Tax Refund Calculator With Recovery Rebate Web 20 d 233 c 2022 nbsp 0183 32 You will need the tax year s and amount s of the Economic Impact Payments you received to accurately calculate the Recovery Rebate Credit Enter the

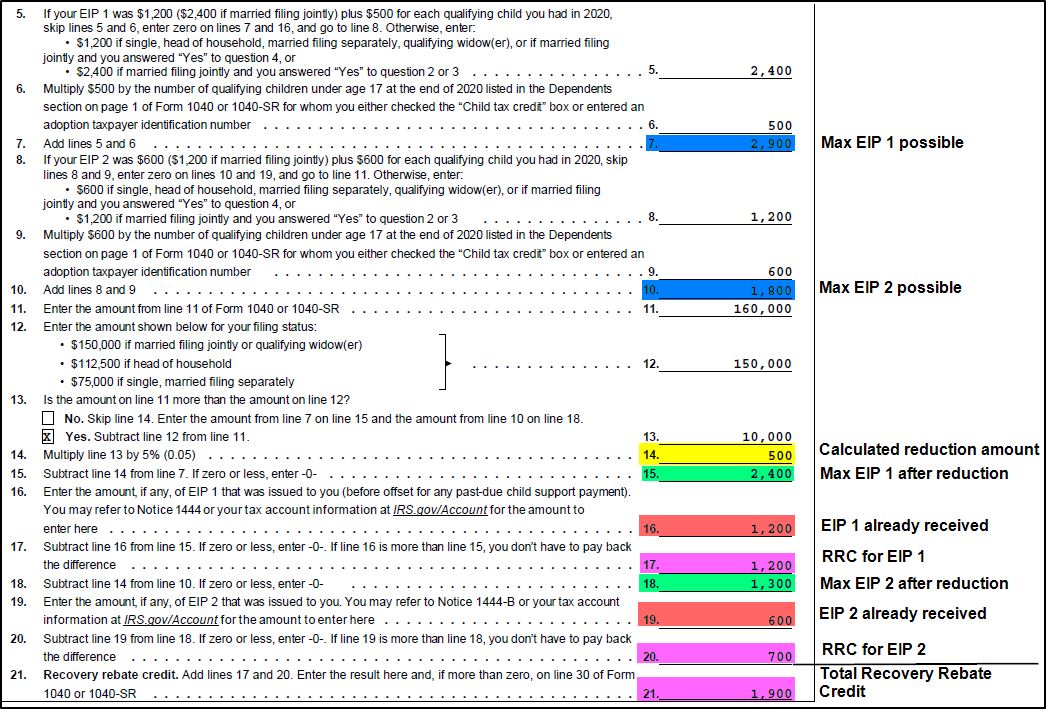

Web 10 d 233 c 2021 nbsp 0183 32 When calculating the 2020 Recovery Rebate Credit using tax prep software or the 2020 Recovery Rebate Credit Worksheet in the 2020 Form 1040 and Form 1040 Web 13 janv 2022 nbsp 0183 32 If you entered an amount greater than 0 on line 30 and made a mistake on the amount the IRS will calculate the correct amount of the Recovery Rebate Credit

Tax Refund Calculator With Recovery Rebate

Tax Refund Calculator With Recovery Rebate

https://i.pinimg.com/originals/c5/01/7b/c5017b88440e5203d6056b3107d8882f.png

Recovery Rebate Credit 2020 Calculator KwameDawson

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

Recovery Rebate Credit 2020 Calculator KwameDawson

https://www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your Web Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return

Web 1 Use the amounts reported by the IRS on Notice 1444 for the first payment and Notice 1444 B for the second payment or the payment amounts in your IRS Online Account to Web 1 d 233 c 2022 nbsp 0183 32 Were no longer claimed as a dependent in 2020 If you weren t claimed as a dependent in 2020 you might be eligible for the tax credit Check the eligibility criteria to see if you qualify Then calculate

Download Tax Refund Calculator With Recovery Rebate

More picture related to Tax Refund Calculator With Recovery Rebate

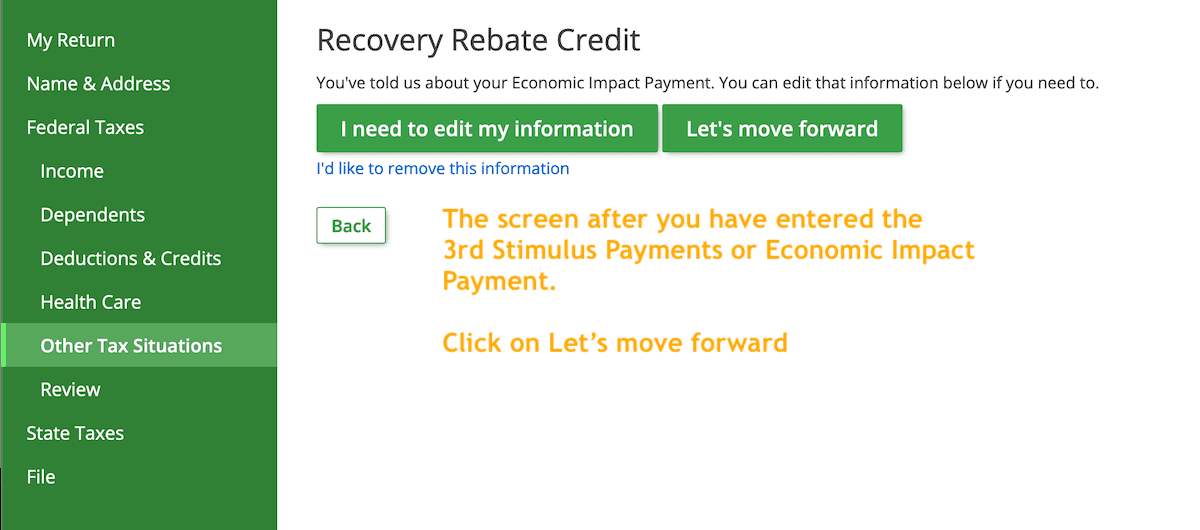

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

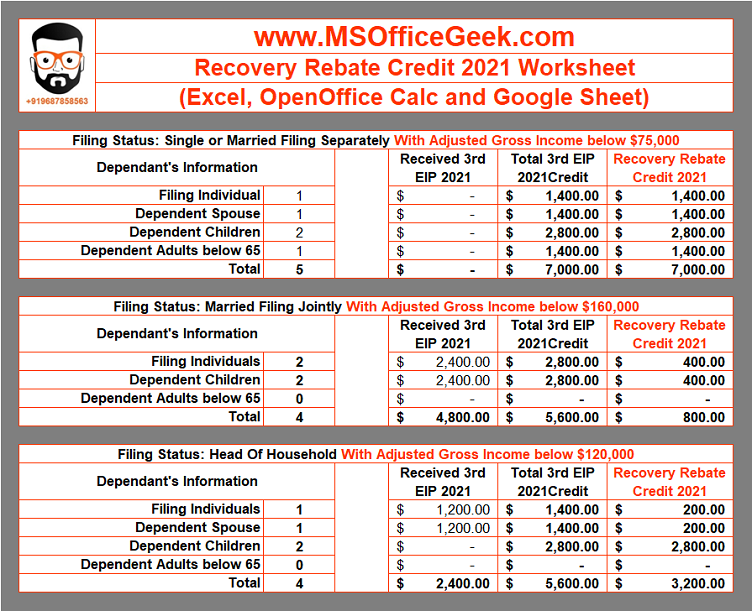

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i1.wp.com/wisepiggybank.com/wp-content/uploads/2021/03/Screen-Shot-2021-03-17-at-4.22.28-PM.png?w=1046&ssl=1

Web 25 mars 2022 nbsp 0183 32 Recovery Rebate Credit and must file a 2021 tax return even if you don t usually file taxes to claim it Your 2021 Recovery Rebate Credit will reduce any tax Web 27 avr 2023 nbsp 0183 32 How To Claim the Recovery Rebate Credit on a Tax Return You will need to file your recovery rebate worksheet along with your 2020 or 2021 federal tax return whichever is applicable If you file

Web The Recovery Rebate Credit is figured like the EIPs except that the credit eligibility and the credit amount are based on the IRS s most recent information for you on file Generally Web 24 f 233 vr 2023 nbsp 0183 32 The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received If a correction

2020 Tax Year Recovery Rebate Credit Calculation Expat Forum For

https://www.expatforum.com/attachments/1633512360704-png.100433/

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

https://images.dailykos.com/images/912447/story_image/1040.PNG?1612073472

https://www.irs.gov/newsroom/recovery-rebate-credit

Web 20 d 233 c 2022 nbsp 0183 32 You will need the tax year s and amount s of the Economic Impact Payments you received to accurately calculate the Recovery Rebate Credit Enter the

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-d...

Web 10 d 233 c 2021 nbsp 0183 32 When calculating the 2020 Recovery Rebate Credit using tax prep software or the 2020 Recovery Rebate Credit Worksheet in the 2020 Form 1040 and Form 1040

Recovery Rebate Credit Calculator EireneIgnacy

2020 Tax Year Recovery Rebate Credit Calculation Expat Forum For

Track Your Recovery Rebate With This Worksheet Style Worksheets

The Recovery Rebate Credit Calculator ShauntelRaya

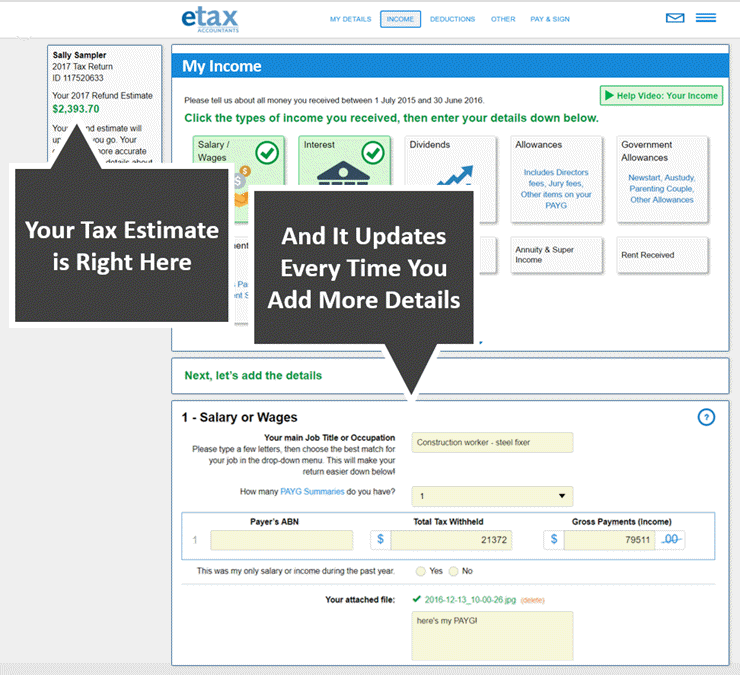

Tax Calculator 2019 Estimate Your Next ATO Tax Refund Etax 2019

The Recovery Rebate Credit Calculator MollieAilie

The Recovery Rebate Credit Calculator MollieAilie

Recovery Rebate Credit 2020 Calculator KwameDawson

The Recovery Rebate Credit Calculator MollieAilie

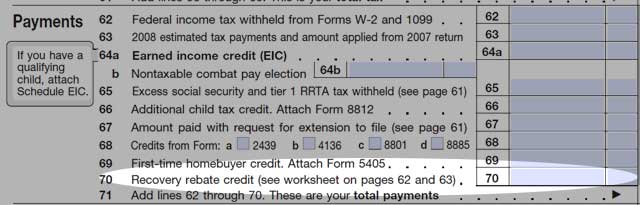

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Tax Refund Calculator With Recovery Rebate - Web 6 mars 2023 nbsp 0183 32 March 6 2023 by tamble Rebate Recovery Credit Calculator The Recovery Rebate allows taxpayers to get a tax refund without having to adjust the tax