Tax Rebates For Home Improvements Web 29 ao 251 t 2022 nbsp 0183 32 Ryan Eichler If you ve been considering making green home improvements you might be in for some budgetary luck President

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for Web 22 juin 2023 nbsp 0183 32 Home improvement tax deduction Qualifying improvements to your home that qualify for tax deductions What Home Improvements Are Tax Deductible in

Tax Rebates For Home Improvements

Tax Rebates For Home Improvements

https://wilsonexteriors.com/wp-content/uploads/2023/05/Featured-image-223-768x432.png

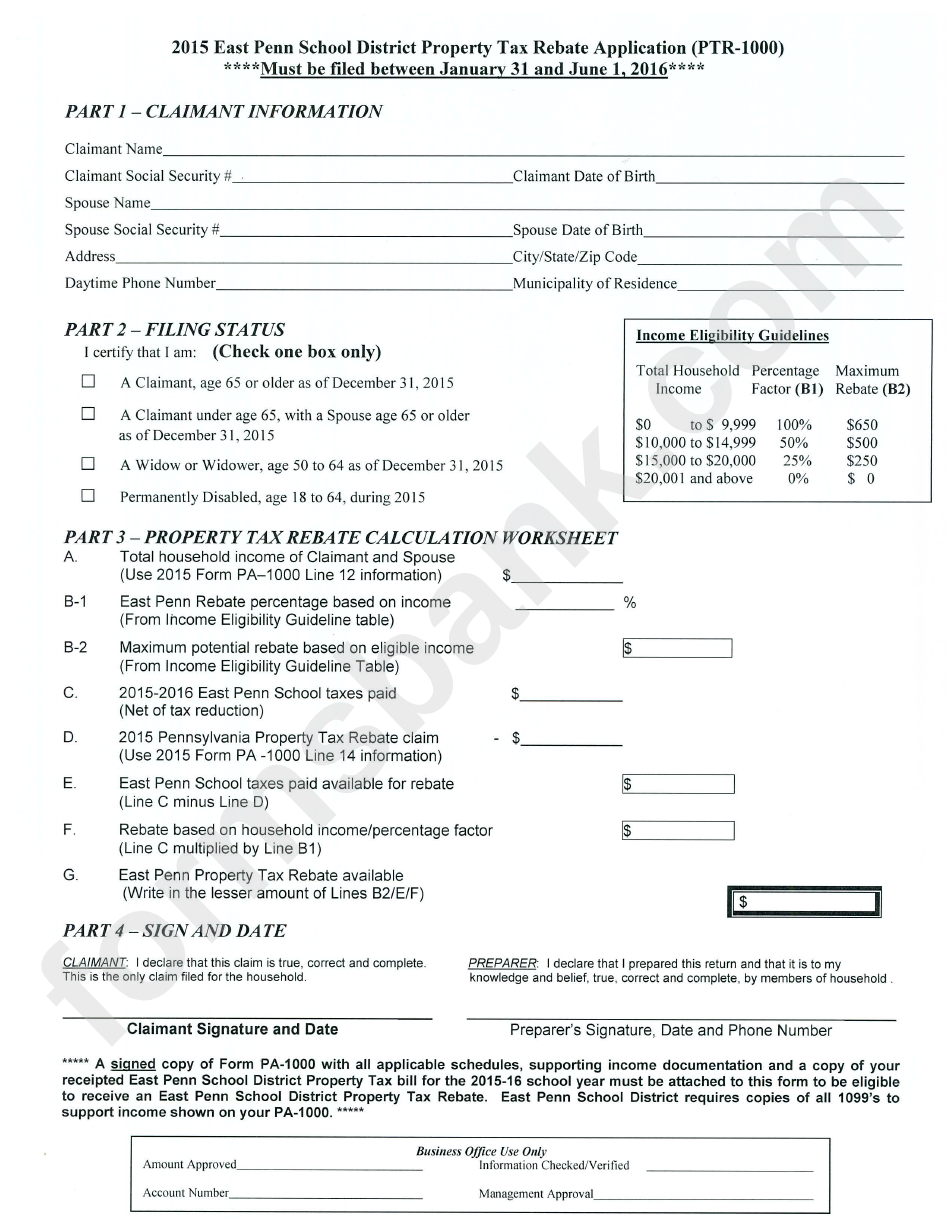

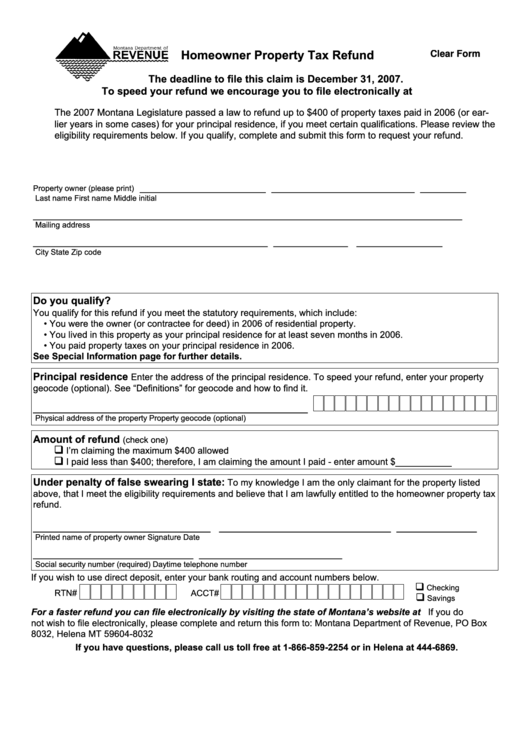

Property Tax Rebate Application Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/140/1407/140793/page_1_bg.png

Rentalfreebie Home Improvement Home Improvement Loans Home

https://i.pinimg.com/originals/56/f9/f5/56f9f5f0048a55a26c32513b4b30dfe3.jpg

Web 28 sept 2022 nbsp 0183 32 Under the Home Owner Managing Energy Savings HOMES rebate homeowners who install upgrades that cut energy usage by 35 or more are eligible for Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat

Web 16 mars 2023 nbsp 0183 32 Which home improvements qualify for the Energy Efficient Home Improvement energy tax credit Beginning January 1 2023 the credit becomes equal to Web 9 ao 251 t 2023 nbsp 0183 32 New Tax Rules Can Save You Thousands on Home Renovations Coming rebates for energy efficient upgrades can be combined with existing tax credits PHOTO

Download Tax Rebates For Home Improvements

More picture related to Tax Rebates For Home Improvements

Avista Corp Idaho Home Improvement Rebates PDF Hvac Water Heating

https://imgv2-1-f.scribdassets.com/img/document/136174816/original/0cebe19225/1628596182?v=1

Avista Corp Washington Home Improvement Rebates Furnace Hvac

https://imgv2-2-f.scribdassets.com/img/document/136471736/original/bc9ec26061/1587639082?v=1

Home Energy Efficient Improvements Tax Rebates

https://mccannwindow.com/wp-content/uploads/2022/09/mccann-sept-energy-1200.png

Web 13 f 233 vr 2023 nbsp 0183 32 The IRA allows homeowners a 30 tax credit for some energy efficient updates capped at 1 200 per year There s also a 2 000 credit for heat pumps heat pump water heaters and biomass stoves Web 17 mars 2023 nbsp 0183 32 taxes tax law Save More with Tax Credits for Energy Efficient Home Improvements Tax credits for energy efficient home improvements are extended and expanded because of the Inflation

Web 3 f 233 vr 2023 nbsp 0183 32 1 Go Renewable One of the best ways to save money on electricity is by generating your own Under the Inflation Reduction Act you can get a tax credit for 30 Web 8 mars 2021 nbsp 0183 32 There are multiple tax deductible home improvements you can undertake That new bedroom might just increase your refund In this article we ll show you what

7 Home Improvement Tax Deductions INFOGRAPHIC

https://help.taxreliefcenter.org/wp-content/uploads/2018/07/Tax-Relief-Center-7-Home-Improvement-Tax-Deductions-For-Your-House-FEATURED.jpg

How To Save Money On Home Improvements With Energy Efficiency Tax

https://mlsjoxwh2dv5.i.optimole.com/cb:fJ2b~7176/w:auto/h:auto/q:90/f:avif/https://finmasters.com/wp-content/uploads/2022/12/How-to-Save-Money-on-Home-Improvements-with-Energy-Efficiency-Tax-Credits-Rebates.jpg

https://www.investopedia.com/tax-credits-for-…

Web 29 ao 251 t 2022 nbsp 0183 32 Ryan Eichler If you ve been considering making green home improvements you might be in for some budgetary luck President

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

7 Home Improvement Tax Deductions INFOGRAPHIC

The Homeowners Guide To Tax Credits And Rebates

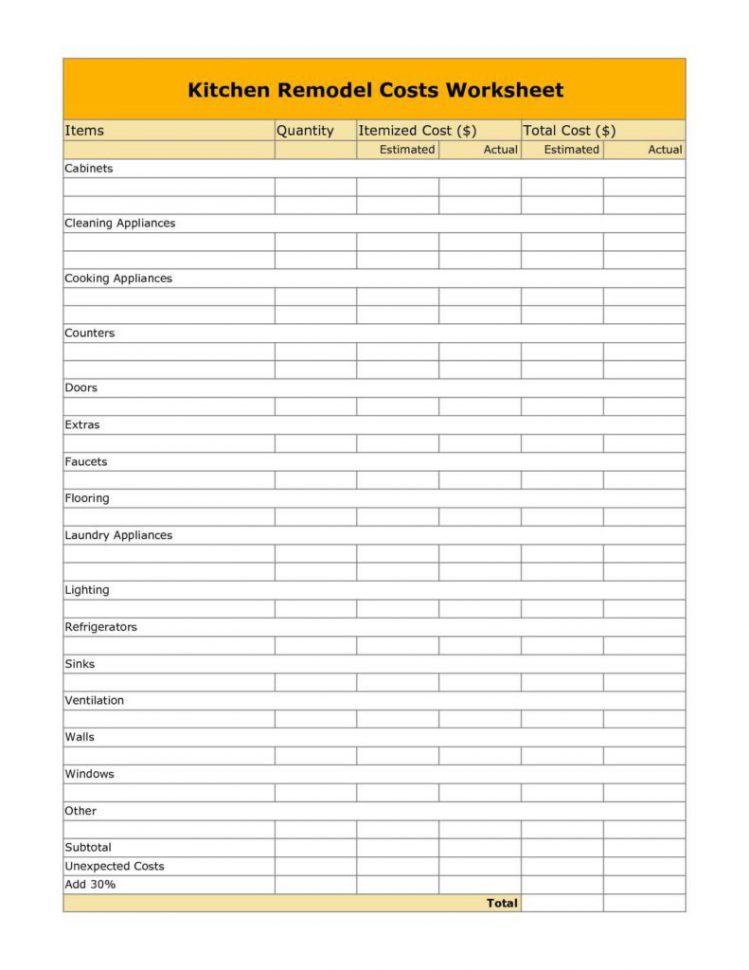

Home Renovation Budget Spreadsheet Template Db excel

The Homeowners Guide To Tax Credits And Rebates

Working From Home Tax Rebate Form 2022 Printable Rebate Form

Working From Home Tax Rebate Form 2022 Printable Rebate Form

Fillable Homeowner Property Tax Refund Form Montana Department Of

Home Improvement Estimate Template Breaking Limits Home Health Business

Ouc Rebates Pdf Fill Online Printable Fillable Blank PdfFiller

Tax Rebates For Home Improvements - Web 16 mars 2023 nbsp 0183 32 Which home improvements qualify for the Energy Efficient Home Improvement energy tax credit Beginning January 1 2023 the credit becomes equal to