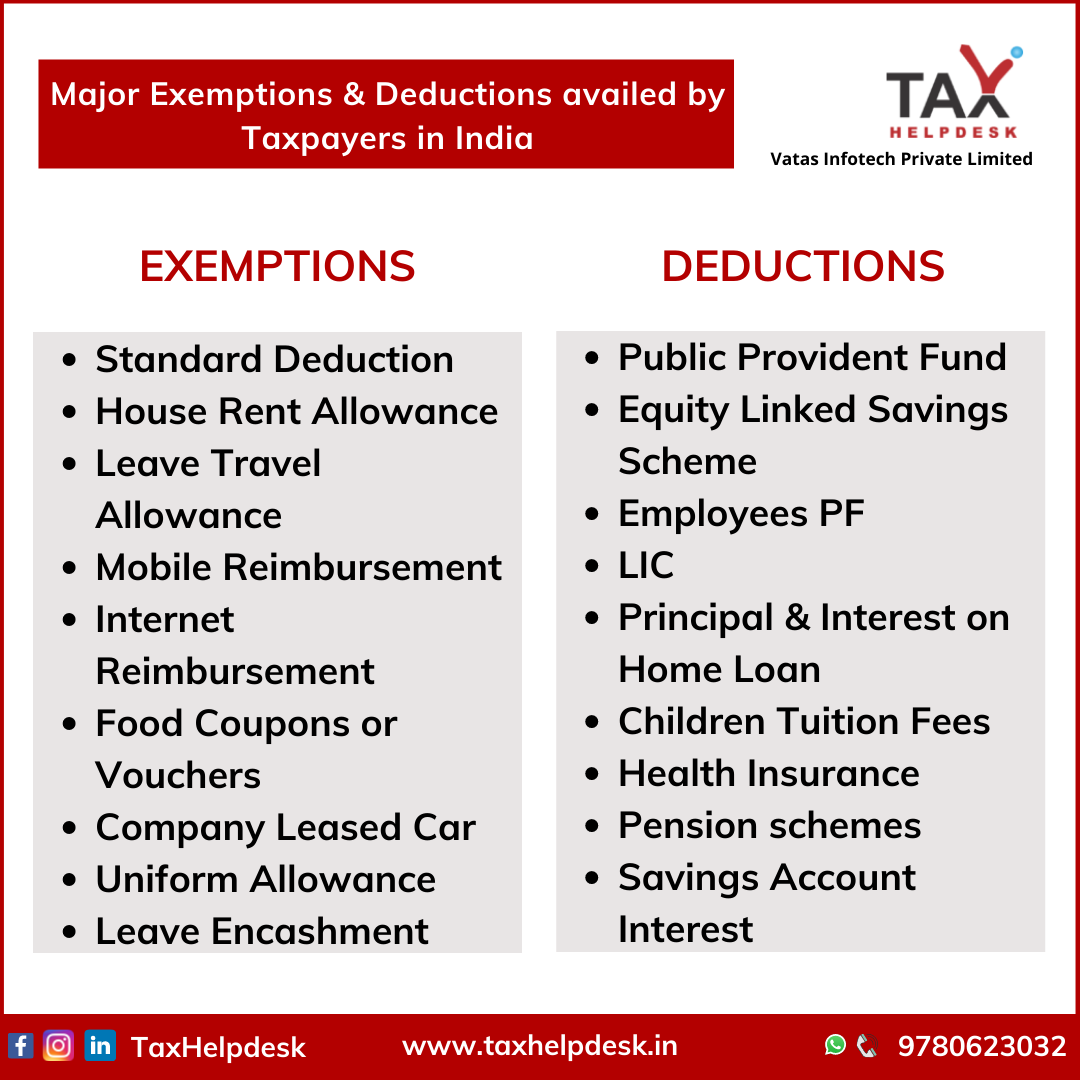

Major Exemptions Deductions Availed By Taxpayers In India

https://www.taxhelpdesk.in/wp-content/uploads/2020/12/Weekly-Updates-1.png

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Web Tax Credits vs Tax Deductions and Tax Refunds Britannica Money Household Finance Tax deductions tax credits and tax refunds what s the difference Top line bottom Web Tax Credit Vs Rebate By Dennis Hartman Fact Checked Tax return forms list spaces for claiming eligible credits Paying income taxes can be an expensive undertaking that

Web Optimally a return should result in a payment owed of just less than the amount that would cause a penalty charge which is 100 of the prior year s tax 110 for high income Web Tax return or tax rebate which do you need help with At first glance tax returns and tax rebates or tax refunds look like they re talking about the same thing They re

Download Tax Rebate Vs Tax Return

More picture related to Tax Rebate Vs Tax Return

Strategies To Maximize The 2021 Recovery Rebate Credit In 2021 Income

https://i.pinimg.com/originals/04/6c/93/046c93de3420d11217b08ec3f970154b.png

How To Choose Between The New And Old Income Tax Regimes Chandan

https://images.moneycontrol.com/static-mcnews/2022/02/New-vs-old-tax-regime-Make-a-wise-choice-R.jpg

Pin On Tax Credits Vs Tax Deductions

https://i.pinimg.com/originals/9f/13/5e/9f135e8d89955e3dea41d76cd0ff4d6b.jpg

Web 31 janv 2023 nbsp 0183 32 A tax credit valued at 1 000 for instance lowers your tax bill by the corresponding 1 000 Tax deductions on the other hand reduce how much of your income is subject to taxes Deductions Web 27 f 233 vr 2023 nbsp 0183 32 Tax refunds are the opposite of a tax bill which refers to taxes owed by a taxpayer In the case of a tax bill you owe more taxes to the government than you paid during the year You normally

Web Tax Calculator 2022 2023 Refund and Tax Estimator Estimate how much you ll owe in federal taxes for tax year 2022 using your income deductions and credits all in just a few steps with our Web The IRS says that tax credits can reduce the amount of tax you owe or increase your tax refund They are different from deductions which reduce your taxable income Tax

IRS Issues Guidance On Delay In Paying Federal Taxes Owed Newsday

https://cdn.newsday.com/polopoly_fs/1.43295324.1584578405!/httpImage/image.jpg_gen/derivatives/landscape_1280/image.jpg

A Tale Of 2 Taxes How Carbon Pricing And Revenue Rolls Out In Alberta

https://i.cbc.ca/1.4971762.1547067964!/fileImage/httpImage/image.jpg_gen/derivatives/original_620/climate-action.jpg

https://obliviousinvestor.com/tax-return-vs-tax-refund-vs-tax-rebate

Web 7 juin 2009 nbsp 0183 32 Tax Return vs Tax Refund vs Tax Rebate Now that tax season is in full swing many personal finance bloggers are delving into the field of taxation to offer tips

https://turbotax.intuit.com/tax-tips/tax-relief/w…

Web 1 d 233 c 2022 nbsp 0183 32 The eligibility requirements for tax rebates vary widely but generally taxpayers do not have to wait until they file next year s tax return to receive payment In many cases your tax rebate check isn t directly

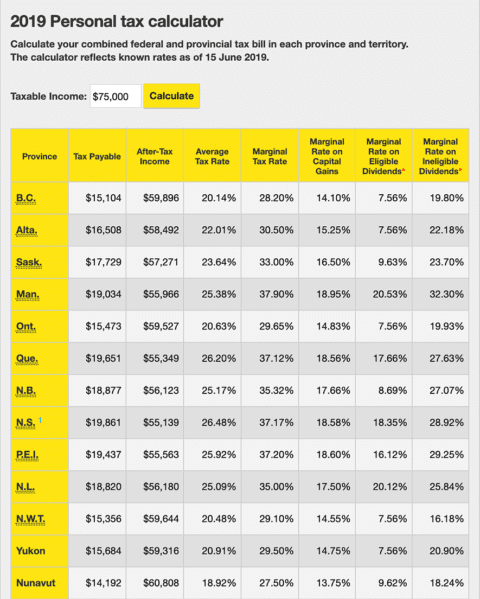

Top 15 Ey Tax Calculator Rrsp En Iyi 2022

IRS Issues Guidance On Delay In Paying Federal Taxes Owed Newsday

Difference Between Income Tax Deductions Exemptions And Rebate Plan

Difference Between Tax Exemption Tax Deduction And Tax Rebate The

Business Tax Credit Vs Tax Deduction What s The Difference

New Income Tax Regime Vs Old Key Things To Consider Budget 2023 Regimes

New Income Tax Regime Vs Old Key Things To Consider Budget 2023 Regimes

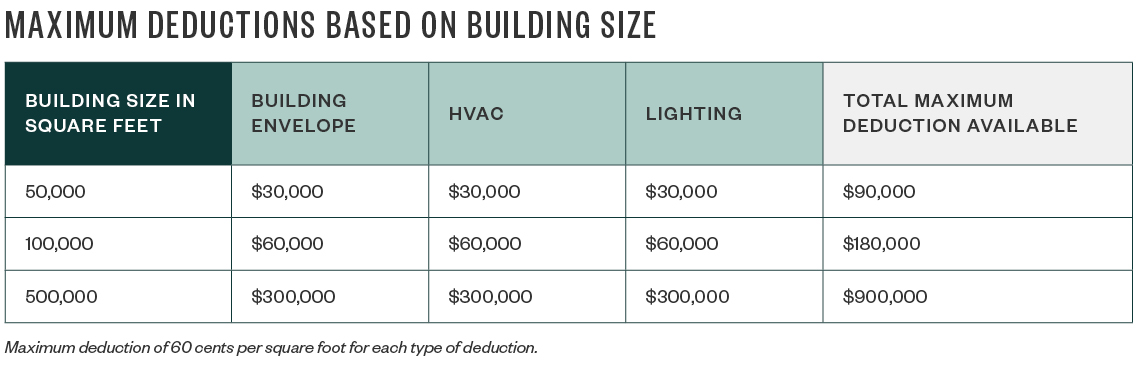

Tax Incentives For Energy Efficient Buildings

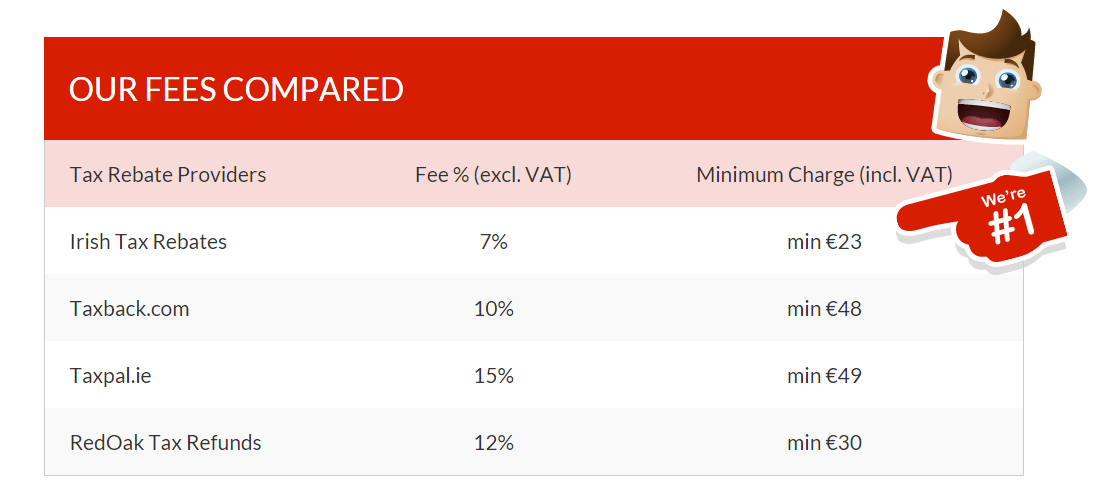

Why You Should Use A Tax Expert To Claim Tax Back Irish Tax Rebates

Can I Claim Ppi Back From My Catalogue

Tax Rebate Vs Tax Return - Web Tax Credit Vs Rebate By Dennis Hartman Fact Checked Tax return forms list spaces for claiming eligible credits Paying income taxes can be an expensive undertaking that